SUMMARY

Why corporate innovation doesn't reverse the structural decline, and how to fix it

Startups and corporate innovation is not the same ball game

Successful innovation is innovation that restores, protects or enhances power levers

In 1958, the average lifespan of a S&P 500 company was 61 years. By 2017, it had declined to less than 18. Half the companies on the S&P 500 between 2000 and 2010 have fallen off. Former giants like Sears, Kodak, Nokia, Motorola, Toys R Us, Radio Shack, Borders, Blockbuster – have gone bankrupt, disrupted by younger, hungrier, digitally native businesses.

None of these companies died overnight. Most tried desperately hard to innovate their way back to growth and most failed.

Why did they fail? And what lessons can corporations look to avoid their fate learn from these failures?

The Perils Of Corporate innovation And The Role Of Power

“Startups have religion. Corporations don’t.” ~ Aaron Sarma, CEO and founder of travel startup Vidi.

Early stage startups have shared beliefs and goals. Corporations have conflicting mental models, agendas and an abundance of skeptics.

No wonder, digitally-non-native businesses seek to emulate startup practices in a bid to replicate startup success. Attempts can range from the cosmetic (trendy offices & informal dress codes) to the structural (quasi-autonomous digital spin-offs).

Nonetheless, the track record of innovation in Corporate Renewal remains very modest.

We believe that corporate innovation faces – and typically fails due to – challenges fundamentally unique to corporations and unaddressed within startup canon.

Corporate innovation cannot reverse structural decline without addressing these challenges.

