SUMMARY

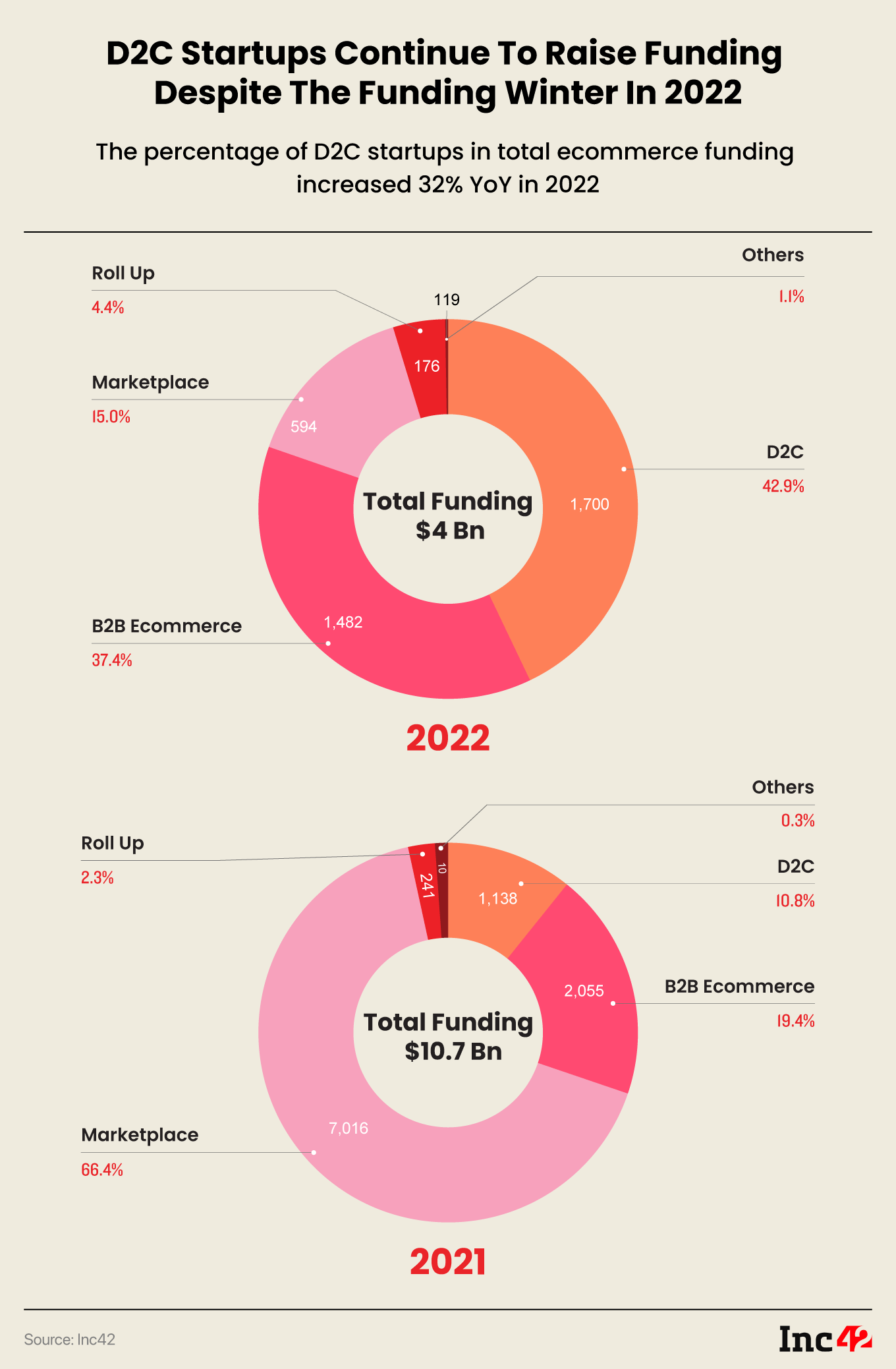

According to Inc42’s report titled The State Of Indian Ecommerce Q1 2023; In Focus: Omnichannel, D2C emerged as the most funded ecommerce sub-sector in 2022 and replaced the marketplace

