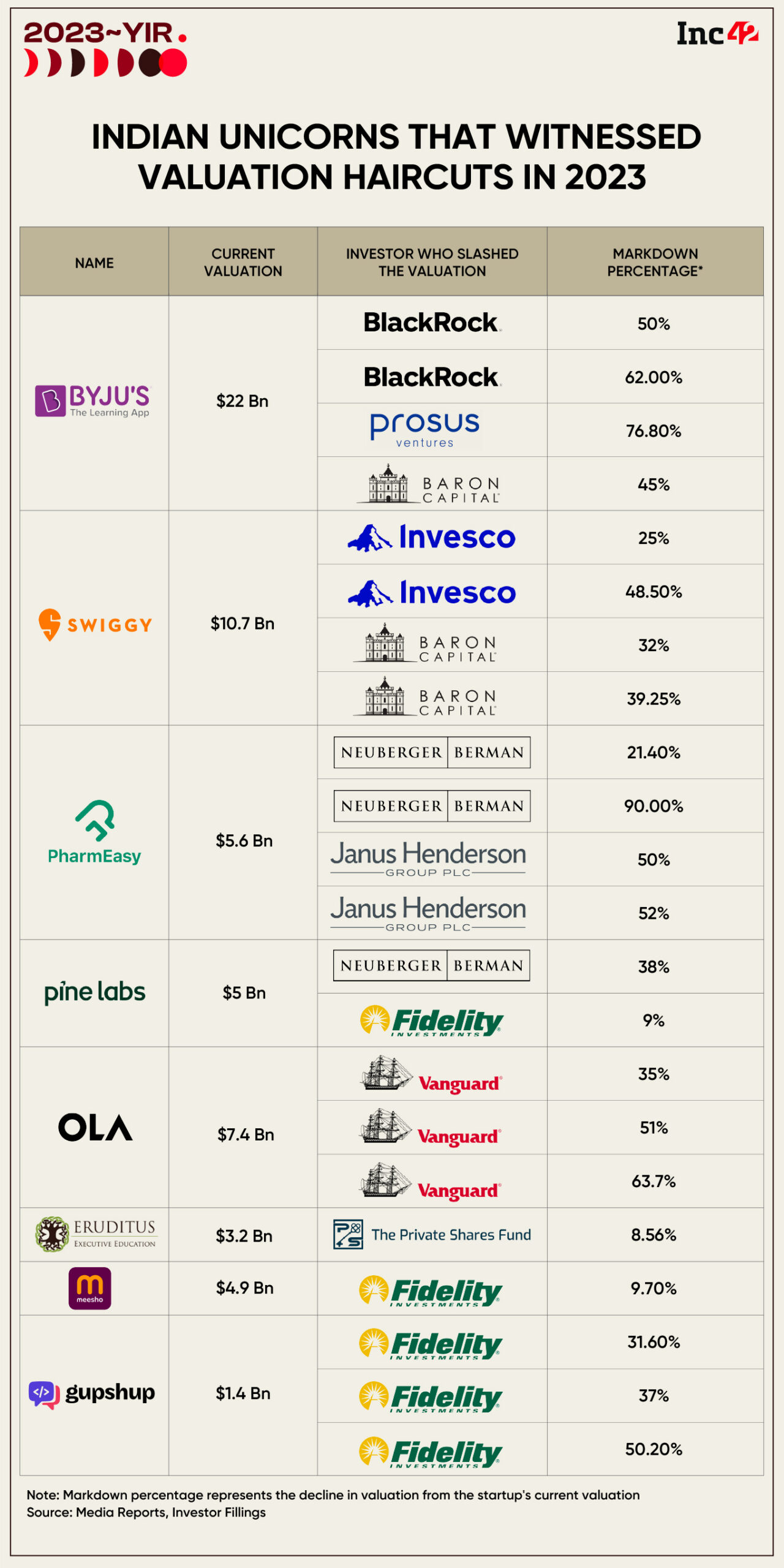

Amid a slowdown in business and the ongoing funding winter, many investors in top Indian startups felt that their portfolio companies were overvalued and went on a valuation markdown spree in 2023

