SUMMARY

The Big 5 Google, Microsoft, Apple, Facebook And Amazon Have Made A Total Of 438 Acquisitions Since 2007

There are number of factors that motivate businesses to take over other businesses. These factors include innovation, integration, portfolio expansion, killing competition, talent or customer acquisition. The 5 most powerful tech companies (Microsoft, Google, Apple, Facebook and Amazon, hereinafter called the Big 5) have been at the forefront of making such acquisitions. They have strengthened their competitive position and have a combined market capitalisation of over $2.8 Tn. While comparison is odious, consider that the Indian GDP is around $2.3 Tn and one can imagine the value they have created. We have studied the acquisition strategies of the Big 5 to come up with some interesting observations and the implications that it has for innovation as well as for the general humanity at large.

The Big 5 Story

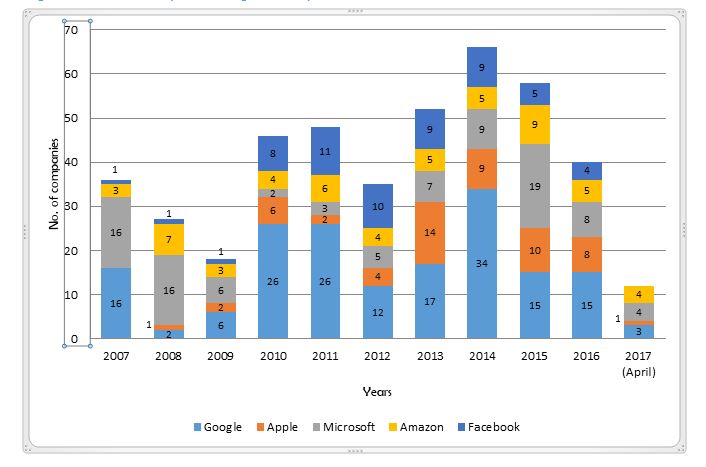

Google leads the way with volume of deals

The Big Five have made a total of 438 acquisitions in the last 10 years since 2007. 40% of all acquisitions made by the Big Five were made by Google, which acquired 172 companies since 2007. Google is by far the most active acquirer, averaging over 17 acquisitions per year i.e. at least one and half acquisition every month. Google M&A activity took a sharp dip in 2008, owing to the worldwide recession as their revenues dipped by 3% during the same year. Amazon has been the relatively most quiet of the five companies, acquiring an average of just over 5 companies per year.

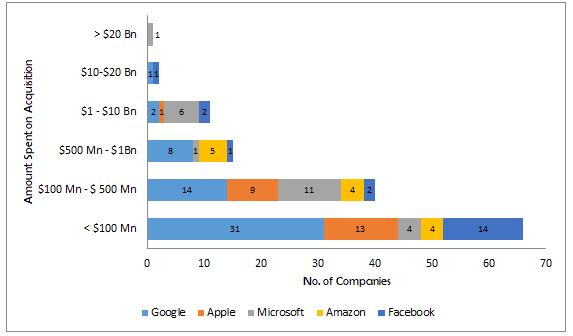

Figure 1 : YOY number of acquisitions of Big 5 Tech Companies

2014 was the most prolific year

2014 was the hottest year in terms of acquisitions so far with 66 companies acquired by the tech giants. 2014 was also a year when Apple, Facebook, and Amazon made their biggest acquisitions with Beats, WhatsApp, and Twitch respectively. Meanwhile, in 2016 media has been the most popular industry for acquisitions, as Apple bought Carpool Karaoke and both Google and Microsoft acquired media platforms like Synergyse, Anvato. Groove, Beam etc.

Google tried to be social

Google bought 15 social networking companies since 2007 in an attempt to build out Google+ to capture social networking share of Facebook which is now deemed a failed attempt. Google’s acquisitions are more than any other tech giant including Facebook, who has acquired 11 other social networking companies.

Figure 2 : No. of acquisitions made by Big 5 Tech companies across verticals

Despite dominating mobile, Apple has not been very active there

Despite iPhones and iPads dominating the mobile market, Apple has made just three acquisitions since 2007 in the purely mobile space, relying instead on its own capacity to innovate. In fact, Google and Microsoft made the most acquisitions in this space, each having bought former titans of the mobile market Motorola and Nokia respectively. Most of Google’s acquisitions have been in mobile as its Android OS grew to rival Apple’s iOS and the company now makes top end smartphones.

