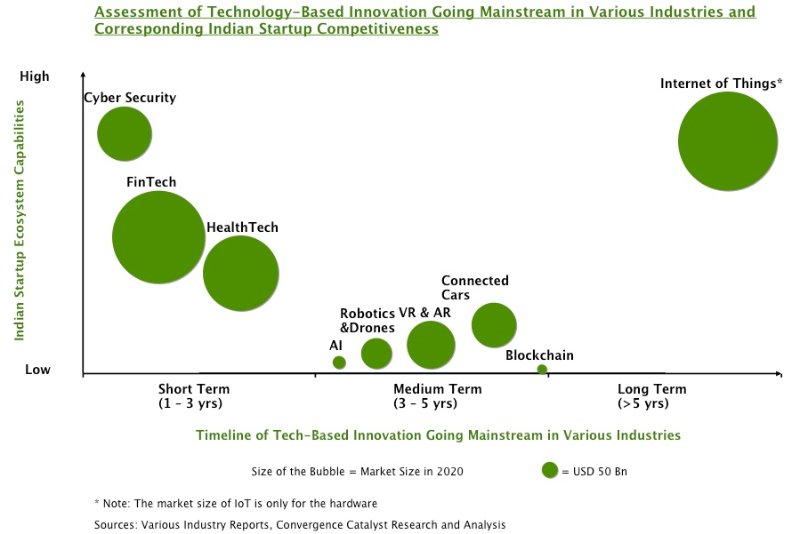

Technology-based innovation and disruption across various sectors is increasing rapidly around the world. In the next few years, the technology driven innovation is about to hit the inflection point and/or go mainstream across many industries. And, most of this innovation and disruption is being driven by young startups.

India has a lot of talent and a growing startup ecosystem in the technology space. However, conventionally, Indian companies tend to contribute and grow only after the innovation and disruption in an industry or sector goes mainstream (for instance, India currently has over 2.5 mn mobile app developers, but most of these engineers ventured into mobile app development after it went mainstream in 2011-12). As the technology startup ecosystem in India garners significant focus and spotlight right from the government’s ‘Startup India, Standup India’ initiative to access to private funding, it is the right time to evaluate the current state of Indian technology startup ecosystem in terms of its ability to actively participate and drive the upcoming global innovation and disruption of some of the industries.

Cybersecurity

The information security, at a high-level, can be classified into three key components: Confidentiality (endpoints threat, which most of the companies focus on solving), Availability (denial of service threat, similar to the recent power grid outage in Ukraine) and Integrity (assessment of compromise of network, systems, software and data, and identification of unauthorised elements on the network). Cybersecurity industry is highly focused on confidentiality threat and most of the solutions available in the industry currently target to solve this threat by “encrypting everything”. However, with the rise of smartphones, BYOD culture in enterprises, upcoming sensor enabled connected devices and Software Defined Networks (SDNs) replacing data centers, the focus needs to move on to analyzing and thwarting potential security threats in data streams instead of data lakes. The shift to OT (Operational Technology) from IT (Information Technology) from the cybersecurity viewpoint is imperative. This is the current need of the hour, and no company as yet has an ideal solution against the increasing complex cybersecurity breaches. India, has a number of promising cyber security companies, many of which have evolved during the IT industry growth phase, and our ecosystem has sufficient talent to come up with potentially world-class solutions in this space.

FinTech

Technology is upending workflow and processes in the financial services industry. Almost every type of financial activity and service from banking to payments to wealth management to loans, stock trading and more is being re-imagined by technology startups.

These young startups are not competing and out-innovating the banks and large financial institutions directly across multiple products, instead they are attacking individual services and products. Over 500 Fintech startups have emerged in the last 5 years and a number of them are VC backed. The highly regulated environment of this industry makes global scale and expansion difficult for Fintech startups and every market has its own set of disruptive players. India is one of the leading countries with a significant number of Fintech startups spanning across digital wallets and payments (Mobikwik, PayMate, MoneyOnMobile, PayTM, Qarth, Chillr, MobileGullak, etc), telecom carrier billing (Yippster, PayChamp, iPayy, JunoTele, etc) and mobile POS (ePaisa, Mosambee, MobiSwipe, MSwipe, etc). Also, with initiatives such as iSPIRT’s “India Stack” platform, the numbers of innovative Fintech startups in India are only going to grow.