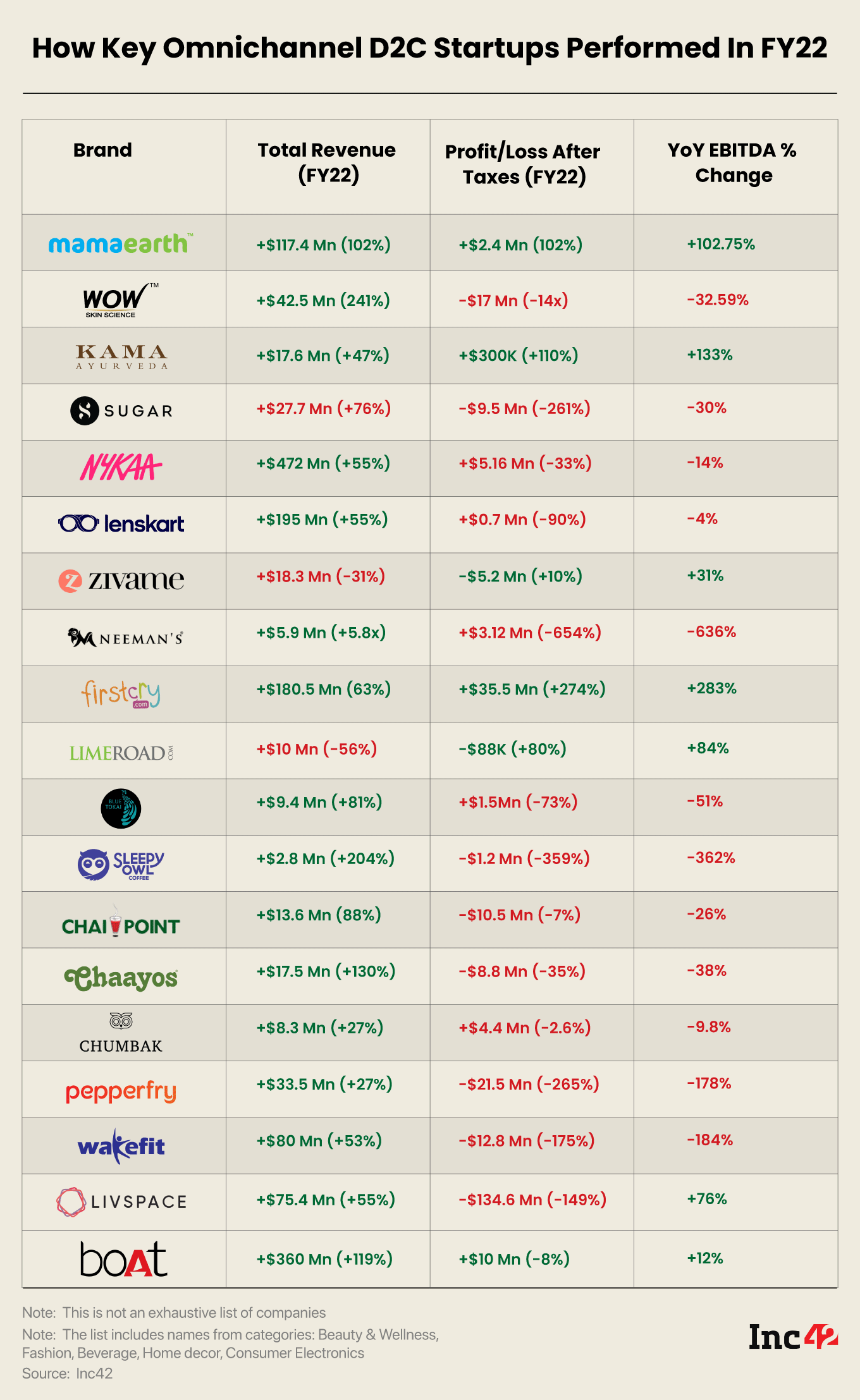

However, out of the 18 companies which published their FY22 financials, only seven were EBITDA-positive YoY

Looking for better growth opportunities, many deep-pocketed D2C brands have extended their presence offline to leverage scale and increase their margins

The Indian retail sector is estimated to grow at 9-10% annually to reach a whopping $2 Tn by 2032, an industry analysis by the Boston Consulting Group (BCG) says. The retail surge is triggered by many factors, especially the high levels of digital penetration in most regions and the steady rise of direct-to-consumer (D2C) brands since the outset of the pandemic in 2020.

