A Digitised Employee Benefits Programme Can Help You Increase Your Employees’ Take-Home, Boost His Morale And More

The 2018 Union Budget had great news for employees and HR managers alike. I am, of course, talking about the reintroduction of the standard deduction for all salaried employees and the phasing out of medical reimbursements and conveyance allowance.

For organizations, these “benefits” have always been a proverbial white elephant. They were expensive to offer, and the value derived did not really match the costs involved. Employees would typically fill up forms, attach bills and submit them, and HR managers would verify each claim manually before approving or rejecting them.

But now, with the standard deduction adding INR 40,000 to all employees’ non-taxable income, there’s reason for both employees and HR managers to rejoice — employees don’t have to worry about saving bills to claim them, and HR managers are freed from the burden of having to verify these claims. However, it’s not really a rosy picture for either party.

The Realities

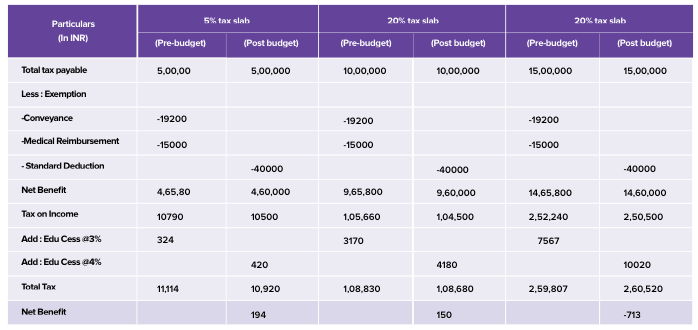

With both medical reimbursements and travel allowances, employees could save taxes on a total of INR 34,200, where INR 15,000 could be claimed against medical expenses and INR 19,200 against travel expenses. With the INR 40,000 standard deduction, only INR 5,800 is being added to an employee’s non-taxable income.

After doing the math, an employee with an annual income of INR 5,00,000 a year, and falling in the 5% tax bracket, can expect to save only an additional INR 290 a year. While employees in the 20% and 30% tax slabs can expect to save more, any celebration would be rather premature.

Education cess blues

Since 2008, salaried employees have been contributing a small percentage of their paychecks towards education. This is deducted from salaries as an education cess, which is used to fund mid-day meal programmes, build and run government-aided schools and colleges, pay salaries to the teachers at these institutions and a lot more. Until March 31, 2018, education cess would stand at 3%.

As any parent would tell you, education isn’t cheap, and with the 2018 Union Budget, the percentage contribution to education cess has been increased to 4%. While your contribution is towards a good cause, the sad part is that it completely negates the benefits derived from the standard deduction.

In the red

The table below will give you a better understanding of the actual impact of the standard deduction on employee take-homes. Drawing attention to the very last row, you can see that the impact is at most a savings of INR 194, a year.

A Golden Opportunity

As the current financial year draws to an end and a new one is about to begin, salary structures are going to undergo an overhaul to accommodate the standard deduction. And this is where the colours fade for HR managers.

For long, employee benefits have been a great tool for HR managers. They are excellent for attracting new employees, work as a great bargaining tool, and are also effective at keeping employees motivated. However, with two of the most popular benefits no longer available to HR managers, and standard deduction is standard across companies, salary structures are going to need a dash of colour and sparkle. HR managers would now consider the options available to them to make the salary structures offered to employees more unique and interesting.

The question HR managers are going to have to ask is not what employees can do for their company, but what a company can do for its employees. It’s the perfect time to relook employee benefits, and tax-saving reimbursements must be at the top of every HR manager’s list.

A rainbow of benefits

The Income Tax Act, under sections 10 and 17 lists down the different benefits and perquisites salaried employees can receive from their employers, a lot of which are tax free. By offering some of these benefits to their employees, HR managers can directly improve an employee’s take-home salary, without having to increase the total CTC or cost to company.

It may sound too good to be true, but by offering the more popular benefits like fuel reimbursement, leave travel allowance (LTA), book & periodicals allowance, gift cards and a few others, an employee’s take-home salary can be increased by up to INR 80,000, a year.

Right now, HR managers reading this are probably expecting the catch that comes with such a sweet deal to be revealed.

Benefits with a pinch of salt

The problem with offering tax-saving reimbursements is in the bills. Companies have historically shied away from offering these benefits because of the hassles involved. As per law employees are required to submit supporting documents and claim these benefits. This is where the perception that the value derived from employee benefits don’t match up to the investments made by the company, is built.

Verifying employee claims is a time-and resource-intensive job, beginning with employees making a claim. The claims process is a rather unglamorous one where employees are required to fill up claims forms and attach appropriate bills to them. In the event the bill has been printed on thermal paper, employees are also required to take photocopies of the bills and submit them. In some companies, policies require that employees fill up a separate form for each bill.

The work for HR managers begins next. The first step for them is to ensure bills from their offices across the country are brought to a centralised location, in order to begin the verification process. Then, each claim needs to be manually verified before being approved or rejected. Sometimes, the bills submitted are illegible or invalid, or there are errors in the form, which require follow-up on the part of the HR manager. HR managers have to follow up with employees and get these corrected or resolved, which stretches out the claims process even more as employees typically have to submit yet another form with the corrections made.

Lending colour to benefits

In December 2017, the Central Board of Direct Taxes (CBDT) formed committee to provide a road map for the Government of India to roll out an e-assessment procedure for all income taxpayers in the country this year. From an administration point of view, a nation-wide transformation of this proportion is going to take some doing. Since all assessee submissions will have to be done electronically, and e-proceedings will take over the conventional method, there will be a rapid reshuffle of IT manpower in order to deploy them in their new roles.

However, a recent announcement by the government has paved the way towards something that could make administering tax-saving reimbursements less of a hassle. At the 2018 Union Budget announcement, Finance Minister Arun Jaitley also revealed that e-assessment of taxpayers would be the norm. This opens up avenues for solutions that seek to fully digitise the way tax-saving reimbursements are administered.

Essentially, what this would do is eliminate the need for a face-to-face interaction between a corporate and a tax official during the assessment process, replacing it with a digitised process, where electronic copies of documents will become the norm. While this move promises increased transparency, it would also pave the way towards overhauling the way organisations view a lot of their processes, particularly tax-saving employee reimbursements.

With the standard deduction taking away all the hassles of dealing with paperwork, it could just so happen that companies might be tempted to be happy with the new status quo, where no additional benefits are added to employees’ pay slips to fill the void left behind by medical reimbursements and conveyance allowance. While the employee in higher tax brackets is already looking for alternatives, now is the time for organisations to do something different.

To all organisations, the customer is king, however, it’s rather unfortunate that it’s only in some employees are treated like customers. The approach of treating employees as customers attaches a lot of weight to employee happiness. A happy employee is a productive one, and productivity, as you know, is good for business.

Now is the perfect time to do more for employees by way of introducing additional tax-saving reimbursements to your employee benefits programme. Specifically, one that fully digitises the process.

A digitised employee benefits programme can help you increase your employees’ take-home, allow you to offer an extremely competitive benefits package and help you boost employee morale. Since there is tremendous potential to simplify the claims process, a digitised employee benefits programme could give employees the impetus to avail these benefits instead of opting out or not claiming them at all.

Digitised employee benefits solutions also enable organisations to administer these benefits in a cost-effective manner that also puts resources to better use. By distributing grants electronically and enabling employees to make claims on the go via their smartphone, logistical hassles can be eliminated. These digitised solutions also offer increased transparency and since they are inherently e-assessment ready, they ensure 100% compliance with legal requirements.

Ad-lite browsing experience

Ad-lite browsing experience