Unicorns like BYJU’S, Meesho and PharmEasy were among those whose investors cut their valuations on their books, even multiple times in some cases

While most of the valuation cuts in 2023 were by minority stakeholders in these startups, the valuation markdowns do have the potential to cause a ripple effect

The year 2021 will be etched in history as the most fructiferous year for the Indian startup landscape. The entire world was in crisis due to the Covid-19 pandemic at that time, but Indian entrepreneurs shone brightly by embracing innovation.

Indian startups shot to fame and investors across the globe wanted to be a part of the country’s startup ecosystem. The result was investors infusing a whopping $42 Bn in Indian startups in 2021, which resulted in the creation of a record 44 unicorns during the year.

However, the start of the Russia-Ukraine war in 2022, increase in interest rates by central banks to combat inflation, and the global economic slowdown brought startup funding to a standstill. Investors increasingly started focusing on profitability and valuation, and this resulted in the creation of new unicorns almost halving in 2022.

All hopes for an uptick in funding activities in 2023 were quickly dashed as investors refused to loosen purse strings. Amid this, a lot of investors also felt that the startups in their portfolios were overvalued and started re-evaluating the valuations. This resulted in prominent backers of many Indian startups slashing the latter’s valuations on their books. Unicorns like BYJU’S, Meesho and PharmEasy were among those which saw valuation markdown by their investors in 2023.

As the ongoing year nears its end, we, at Inc42, have collated a list of major unicorns that saw valuation markdowns by their investors in 2023.

8 Indian Unicorns That Faced Valuation Markdowns In 2023

Troubled BYJU’S See BlackRock, Prosus And Baron Cut Valuation

Edtech giant BYJU’S became the most-valued Indian startup in March 2022 by clinching a valuation of $22 Bn, just before things started going downhill for it and the entire ecosystem. Since then, BYJU’S has been fighting on multiple fronts and this resulted in three of its investors slashing the value of their stake in the company in their books.

It began with investment firm BlackRock marking down the value of its shares in the company by 50%, cutting BYJU’S overall valuation to $11 Bn. In April, the US-based firm, which owns less than 1% stake in BYJU’S, marked down the value of its shares in the edtech company to $2,855 per share from $4,660 per unit in April 2022.

A month later, it further marked down the value of its shares, taking BYJU’S valuation 61.9% lower to $8.36 Bn from $22 Bn.

In June, Prosus, which owns 9.6% stake in the startup, marked down its share value by 76.8%, thus bringing down its valuation to a meagre $5.1 Bn.

Just last week, Prosus, during its earning call, further revealed that it has marked down BYJU’S valuation yet again, bringing it below $3 Bn.

Baron Capital also jumped on the bandwagon in August, trimming BYJU’S valuation by 45% to $11.7 Bn.

Amid all these, BYJU’S has been in the news for all the wrong reasons. While it is entangled in a legal battle with lenders for a $1.2 Bn Term Loan B it took, the company is also being probed by the Enforcement Directorate (ED) for alleged FEMA violations.

The company has also failed to file its financial statements for the FY22. This delay also resulted in the resignation of its statutory auditor Deloitte, which was replaced by BDO (MSKA and Associates). Three out of its six board members – GV Ravishankar of Peak XV Partners, Russell Dreisenstock of Prosus and Chan Zuckerberg’s Vivian Wu – also resigned to further add to its woes.

The company has also been plagued by high-level exits, including of top executives such as Mrinal Mohit, Anil Goel and Ajay Goel. After firing thousands of employees since 2022 so far, BYJU’S is currently also undertaking another layoff exercise which would see around 4,000 employees lose their jobs.

Swiggy Fails To Satisfy Investors’ Appetite

Foodtech major Swiggy entered the decacorn club in early 2022 after bagging $700 Mn in a funding round led by Invesco. However, amid the funding winter, the same investor marked down the value of its stake in Swiggy by 25%. This took the startup’s total valuation to $8 Bn, making it lose its decacorn status.

