SUMMARY

It is no secret that Indians are crazy for gold. The demand for gold gets much stronger during the festive period and the following wedding season

After seeing a rise in demand during the pandemic, the popularity of digital gold has been on a decline due to lower returns compared to some of the other asset class

However, industry experts see the demand rising during the first pandemic-free festive and wedding season in the country in three years

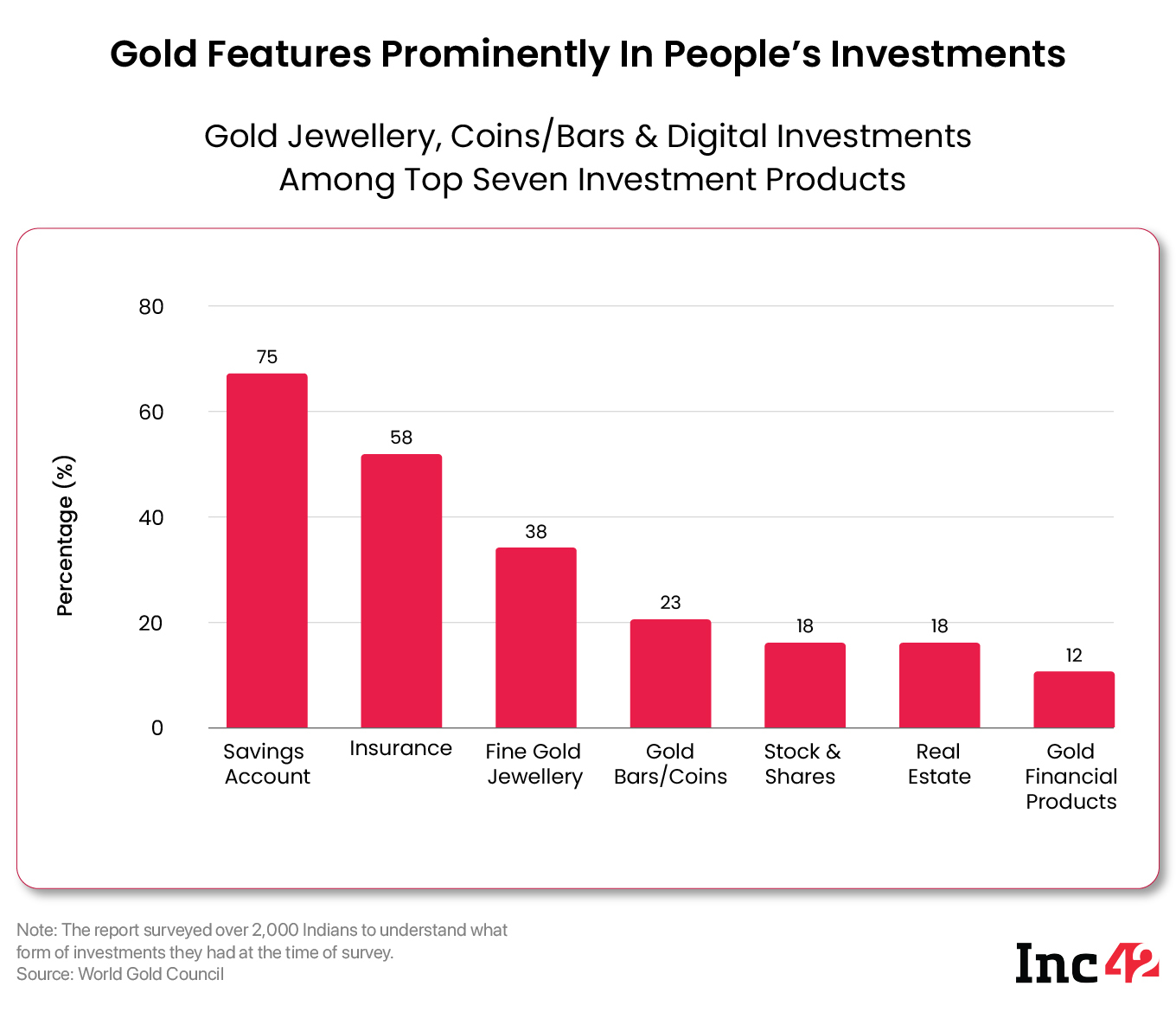

According to a consumer data intelligence report, more than 65% of Indians invest a part of their income in one form or other. Gold is the most popular investment category among them, with 15% of India’s youth keen on investing in digital gold.