India is now home to 50K+ digital-first brands, which have delved deep into every popular or niche segment and have been on investors’ radar for a considerable period. According to Inc42’s latest report titled The State Of Indian Ecommerce Q1 2023; In Focus: Omnichannel, D2C replaced the marketplace to emerge as the most funded sub-sector in 2022. It raised $1.7 Bn, nearly 43% of the total $4 Bn bagged by the overall ecommerce sector.

But here lies the glitch.

Industry sentiment suggests that consumers’ (and investors’) inclination towards the D2C model, induced by changes in consumer mindset and consumption patterns during the Covid years, is gradually fading away. A quick look at the financials of the key brands validates it further. Out of the 19 omnichannel D2C companies which published their FY22 reports, only seven were EBITDA-positive on a YoY basis [based on standalone company financials and calculations made in Inc42’s Q1 2023 Ecommerce Report]

Omnichannel Is No Longer A Choice But A Necessity

Dhruvan Barar, cofounder of the Inflection Point Ventures-backed kids’ furniture brand Boingg, hit the nail on the head when quizzed about the slump in the D2C space. According to him, brands bet big on assumptions that post-Covid, there would be a higher digital exposure at the B2C level, and consumer habits [of shopping offline] would change for good.

But online retail penetration is still limited to 4-5% across the country, while word-of-mouth and touch-and-feel experience continue to dominate purchasing decisions. This is especially true when one buys big-ticket electronic goods, furniture or home décor items.

“In Delhi-NCR, nearly 30% of our sales come from products in the INR 30-40K price range. Or let’s say that large-size items like bunk beds are selling more. But in Bengaluru, where we don’t have an offline store, only 8% of the orders are for bigger items,” said Baraar.