It must be noted that Invesco slashed the value of its stake in Swiggy in October 2022, but it was reported in April 2023.

Later, the Atlanta-based investment firm again slashed the value of its stake, taking the startup’s valuation 48.5% lower from its peak $10.7 Bn.

Besides Invesco, the US-based asset management company (AMC) Baron Capital also marked down Swiggy’s valuation twice – once by 32% and later by 39% from its last valuation of $10.7 Bn.

It is pertinent to note that around this time, Swiggy also initiated steps to cut costs with an eye on profitability. It laid off around 380 employees and pulled the plug on gourmet grocery delivery vertical Handpicked.

Swiggy is yet to file its FY23 financials. The startup’s loss doubled to INR 3,629 Cr in FY22, while operating revenue increased to INR 5,704.9 Cr. This takes its peak valuation to 15X of its operating revenue.

Debt-Laden PharmEasy Faces Wrath Of Neuberger Berman, Janus Henderson

PharmEasy, which has been facing a financial crunch for some time, saw its investor Neuberger Berman slash the value of its stake in the epharmacy startup by 21% in May. This took the startup’s valuation to $4.4 Bn from its peak $5.6 Bn

In November, Neuberger Berman further slashed the valuation of its stake in the startup by over 90% to $550 Mn, stripping it off the unicorn status.

Besides, the UK-based investment firm Janus Henderson too slashed PharmEasy’s valuation twice this year. In May, the investor slashed the value of its stake in PharmEasy by 50% on its books. Later in June, it trimmed the valuation further by 52%.

However, amid these valuation cuts, PharmEasy had bigger issues to worry about. After cancelling its proposed INR 6,500 Cr IPO plan in 2022, the startup took a loan of INR 2,280 Cr ($285 Mn) from Goldman Sachs to pay off an earlier debt it raised from Kotak Mahindra Bank to buy Thyrocare. But the startup breached its loan covenant terms with Goldman Sachs within a year after raising the debt and found itself struggling to repay it.

The startup is also plagued by other issues such as thousands of layoffs, mismanagement of the profitable Thyrocare business, and exit of key personnel. While PharmEasy is yet to file its FY23 financials, the startup’s loss jumped 4.3X to INR 2,731 Cr in FY22, while its operating revenue stood at INR 5,729 Cr. This translates to a valuation to an operating revenue ratio of 7.8X at its peak valuation.

In October, PharmEasy cofounder Dhaval Shah claimed that the startup’s INR 3,500 Cr rights issue was oversubscribed.

Pine Labs’ Valuation Goes South

Singapore-based fintech unicorn Pine Labs, which is among the few Indian unicorns that have not laid off employees amid the funding winter, saw two of its investors reduce the value of their stakes in the company.

It began with Neuberger Berman reducing the valuation of its stake in Pine labs by 38%, resulting in the unicorn’s plummeting to $3.1 Bn from $5 Bn in July 2021.

Besides, Boston-based Fidelity Investment also marked down the value of its shares in Pine Labs by 9.2% in June this year. The developments came on the heels of Pine Labs deferring its IPO plans citing weak market sentiment.

The startup, which has raised over $1.2 Bn in funding, is currently focusing on expansion in Southeast Asia, Malaysia, and the Middle East.

While Pine Labs is yet to disclose its FY23 financial numbers, the startup’ loss stood at INR 259 Cr in FY22. Operating revenue stood at INR 1,017 Cr during the year, translating to a valuation-to-operating revenue ratio of a whopping 39X at its last valuation.

Ola Cabs Sees Multiple Valuation Cuts

Bhavish Aggarwal, who introduced online cab aggregator services in India with the launch of Ola Cabs, has of late been more focused on his second venture Ola Electric.

