According to an Inc42 report, India’s fintech industry is estimated to breach the trillion mark by 2030

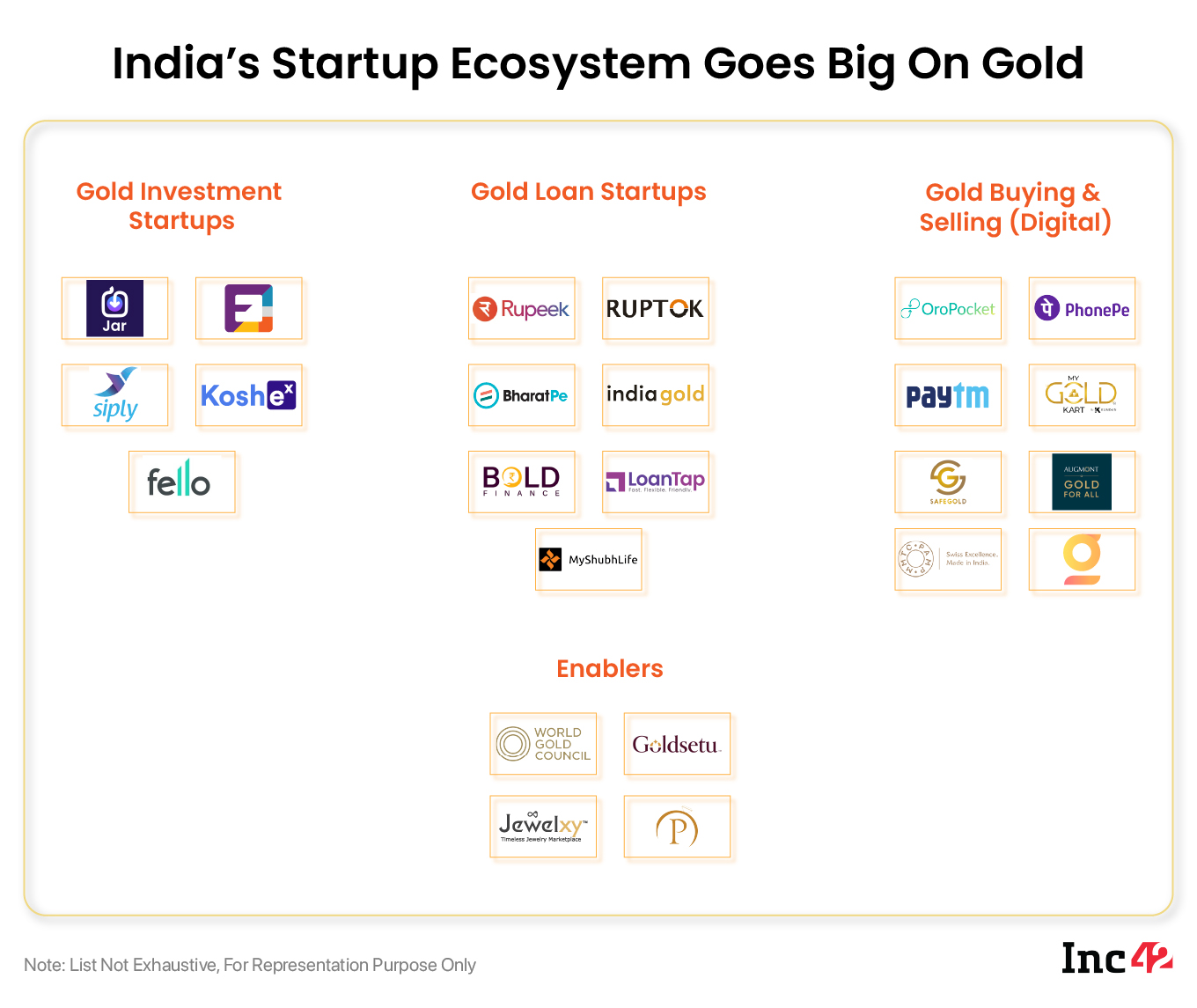

To capitalise on India’s enormous gold market opportunity, several fintech startups have entered the gold segment in recent years

The demand for gold spikes during the festive season. However, digital gold has emerged as an alternative option to jewellery and coins over the last few years

Buoyed by the growing demand for formal finance and increasing internet penetration, fintech startups are upending traditional methods of banking, investing, payments, insurance and lending in the country. According to an Inc42 report, the country’s fintech industry is estimated to breach the $1 Tn mark by 2030. Within fintech, lendingtech is the fastest growing subsector, as per the report.