Google and Amazon are battling it out in ecommerce

Ecommerce is a well-known recent battleground between Google and Amazon as they jostle to become the online starting point for a purchase. Not surprisingly, Amazon is aggressive in this sector with 15 acquisitions since 2007. But Google is showing more intent recently with 19 acquisitions, 17 of which happened since 2011.

All the Big 5 are betting on artificial intelligence (AI)

Fighting for the dominance of the future, the Big Five have all been actively acquiring Artificial Intelligence (AI) companies. On its way to the AI-first world, Google is way ahead of the field with 22 acquisitions in this space since 2007. Apple, however, is catching up with five out of its last ten acquisitions being AI or machine learning companies. Amazon beat Google to the first AI-for-the-home device on the market and follows closely with seven AI acquisitions since 2007.

Facebook is leading the way in augmented reality (AR)/virtual reality (VR)

A fast growing battleground will be AR / VR and Facebook is showing the greatest intent here with four acquisitions including their second biggest acquisition – Oculus for $ 2Bn. Google and Apple also seem to be following Facebook into this battle with two acquisitions each.

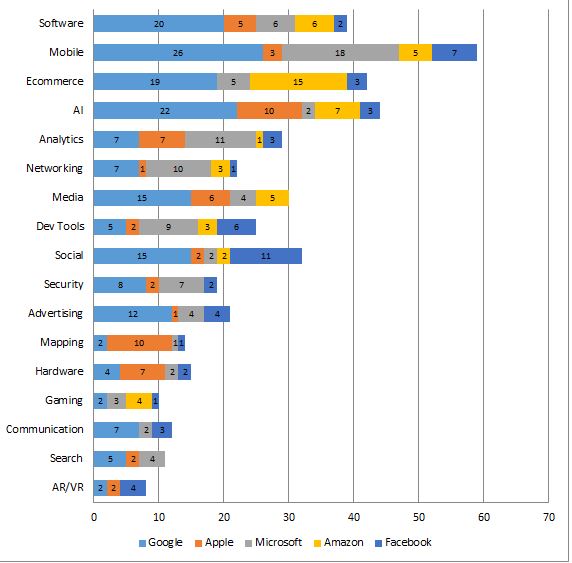

Figure 3 : Amount Spent by Big 5 Tech companies per acquisition

Microsoft has spent the most money

In total, the tech giants spent a staggering $128.5 Bn on acquisitions till date, half of which was spent in the last three years. Microsoft alone spent nearly $62Bn on acquisitions (in the past 3 years) which is almost as much as all the other tech giants combined. Microsoft not only has the most expensive acquisition of LinkedIn for $26Bn, but six acquisitions worth between $1 and $10 billion.

Jeff Bezos didn’t spend more than $1 billion on a single acquisition until recently when it bought Whole Foods for $13.7 Bn in June 2017.

While Steve Ballmer has made the most acquisitions in total, Larry Page has acquired the most companies in the shortest space of time, averaging 21 acquisitions per year in his term as Google’s CEO between 2011 and 2015. Microsoft’s new CEO Satya Nadella is the 2nd most active, averaging 12 acquisitions per year since he has been put in charge of the company. Steve Jobs, known for his view of acquisitions as a “failure to innovate”, is reflected in the fact that despite being cash rich, Apple has not acquired many companies.

Google acquired companies in early stages mostly for its technology, as it acquired most companies when they started gaining traction or even before that. It has used acquisitions to expand its workforce and launch new products before it was a household name. Following a similar trend, initially Facebook has also acquired most of the companies in its early stages to acquire the talent pool, which is merged with an existing Facebook unit to develop new products.

Lately, Facebook is using its fast-growing cash hoard to take control over sectors both adjacent to its core product like WhatsApp acquisition for $22 billion and Oculus VR for $2 billion. On the other hand, Microsoft and Amazon acquired most of the companies for its business at later stages when the companies have achieved a scale. Microsoft and Amazon are making big-ticket bets by buying Minecraft developer Mojang for $2.5 billion and video game streaming site Twitch for $970 million respectively.

Amazon’s recent acquisition of grocery chain Whole Foods is also along the same line of buying businesses for scale, expansion and threaten the offline retail (read Walmart). Apple, which long ignored splashy acquisitions in favour of much smaller, less public buys, has bought many companies lately for more than $500 Mn, including the $3 billion purchase of Beats.