While Ola Electric continues to rake up huge funding, Ola Cabs has faced a fair share of problems, including valuation markdowns. In May this year, the US-based Vanguard Group reduced the valuation of its stake in Ola Cabs’ parent company ANI Technologies by 35%, bringing the overall valuation of the startup to $4.8 Bn from $7.4 Bn.

In August, Vanguard further slashed the startup’s valuation to $3.5 Bn in its books.

A month later, the investor again cut the worth of its shares in ANI Technologies, valuing the cab-hailing startup by 63.7% lower from its peak valuation at $2.7 Bn.

It is pertinent to note that Vanguard holds less than 1% stake in Ola.

The valuation markdown came at a time when Ola has been facing multiple challenges, ranging from regulatory challenges and delay in filing financial statements to mounting competition from peers such as Uber and BluSmart.

Besides this, in July this year, more than 350 Ola Cabs drowned during floods in Uttar Pradesh’s Noida in a parking yard, which almost sparked a major standoff with local law enforcement agencies.

While ANI Technology is yet to file its FY23 financial results, the startup’s overall loss increased to INR 1,522.3 Cr in FY22 and operating revenue doubled to INR 1,970.4 Cr. This translates to a valuation to operating revenue ratio of 30X at its last reported valuation.

The Private Shares Fund Marks Down Eruditus’ Valuation

Singapore-registered edtech unicorn Eruditus saw one of its investors, The Private Shares Fund cut down the value of its stake in the startup by 8.56% in the March quarter, bringing down its valuation to $2.9 Bn from $3.2 Bn.

The Private Shares Fund has a 0.2% stake in Eruditus and pegged the fair value of its 36,264 shares in the edtech firm at $4.66 Mn.

The development came just a couple of months after Eruditus reported that its loss for FY22 shot up 1.5X to $386.6 Mn, while the revenue from operations rose 1.8X to $245.2 Mn. This translates to a valuation to an operating revenue ratio of 13X.

Recent media reports suggested that the startup might see exit of some US-based investors via a secondary round. Japan’s SoftBank and Canada Pension Plan will reportedly pick up stakes in the startup.

Meesho Faces Fidelity Investments’ Ire

Once the posterboy of social commerce in India, Meesho too was hit by investor markdowns in 2023. Its key investor Fidelity Investments internally marked down the value of its stake in the startup by 9.7%, pegging the company’s valuation at $4.4 Bn as against its peak valuation of $4.9 Bn.

The markdown came right after the ecommerce giant recorded a 550% surge in its loss to INR 3,247 Cr in FY22 from INR 498 Cr in the previous fiscal year. Operating revenue also surged 300% to INR 3,359.4 Cr in FY22 from INR 838.6 Cr in FY21.

Meesho, which has moved away from its social commerce model, now more or less operates within the ambit of B2C ecommerce space. It competes with the likes of giants such as Amazon and Flipkart.

The startup has lately undertaken a cost-restructuring exercise, cutting corners and streamlining operations. As part of this, the company shut down its grocery vertical Meesho Superstore in August last year and has fired more than 700 employees since 2022 across multiple layoff rounds.

While the ecommerce giant is yet to file its FY23 financial numbers, its valuation to operating revenue ratio stand at 12X at its current valuation.

Investors’ Snatch Gupshup’s Unicorn Status

SaaS startup Gupshup was also among the unicorns that were hit by valuation markdowns in 2023.

The situation was especially dire for Gupshup as the first round of markdown by the US-based asset management company (AMC) Fidelity Investments, in May, snatched the coveted unicorn tag from it. Back then, Fidelity slashed the value of Gupshup’s shares on its books by 36% to $957 Mn.

A month later, in June, Fidelity again trimmed the startup’s valuation by 36% internally, bringing its valuation to $882 Mn. The AMC struck again in July as it went on to truncate the values of its share by 50%, resulting in Gupshup’s valuation dropping further to $697 Mn.

The startup, which turned a unicorn in April 2021, reported a net profit of INR 40 Cr in FY22 on revenue from operations of INR 1,132 Cr. This implies a valuation to operating revenue ratio of 9.8X.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech