Although most unicorns are still deep in the red, and profits are not forthcoming, their valuations are the elephant in the room that no one wants to discuss

While investors cite their theories and playbooks for putting money in these (loss-making) businesses, founders are busy playing in the name of innovation, category building, gross merchandise value (GMV) for some, and other metrics which do not convert to actual money

According to an Inc42 analysis, of the 60+ Indian unicorns analysed, 37 companies had their multiples higher than the median multiple of the top 10 US-based unicorns

The Indian startup ecosystem is very different today from what it was a decade ago. As the landscape has grown fiercely competitive over the years, ventures move from one animal tag to another that essentially sums up their operational strategies.

We have the unicorns and their dream success runs to hit billion-dollar valuations. But there are also the startup dragons, the centaurs and the gazelles, the cheetahs and the zebras, leveraging different windows of opportunity.

Some have also earned negative connotations (dinosaurs, elephants, insects and leeches), although the roaches are highly valued for their resilience. In brief, it is a fast-evolving startup jungle out there, with everyone zeroing in on growth despite the cyclical ups and downs.

Interestingly, Indian startups saw an unprecedented funding swing, unicorn creation and IPOs in 2021 despite the pandemic. The frothy market, triggered by FOMO and the subsequent free-flowing VC money, sped up the startups’ growth journey multifold.

But the good times did not last long. High-interest rates and concerns about stagflation have taken their toll on liquidity, and capital inflow has dried up with the onset of a long and harsh funding winter.

Consider this. Indian startups raised $3 Bn in Q1 2023, down 75% from $12 Bn amassed in Q1 2022. Additionally, there were only seven mega deals in Q1 this year, a drop of 77% against Q1 2022.

The situation has worsened as the slowdown and volatility hit the public markets. In fact, many of the listed unicorns from India that went public in the past two years are now struggling below their issue prices.

Then there are intermittent startup shutdowns, zero unicorns added since September 2022, delayed IPOs and companies scaling back their operations to focus on their core offerings.

And finally, there are losses, and the revenue multiple led skyrocketing valuations.

Of the 74 unicorns included in Inc42’s report on top 200 startup financials, 55 reported a collective operating loss of $5.9 Bn in FY22 (the remaining 19 were operationally profitable.) With a median expenditure-to-revenue ratio of 1.5, these loss-making unicorns spent INR 1.5 to generate INR 1 in revenue in FY22.

Although most unicorns are still deep in the red, and profits are not forthcoming, their valuations are the elephant in the room that no one wants to discuss.

The Elephant In The Room

While investors cite their theories and playbooks for putting money in these (loss-making) businesses, founders are busy pitching innovation, category building, gross merchandise value (GMV), and other metrics which do not convert to actual money.

There are examples galore. For instance, edtech unicorn BYJU’S which faced a 50% valuation cut from BlackRock, is now experimenting with BADRI, an AI-powered personalised learning model being developed in-house and is also in talks to raise another $700 Mn.

If that looks like a lot of cash burn in troubled times, here is a quick look at its cost-cutting initiatives. After laying off nearly 4,000 employees, the company is now looking to cut marketing and advertising spends. For instance, not renewing its contract with BCCI for the next IPL season.

CRED also has a story here. After clocking INR 1,279 Cr in losses in FY22, the fintech startup is now busy pivoting into a super-app by allowing users to book vacations, pay utility bills, shop on the app and do much more.

Founder Kunal Shah blatantly told the media he was not worried about profitability. In the near future, CRED will continue to focus on building the brand and its member base besides adding to its offerings.

During an Inc42 analysis, we further identified several unicorns like Groww, CoinDCX and 1mg, which posted more than a 20x rise in YoY operating losses.

This begs the question: Can these Indian unicorns justify their valuations or ever see sustainable growth? What’s next for these loss-making, cash-guzzling and high-valuation startup entities? More importantly, why do VCs keep funding their portfolio unicorns despite huge losses?

Overvalued Unicorns? What The Valuation-Revenue Multiple Indicates

For a long time, analysts have been questioning the viability of Indian unicorns based on their valuation-to-revenue multiples. For context, a valuation multiple is the ratio of a company’s valuation (value measure denoted by enterprise/equity value) and a value driver or a specific financial metric – revenue, in this case.

Although there are no set rules, a high ratio often indicates that a company is potentially overvalued in the market and vice versa.

The median valuation-to-revenue multiple for the top 10 Indian unicorns was 23x in FY22 compared to 21x posted by their U.S. counterparts, according to an Inc42 analysis.

Moreover, of the 60+ Indian unicorns analysed, 37 startups had their multiples higher than the median multiple of the top 10 US-based unicorns.

As we can see in the table below, SpaceX has the highest valuation-to-revenue multiple of 40, which is considerably lower compared to India’s fintech unicorn CRED, with a multiple of 121x.

Among the Indian peers, CureFit, Open Bank and Apna also have high multiples of 249x, 142x and 134x, respectively.