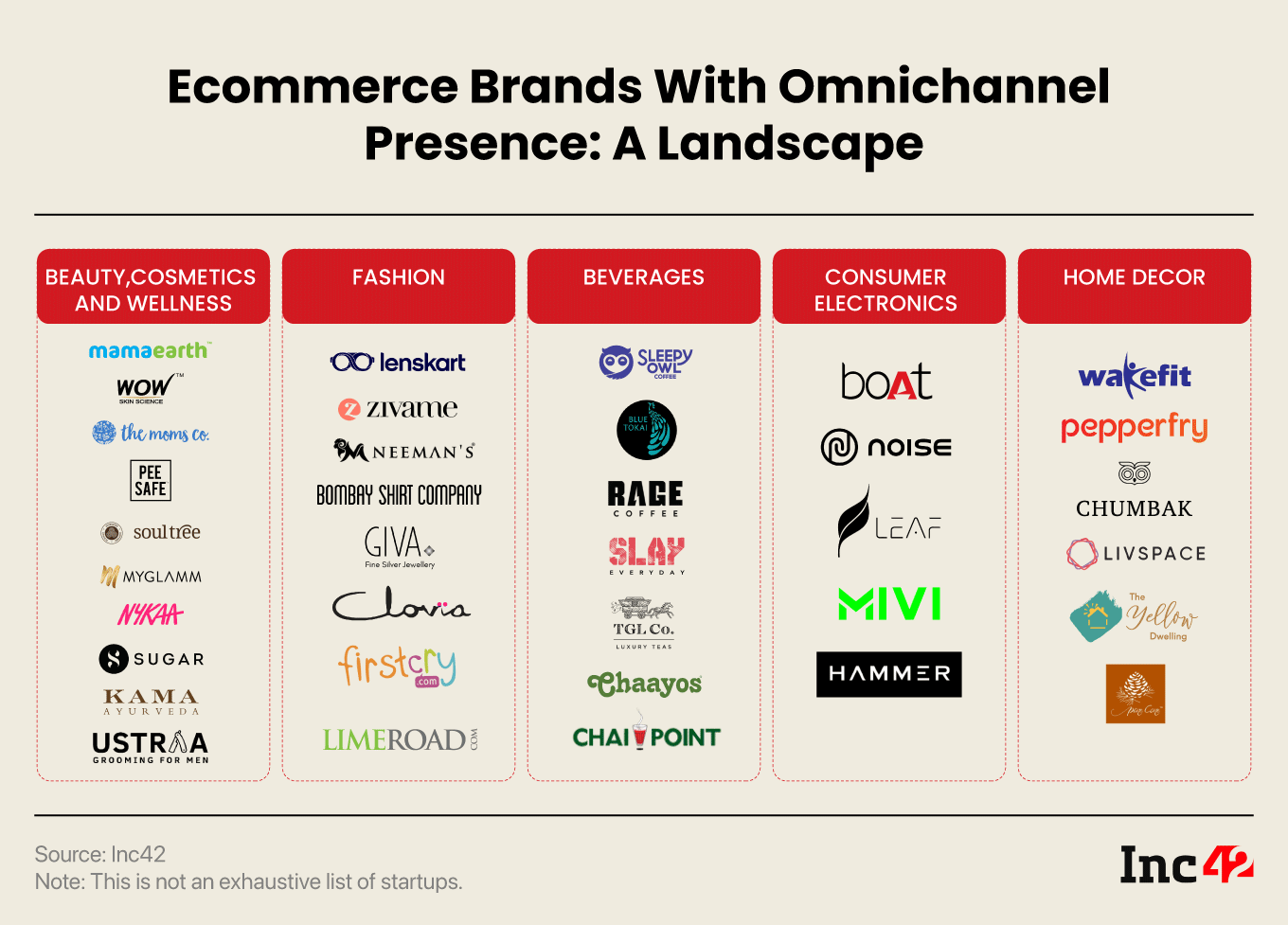

This could be why many deep-pocketed D2C brands built their offline presence in the past few years. A hybrid growth strategy and omnichannel business model have helped category leaders like Mamaearth, Lenskart, Pepperfry, Wakefit, boAt and Rage Coffee leverage scale and increase their margins.

Essentially, many industry experts think this is the right time for D2C brands to realign their business growth strategies. After all, every sector has to go through this phase on its way to attaining maturity.

Of late, the digital-first D2C model has faced a few fundamental challenges, according to Rage Coffee founder Bharat Sethi. These include successful scaling, customer acquisition in a profitable way or without burning too much cash, customer retention and repeat transactions.

“At the initial stage of building Rage Coffee, we realised that branding, marketing, and visibility can bring us the first set of consumers, and loyalists can be built online based on this. But can we build an INR 500 Cr company online? Definitely not,” added Sethi.

He was not wrong. The lines between online and offline retail are getting very blurred, and the companies/brands which are able to marry these formats will be eventual winners.

Is The Business Ready For Offline Expansion?

Before going for offline expansion, one of the primary checkpoints for a D2C startup is to assess where it stands.

Shashank Randev, founder of 100X.VC, suggests that if a D2C brand is at the seed stage, going offline immediately will not work. Instead, it is advisable to start small online, identify the niche and build a key differentiator. But for a growth-stage startup, going offline will be the natural step towards scaling if customer acquisition costs are in control, margins are in place, and brand pull and product-market fit have been established.

“One must take a cautious bet on the offline route they aim to adopt. For instance, our portfolio company, Kerala Banana Chips, will not necessarily need its exclusive store to go offline. But for Nykaa, a D2C marketplace hosting multiple brands, an exclusive offline store will make more sense,” he added.

Based on our discussions, here are the three essential parameters to decide when to opt for the offline route.

- Shelf life of a product: For products with a lower shelf life, it will be more convenient to explore the existing chain of retail networks and build the distributor network slowly. However, an exclusive retail or experiential store will be more suitable for a startup offering products with a longer shelf life (between six months and two years).

- Number of consumer touchpoints: From email, text messages, and calls to WhatsApp communication, from chat to social media reviews and comments, a customer goes through multiple touchpoints during the purchase journey. If the touchpoints are more than three or four in a given case, it typically means that the customer is finding it difficult to trust the brand. To ace the interaction and engagement, brands must understand what customers are asking.

- Understanding the category/segment: Some categories like electronics, apparel and beauty have already moved 30-40% of their businesses online. In such cases, D2C startups can continue to scale digitally and emerge as very large brands without going offline for a considerable period. As for other categories with less online penetration from the consumer side, the channel can be used as a quick route to attain the product-market fit and build the brand pull before scaling offline to capture the larger market.

Experts think when a startup thoroughly analyses its category market, it will be easy to imagine that the channels it is now scaling will give it 2x or 3x better reach.

“So if your category is 15% online, you need to pick up the channels where another 85% of the consumption in India happens. So technically you can grow 3x-4x times if you maintain the same market share. That is the broad thinking.”