Over the last few years, a slew of fintech startups has entered the gold segment to disrupt the conventional gold buying and investing behaviour. From purchasing digital gold to getting loans against gold in a hassle-free, paperless manner, fintech startups are changing the way Indians invest and use gold.

Traditionally, the yellow metal is seen as an effective hedge against inflation due to its high liquidity, which also makes it a lucrative asset class. Besides, gold has a deep-rooted cultural significance as Indians see it as a symbol of wealth and good luck. Hence, it is hardly surprising that India is counted among the largest gold markets in the world.

As the country gears up for its biggest gold rush in the ongoing festive season, Inc42 brings to you a list of Indian fintech startups that are disrupting the gold category.

The list is not meant to be a ranking of any kind. The fintech startups have been listed in alphabetical order.

BharatPe

Fintech unicorn BharatPe launched its gold loan vertical in March 2022 to enable partner merchants secure loans against gold. The startup has partnered with a slew of non-banking financial companies (NBFCs) to offer gold loans of up to INR 20 Lakh. The loan is reportedly provided at an interest rate of 0.39% per month, or 4.68% per annum. BharatPe aims to disburse loans worth INR 500 Cr by the end of this calendar year.

Since the beginning of the year, BharatPe has been steeped in controversy, with its top executives publicly bickering over various issues. The startup has seen an exodus of executives from its leadership team. Cofounders Bhavik Kalodiya, Ashneer Grover, and founding member Satyam Nathani are among those who quit the startup.

Despite the tumultuous scenario, the fintech startup is aggressively scaling and has reached a valuation of $2.8 Bn in four years.

Bold Finance

Bold Finance is on a mission to organise India’s unorganised gold loan sector, which accounts for nearly 65% of India’s total gold loan market. The fintech startup leverages its network of jewellers, pawnbrokers and moneylenders (credit franchises) to source and dispense small-ticket gold loans to consumers, primarily in India’s Tier-2, 3 regions.

While these partners act as credit providers who approve loans using the startup’s platform, Bold Finance’s partner banks underwrite the loans. The customers can reportedly get credit between INR 10,000 and INR 15 Lakh for a period of six months through Bold Finance.

Gullak Money

Founded in January 2022 by former Juspay executives, Gullak Money allows users to invest in digital gold. Customers can set up an automatic payment plan to reach their goals (higher education, buy a house, plan a wedding and more). Alternatively, they can also choose between spare change savings and one-time investments.

Customers can pause/ edit and withdraw the investment at any time and choose to liquidate it as gold or cash.

In June, the startup raised $1.3 Mn in a pre-Seed round from a clutch of investors, including Better Capital, Stellaris Ventures Partners, and angel investors like Vimal Kumar and Sheetal Lalwani (Juspay cofounders), and Nitin Gupta (UniCards founder and CEO).

Indiagold

Indiagold claims to have offered gold loans and digital gold investment services to 20 Lakh consumers till date. The startup has partnered with a slew of banks and NBFCs to offer instant digital gold loans to users.

Additionally, the platform has an innovative doorstep gold locker solution wherein once users sign up, they can have their gold possessions picked up from the doorstep (with a biometric locking system) which are then transferred to Indiagold’s lockers. Customers can track and manage their lockers through the Indiagold mobile app. This facility is currently available in Delhi and Gurugram.

Jar

Jar is a digital investment platform that allows users to make investments as small as INR 10 in digital gold. Users can automate savings and make daily investments anywhere between INR 10 and INR 500 in digital gold. In addition, they can also invest round-up amounts from their daily spending and liquidate without any lock-in period.