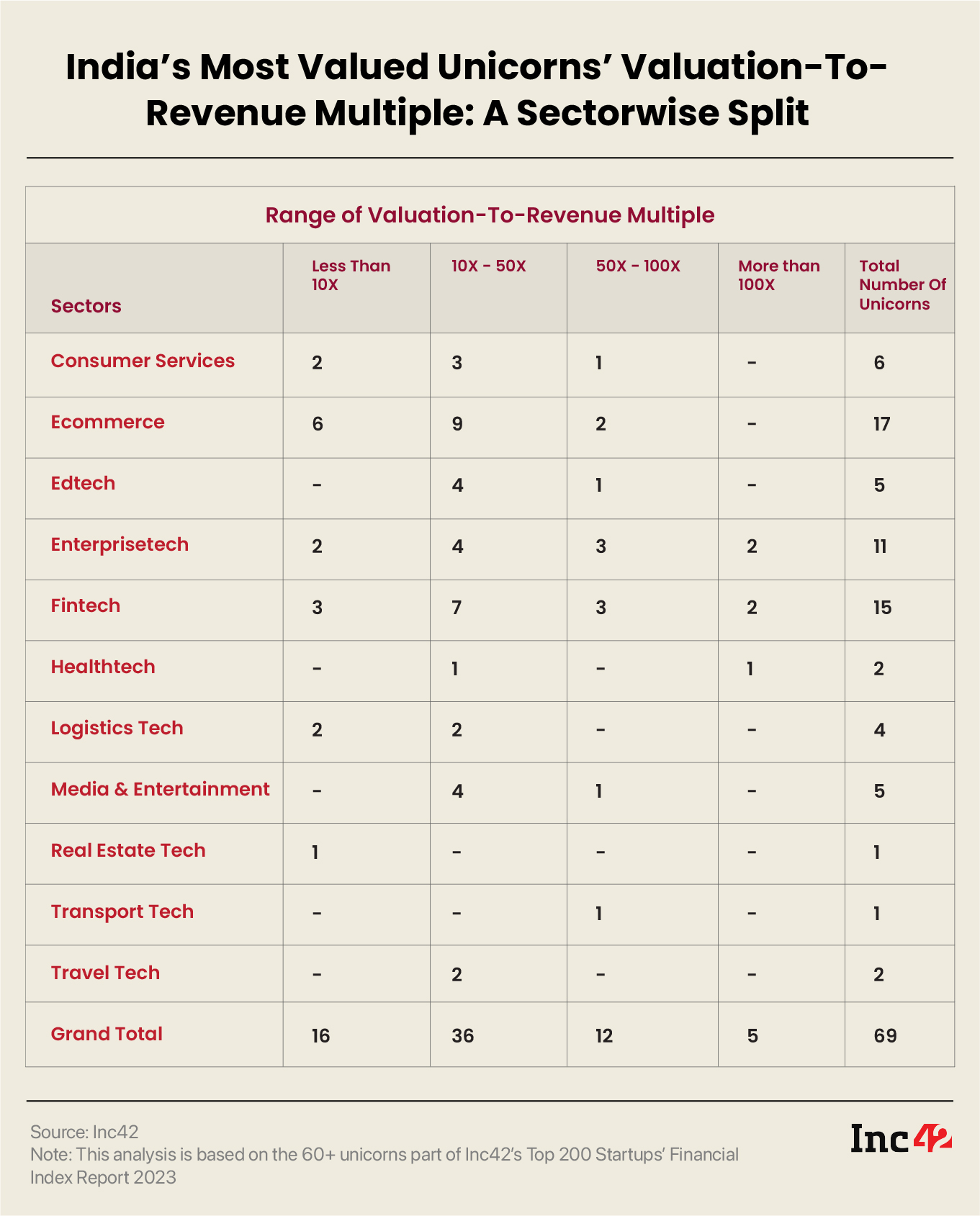

Interestingly, only the Indian unicorns from healthtech, fintech, and enterprisetech had valuation-revenue multiples higher than 100x.

We will be diving into this, but that’s a story for another time. For now, here’s an indicative representation for the same from the sector perspective.

How TAM Works In The Valuation Game

According to industry experts, Indian unicorns with similar or higher valuation-to-revenue multiples comparable to leading U.S. startups indicate the maturity of the Indian startup ecosystem. However, the higher the multiple, the bigger the concerns about sustainability and sound fundamentals for driving revenues.

As per the analysts interviewed by Inc42 for this article, the total addressable market, or TAM (a sector’s entire revenue potential), and a fast-growing economy can be the primary reasons driving investor confidence. However, startup founders often leverage unrealistic TAM projections in their pitches to secure higher valuations, which can backfire in time.

“Institutional investors look for successful exits with manifold returns in three to 10 years. But unlike traditional methods, the valuation of a new-age unicorn depends more on the business concept, market size and future growth potential.”

