Since the unprecedented funding boom of 2021, startup funding has mostly returned to 2020 levels

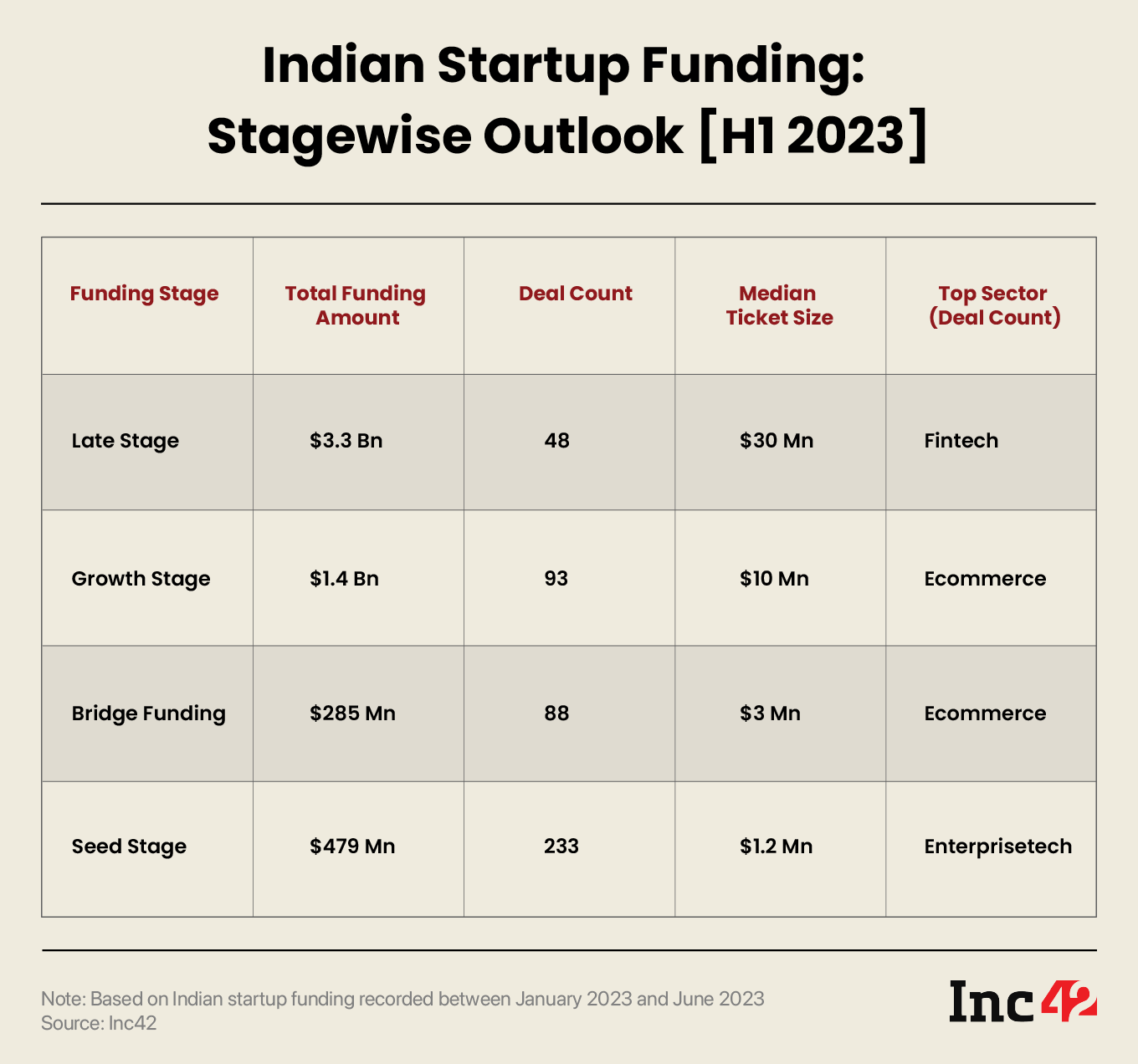

While late stage funding improved 30.44% sequentially to $3.3 Bn, seed funding declined 53% to $479 Mn, compared to H2 2022

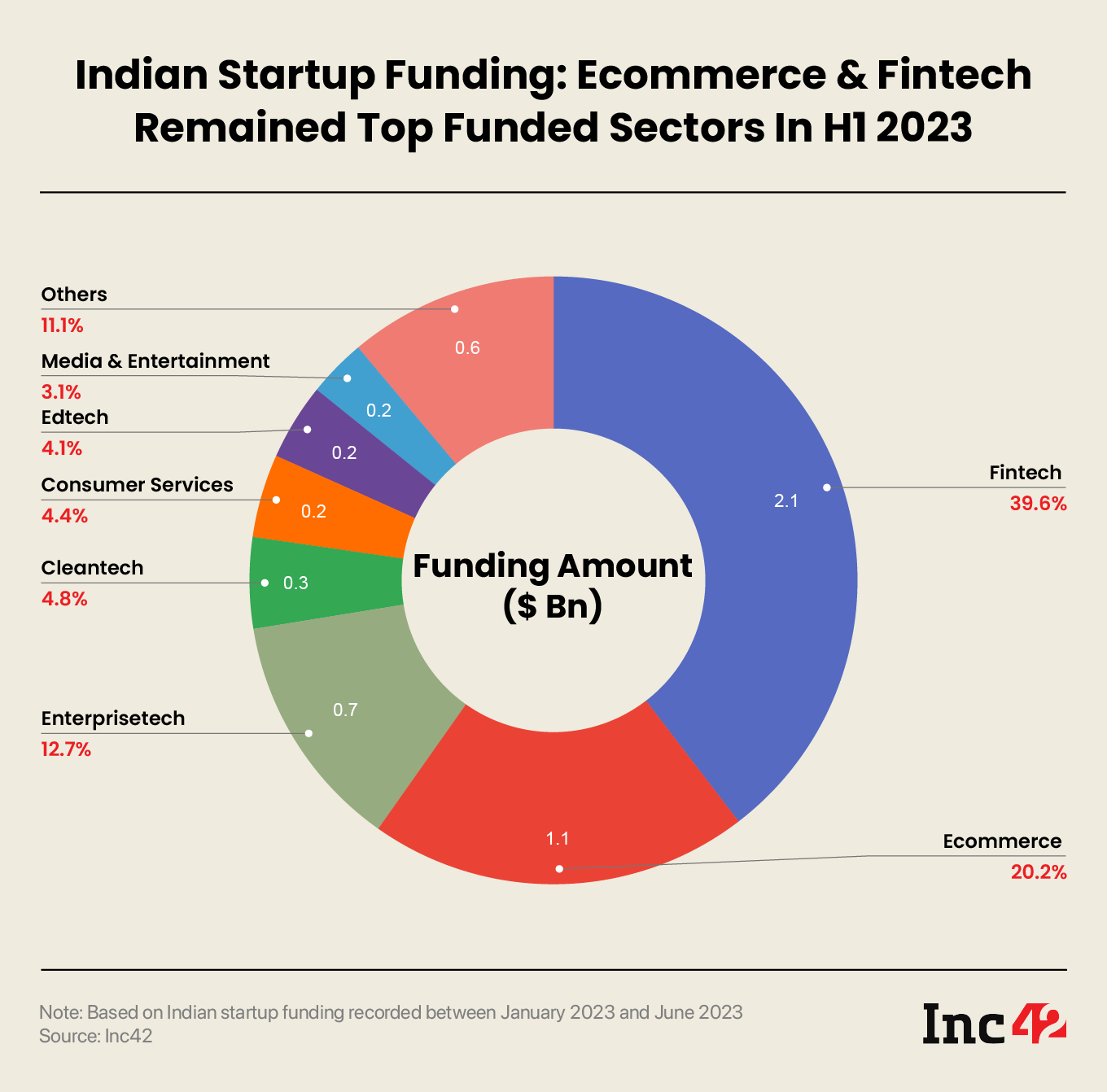

In H1 2023, fintech startups continued to remain investors’ favourite with a $2.1 Bn funding infusion, followed by ecommerce ($1.1 Bn) and enterprisetech ($683.9 Mn)

It has been nearly a year since the Indian startup ecosystem minted its last unicorn in September 2022, Tata 1mg, which raised $40 Mn at a valuation of $1 Bn from its parent entity Tata Digital.

Since then, it has been a rollercoaster ride for many Indian unicorns as global investors continue to mark down their valuations. Some of the most impacted ventures have been Swiggy, BYJU’S, Meesho and PharmEasy, all of which have faced massive valuation cuts in the books of their respective investors.

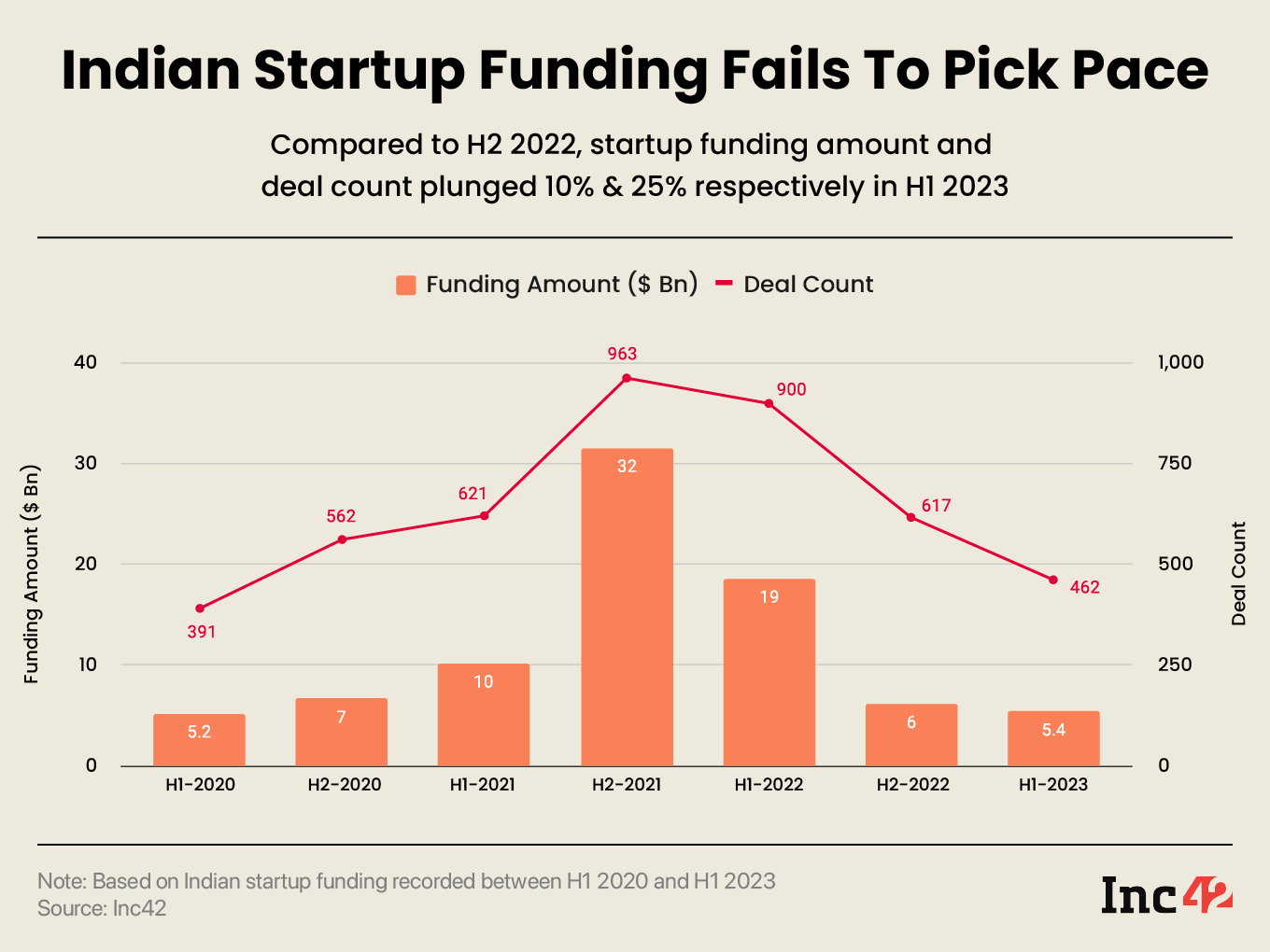

The funding slowdown in the world’s third-largest startup ecosystem has continued unabated as Indian startups could raise only $5.4 Bn in the first half of 2023 (H1 2023) across 462 funding deals.

According to Inc42’s H1 2023 Startup Funding Report, this represents a 10% and 25% decline in funding amount and deals, respectively, compared to the second half of 2022 (H2 2022), when Indian startups raised $6 Bn in funding across 617 deals.

On a year-on-year basis, startup funding declined 72% in H1 2023 compared to H1 2022, when Indian startups had raised $19 Bn across 900 funding deals.

Notably, since the unprecedented funding boom of 2021, startup funding has mostly returned to 2020 levels. For instance, Indian startups raised $5.2 Bn in H1 2020, which is only $200 Mn less than what has been in H1 2023.

This indicates a massive correction that the Indian startup ecosystem has witnessed in funding activity compared to a whopping $10 Bn raised in H1 2021.

Funding Downfall Across Stages

In H1 2023, late stage startups raised $3.3 Bn, the lowest in the past six years. On a YoY basis, late stage funding plummeted 72% in H1 2023 from $12 Bn in H1 2022. However, it is an improvement of 30.44% from the $2.53 Bn raised in H2 2022.

One of the primary reasons for this uptick was the mega deals that happened in H1 2023. The likes of PhonePe ($850 Mn), Lenskart ($600 Mn), DMI Finance ($400 Mn) and Builder.ai ($250 Mn) accounted for nearly 64% of all late stage funding during the period under review.

Download The ReportAt the same time, growth stage funding declined massively. In H1 2023, growth stage startups raised $1.4 Bn, down 38.05% compared to $2.26 Bn in H2 2022.

Also, seed funding witnessed the biggest decline sequentially. While India’s seed stage startups recorded a massive funding influx during the second half of 2022, raising $1.02 Bn, H1 2023 saw seed funding fall by about 53% to $479 Mn.

Fintech, Ecommerce Remain Investors’ Favourite

Maintaining consistency, fintech startups continued to attract investors’ interest and raised $2.1 Bn in the first half of 2023.

A significant chunk of this funding can be attributed to PhonePe, which raised $850 Mn alone, more than one-third of the total funding raised by Indian fintechs in H1 2023.

Indian ecommerce startups raised $1.1 Bn in H1 2023, while enterprise tech startups raised $683.9 Mn.

Interestingly, cleantech was the fourth most-funded startup segment in the first half of 2023, as startups in the segment raised $271.3 Mn in funding across 32 deals. However, the majority of the funding secured by cleantech startups comprised electric vehicle companies.

Bengaluru Retains Its Crown

Bengaluru outpaced Delhi NCR once again to retain its top startup hub status. The startups based in India’s silicon valley raised nearly $2 Bn across 137 funding deals in H1 2023.

While Delhi NCR took the second spot by raising $1.8 Bn, Mumbai secured the third position by securing around $714 Mn in funding in the first six months of 2023. Chennai and Hyderabad were among the top upcoming startup hubs, raising $110 Mn and $76 Mn, respectively.

Download The ReportTurbulent Six Months For India’s Startup Ecosystem

While the startup funding declined in the past 18 months, multiple issues have severely hurt investors’ confidence.

Since early 2022, Indian startups have been on a layoffs spree, which has seen more than 27,000 employees being fired by more than 100 Indian startups.

Corporate governance issues at GoMechanic, Rahul Yadav’s Broker Network and Mojocare, and increasing bad press attracted by BYJU’S have stolen some sheen from one of the world’s most vibrant startup economies.

However, not all is gloomy in the world’s third-largest startup ecosystem. Per Inc42 data, investors have made fund announcements worth more than $3.5 Bn+ since the start of 2023, with many thematic funds being launched recently.

Funds focussed on women-led startups, climate-focussed funds, agritech funds and the high concentration of early stage funds announced this year mirrors investors’ willingness to fuel the Indian startup ecosystem, come what may!

Download The Report

Ad-lite browsing experience

Ad-lite browsing experience