Corporate Vs. Startup Innovation: Not the Same Ball Game

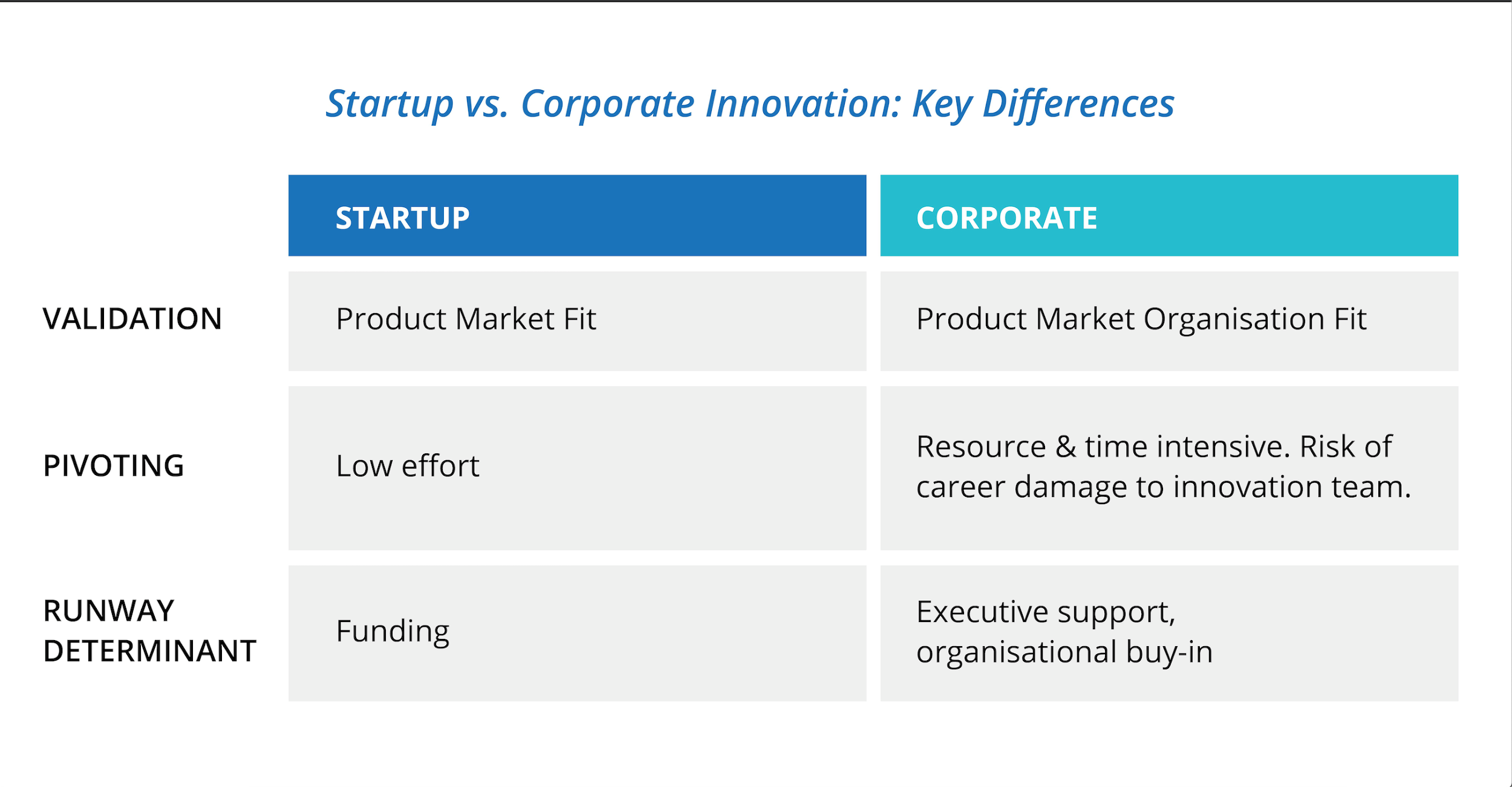

Startup innovation is resource-scarce, corporate innovation is attention-scarce. Optimising for fundraising is the motivation behind most startup practices. In contrast, corporate innovation is not resource-constrained except in extremis. It is constrained by access to executive attention and organisational support.

Corporate innovation teams rarely recognise this distinction or optimize for internal alignment, only to be surprised when organisational inertia or a lack of buy-in kills projects.

Startup success is about product-market fit; corporate innovation success is about product-market-organization fit. Startups care for product-market fit. The proposition, the market, the business model are all mutable as long as changes drive product-market fit.

Corporate innovation however is a three-legged stool. Optimizing for product-market fit at the expense of organisational fit is harmful!

Organisational fit requires two criteria –

- Key organisational constituencies must perceive the innovation to be complementary enough to actively invest in its success

- Innovation must address the structural factors that drive the threat of obsolescence. Mere revenue generation will not suffice.

This can be a tough balancing act as short term revenue wins can create goodwill at the cost of ignoring structural threats or vice versa.

Further, startup success can be emergent, corporate innovation needs to be deliberate. Early stage startups are highly adaptive with the bigger picture gradually emerging over time. This suits startups; they don’t carry baggage and can pivot rapidly.

Corporate innovation cannot pivot as cheaply given the risk of lost internal credibility, high burn rates and potentially complex go to market dependencies. This requires corporate innovation to balance market-facing validation with extensive pre-flight validation and strategic alignment.

Enter Power Thinking: Bridging the Divide

Deteriorating financial performance is a symptom; the root cause is a loss of Power, as pointed out by Geoffrey Moore.

By Power, we mean control of the levers that regulate value flow and profit capture across an industry ecosystem. It is distinct from financial performance. For example, while hospitality giants like Hyatt or Accor generate much higher annual revenues, TripAdvisor has more Power because it has superior access to online traffic, especially in the critical, about-to-book phase.

To paraphrase Moore, power fuels performance and performance is a lagging indicator of power. Disruptive competition disrupts by commoditizing incumbent power levers. Re-framing innovation as a search for power levers can help screen out cosmetic or irrelevant bets, while focusing management attention on the fundamental question at hand:

How do we reinvent ourselves to unlock a new cycle of growth?

Understanding Power: Lessons From The Mobile Telecoms Industry (Western Europe)

The launch of the iPhone in 2007 sparked a race between operators to secure exclusive distribution rights. Operators with exclusivity promoted the iPhone with fervour (e.g. offering unlimited data packages only on iPhones), thereby capturing power users from rival networks.