In August 2022, Jar raised $22.6 Mn in a Series B funding round led by Tiger Global at a post-money valuation of $300 Mn.

OroPocket

OroPocket is an investment platform on blockchain that lets users buy digital gold and silver of a fixed value or weight at live market rates. It records ownership of assets on Ethereum, Tezos and Polygon blockchains. Since transactions are recorded in a public ledger, it brings transparency and security of ownership, the startup claims.

Users can automate investing plans for tokenised precious metals as well as transfer their stored digital assets to anyone globally within minutes.

Paytm

Digital payments unicorn Paytm offers digital gold to its users via its mobile app. Users can create weekly/monthly auto payment investment plans in gold, starting at INR 1. They can redeem the gold as coins and bars and have them delivered to their home.

The fintech major launched its IPO in November 2021 and saw a muted listing on the stock exchanges. Recently, the startup said it disbursed 9.2 Mn loans worth $894 Mn during the July-September quarter of 2022. Loan disbursals during the quarter grew 224% year-on-year (YoY), while the value of loans disbursed grew 482% YoY.

PhonePe

IPO-bound digital payments firm PhonePe allows users to invest in 24-karat gold through its app. The gold is maintained by MMTC-PAMP and SafeGold. Users can liquidate gold into coins or bars.

As of September 2022, the Flipkart-owned fintech unicorn held a 44% share in the UPI market. It processed 1.6 Bn UPI transactions worth INR 3.06 Lakh Cr during the month. Earlier this year, PhonePe acquired freelance microentrepreneurs-focused B2B startup GigIndia.

Rupeek

Rupeek is an instant gold loan provider with a presence in over 35 cities. The fintech startup claims to have disbursed loans worth INR 6,500 Cr till date, with 55% of its customers being first-time borrowers.

Like many other startups, Rupeek has been hit by the ongoing funding winter. As part of its cost-cutting strategy, the soonicorn laid off 200 employees, or 10-15% of its workforce, across teams in July 2022. The layoffs came months after Rupeek raised $34 Mn in a round led by Lightbox, GGV Capital and Bertelsmann which took its valuation to $634 Mn.

The gold loan provider had previously stated that it planned to grow its lender partner network and expand its presence to over 120 cities in 2022.

Ruptok Fintech

Ruptok Fintech provides loans against gold jewellery. The startup claims to have disbursed loans worth over INR 300 Cr and served more than 2 Lakh customers to date. The platform also serves as a banking correspondent to CSB Bank and Fincare Small Finance Bank.

In November 2021, the startup raised $2.1 Mn in a pre-Series A funding round from a clutch of investors, including Manuvel Malabar Jewellers and industry veterans and high-net-worth individuals like Nivedan Sahay and Neeraj Aggarwala. In August 2021, it raised INR 14 Cr in debt funding from Eclear Leasing and Finance.