As the Big 5 companies get larger, they have come to depend on acquisitions not only to broaden their businesses but also to sustain the pace of innovation. The deals are a boon for startups as well as companies can rely on acquisitions rather than IPO to keep growing. If it’s not clear how a startup will eventually convert users into revenue, a buyout from a large firm can render that problem irrelevant or at least less urgent. While investors and founders insist that launching a thriving self-supporting company is still the end-goal in Silicon Valley, exiting via a sale rather than an initial public offering can be a lucrative payout.

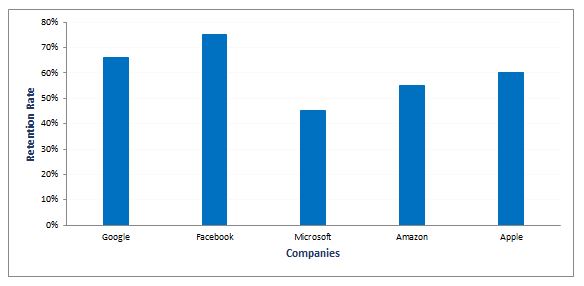

Employee Retention After Acquisitions

But while snapping up a startup is now easy, holding onto its key employees is more difficult. Startup founders, who often think of themselves as entrepreneurs before engineers, are difficult to retain at large firms. That has left firms struggling to keep the expertise they may have spent millions acquiring. A TIME analysis of startup founders’ LinkedIn profiles found that about two-thirds of the startup founders that accepted jobs at Google between 2006 and 2014 are still with the company. Amazon has retained about 55% of its founders over that time period, while Microsoft’s rate is below 45%. Facebook, with a 75% retention rate for founders, is beating its older competitors, but the company only began acquiring companies in significant numbers around 2010. Apple, which has gone on an acquisition spree under new CEO Tim Cook in the last two years, now have a similar retention rate to Google.

Google stands out among this cohort in large part because of the massive number of acquisitions it’s conducted. Overall at least 221 startup founders joined Google’s ranks between 2006 and 2014.

Figure 4 : Retention Rate of founders of acquired companies by Big 5

Even when Google was small, it wasn’t shy about spending. The company’s first startup acquisition, the 2003 purchase of Pyra Labs, forms the backbone of what is today Blogger, an online publishing platform. Since then, many of Google’s most well-known products, including Android, YouTube, Maps, Docs and Analytics, have originated from acquisitions. For Google, before any deal is finalised, it has to pass what CEO Larry Page calls “the toothbrush test”. They key question that Google asks is “Is the product something people use daily and would make their life better?” If anything matches the toothbrush test and relates to technology, then Larry has an interest in it.

Typically, Google acquisitions occur in sectors where the company has already been experimenting itself. YouTube as a prime example as Google already had a video sharing service called Google Video in the mid-2000s, but YouTube’s fast-growing user base convinced the firm to offer a then-eye-popping $1.65 billion for the startup, even though it was barely a year old and earned no revenue. Today, YouTube brings in billions of dollars of revenue per year and is the third most-visited website in the world, according to Web analytics firm Alexa.

Cash Alone Does Not Account For Acquisitions

But the return on investment on an acquisition isn’t only measured monetarily. It’s important for tech giants that the founders behind ideas worth paying for stick around as well. Cash alone can’t convince the top startup founders to join them. Initially in startups, the founder spends 90% of his time on back-of-house stuff managing finances, talking to investors, wrestling with taxes and fending off patent lawsuits. After acquisition, these tech giants enable the founders to spend 95% of his time focussed on product development and key relationships and also give them resources that would have taken much longer to accrue independently.

Tech companies try to ensure founders stick around for a while by offering a stay bonus or company shares that vest over several years. Facebook’s acquisition of WhatsApp, for instance, includes $3 billion in restricted stock for WhatsApp employees, but they can’t fully tap into those funds unless they stay at the company for four years.

In case of acqui-hires, founders are rolled up inside another group inside of the company. They can’t make decisions as freely as when they were entrepreneurs. That affects people’s willingness to stick around.

Many times, a high profile acquisition fails, like when Google acquired Motorola mobility for $12.5 billion, Larry Page hailed it as an opportunity to “supercharge the Android ecosystem.” But Motorola’s phones failed to gain traction, the subsidiary racked up $1.4 Bn in losses for Google, and the company offloaded the handset division to Lenovo for $2.9 Bn in 2014. But these acquisitions played a pivotal role in making them large Goliath businesses.

