As the online lending marketplaces evolve within the fintech ecosystem, the Reserve Bank of India (RBI) has proposed that peer-to-peer (P2P) lending platforms will register as non-banking finance companies (NBFCs).

The proposal comes in order to regulate these lending platforms and bring them under the regulatory purview of the central bank.

The P2P lending or online lending marketplaces are an intermediary that matches lenders with borrowers in order to provide unsecured loans without the intervention of traditional financial institutions such as banks and NBFCs. The borrower can either be an individual or a legal person requiring a loan. In the P2P lending the interest rate may be set by the platform or by mutual agreement between the borrower and the lender.

Thus, P2P players are very different from MFI’s (microfinance institutions), which does not create a marketplace and wherein borrowers usually do not have any control over whom to lend.

Lately the P2P lending has emerged as an intricate system of interconnected investors, lenders, marketing players, credit bureaus, originators, borrowers, information vendors, and soon-to-be-emerging regulators. With the increasing pace of peer-to-peer lending market, it is necessary to have a regulatory framework in place.

While SEBI had come up with a discussion paper exploring the securities side of the business, the RBI has released a consultation paper on its website proposing guidelines for P2P lending platforms.

It has suggested regulating the permitted activities of P2P lenders, along with capital requirements, governance and business continuity plans of such entities. The regulator, however, has stayed away from any structures on the amount of lending that can be done through these platforms and the rate at which this lending is done, which is what the industry had sought during its discussions with the regulator.

The Regulations

- P2P lenders must act only as intermediaries and their role must be limited to bringing the borrower and lender together which includes moving of funds directly from the lender’s account to the borrowers’ account

- The platforms will be prohibited from giving any assured return either directly or indirectly

- The platforms will be allowed to opine on the suitability of a lender and creditworthiness of a borrower.

- The RBI also proposed a minimum INR 2 Cr capital requirement for platforms to operate.

- It has proposed prohibiting P2P platforms from promising or suggesting a promise of extraordinary returns, which implies some form of guarantee of returns to lenders

- Since lenders may not be sophisticated, there may be limits on maximum contribution by a lender to a borrower/segment of activity

- P2P platforms may be required to have a “brick-and-mortar” presence in India

- Adequate regulations on advertisements will also be put in place

- Platforms will need to submit regular reports on their financial position, loans arranged each quarter, complaints, and so on to RBI

In the paper RBI also said that with a view to ensure that there is enough skin in the game at a later date, leverage ratio may be prescribed so that the platforms do not expand with indiscriminate leverage.

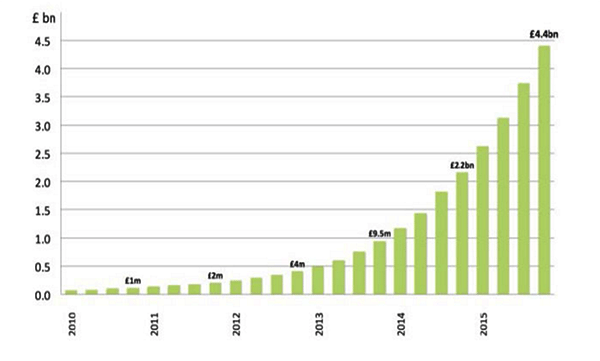

According to the data released by P2PFA, the cumulative lending through P2P platforms globally, at the end of Q4 of 2015, has reached 4.4 Bn GBP. In 2015 alone, around 20 new online P2P lending companies were launched in India. At present, there are around 30 startups in the domain including Kiva.org, Rangde.org, Milaap.org, i-Lend, i2iFunding, Lendbox, Faircent, Lendenclub, Loancircle, Loanzen, and Capzest.

In a reaction to RBI’s proposed guidelines, Vinay Mathews, founder & COO at Faircent, said, “If the guidelines are framed in an intelligent, prudent and practical manner it is always good for any industry. The regulator is an equal partner in the growth and value provided to the consumers. If regulations are given out keeping in mind the interest of the consumers they bring immense value like we have seen worldwide in the case of P2P lending, as the discussion papers states it would allow borrowers to access loans at much lower costs or give access to credit to SME/ Micro SMEs access to loans till now either denied access or underserved by the traditional financial institutions.”

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Ad-lite browsing experience

Ad-lite browsing experience