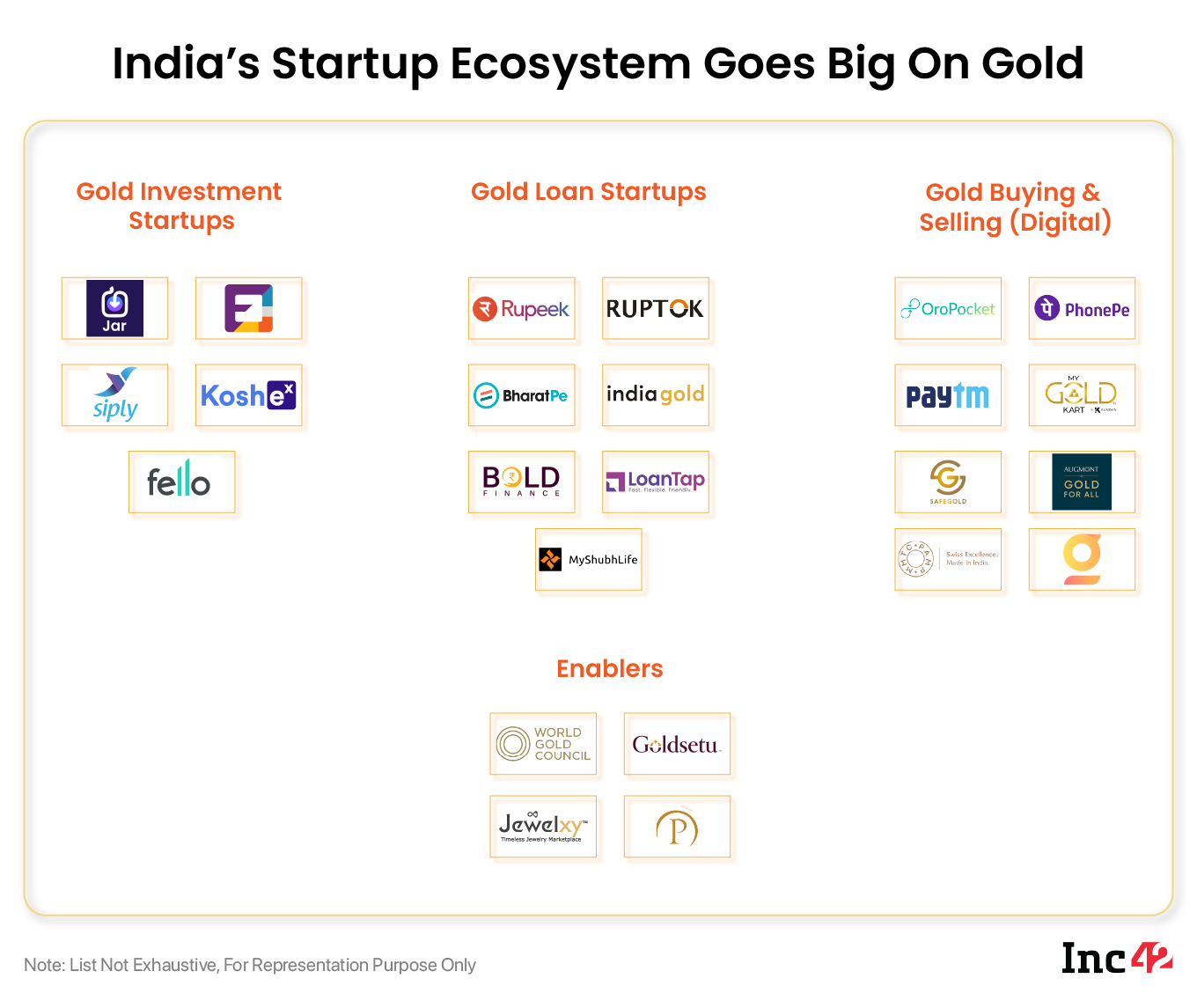

The early part of 2022 saw a big inflow of funds and market consolidation in gold-related fintech startups such as Jar, MyShubhLife, Rupeek, and more. However, gold investments saw a downturn in 2022 – be it investing via spare change or digital gold accumulation plans, and as a result, only about $200 Mn flowed into the subsector in 2022.

It is no secret that Indians are crazy for gold. The demand for gold gets much stronger during the festive season days followed by the wedding season. This is a period of heightened gold buying activity, whether in the form of gold biscuits, jewellery, coins, or now, digital gold. About 30-40% of annual gold coin sales take place during this period.