The Big 5 Market Cap Breakdown

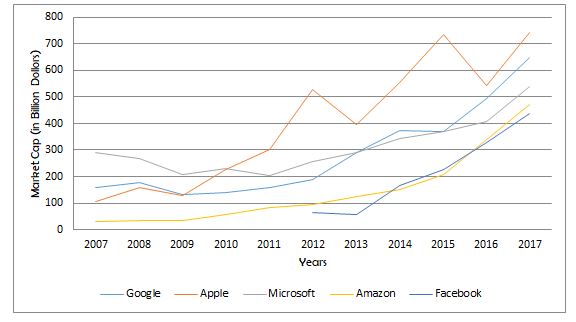

Figure 5 : Growth in Market Cap of Big 5 tech companies since 2007

Google, Apple and Microsoft have gained a market cap of more than $500 Bn in recent years. Amazon and Facebook are not too far behind with market cap upwards of $400 Bn. Google is currently wrestling with multiple threats to its core business, search, including a declining share of desktop searches and a mobile market where Amazon is stealing product search queries and Facebook is taking ad dollars. If Google is to maintain its steady growth, it will eventually have to tap into a new revenue source somewhere, and that may well stem from further acquisitions of companies in newer market. The company may view Nest as the key purchase that ensures its future dominance, in consumer home automation space.

All the Big 5 want to ensure they don’t miss out on the next big thing. The ability to move quickly in rapidly changing markets is one of the major drivers in revenue growth. If they want to effectively compete and innovate continually, it can’t all be from within.

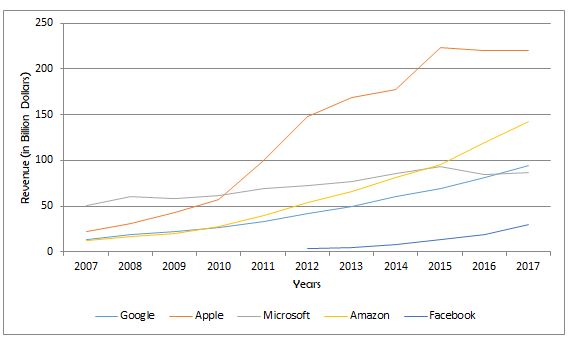

Figure 6 : Growth in Revenues of Big 5 tech companies since 2007

A behavioural study conducted by Forrester research on US smartphone users in January 2015 reveals that Facebook owns 13% of the time users spend on apps. Google is not too far behind with 12% of the time users spend on apps. Amazon and Apple share is 3% whereas time spent by users on Microsoft apps is 1%. Amazon sells over 30 Mn items per month. In the share of operating systems for mobile, iOS, Android and Windows constitutes 94.3% of market.

For desktop OS, the share of all three combined is 94.6%. If we look at the search engine market share of Google and Bing combined it will be 81.8% for desktops and 96.4% for mobiles. Similarly, the browser market share for Google, Apple and Microsoft browsers combined is 86.1% for desktops and 94.2% for mobile.

As per a market intelligence company SimilarWeb, an average user spends around 45 minutes on Facebook and 27 minutes on Instagram in the US. We are living in the world of data boom today where in every 60 seconds around 66K photos are uploaded on Instagram, 29 Mn messages sent via WhatsApp, 500 hours of videos are uploaded on YouTube, 3.3 Mn content units are posted on Facebook, 3.8 Mn items searched on Google.

These statistics are unnerving and demonstrate the stranglehold Big 5 have over the humanity at large. They track people moves, every possible transaction and build monetisation models. Technology has made mincemeat of individual privacy and everyone who has a smartphone is open to scrutiny.

One needs to also take into consideration their financial might while being awestruck at the scale and the stranglehold they have over us as consumers. Between them, they collectively have $573 Bn of free cash flows. This give them a considerable moat and while technology can make good companies look ordinary (remember Yahoo?) in a matter of few years, this cash gives them enormous competitive advantage to keep making acquisitions, grab talent and thwart budding businesses from becoming big.

In other words, there is enormous concentration of technology IP with these majors and with their financial muscle, they can muzzle competition or subsume it in their ecosystem through acquisitions. The benefits of competition, which accrue to the consumers, therefore, are impacted due to such concentration. To conclude, the Big 5 comprising Google, Facebook, Amazon, Microsoft, and Apple will have enormous power through information, economics, and innovation to dominate the discourse for the next few years if not decades.

[This article has been co-written by Shailesh Ghorpade, Managing Partner & CIO and Mohit Babu, Associate with Exfinity Venture Partners.]