The D2C market in India is a $300 Bn opportunity, but with the waning of the pandemic, the segment is grappling with various challenges

Technology integration, digital marketing, inventory and logistics management lead to rising operational costs in the D2C space

Falling margins, rising CAC and growing competition are forcing D2C brands to adopt a hybrid business model

The direct-to-consumer (D2C) business model is often promoted as the future of retail in India, with the total addressable market estimated to reach $300 Bn by 2030. India is now home to 50K+ digital first brands which have delved deep into every popular or niche segment, from healthy food and food supplements to chemical-free personal care, from sustainable lifestyle products to energy-efficient gadgets and gizmos.

Also, customer traction is growing steadily due to the rise of micro-consumers from Bharat, whose digital journey took off in the wake of the pandemic. Simply put, D2C has the biggest growth potential among all ecommerce sub-sectors. These are digital-native, agile businesses (no involvement of intermediaries) open to swift tech adoption and keen to leverage the next billion internet-savvy shoppers by reimagining the brand-customer engagement.

Of course, a funding winter is upon the Indian startup ecosystem, but investor interest in the D2C segment has not waned due to product quality, quick delivery and eco-friendly business models.

According to Inc42’s State of Indian Ecommerce Q3 2022 report, D2C brands raised $1.3 Bn in the first six months of 2022, the highest among all ecommerce sub-sectors. Better still, within two years (2020 – 2022), this space saw the birth of unicorns that scripted impressive growth stories.

The pandemic accelerated the growth of many major D2C brands, and those with their dedicated websites recorded an 88% rise in consumer demand in 2020 compared to the previous year. Personal care brand Mamaearth thrived in Indian and overseas markets. Beauty brand Nykaa made a strong debut in public markets. And the rise of Thrasio-inspired models like GlobalBees and Mensa Brands took retail growth to the next level.

These digitally native brands claimed to disrupt giants like Johnson & Johnson, Himalaya, Hindustan Unilever, ITC, Lakme, and others by cutting out the middlemen. What’s more, popular beauty brands such as Revlon and Lotus took around 20 years to reach the INR 100 Cr revenue mark, but new-age brands like Mamaearth and Sugar took four, to cross the same milestone.

Rising Costs Are Razing The D2C Advantage; Will Omnichannel Help?

India’s newfound interest in D2C brands is undoubtedly commendable – a Diffusion study says more than 80% of shoppers plan to purchase from them by 2023. But the gradual return to normalcy in post-Covid times is bringing back the challenges small entrepreneurs used to grapple with before the pandemic mandated an innovative leap, away from the less-tech, asset-heavy modules.

With deep-pocketed legacy players back in action and customers returning to offline shopping, competition has toughened. Customer acquisition costs (CAC) have gone through the roof, and customer retention has become as dicey as ever, with too many choices available in the market. Add to that the rising costs of procurement, manufacturing and marketing, and it becomes pretty clear that a strategic pivot is needed once more.

It means D2C brands have to adopt an omnichannel strategy and sell through third-party digital marketplaces and brick-and-mortar retail stores to improve brand visibility, engage with customers and drive sales to counter the growing competition from mainstream retailers.

Dr. Somdutta Singh, Founder & CEO of Assiduus Global indicated that in 2021, it was estimated that millennials spend $2.5 trillion annually while shopping online, globally. The focus of an omnichannel approach is the customer, not internal company silos.

“By doing this, a direct-to-consumer brand understands that their clients can interact with them in different ways across various platforms at once (website, mobile, social media, etc.). This means that in order to ensure that customers enjoy a seamless customer experience, blurring the lines across channels, the marketer needs to have a single customer view of every customer,” she adds.

Legacy players have also started expanding their digital footprints, adding to the existing consumer datasets and leveraging them further to derive sales insights. This has narrowed the critical advantage D2C brands had over their large competitors.

The modality of D2C brands is to gain control over quality and pricing by eliminating the middle layer – distributors, retailers, third-party marketplaces and the like. Instead, they utilise social media channels like Facebook and Instagram, their apps and websites for sales. While legacy companies enjoy the advantage of scale, D2C players save on commissions and earn better gross profit margins than the wholesale business.