Going Offline, The Right Way

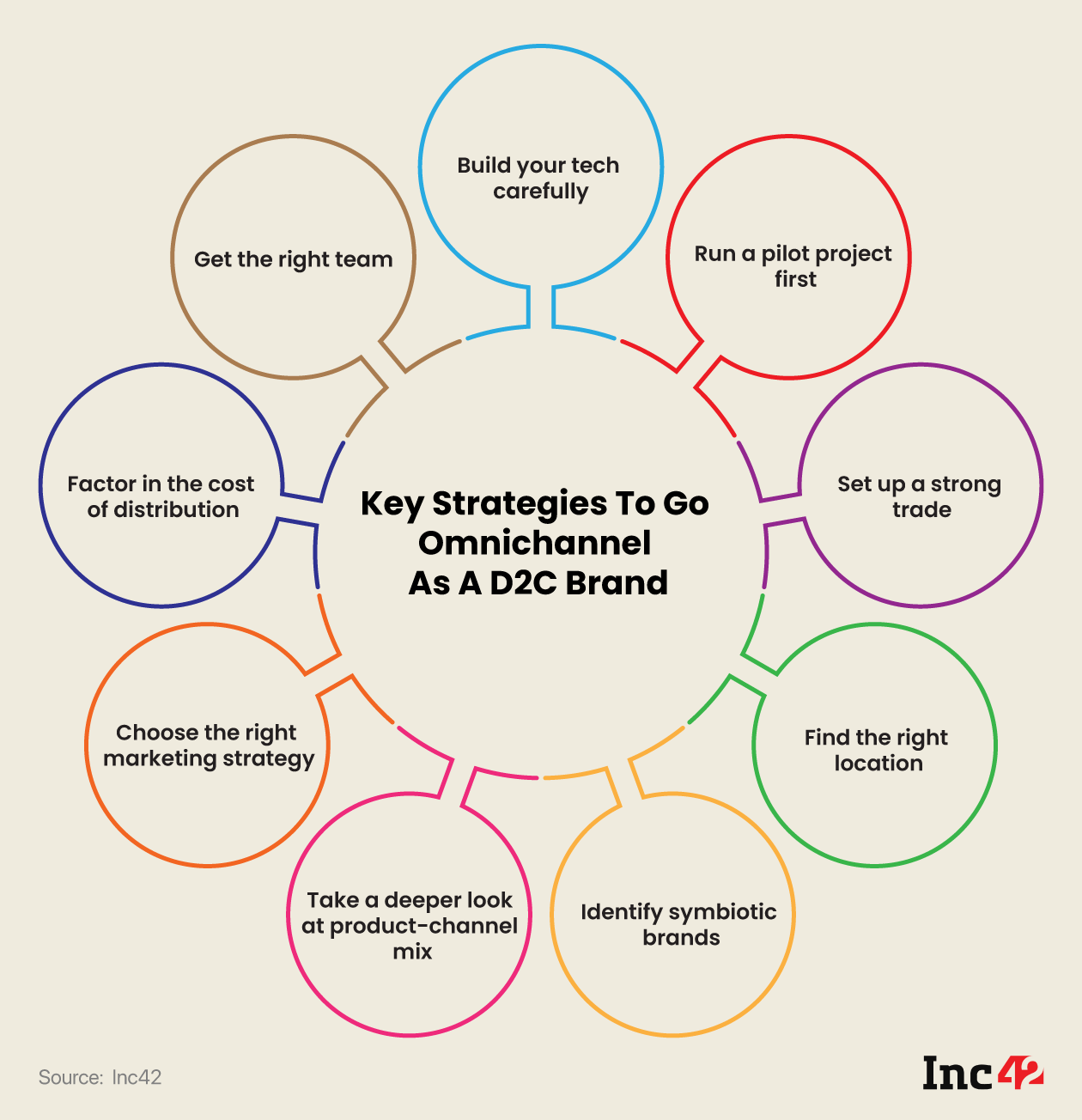

Most brands opt for different strategies in different regions to gather customer data so that they can determine an optimal growth path. Based on Inc42’s interactions with key industry leaders, here are nine must-follow steps before D2C startups consider offline expansion.

Run a pilot project first: Startups need not set up brick-and-mortar stores from the word go. One should run a pilot first and test the waters through trade fairs, exhibitions, flea markets, kiosks and pop-up shops. Brands can also promote their offline initiatives online. Eventually, they need to figure out what will push customers to try their products in a physical setting and what should be the differentiator that will set them apart.

