SUMMARY

The launch of the e-rupee by the Reserve Bank of India has sparked a great deal of curiosity in the concept of Central Bank Digital Currency in India

A well-designed CBDC can have multiple benefits when it comes to how we handle money and the associated safety risks. Unfortunately, the current e-rupee design falls far short of this

Let’s understand the nature, uses and limitations of CBDC, and where it stands when compared to stablecoins and bank money

The launch of the e-rupee by the Reserve Bank of India has sparked a great deal of curiosity in the concept of CBDC (Central Bank Digital Currency) in India. Let’s understand the nature, uses and limitations of CBDC, and where it stands when compared to stablecoins and bank money.

A Quick Primer

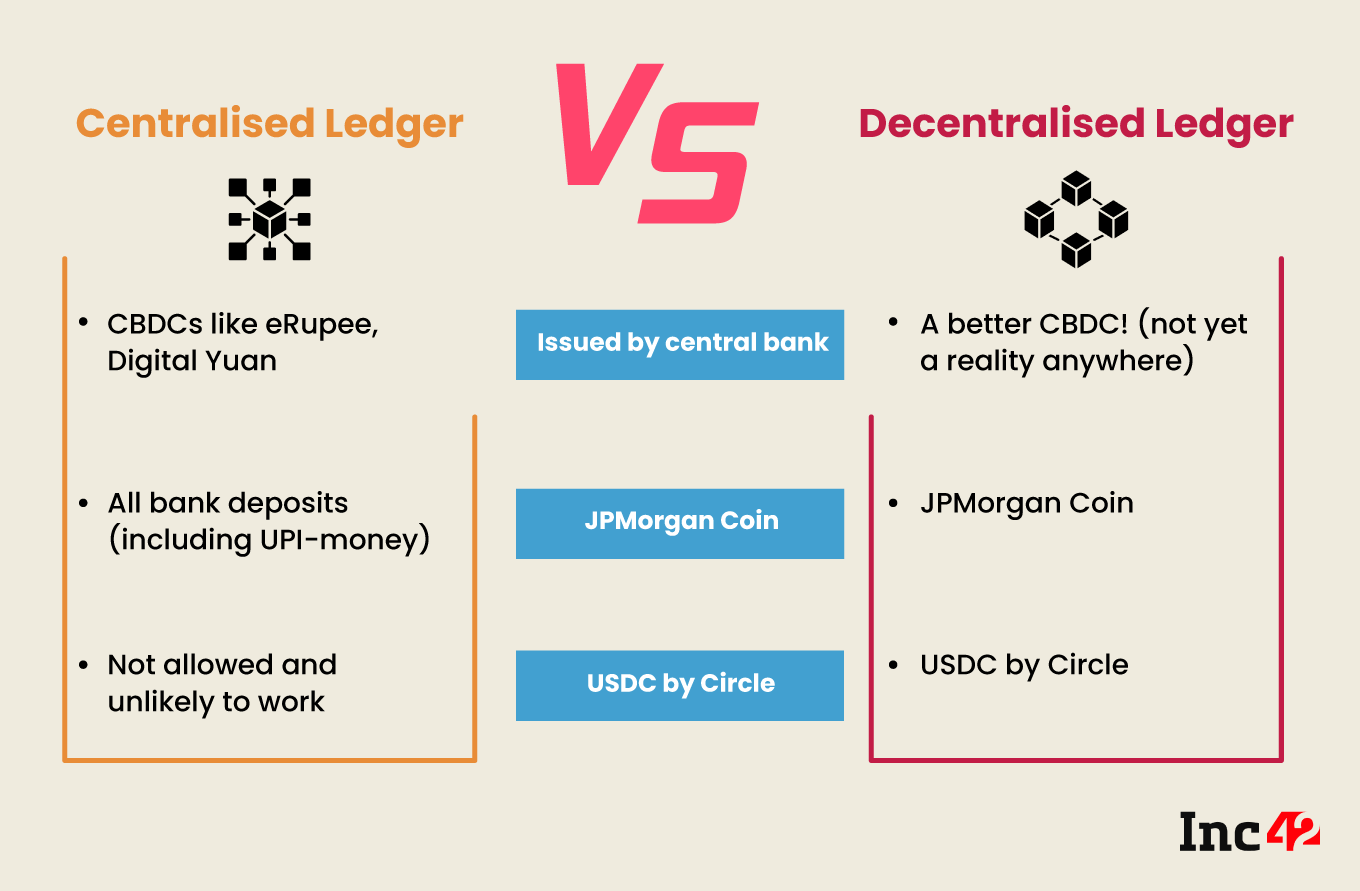

Central Bank Digital Currency is a digital currency issued by the central bank of an economy. It is at par with physical cash and may or may not be on a distributed ledger.