But being a digital-first business has its specific costs. From tech integration to tech updates, digital marketing and enabler/platform fees for inventory, logistics management and other services have significantly increased the operational costs of D2C brands.

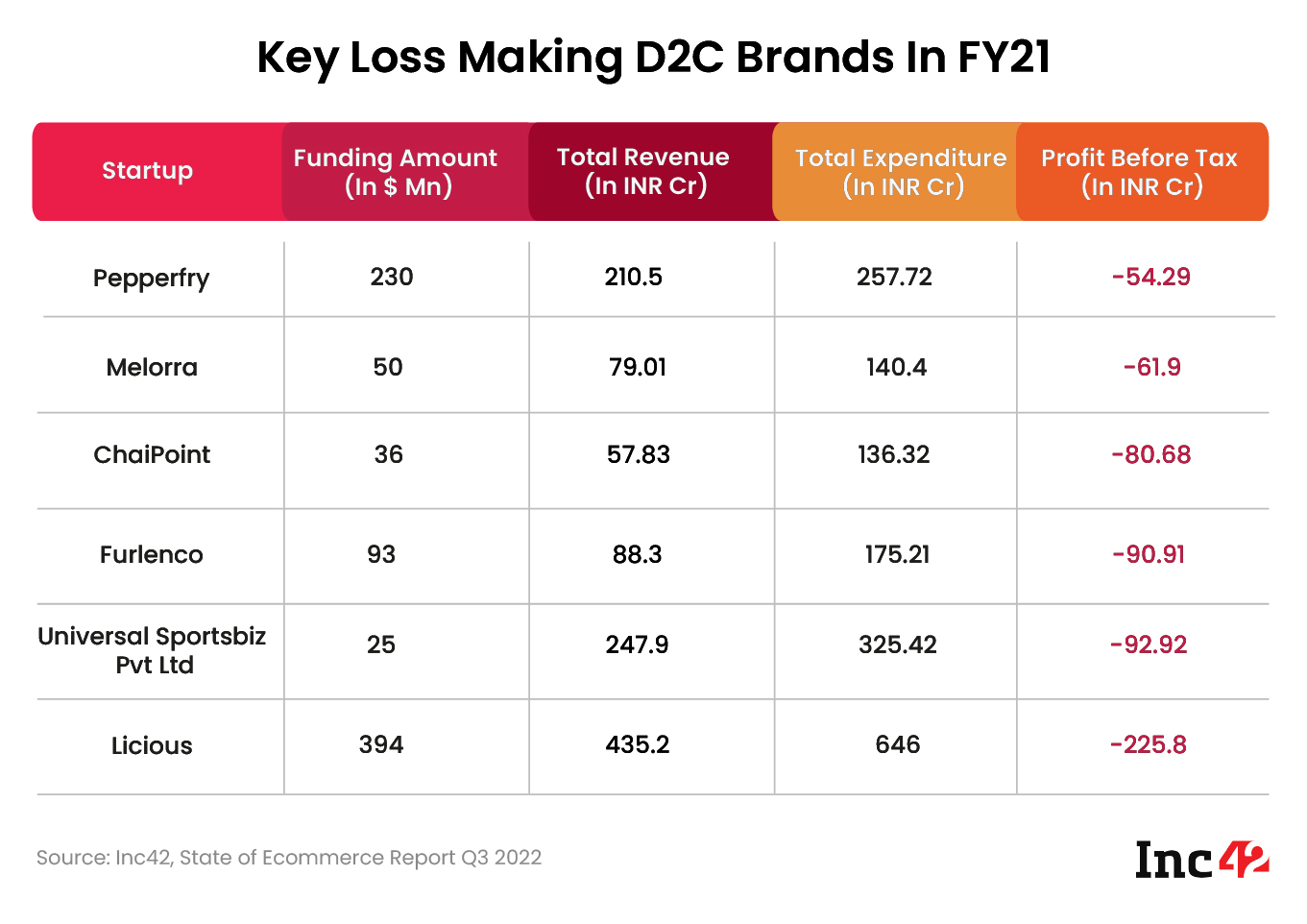

Consider this. Mylo, a D2C brands offering a full-stack platform for baby and mom-care products, had a total expenditure of INR 19.3 Cr in FY21 and total revenue of INR 3.2 Cr. It means that the brand spent INR 6 to earn a single rupee. It is the same narrative almost everywhere, and we have done some data crunching to understand the financial performance of the key loss-making D2C brands in FY21:

