Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

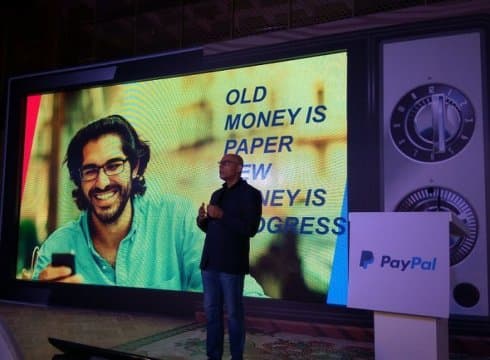

In yet another move to tap the burgeoning digital payments space in the country, digital payments player PayPal has announced the launch of PayPal.me– a new peer to peer payment feature which allows receiving payment via the click of a link in a fast, convenient and personalised way. PayPal.me for business is specifically targetted at freelancers, casual sellers and B2B sellers in India to receive payments from customers around the world, simply by asking them to click a personalised link.

Anupam Pahuja, Country Manager and Managing Director, PayPal India stated, “At PayPal we are focussed on enabling digital payments in a safe and secure environment. PayPal.me offers a quicker and on-the-go facility for the freelancer segment to receive payments. Interestingly, a safer payment option takes priority over all other factors including discounts which make us a preferred payment option with our focus on risk & security.”

How Does It Work

PayPal customers can create a personalised PayPal.Me link for receiving cross-border commercial payments with their existing PayPal account. This link with the amount appended can be shared with customers to request payment. For example, merchants can use, PayPal.Me/MerchantName/45 to ask for $45.

The payees can click the link, log into PayPal (or create a new PayPal account) and complete the payment. The funds are transferred into the receiver’s account within seconds. Consequently, freelancers or sellers no longer need to send a manual payment request or detailed bank account number and SWIFT code. They can simply send their PayPal.Me link while chatting with their client and get paid right away.

The move comes as freelancers and casual sellers selling cross-border are consistently faced with the challenge of receiving and making payments in a timely and efficient manner. Additionally, the amount to be processed more than often is lost in transition between the time a payment request is made and the time payment is received.

PayPal has been vociferous about empowering freelancers, startups, and small businesses as it eyes a substantial stake in the growing Indian digital ecosystem. One of its initiatives in this regard is to remove doubts about the security of digital payments by offering both buyers and sellers the Buyer Protection and Seller Protection programmes. Towards this, in July, PayPal announced the launch of seller protection for intangibles, an expansion of its existing seller protection programme, that earlier only covered merchants selling tangible goods such as handicrafts, fashion, art, etc.

As per a World Bank report cited by Anupam, India is home to 1.8 Cr freelancers and the number is expected to grow further. No wonder, Paypal is actively looking to tap into this community.

82% of Indian Millennials Indulge In Cross Border Shopping

Additionally, PayPal also released findings from the PayPal and IPSOS Cross Border 2015 Millennials report which evaluates the online and cross-border shopping habits of over 23,000 Internet users across 29 countries including interviews of 517 millennials in India.

As per the report, 82% of Indian millennials have shopped across the border last year. Other highlights include –

- Close to 79% of Indian millennials shop for event tickets online while 82% spent on travel.

- The US continues to be the most preferred nation for cross-border shopping followed by China, UK and Singapore.

- 59% of millennials, while shopping cross-border online are more likely to purchase from a site from which they have already bought before.

- Millennials (85%) prefer large global online stores such as Amazon to buy products while shopping cross-border.

- 48% of these made purchases in a foreign currency while 39% bought from a website in a foreign language.

- In Asia-Pacific, 1 in 3 cross-border transactions made by millennial cross border shoppers are made on tablet or smartphone.

PayPal’s new initiative comes as digital payments have become a hot turf in the Indian ecosystem. The recent Google and Boston Consulting Group reports states that the digital payments industry in India is projected to reach $500 Bn by 2020, contributing 15% to India’s GDP.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.