Bank money is credit money issued by private banks in an economy. Backed by loans and other assets of the issuing bank, it is partially insured by deposit insurance. Traditionally, these were issued on centralised bank ledgers; however, some banks have recently issued them on decentralised ledgers. This includes UPI, savings accounts, and so on.

Stablecoin is a digital form of currency issued by an issuer (public/private) on a decentralised ledger. This is backed by assets held by the issuer, typically government debt, but also CBDC, commercial paper, bank money, or crypto assets. In some cases, it might also be backed by real assets such as gold or property.

If a central bank issues CBDC on a public blockchain, it would overlap with stablecoins and might overshadow them because users would prefer zero-risk CBDC anyway.

Cash is a physical currency issued by any economy’s central bank and is on par with CBDC.

The D In CBDC

To understand how CBDC is different from money that we handle through internet banking, it is important to make the distinction between ‘credit money’ issued by banks and ‘high-powered money’ issued by the central bank.

While we consider cash and bank balances, they are not legally or technically fungible. The central bank issues cash and is liable for it. A bank deposit (savings, current, or fixed) is the bank’s liability. While a typical central bank will try to prevent a specific private bank from failing, it has no legal liability for the deposits of such a failing bank.

Cash, on the other hand, is directly under the control of the central bank. The fiat nature of currencies since 1971 (before that it was the gold standard) means that this liability doesn’t translate into anything payable by the central bank but that is a topic for another day!

The ‘digital’ nature of CBDC means it is akin to electronic cash, issued by the central bank. Before CBDC we had only physical cash and electronic private bank deposits. Now we have electronic cash as well.

What’s The Big Deal?

In the short term, switching from UPI (united payment interface) to CBDC makes little difference for users. There is a technical point of the credit risk of an issuing private bank for UPI money and virtually no credit risk in CBDC. On a daily basis, however, most of us are not bothered by this.

A well-designed CBDC (shown above, first row, second column) can go much further. Unfortunately, the current e-rupee design falls far short of this. A well-designed CBDC makes the following benefits possible, at least in theory.

- Open architecture of money handling in the economy: Instead of everyone relying on banks to handle money transfers, a good CBDC allows anyone to send and receive money without relying on banks. It would typically occur via some app or another, but they would essentially be front-ends with no risk or liability. The signatures will be cryptographically secured, similar to how bitcoin and other cryptocurrencies are transferred today.

- Smart money for no counterparty risk: A well-designed CBDC can eliminate counterparty risk from multiple bilateral transactions, reducing reliance on centralised capital markets and bank escrows significantly. Since all trades will be settled immediately, an exchange will not be required to act as a counterparty in trading.

- Smart money for targeted use: A good CBDC can have more complicated features than passive cash. This includes targeted subsidies, expiring value (China is trying that with its CBDC) and so on.

What’s The Difference Between Stablecoin & CBDC?

A CBDC does not have to be on a distributed ledger like blockchain, though it would benefit greatly if it were. The Indian e-rupee, for example, is recorded on a centralised ledger maintained by the central bank (no pun intended!). A stablecoin, on the other hand, is always stored on a distributed ledger. It may not be issued by a central bank. USDC, for example, is issued by Circle, a private non-bank company.

A stablecoin has all the benefits of smart money mentioned above. A centrally run CBDC has none of them. A stablecoin does not have the inherent zero-credit-risk nature of a CBDC, but it can come close (for example, by holding government debt against the issuance of stablecoins).

So What Do We Need?

We need the RBI to open up the e-rupee ledger so that everyone can read it. Nobody knows who owns which wallet, so no one’s privacy is violated. Users can create multiple wallets to avoid being mapped to wallets by anyone who discloses wallet details for specific transactions.

The advantage of having open read access to CBDC ownership is that some of the advantages of programmable smart money can be obtained even with such read-only access. Oracles that read this ledger for proof of payment can provide input to smart contracts. Non-banks do not have access to this under the current closed architecture. That robs e-rupee of significant potential benefits.