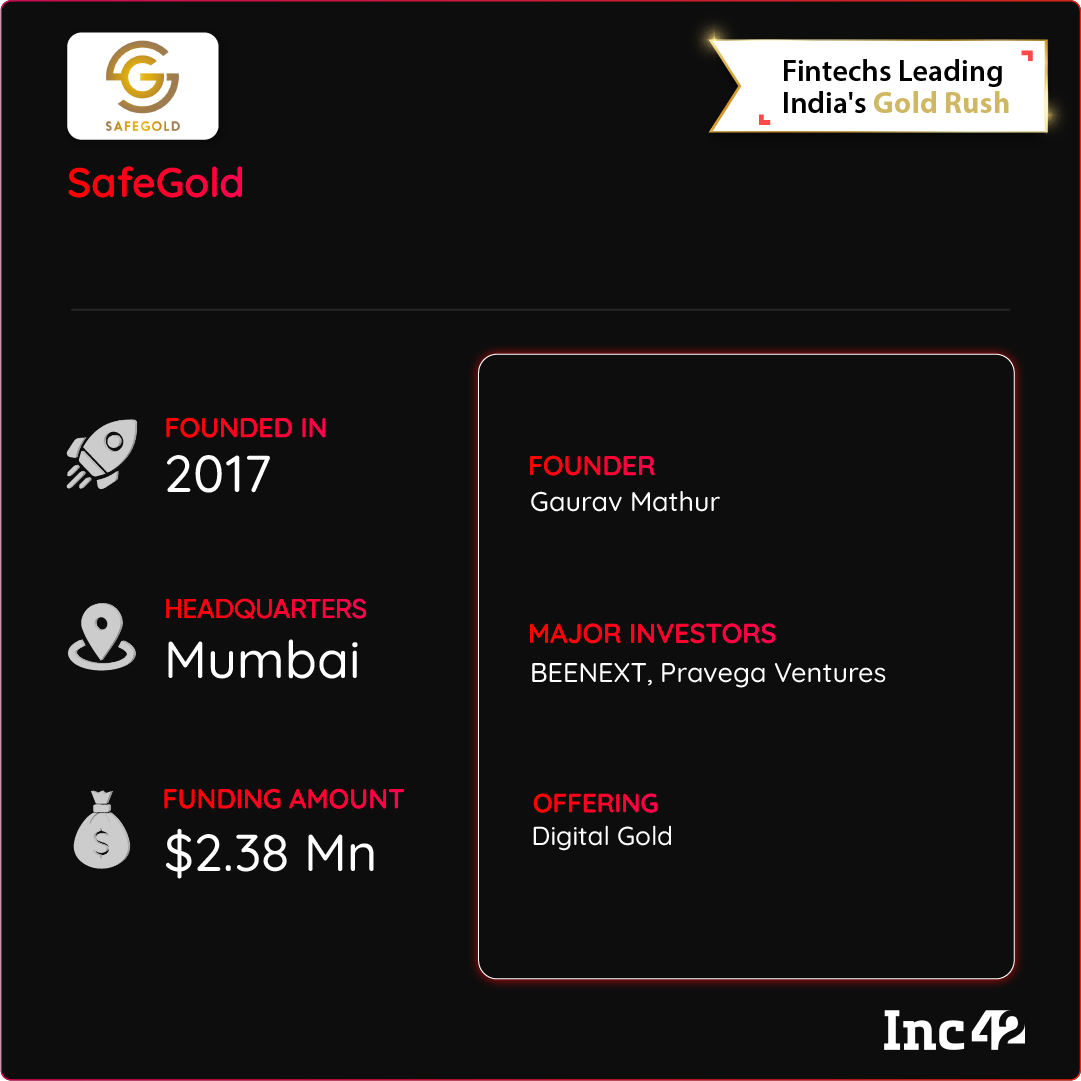

SafeGold

SafeGold is a digital platform that enables users to buy and sell digital gold and exchange it with real gold through its partners. Users can invest in gold and it can be bought and sold online from a digital vault through its partner banks and fintech players such as Axis Bank, Jar, PhonePe, Amazon Pay, and more. Customers can even exchange their digital gold for jewellery at its partner jewellery stores like Tanishq and Caratlane.

The platform claims to have over 100 partners globally. Further, it claims to have completed over 75 Mn transactions and served over 28 Mn customers to date.

The platform recently launched a new offering called Gains. With this service, customers can lease their gold possessions to jewellers. The new product intends to benefit MSME jewellers who can access domestic gold easily and enable individuals to earn a yield on the lease.