HealthTech

In the US health care industry, the introduction of Obamacare and Affordable Care Act is driving a sudden, ongoing and massive shift in the industry’s economics and business models. Health care spending, which equals a fifth of America’s GDP is being curtailed and the focus is on reducing the expenses without compromising on the quality of care. This shift has forced the health care organizations to open up for technology-based solutions that curb the need for costly spending. And the digital technology startup ecosystem led by the Silicon Valley entrepreneurs and investors responded by contributing to the growth of HealthTech industry, both in US and globally.

India already has a number of HealthTech startups offering a number of solutions including remote patient monitoring, cloud-based analytics, technology-enabling health care workers and doctors, automated patient care, electronic medical records, etc. There also exist innovative young startups such as Cardiac Design Labs, Oxys Technologies, Wrig Nanosystems, Map My Genome, etc., which are developing and implementing affordable and reliable patented health care technology solutions in bioelectronics and genome-sequence based disease identification space. India has tremendous potential to deliver world-class HealthTech startups.

Artificial Intelligence

Artificial Intelligence (AI) is already pervasive in our lives, albeit invisible to most people. The custom search engine results, social media alerts and notifications, the e-commerce recommendations and listings, all have strong AI engines at the backend. AI is fast turning out to be the key utility of the technology world, and like all utilities it will enliven most inert objects, much as electricity did a century ago. Everything that we formerly electrified we will now cognitize. Speech & image recognition, universal translation, personal photo archiving, self-driving cars, smarter news feeds, personal digital assistants, etc., are all driven by AI engines.

Most of the big technology giants including Google, Baidu, IBM and Microsoft are open sourcing the software engine that drives its deep learning services, sharing this all-important tech with everyone to drive faster innovation in this space. Yahoo is making 13.5 TB of its web services data freely available for training various machine-learning algorithms powering different AI engines. Close to US $20 Bn have been invested in AI companies since 2009 globally. However, in India, there are only a handful of companies working on core AI technologies, ML algorithms and supporting mathematical models. India with over 1,000 languages and dialects is a development and testing ground for AI solutions in the speech recognition and translation space that could potentially scale globally. But, unfortunately that potential is being left untapped by Indian technology startups.

Robotics and Drones

Robots and drones have started emerging in 2015. Lower price of components and increasing number of plug and play hardware and software is enabling a number of companies, especially Chinese companies (such as DJI) to design and develop these devices. Large American technology players such as Google, Amazon, Tesla, Apple and Uber are investing in or acquiring various companies, talent and technologies in this space. Going forward, as developments in AI and deep-learning improve, the robots are expected to become personal, smarter and share knowledge.

In India, although there are over 40 startups in the robots and drones space, most of them offer services instead of developing core technologies. Most of the drone companies in India (such as Idea Forge, Edall Systems, Radianx Robotics, Kadet Defence, etc) develop industrial UAVs for Indian defence sector, and hardly any Indian companies work on core technology development of auto-pilot systems, development platforms, mapping, fleet management, computer vision speech recognition or self-learning systems.

Virtual and Augmented Reality

A number of VR headsets were launched in 2015, ranging from the basic Google Cardboard, to Gear VR and many Chinese competitors, to the high-end Oculus, HTC Vive and PlayStation VR. However, the current headsets are all suited for ‘Seated VR’ and it could take close to a decade before virtual reality headsets become cheap and portable enough to support ‘Mobile VR’ and replace smartphones as the technology industry’s dominant computing platform. In Virtual and Augmented reality space, the immediate opportunity for innovation and creation is in the Content and Software space. Will Facebook continue to be Facebook in the VR domain? Or, could Second Life’s ‘Project Sansar’ provide a second life to the company? Will Microsoft and Skype dominate the immersive virtual communication space? Although the VR domain is currently focusing on gaming, eventually the true innovation will be witnessed in the Social and Communications space. India has a lot of software developers and coders, but not as many world-class UI/UX designers and developers. And, this could be a potential problem for the country’s tech startup ecosystem to make a mark in the upcoming AR/VR industry. The few companies in the AR/VR space in India are working on overlaying visual digital layers for marketers and brand managers, and there is lack core technology innovation here.