Gold can be used in jewellery, gift or collateral for loans and currencies. Considering this, gold’s importance as an asset class should have increased in 2022 amid the global economic slowdown and negative market sentiment.

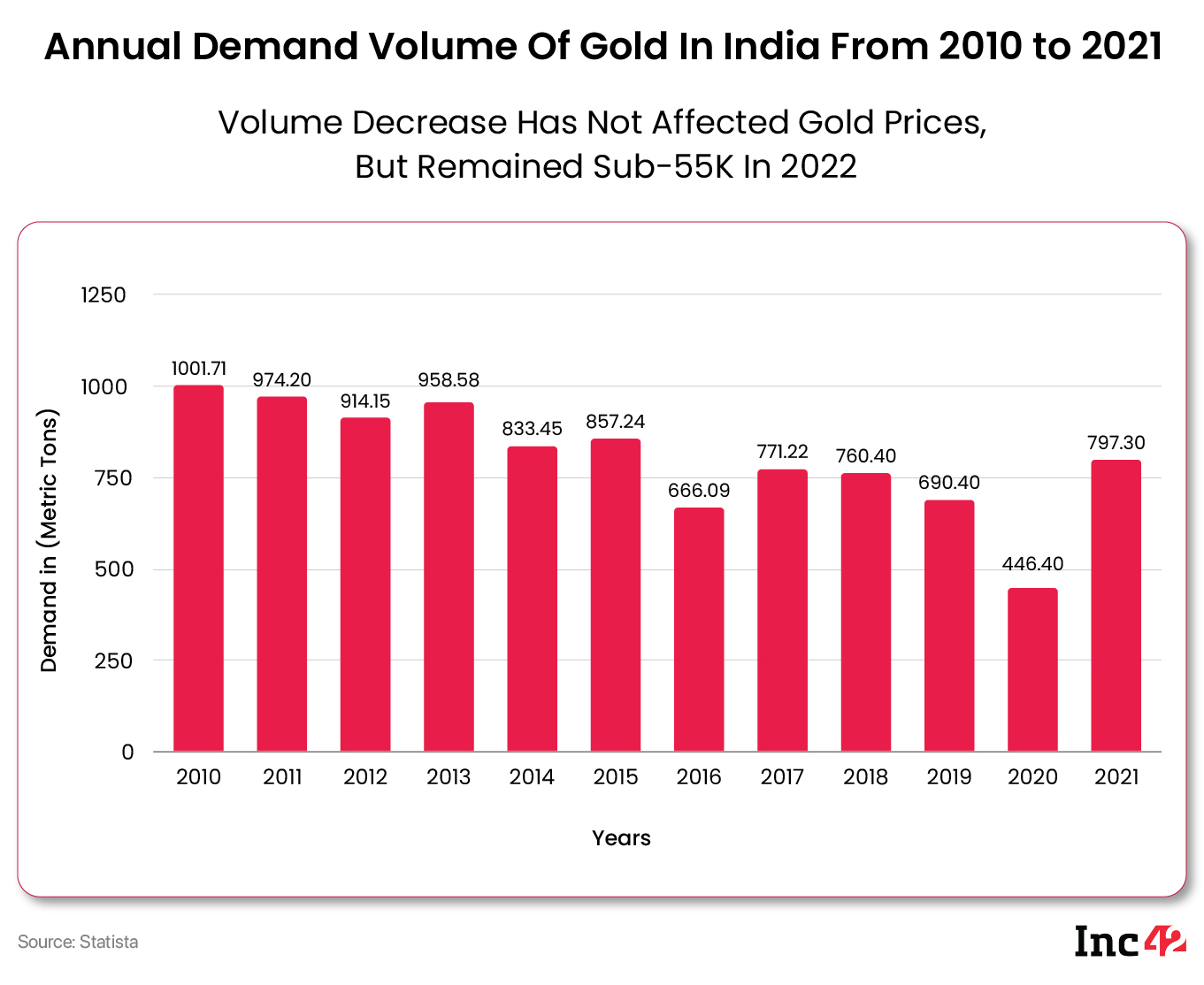

However, demand for physical as well as digital gold has been on a decline in the country for the last decade. In 2021, only 797.30 metric tons of gold was bought in India, compared to 1001.71 metric tons bought in 2010. According to the World Gold Council, the demand for gold in 2022 will also be 800-850 metric tons, which is not a significant rise despite festivity and wedding season normalcy returning in India.

According to experts, the current global economic conditions are one of the main reasons for the decline in demand for digital gold. Other key reasons for the slowdown include slower and non-gratifying returns when compared to other investment avenues such as mutual funds, cryptocurrencies and more.