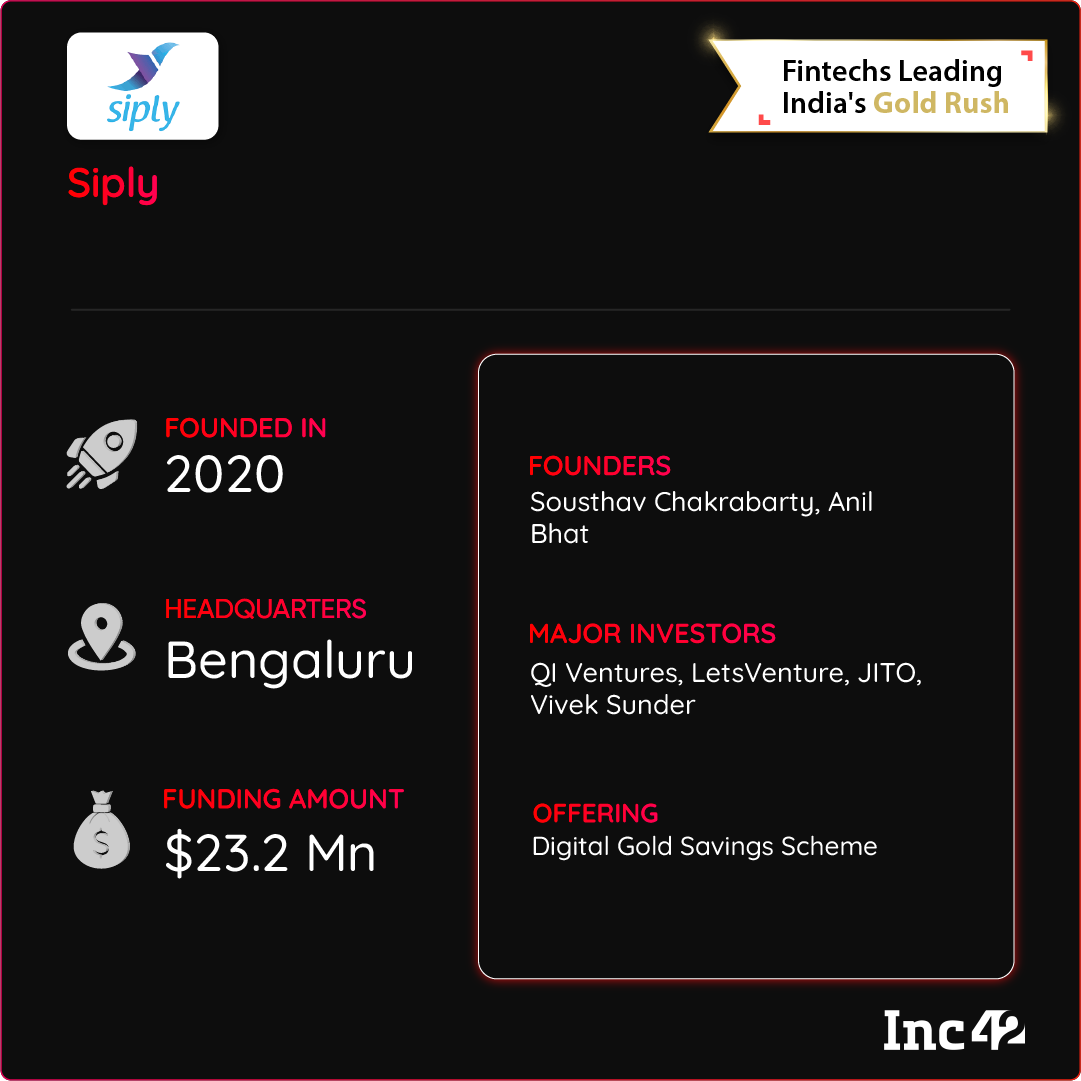

Siply

Siply is a micro-saving app that aims to inculcate saving behaviour in the underserved masses in the country. With its gold savings scheme, users can invest an amount between INR 100 and INR 10,000 weekly in digital gold. The scheme has a tenure of 13 weeks. Upon maturity, users can either renew the scheme, get gold home delivered, or liquidate it to receive cash.

In June this year, the fintech startup raised $19 Mn through a mix of debt and equity financing in its pre-Series A funding round led by QI Ventures. The round also saw participation from Siply’s existing investors, including LetsVenture and JITO, and angel investor Vivek Sunder of Cuemath.

Siply claims to have over 6 Mn active accounts and clocked more than 8.5 Mn transactions to date.

Update | October 25, 2022, 4:30 PM

Gullak’s name has been shifted from ‘gold investment’ category to ‘buying and selling (digital)’ category in the infographic upon the company’s request.

Ad-lite browsing experience

Ad-lite browsing experience