SUMMARY

This is not your average high school bake sale we’re running. The Global Economy is at stake. People’s lives are at stake.

Every startup conference I’ve attended in Bangkok the main topic of discussion is always “How do we raise funding, and attract VCs”. People are throwing words like “acquisition”, “acquihire”, “merger”, “series A” around. Every time I hear those words I roll my eyes and tell myself “This is the last time I am attending one of these stupid events”. Which is why I’ve basically stopped going to these events.

We as an industry need to stop having startup conferences about how to raise money, and more conferences about how to provide real value to the market, how to communicate with the market, how to build solid teams, how to keep employees happy, how to build products, how to sell and make money, how to build brand and loyalty.

Entrepreneurs! VCs are not your customers, nor are they your friends and they’re definitely not your employees they don’t give a frack about you. The only thing they care about, is how you perform, your bottom line, and if you don’t perform, you’re just a statistic on an excel spreadsheet. The way VCs work is they throw mud at the wall and hope that one sticks. You need to focus on building a business and stop raising funding, and if you can’t, raising another funding round ain’t gonna help you figure it out. If you succeed however, investors will come to you, and when that happens you set the terms. YOU decide how much of the company you want to give away. If your investor decides that for you, you’ve lost. Negotiations 101

Anyone can run a money losing business. Even my daughter. You know what she would do if I gave her a few million USD? She would probably buy unicorns. It scares me that more and more people looking in is following the herd without doing their own thinking. There is so much “Fear Of Missing Out” going on.

The rules of business is like gravity. Provide value or die. You can buy time by merging with other companies, raising funding, sell part of your company, but eventually you will die, if you can’t provide value to the market. How many of you have gone out and talked to your customers and asked them what they think of your product? What they think you can do better? Would they buy again? If not why not? I don’t mean some stupid survey, I mean set an appointment with your customer face to face, and visit them and ask them. If physicality is not possible, send them a personal email, not one of those stupid automated response.

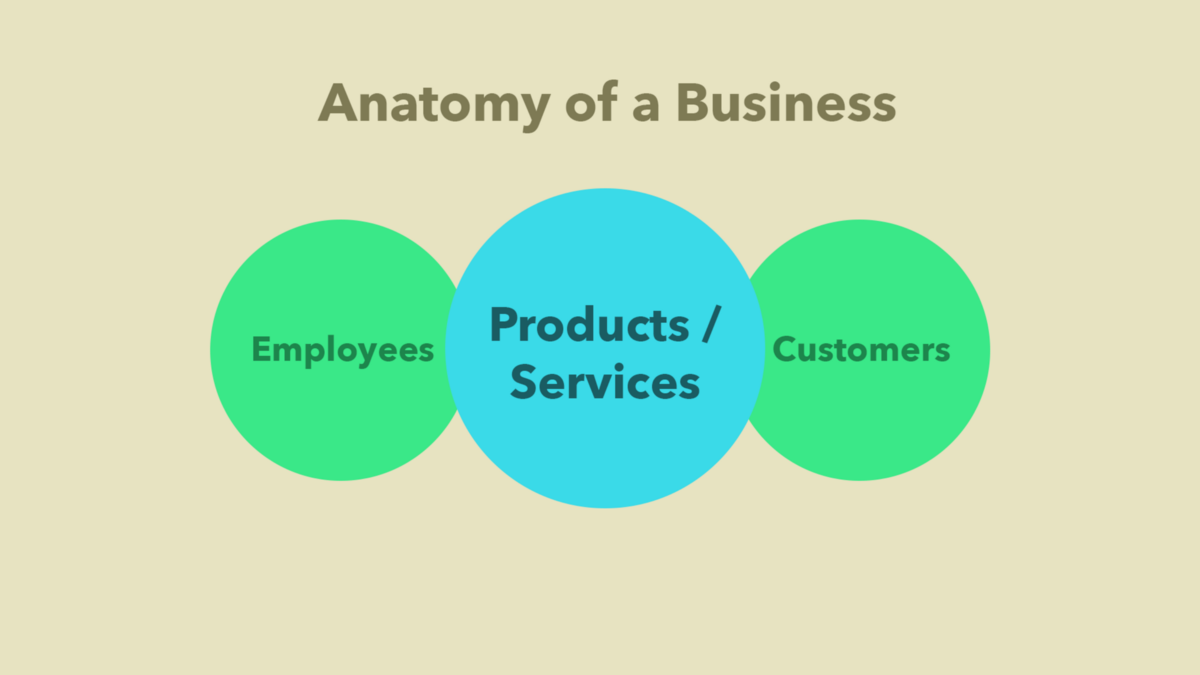

Time and time again I hear stories about how investors are putting stress on getting the ‘numbers’. Employees of businesses then have to take on the burden of performing by doing 3 month long ‘crunch periods’ where they have to work long hours with no breaks. In some cases I’ve personally seen businesses will even spend money to acquire customers, not by providing real value. It’s simple if your employees are not happy your business suffers. If your business suffers your customers are not happy. Here is how it works in one simple diagram.

Your employees are they key to your success. They come first, not investors, not even your customers. Employees are the foundation of businesses. When was the last time you asked your employees how they feel? What their goals and dreams are? What you can do for them? How their kids are doing? Here is a good one, how they think you are doing as a CEO / Founder?

If you have a business that makes money, and provides for everyone in the company, would you ever want to sell it? If you love what you do everyday would you sell it to someone? If its that easy for you to give away your business, you’ve either lost the love you had when you first started and want to get out, or you just can’t figure out how to make money. Because no good entrepreneur would want to take on the burden of taking someone else’s money without knowing how to return it if they haven’t made a sustainable business yet. On the flip side if they’ve made enough money to be sustainable they wouldn’t want to so easily part ways with the company they built, because they love it so damn much.

The only time investment is a good idea is if you have a working machine that can sustain itself, and what you want to do is grow. When you are able to sustain yourself as a business you are in the position to say ‘NO’ to people who don’t play by your rules. That in effect protects the DNA of your business. It will protect the reason why you started your business in the first place. You need to be in the position to set the terms, not have the terms set for you.