Lending norms of NBFCs are somewhat lenient as compared to banks

NBFCs possess an incredible share of non-security small business loans

NBFCs offer competitive rates of interest on business loans

The NBFC sector in India has evolved tremendously over recent years. The transformations to the sector have promoted the growth of the Indian financial system.

The Non-bank Financial Companies (NBFCs), also known as India’s Para-bank or shadow banking system, are the financial intermediaries registered under the Companies Act, 1956. Regulated by RBI and other government bodies these financial institutions are entitled to disburse loans and advances and acquire shares, stocks, or bonds.

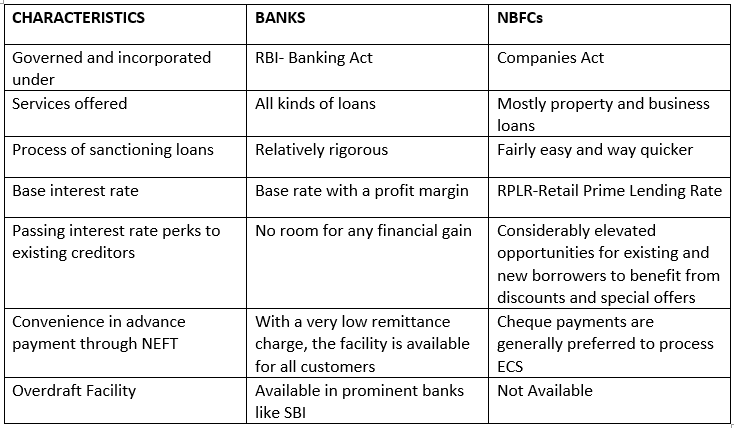

The debut of NBFCs has dramatically improved the business financing landscape. Fostering inclusive growth by being able to meet the diverse financial demands of bank excluded customers the NBFCs have accelerated the growth of MSMEs. Contrary, to banks NBFCs, have emerged successful due to their innovative financial products and less stringent lending procedure.

BANKS V/S NBFCs

Factors That Led The Growth Of NBFCs In India

Innovative product customisation

- Targeting customers by offering a limited array of products

- Devising non-standardized pricing strategy for products as per the customer’s profile and associated lending risk

Understanding the customer

- Lending finances to neglected and unorganized sections of the economy

- Less stringent procedures to cater to the diverse needs of customers

Incorporating technology

- Improved customer experience with optimized time to market

- Offering credit analysis tools and optimization in business processes

Extending approachability to wider customer base

- Meeting capital requirements of Tier-2, Tier-3 and Tier-4 market sections

- Establishing a wide network with multiple points of contact and round the clock service and sales for loan disbursement

Strategic Management of Risk

1. Enhancement of governance processes by the adoption of the agile risk assessment model

Why NBFCs a better choice for business loans?

Recently, NBFCs have taken a lead in providing business loans. Despite economic up-downs, they have remained the preferred choices for retail lending. And still, due to less stringent terms and procedures these non-bank financial institutions continue to hold a major share in business loan financing.

Here are some of the reasons behind NBFCs presuming a lead role in MSME financing:

Quick disbursal of funds

Availing business financing through banks involves stringent lending process and humongous paperwork making the loan disbursement a lengthy process. As compared to this, lending norms of NBFCs are somewhat lenient. They have relaxed requirements and minimum documentation. With this less complicacy in loan processing, NBFCs are said to lend higher satisfaction among customers.

Competitive Interest Rates

Interest rate is one of the primary concerns for loan seekers. And this is where the NBFCs have excelled. As compared to traditional banks, NBFCs offer competitive rates of interest on business loans. Their base interest rate is stipulated based on the prime lending rate (PLR) which is not regulated by RBI. Therefore, these Non-financial institutions enjoy greater flexibility and can vary their rates of interest in SME loans.

Lenient eligibility criteria

Contrary to banks, NBFCs follow a relaxed approach to loan eligibility. They accord the customers easier and faster financing. Despite having low credit score one can easily qualify for a loan from an NBFC. Also, lending 100% loan amount provides the NBFCs with an edge over traditional banks. Many of these financial institutions disburse the entire loan amount without requiring any collaterals.

Minimum supporting documents and paperwork

NBFCs possess an incredible share of non-security small business loans. They are able to garner the attention of loan seekers due to minimal documentation and paperwork. On the other hand, Banks follow more stringent rules and regulation when it comes to paperwork. In case if a borrower fails to furnish the required documents banks may refuse to process the loan application.

Takeaway

Considering the aforementioned benefits it is evident that NBFCs play a critical role in boosting the economy of the country. By fulfilling the credit requirements of MSMEs the non-banking financial institutes tend to spur the growth of essential areas requiring requisite change. Moreover, concerning lending in India, NBFCs outperform traditional banks in terms of ease of offering business loans. Even the financial stability report issued by RBI has revealed that the performance of NBFCs has improved notably.

Hence, with regard to benefits and upcoming trends in the non-banking financial sector, it is right to approach NBFCs for quick and hassle-free business loans.

Ad-lite browsing experience

Ad-lite browsing experience