Investing in private companies, particularly startups, has become an important asset class for investors in India

When it comes to individual investments in private companies, India is a severely underserved market. The exposure in traditional asset classes has peaked, and investors are looking at alternative investments

As investors plan their strategy around investing in private companies, here is a primer on how private companies can complement your traditional investment portfolio

Once inaccessible, investing in private companies via debt or equity, popularly coined as ‘startup investing’ has become an important asset class for investors in India. Rising income levels, the availability of historical data, the active participation of institutional investors, the end-game in sight with the recent tech-IPOs, more startups entering the unicorn club, portfolio diversification, the millennial mindset towards wealth creation and a generation of leaders across the top tech firms who turned to angel investing or a VC play have collectively contributed to a rise in investments across private companies.

Regulatory bodies like SEBI have also stepped in at the right time and created a regulatory framework that prioritises investor interest. As investors plan their strategy around investing in private companies, here is a primer on how private companies complement your traditional investment portfolio.

The age-old wisdom of financial planners definitely stands strong — every investor needs to stick to the basics before venturing into startup investments. Prioritise emergency funds, life insurance, health insurance, goal-based fixed-income instruments such as FD, RD, bonds, gold, and ELSS, as well as estate and tax planning. Before investing in early-stage startups, one should also consult with a financial planner.

However, when it comes to individual investments in private companies, India is a severely underserved market. The exposure in traditional asset classes such as listed equity, mutual funds, bonds and gold has peaked, and investors are looking at alternative investments to add to their portfolios.

State Of Early-Stage Investing In India

Investing in private companies opens up the possibility of investing in startups. The vibrancy of the Indian startup ecosystem has piqued the interest of global investors in growth and late-stage funding rounds. The growth story has given confidence to Indian investors who have ventured out to explore startup investing.

Initially, HNIs and family offices were the first to start investing via the Alternate Investment Fund (AIF) route. Once these investors saw some success, a few among them started exploring direct investments in startups.

Some of them have found much success and have created wealth through the direct route, while some have continued using the VC fund route via AIFs, and the remaining few invest via a combination of funds. These developments have given them more confidence in this growing asset class. Eventually, this has led to an increase in their YOY allocation as part of their portfolio.

Although certain startup investments have given them very high returns, many of them either gave them average returns or shut down. This experience has given them an understanding of the risk-return ratio. They recognise that this is a high-risk, high-return investment class in which not all investments provide disproportionate returns. But they are slowly getting more confident in today’s investing scenario and have come to the conclusion that private companies cannot be ignored.

Focus On An Investor-Friendly Structure

SEBI too has been constantly evaluating the minimum thresholds for investments in this asset class, and several committees have presented their suggestions. They have been proactively working on a structure that is investor friendly. Today, an investor can invest from INR 25 Lakh onwards in a Category 1 angel fund, from INR 1 Cr onwards in a CAT 1 VC fund, and in other Cat II and III AIFs.