Speaking to Inc42, gold-focussed SaaS startup GoldSetu’s founder Vikas Verma stated that GenZ and millennials are the key drivers of the digital gold ecosystem.

The growth in fintech startups which made buying gold simpler by offering spare change savings, digital buying, cashback on buying gold, and coupon-based promotions, made digital gold a popular investment avenue for GenZ and millennials.

As the situation returns to normal, the consumption of gold (in the form of utensils, jewellery and coins) will gain more popularity as opposed to viewing gold as an investment, he said.

A World Gold Council report recently suggested that GenZ and millennials have started feeling a disconnect with gold and the segment is being redefined once again.

As per reports, Indian vaults are holding 10% less gold compared to previous years and the export has also fallen by 30% year-on-year.

Reasons For Fall In Digital Gold Demand

Verma said that the market shift can be seen within startups operating in the ecosystem. They have a large volume of transactions, but per wallet transaction (value) has constantly been falling as retail investors see lower returns.

Correlating this continuous fall in the market to several factors, besides changing consumer preferences, experts told Inc42 that there are four key reasons for the decline in demand:

Market Conditions: The fall in the price of gold in the global market, having touched nearly $1,600 per ounce, has affected the demand for digital gold in India (a strong dollar keeps gold prices in check). Besides, the Reserve Bank of India (RBI) has been increasing the repo rate, which may also have an effect on gold loans. The rise in repo rate may lead to the interest rate for gold loans increasing to as high as 28% per annum against the industry average of 12-13%.

High Inflation: The rise in inflation over the past few months has affected the purchasing power of Indians. Besides, in an age when everyone is looking for quick and big returns, the lack of big returns from fractional digital gold ownership has made many move to either buy physical gold or opt for the ‘save now, buy later’ philosophy.

Shift To Physical: Digitisation within the gold industry was fuelled by the Covid-19 pandemic. As life has slowly gone back to pre-pandemic normalcy, customers have adopted a hybrid model. For gold jewellery, they like to browse online and go to a physical store to buy it. However, the experts pointed out that the demand for digital gold has been strong from retail investors as digital gold vouchers have gained popularity.

Absence Of Regulations: In 2021, an India Infoline report suggested that despite having a turnover of INR 4,000 Cr for digital gold, the market was dominated by institutional investors. While India had 12 Cr retail investors and 10 Cr institutional investors, the retail investors were spending too little, and only institutional investors were buying big. The retail investors spent denominations as small as INR 250 – INR 500, and thus, the government had to intervene with certain regulations.

While the regulations are majorly concerning the sale of digital gold on brokerage firms, there are no clear guidelines to safeguard buyers from potential snags. Owing to the unregulated nature of the industry, retail investors find it easier to connect with physical gold sellers and can be averse to the digital market, according to analysts.

Besides, dual GST payment – once when buying/selling digital gold and the second time when converting it to physical gold – has been a bottleneck for the industry and the regulators are considering the issue now.

Will Festive Season Revive The Demand For Gold In India?

According to digital gold startup SafeGold’s Head of Consumer Business Rhea Chaterji, the years 2021 and 2022 saw a sharp rise in gold loans, especially due to financial hardships faced by the people due to the impact of the pandemic on incomes, and this is likely to continue for some time. However, the recent hike in the repo rate by the central bank can hit the demand for gold loans.

On the other hand, Rahul Kalyani, VP – Partnerships (sales and marketing) at LoanTap, believes that while physical gold has always been preferred in India, the market for gold loans has been increasing with the availability of loans at lower interest rates.

Chaterji also pointed out that demand for digital gold saw a clear increase in the quarter preceding the festive season, mirroring the rise in retail purchases of gold jewellery. Besides, there was also an increase in the conversion of digital gold to physical gold for jewellery making as the wedding season will follow the festive season.

World Gold Council’s marketing head Arti Saxena believes that the risk-free, storage-proof option of digital gold has proved that it is reliable as an investment option. Strengthening the product range by making it easier to convert digital gold to physical gold or gold balance will be more ‘meaningful’ and ‘self-expressive’ for users, leading to a higher demand within the ecosystem.

However, the ecosystem is more eagerly awaiting a clear regulatory framework.

“Given that digital gold is predominantly an investment instrument, it should be brought under the ambit of SEBI, like the proposed Exchange Gold Receipts (EGRs). Such a framework would allow for zero GST, transparent and justified spread and seamless conversion of physical gold,” Verma said.