Connected Cars

2016 will be the year in which cars will begin to have their Smartphone moment. Large, global car makers such as GM, Ford, BMW, etc., are increasingly investing in ICT, while the big technology companies such as Apple and Google are trying to enter the car industry through technology innovations and disruptions. Regardless of who manages to get on to the other’s turf, the ‘platformization’ framework for the car industry is being put in place, and crowd sourcing of digital technology solutions and innovations through 3rd parties will happen rapidly.

By 2018-20, the connected car ecosystem and the technology innovations in the industry are expected to go mainstream. In India, many young startups including CarIQ, 6Zene, etc., are working on cloud-based analytics and vehicle health and diagnosis services. And, currently there are also some interesting startups such as Savari Technologies, Exploride, etc., which are working on patented technologies and solutions, driving true innovation in the connected car space.

Blockchain

Blockchain, the “Distributed Ledger Network” technology (on which Bitcoin, the programmable cryptocurrency is based on) is useful not only to mine and track virtual currency but also other assets including stocks, bonds, car and house titles. Apart from banking and finance, blockchain technology has multiple applications in various other industries including online music, academia, voting, sharing economy, etc. There are many blockchains that are being developed by different companies (big and small) around the world. While the technology and banking giants including Cisco, JP Morgan, Wells Fargo, State Street, Fujitsu, VMWare, etc., led by IBM are working and contributing to an open source project – Open Ledger Project, young startups such as Ethereum, Freemint, Align Commerce, etc., are working on alternate blockchain technologies. Even in these nascent stages of blockchain evolution, there are already advanced developments in the domain such as Sidechains, whose vision of the future is a vast globe-spanning decentralized network of many blockchains, an intertwined cable rather than a single strand, each with its own protocol, rules, and features. India, currently has all but one startup working on blockchain, that too providing a service and not developing a technology solution. There is an urgent need for technology startups in the country to focus on this upcoming technology trend.

Internet of Things

The Internet of Things (IoT) has evolved from early-stage innovation trigger to the peak the ‘Hype Cycle of Emerging Technologies’ in 2015. The IoT is rapidly emerging as a third, and likely a bigger wave in the development of the internet, following the rise of the fixed internet in the 1990s and the mobile internet in the 2000s. There is a lot of ongoing supply-side activity globally in the IoT space, in the form of multiple platforms, products and solutions development, regulatory frameworks development, standardization, investments, mergers and acquisitions, etc., and many companies, big and small, are actively involved in it.

For the first time in the ‘Digital Technologies’ era, India is positioned on par with leading countries, both as an innovation hub and a market for various IoT-based products and solutions. IoT is expected to go mainstream only after another 7 or 8 years. However, even at the current nascent stage of the industry evolution, there are a number of Indian startups working on core technology solutions (better wireless protocols, IoT platforms, patented sensor and gesture based solutions, etc) with an eye on global fitment and scale.

To shape the direction and growth of the 21st century, India cannot wait for various innovations and industries to go mainstream. We have to play an active role during the nascent and early stages of the global evolution, and shape the ecosystem growth. Most of innovations and disruptions in the above-mentioned industries can be primarily attributed to three key technology evolutions that have come of age (apart from able and due support of VC funding): Moore’s law, Smaller and Cheaper Sensors, and Big Data. As and when the fourth key enabler – Ubiquitous and Reliable Wireless Connectivity – evolves and is ready, the world, in the 21st century, will witness unprecedented innovation and growth… much more than all the previous centuries combined. What role will India play in that disruption?

An abridged version of this post was originally published in The Economic Times, in the ‘By Invite’ section on 26th January, 2016.

Convergence Catalyst is a leading Indian Research and Advisory firm providing insights about technology markets, segments, emerging trends and intelligence on specific companies. The company offers discovery and diligence services for institutions wishing to acquire, or invest in India-based companies.

Ad-lite browsing experience

Ad-lite browsing experience