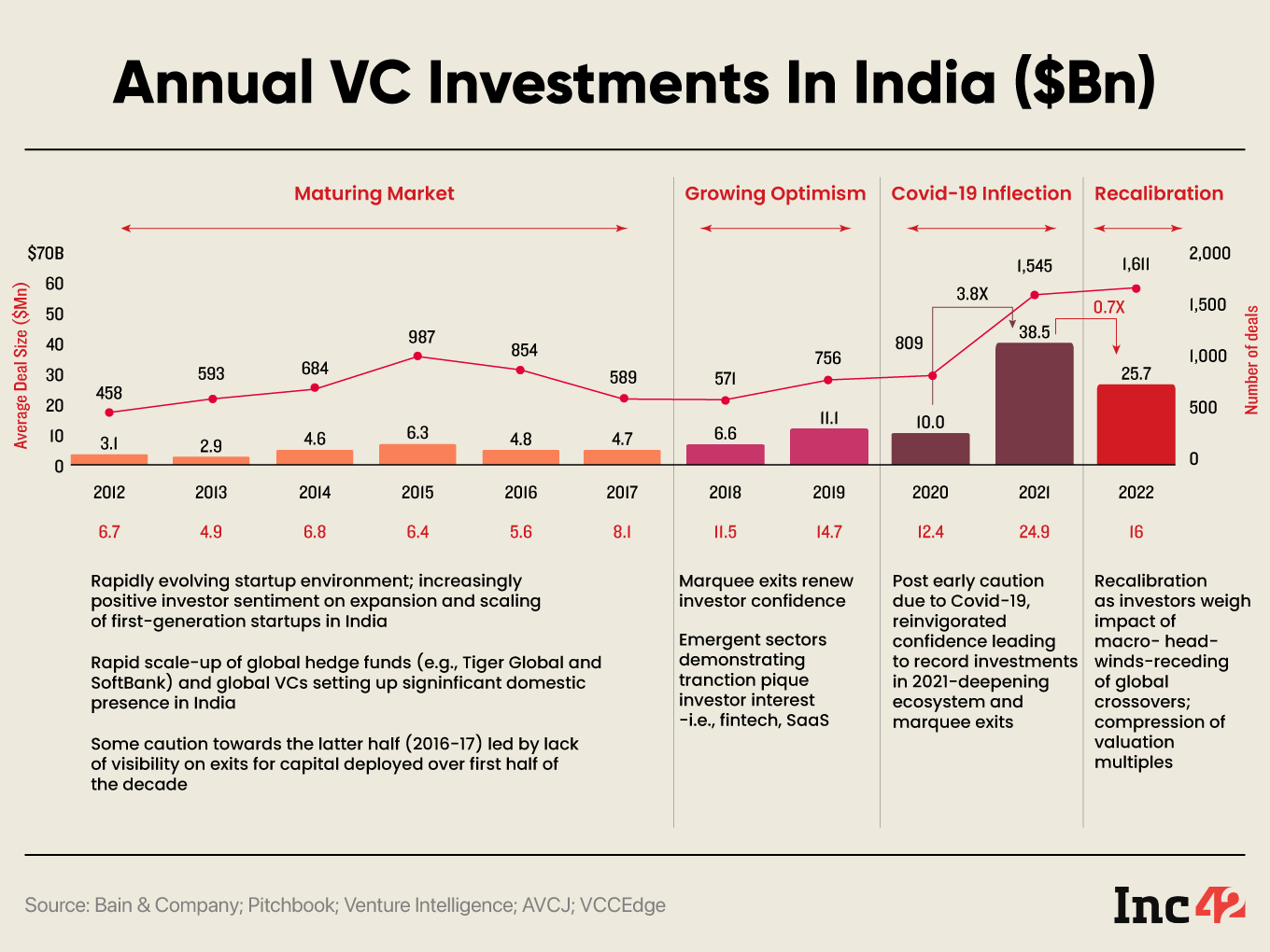

A 2022 EY and LetsVenture’s trica report that surveyed over 100 family offices stated that family offices allocated close to 18% of their investible income into startups and VC funds. The growth of investments in this asset class has peaked from $3 Bn in 2012 to $25 Bn in 2022 (IVCA report).

Why Private Companies And Why Now?

As the Indian ecosystem evolves and matures, young entrepreneurs are working on solving business and consumer problems. These entrepreneurs will work on disrupting existing business models using technology, which in turn will change the way traditional businesses function across sectors. As the number of such business models and new-age founders has grown, so has the need to fund their companies at various stages.

An investor betting on these new-age entrepreneurs frequently seeks higher returns in early-stage companies than in any other investment. This, in turn, will assist them in increasing the average return on their overall portfolio. If one of the investor’s investment calls is successful, it has the potential to provide 10X-100X returns on invested capital over a period of 8 to 10 years.

How To Evaluate Startups Across Early-Stages Vs Growth Stages

Evaluating a startup is both an art and a science. At the pre-seed stage, when the founder only has an idea, some of the key factors to consider before investing in a startup are the founder’s background, educational qualifications, domain experience, previous ventures, market size and the complementary skills brought by the cofounders.