Sales and marketing costs to acquire customers are also hurting D2C brands moving towards profitability. In a less-than-favourable funding scenario, when capital is more expensive, one must ensure that CAC remains lower than customer lifetime value (CLTV), the revenue received from customers in the first year. After all, high-growth startups with moderate burn and large, positive gross margins are the most likely to get new funding at desired valuations.

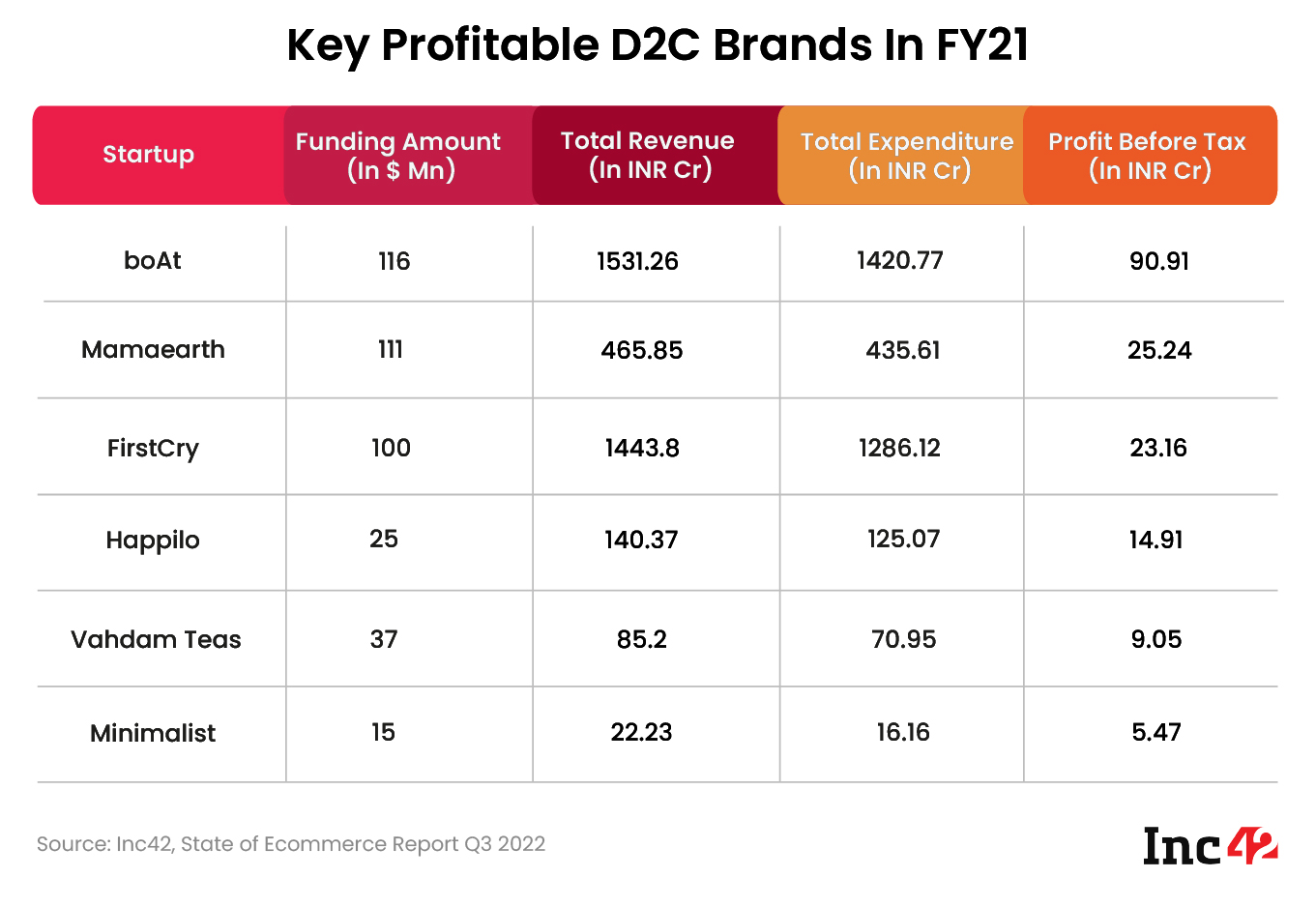

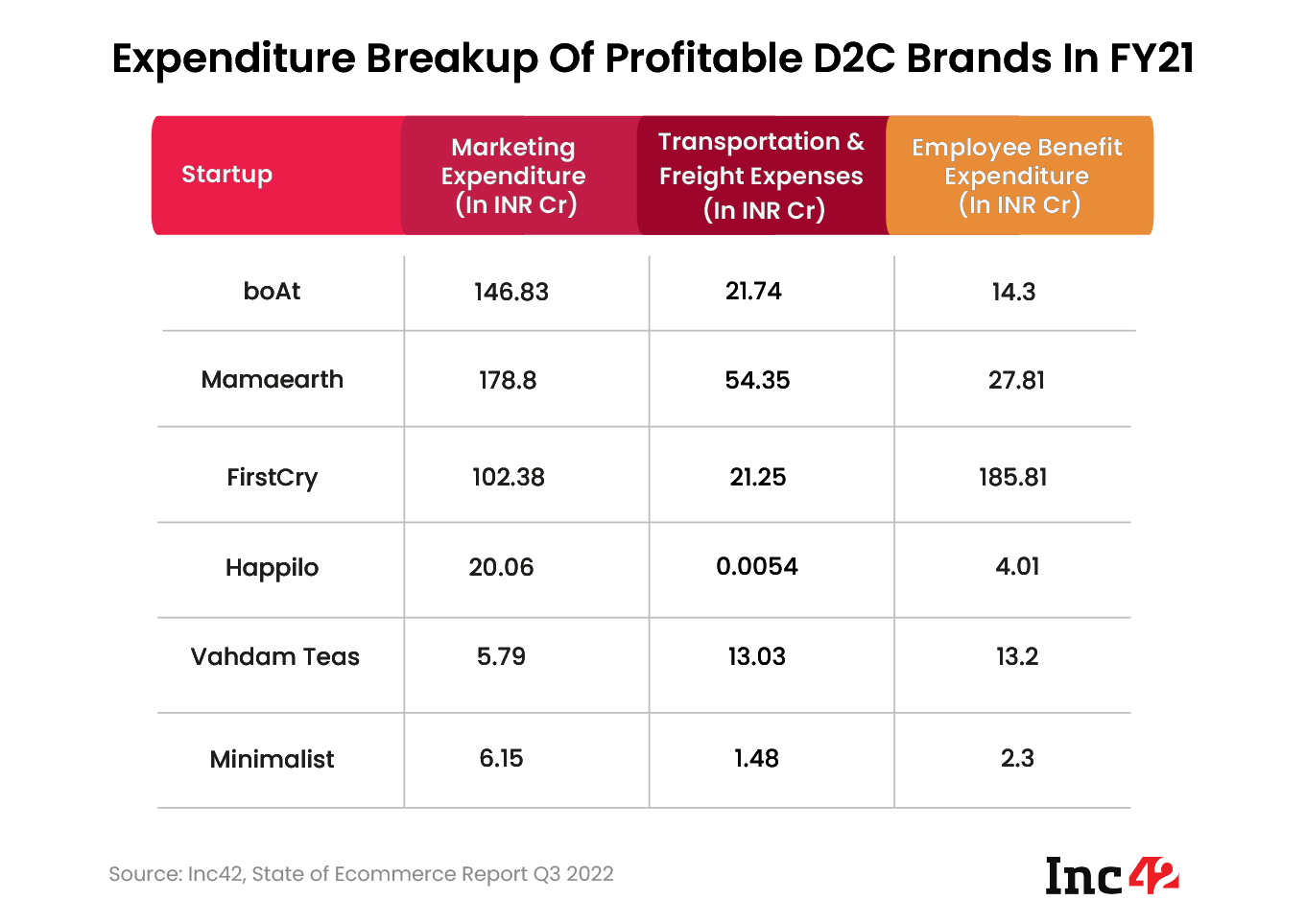

The likes of boAt, Mamaearth, FirstCry, Happilo, Vahdam Teas and Minimalist are among the D2C brands that reported profit before tax in FY21. Most have already expanded their footprint into offline retail channels and third-party marketplaces. Mamaearth products are even available in department store chains like More.