Set up a strong trade: According to Sethi of Rage Coffee, setting up end-to-end business operations that function smoothly is the biggest challenge when a brand goes offline. A robust network of distributors and retailers and a comprehensive ecosystem of credits and collections are of critical importance here. In addition, startups need to build better warehousing capabilities across locations, ensure timely order fulfilment and implement efficient outbound logistics.

Find the right location: Locations play an important role when businesses reach out to their target audience. As Barar of Boingg explained, the brand could have set up its offline retail establishment in and around the furniture hubs to target customers who would only walk in to purchase furniture. Or it could have chosen a mall with high footfall, leading to more discoverability. In essence, founders should have a location strategy in sync with their end goals.

Identify symbiotic brands: Another key factor is to partner with brands that can complement a D2C startup’s value proposition or help expand its reach. For instance, beauty, wellness or FMCG brands are now utilising platforms like Smytten, BigBasket and Milkbasket to do pilots through sampling and figure out demand by studying repeat purchases.

Take a deeper look at product-channel mix: As Vinit Garg, founder and CEO of Mylo, pointed out, the biggest difference between online and offline retail formats is shelf space availability. A brand can list thousands of products on its website, app or other marketplaces. But offline retail has limited space, and physical stores need to optimise their displays and inventories to ensure products should sell and move fast. Pushing out the hero products (most popular ones) first could be a good strategy, as overflowing inventories can choke sales channels. Also, one has to strike a balance between FEFO (first expiry, first out) and other fast-selling products when it comes to stock rotation.

Choose the right marketing strategy: Even top-notch visual merchandising will not move a product unless effective marketing is done to promote it. Once the products are there in physical outlets, there must be a clear-cut strategy to move them off the shelf even faster.

Garg likened it to a classic chicken-and-egg situation.

“As a startup, you operate with a very, very limited budget. You may get this wrong by spending too much money so that you don’t have products on the shelf. On the other hand, if you spend too little and have too many products on the shelf, your inventory is stuck, and you won’t have the money for marketing. Getting these two things right is even more critical than deciding on [sales] channels,” he added.

Factor in the cost of distribution: When expanding offline, startups must decide whether maximum distribution should be built around general or modern trade to ensure cost efficiencies. Modern trade is less complex and similar to ecommerce, where retail chains can buy directly from startups, absorb costs and even help drive sales with discounts and promotions (BigBazaar and More Retail, for instance). In contrast, general trade is largely unorganised, mainly procuring products through intermediaries like wholesalers and distributors and primarily operating on cash or short credit cycles. However, the market is big with more than 12 million retail stores across India. With better strategies, general trade can help D2C startups grow 10x according to experts.

Get the right team: As a D2C startup with omnichannel aspirations, building the right team is difficult. People who can execute offline formats often come from traditional setups, and not many brands have created a talent pool adept at every aspect of a business that aims to marry online with offline. Startups eyeing hybrid growth need to get this right on a priority basis.

Build your tech carefully: Most D2C startups are powered by tech platforms and ecommerce enablers during the initial phase, and their tech stacks are rarely built in-house. Their storefronts are set up on the frameworks offered by Shopify, WeCommerce and the like. Sales are mainly generated through marketplaces like Amazon and Flipkart. And order fulfilment is often done by third-party service providers. But building reasonable heft offline is no cakewalk, requiring robust tech strategies and flawless execution. Hence, many of these startups may find it difficult to be up to speed in a hybrid format.

Nothing Cut-And-Dried About It

In spite of all the analyses and guidelines, there is no right way of doing it, and no ready-made playbook is available to guarantee instant success. As Barar of Boingg said, the D2C industry is at the cusp of identifying the right strategies, and everyone is experimenting now. But going without an offline strategy is not advisable.

“Very few D2C brands are now operating online-only channels. Most have four or five different channels for sales. Essentially, it is all about what is right for your product. If your product can reach consumers [given your strategy, all answers will lie there,” he added.

With legacy retail (read brick-and-mortar behemoths) also exploring the hybrid format to maximise growth, omnichannel will be the next battleground for India’s D2C startups. And once again, cornering success will depend on strong fundamentals and data-backed strategies.

However, stakeholders across the D2C community believe that offline retail is a different ball game, and cracking it will be challenging, to say the least. In a sector where every category calls for a different play, and there is no standard playbook to follow, it will be worth watching how Indian D2C startups carve a niche in the omnichannel space.