The criteria at the growth stage vary as companies are believed to have achieved product market fit. This implies that the startup should ideally have a list of paying customers, predictable sales cycles, a clear value proposition, and a growing revenue pipeline. At this point, one must assess their go-to-market strategy, distribution channels, scalability, execution team, and so on.

By the time a company reaches the unicorn stage, it is too late for an individual investor to invest because the valuation is very high and the upside potential is relatively low. In addition to that, the minimum investment in these companies is also very high. It is not advised for individual investors to participate at this stage since a lot of their capital will get blocked in a company that has limited potential in terms of valuation and linear growth.

How Can An Investor Invest In Startups?

An investor can invest in startups in two ways — directly and indirectly. In the case of direct investment, individuals source investment opportunities and invest in them directly. They identify startups and founders who have a unique business model, a strong past track record and deep domain knowledge.

In direct investments, the individual has limited bandwidth to perform due diligence, and most decisions are made based on gut feelings. This is also because there is not much available other than a pitch deck and the founding team.

Having said that, there are three main ways of indirect investment in a startup:

Angel Network

An angel network is a group of individuals coming together to source investment opportunities and invest in startups collectively as a group. Each individual invests a small amount, and the total contribution is pooled from multiple investors.

These networks are open to cross-sector investment, but they also limit investment in a single company because the risk is highest at this stage. They prefer to invest in multiple companies and diversify their portfolio.

Syndicates

Syndicates are led by individuals known as syndicate leads. They have extensive domain knowledge and a large network among the founder community. They source deals from their network of founders, evaluate them and are typically the first to commit to an investment.

Then they share the opportunity with other individual investors who follow them because of their investment thesis, sectors, past success, and track record. Even in syndicates, like angel networks, individuals invest small amounts in multiple companies. Syndicates are the first group of investors in companies. Due to the fact that their turnaround time is fast, founders like to go to syndicates even before an angel network.

Angel Fund

The third way to invest in startups is through an angel fund, which is classified as an Alternative Investment Fund. These AIFs raise HNI capital and invest in startups. Angel funds are licenced by SEBI and have to meet all regulatory guidelines, both pre-and post-investment. These funds have a clear investment thesis, criteria for investment and the stage at which they invest.

They are headed by general partners who are responsible for managing the investments and day-to-day operations of the fund. In an AIF, an investor should commit a minimum of INR 25 Lakh to be deployed over the investment period, which typically will be between four and five years.

Angel funds have a life cycle of 8 to 10 years from investment to exit. This structure is very investor friendly because investors have the option of selecting companies from the deal flow and investing in companies in which they have confidence.

Furthermore, when compared to other types of AIF, the drawdown of the committed amount occurs only when an investor confirms to invest in a company. This allows investors to manage their cash flow and invest only in companies of their choice over a four-year period. According to SEBI regulations, the fund manager is also responsible for tracking the progress of the investment and must provide investors with a quarterly update on the investee company.

For new investors, the best way to invest in startups is via the indirect investment route. Each of these investment styles has a different approach in terms of the number of transactions, level of evaluation and post-investment tracking. Indirect investment through the fund route follows a standard process for investment in startups, which includes evaluation of the business model, size of the potential market, reference checks and due diligence on the company, including legal and regulatory checks.

For investors looking to invest via the direct route, unless one has in-depth knowledge about a domain and knows the founders in person, it is a risky channel for individuals to invest in startups directly. There are other challenges, like difficulty getting regular updates on the progress of the company and a lack of negotiating power since the investment amounts are typically very small.

Hence, using the right channel is very important to mitigate the risk of investing in startups. Good management, a proven track record of work, ethics, governance, SEBI registration, the theme of investments, the stage at which the investment is being made, and so on are some factors to be assessed before investing via these routes.

How Can Investors Build A Deal Flow?