Interestingly, these D2C brands invested only up to an average 17% of total revenue for marketing activities, not a sound promotional strategy.

“With online retail penetration only 4-5% in the country, D2C brands missed out on the exposure enjoyed by offline retail storefronts. They also missed the fulfilment leverage offered by an ecommerce marketplace for the commission charged per transaction,” another industry expert said.

Navigating Shipping Challenges Is Tough

Another critical and high-burn area is logistics. High shipping costs and too many RTOs (return to origin), coupled with the lack of scale and the mounting pressure on brands to ensure fast and free deliveries like their legacy peers, put most D2C players at risk.

According to Abhishek Bansal, cofounder of the on-demand delivery platform Shadowfax, D2C businesses primarily opt for two kinds of shipping services – intracity orders with same day delivery and pan India shipping. The typical cost for the same day intracity shipping service is around INR 70-100.

For pan India, brands have two choices – deliver an express service or deliver a more relaxed service. Express service is done by brands where margins are high and shipping service cost can be anywhere between INR 100 – 150.

So, if the basket size is more than INR 1000, it becomes more easier for the D2C brand to manage the associated costs. But that is not the case for all orders and this is the reason why every ecommerce company in India is still not profitable, as the Indian customers are not willing to pay more.

“On the other end, the logistics company also has the costs to bear .. its not like logistics companies are insanely profitable. Businesses witnessed a 10-15% rise in logistics costs in the past two years, primarily driven by fuel price hikes. It is genuinely a tough market to operate. So people need to create models keeping these costs in mind,” he added.

Good Times Over For D2C Brands In India?

An industry report by HDFC Securities published in June 2022 says consumption is under pressure in India due to high inflation. The decline in venture funding for startups may also lead to a slowdown in the near-term growth of startups in the nascent D2C space.

Moreover, market gyrations and selective funding may lead to industrial oligarchy and consolidations in this segment. Overall, the emerging conditions are likely to favour D2C brands with a sharply-defined customer offering, and a focus on growth well synced with profitability.

“While mortality of smaller brands is possible in the near term, with the evolving ecosystem, we expect the inception journey of new brands to become easier. This could lead to a long tail of brands adding up while only a few will be able to scale up beyond their niches,” the report said.

However, the sheer scale of the country’s retail market – the fourth-largest in the world and worth more than $800 Bn – makes it too big for occasional turmoils and headwinds. It is expected to grow at a CAGR of 8-9% in the next five years, thus enabling exponential growth for all its sub-sectors, including digital commerce.

The government’s pro-industry policies will further push ecommerce growth. As the authorities work on ecommerce draft rules and guidelines and ambitious projects like the Open Network for Digital Commerce (ONDC), overall e-retail penetration is expected to reach nearly 25% in the next five years.

Customer acquisition costs are no longer as profitable as they once were, and with time, new problems have emerged in D2C marketing, like a decline in ROAS. For the consumer who has many options, brands must stray from product or catalogue marketing and instead develop strong consumer affinities and authenticity.

Singh of Assiduus Global further suggests that modern business owners should avoid developing “me too” products and instead concentrate on intriguing product niches and innovations that place an emphasis on aftersales, which are just as important as sales.

Brands must strategically embrace improved MarTech solutions to guarantee effective and cutting-edge marketing funnels. Improvements to CACs depend on having automatic emailers, push notifications, heat maps, WhatsApp connectors, granular analytics, and communication, among other integrations.

This huge market opportunity, clubbed with future tech, better governance, and a level playing field, will undoubtedly provide an edge to D2C brands. But to fully realise their potential, D2C brands need to adopt a hybrid approach to utilise their resources and enhance their reach. They are also expected to enter new categories to disrupt, scale and grow.

Ad-lite browsing experience

Ad-lite browsing experience