By 2010 the exclusivity lapsed. The iPhone expanded to other operators, who now promoted it with pent-up vigour. Meanwhile, non-Apple handset vendors rallied behind Android to offer competing smartphones. By the time the dust settled, smartphones were ubiquitous.

Smartphone adoption boosted operator revenues but cost operators control of the ecosystem. Whereas formerly only telcos could offer voice or message, smartphones (and data networks) allowed any application to offer them, thereby corroding the value of network ownership while commoditizing operator revenue streams.

Today operators face a greater threat of disintermediation. One acute threat is from virtualized SIM cards that can map to an operator based on business rules controlled by the device / OS vendor. This risks a scenario where networks are mere connectivity wholesalers without a direct relationship with end users.

Smartphones delivered operators performance but at what cost to power?

How To Transform Corporate Innovation

In the inital part of the article, we saw that corporate innovation tends to fail for reasons unique to corporations. Consequently it needs to do more than just copy-paste startup success patterns. Corporate innovation needs to focus on Power – the levers that determine profit capture within an industry – instead of financial performance.

Three primary shifts are needed to set up corporate innovation for meaningful success:

Re-orient Innovation around Power

Successful innovation is innovation that restores, protects or enhances power levers. Senior leadership teams need to drive conversations about power balance and how to enhance it, while disincentivising low power investments.

Create A Power Narrative

Disruptive competitors commoditise incumbent power levers. This eventually impacts revenues, leading to a search for compensatory revenues from innovation.