As per some past data, only 10% of the companies that started were successful. 50% of companies fail after a series A round. Hence, capital raised isn’t the only metric for a successful startup. In an early-stage investment, the most important element is to have access to as many companies as possible. A good deal flow can come from anywhere. Hence, it is very important to be very active in deal sourcing.

One needs to build a good funnel in the case of a direct investment strategy. Some of the common sources of building a good deal flow are incubators, accelerators and alumni networks. Many seed-stage investors are very active on social media platforms like Twitter and LinkedIn. Founders follow them and reach out to them at the right time. In case an investor does not have the bandwidth to do this, joining an angel network, syndicate or fund gives you access to a curated set of companies. However, investors need to do in-depth research and due diligence before shortlisting any of these indirect routes.

Ticket Size

Depending on your investment appetite, the amount being allocated stems from your net worth and portfolio strategy. However, if an investor can allocate INR 25 Lakh to INR 1 Cr over a period of 3 to 5 years, it is better to be a part of an angel fund. However, if the investment appetite is greater, options like direct investment, investing via a VC fund or a combination of these two can be considered.

Know What You Are Investing In

There are primarily two broad instruments for raising capital — equity and debt. These are equity shares and convertible notes. Under both of these instruments, there are several sub-instruments like common shares, compulsory convertible preference shares, optionally convertible preference shares, compulsory convertible debenture, SAFE notes, and more.

In the case of an equity instrument, which is the most familiar option, the investor will know the valuation of the company, the price of the share at which they are investing in the company and the percentage of equity the investor gets in the company in return. Since equity shares are issued in a priced round, investors need to note that their equity percentage will reduce each time there is a fresh round of capital raise.

However, in the case of a convertible note, the price of the shares will be known only when the convertible note is converted into equity at a future date. The conversion terms are derived at a future date subject to the startup meeting certain predetermined conditions set by the investors, namely the size of the raise, valuation and time period within which they are able to raise. So, there is an element of uncertainty involved in the case of convertible notes.

Equity instruments were traditionally common in India, whereas convertibles are something new and have become mainstream over the past 5-6 years. Companies use different kinds of instruments depending on their business model and the stage at which they are operating. There is no single instrument that fits all sectors. It remains completely between the investors and founders and the terms they negotiate.

How To Mitigate Risk And What Is The Average Waiting Time

The average investment period in a startup from investment to exit is 7-8 years. An investor has to plan and be prepared to wait for that period to start getting an exit. It is important for investors to use only the capital they don’t need for this time frame to invest in private companies.

There are always some lucky bets that give you a return in 3 to 4 years, but at a portfolio level, 7 to 8 years is an average waiting period. The exit period would also sometime change according to the sentiments of the investors which may depend on macroeconomic indicators like interest rate, investment cycle, etc.

One of the ways to mitigate risk is to invest based on collective intelligence, which comes from investing in groups. If you are investing with your gut, the risk is very high, and there is a 90% chance that you will end up making a lot of bad investments.

There are two strategies: spray and pray, in which one invests a small amount in a large number of companies and waits for a few of them to hit the jackpot, or a slightly larger amount in a smaller number of companies where one understands the sector well. Investment diversification is also a strategy where you spread out your risk by investing in different sectors, such as B2B vs B2C.

Angel or early-stage investment sounds glamorous. However, it is also the riskiest category of asset classes due to the inherent nature of the risk involved in investing in startups. The risk of losing the invested capital is very high, and not all companies give you great returns.

Therefore, one should use only the excess money post savings and goals to invest in this asset class. The other most important thing is to invest via the indirect method of investment. It is advisable to consult a SEBI-registered financial planner before investing.

Conclusion

With the increased participation of AIFs, corporates, and family offices in private companies, the Indian startup ecosystem has gained the trust of local investors. This has unlocked a large pool of domestic capital to support startups. With the increase in the quality of entrepreneurs and acceptance of entrepreneurship as a career culturally in India, we as a nation are poised to help solve global problems and work towards making India a $5 Tn economy in the next 5 years. This asset class, or startups, is expected to play a significant role in reaching this milestone.

Ad-lite browsing experience

Ad-lite browsing experience