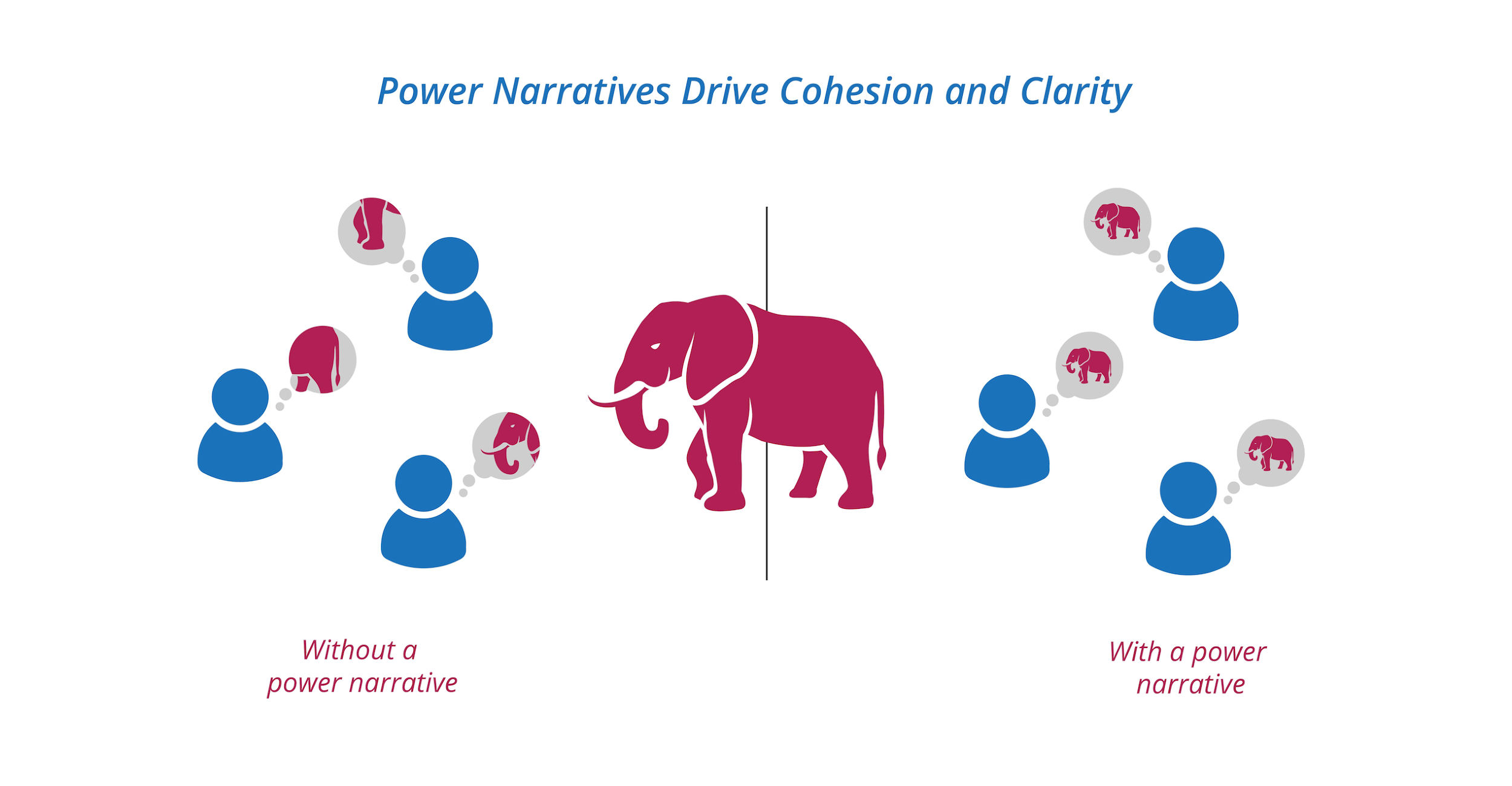

Unfortunately, this is confusing the symptom for the disease. Performance cannot be sustainably repaired without rebuilding power. Without a shared vision of how to build power, innovation bets tend to be incremental, with many low-power projects getting greenlit.

In remediation, corporate innovation must be structured as a search for that shared vision. We call this the Power Narrative.

A formalised power narrative is a critical first step for any entity facing disruption. It reads across problem root causes, solution possibilities, business model choices and execution constraints to etch out a plan for how specific capabilities or bets will combine to create power.

Make Fewer, Bigger, Connected Bets

Boardrooms need to track not just success metrics for individual innovations but also the strategic congruence and synergism of the overall portfolio with respect to an agreed power narrative. Leadership needs to transition from a mindset of diversifying risk through small bets on unrelated innovations to placing parallel bets on multiple, potentially high risk, inter-related initiatives designed to restore power. Example: Power Narrative @ Work

Imagine a chain of cinemas bleeding profitability due to the emergence of online aggregators that offer a single portal for all leisure activity bookings across providers. Conventional innovation solutions to the threat might include:

- Relaunch and promote the chain’s website

- Improve ancillary revenues

- Cross sell new products to customers

Each of the above solutions is focused on repairing performance without addressing the fundamental power asymmetry between the chain and the online aggregators. A power narrative would call this out and focus the chain’s innovation dollars on initiatives that remedy the power imbalance. E.g.

- Open platform for all leisure booking providers

- Cross-chain loyalty scheme & unlimited tariff supported (only) via the open platform (mitigate demand-side imbalance)

- A flexible billing system that revenue-shares the tariff with each provider based on their share of the activities consumed (enable cooperation)

- An open data platform that allows each vendor to view and process relevant customer data (enable cooperation)

Assuming the above portfolio stands up to validation with other leisure booking providers, it would be broken down into initiatives, which would each be further broken down into a portfolio of individual bets. Collectively these would form a Power Narrative aligned portfolio.

It would be easy for senior management and various parts of the business to understand how the success of this portfolio of initiatives relates to the success of the overall business. Such a shared understanding would set the context for both top down and bottom up prioritisation of financial and operational resources to accelerate these initiatives without being bogged down in incrementalism or uncertainty as to the overall endgame.

To return to our opening quote,

Startups have religion. Corporate innovation teams have Power Narratives.

In Summary

Corporate innovation can ill-afford to blindly copy startup wisdom. It needs to acknowledge and explicitly work around its in-built constraints. A willingness to switch from a financial performance optimization mindset to a power optimization mindset is a necessary prerequisite.

A power narrative helps a corporation rally behind a shared mental model of the root causes of the disruption that it faces and to generate an innovation portfolio designed to address those root causes.

By doing so, it optimises for sustained executive attention and political capital – the key resources that determine the length of runway for corporate innovations.