Startups in certain sectors have also seen exponential growth, which may ensure blockbuster exits. The fintech space illustrates this. Initially, the likes of Paytm, PhonePe and MobiKwik used to leverage technology to develop their service offerings. But after the demonetisation in 2016 and the growing focus on a less-cash economy, the fintech ecosystem has gone from strength to strength.

Post demonetisation, Paytm’s valuation increased 16x to reach $16 Bn in 2019, and it went for a public listing in 2021. PhonePe, now on track to become the next super-app like Paytm, became a unicorn in 2018. It shifted its base back to India from Singapore in October 2022, and two months later, it was spinned off from its Walmart-owned parent company, Flipkart.

The fintech was recently valued as a decacorn after raising back-to-back funding rounds at valuation of $12 Bn.

But this is just one sector out of the 13 where the country’s 108 unicorns operate, and each industry and company have unique narratives. However, only a few players have been able to justify their high valuations based on TAM and future brand value.

The dwindling stock performances of companies like PolicyBazaar, Paytm, Delhivery, Zomato, Nazara Games and MapMyIndia for an extended period post their IPOs clearly indicates that valuation is more of a conceptual thing based on TAM, and it is not always aligned with actual business yields.

Zerodha cofounder Nithin Kamath aptly summed this up in one of his tweets.

“Higher valuations force you to spend more, hire more & take random bets. [So] founders end up losing interest if the assumptions about the total addressable market (TAM) don’t materialise, and growing fast enough to justify the valuations isn’t possible,” he added.

Is A Decline In Unicorn Valuation Inevitable?

As venture capitalist Bill Gurley said in 2015, “One thing that happens in Silicon Valley – and this has been highly cyclical – the more we get into peak-y [valuations] territory, the more optimistic we get about business models that are lower margin.”

The Indian startup ecosystem is no different. The unicorn tags created based on high-potential TAM are primarily consumer-facing businesses, hoping to bridge the margin gap with scale. But growth or scale cannot substitute hard-core profitability, and downsizing the business or a decline in valuation is inevitable in such cases.

Also, many of these valuations could have been derived from high-value secondary trades. But public market fluctuations during a global downturn are bound to impact the private market (historically, there is a six-month lag) and, eventually, the skyrocketing valuations of loss-making unicorns.

The valuations of listed unicorns will also take a hit in line with the capital market. For instance, fintech unicorn Paytm, which entered the public market eyeing a valuation of $20 Bn, was valued at $5.2 Bn on March 31, 2023. The market capitalisation of Deepinder Goyal-led Zomato, which went public in 2021 at a valuation of $12 Bn, also slumped to $5.5 Bn as of March 31.

More importantly, the falling value of the Indian rupee to the U.S. dollar may change the dynamics of the Indian unicorn club very soon.

With the funding winter estimated to continue for the next 12-18 months, unicorns are now forced to show profits or raise a down round (funding at a lower valuation). As per media reports, e-pharmacy unicorn PharmEasy may raise funds with a 50% cut in valuation. Meanwhile, SoftBank, a prime backer of Ritesh Agarwal-led OYO, marked down the hospitality unicorn’s valuation by 20% on its books, from $3.4 Bn to $2.7 Bn.

Top investors like Tiger Global and SoftBank, who typically engage in mega deals worth over $100 Mn, have also paused their investments in the Indian market after burning their fingers.

Tiger Global’s mega-deal count declined by 73%, from 26 deals in 2021 to just seven in 2022. Again, Masayoshi Son’s SoftBank was involved in just two mega deals last year compared to 14 in 2021.

Overall, 2022 saw a 50% slide in the mega-deal count – just 45 deals with a combined value of $11.6 Bn compared to 90 deals amassing a total of $28 Bn in 2021, as per an Inc42 analysis.

What Leads To Inflated Valuations?

It is generally believed that high-velocity startups need to burn capital to sustain growth before achieving profitability. VC firms are willing to back good concepts as these can disrupt existing markets or create new ones. Also, the market opportunity will be large enough to justify the risk of initial losses.

Here is a quick look at the key components behind oversized valuations:

Innovation, innovation and innovation: Unicorns today focus on product and service innovation, rapid expansion into untapped markets and investment in talent to drive business growth.

But these measures lead to massive cash outflows, and new ventures cannot concentrate on positive unit economics from the word go to reach profitability at the EBITDA level. Even CRED’s founder Kunal Shah pointed this out in one of his recent Instagram posts.

Revenue projection not accurate: Most unicorns are accurate about projecting their expenses. But it is far more difficult to project revenues. Plus, it can be challenging to judge when to ramp up expenditures. This is because the higher the burn multiple, the more capital a startup burns to achieve each unit of growth and vice versa (the lower the burn rate, the more efficient the growth).

“There is an oversight now regarding how much companies are burning to generate each incremental revenue dollar. Hence, burn multiple becomes a rule of thumb to track a startup’s health,” said Ankur Bansal, cofounder and director of the Mumbai-based investment group BlackSoil.

Second- or third-time founders call the shots: The founding team remains vital in the valuation game. Investors often assess the problem-solving prowess of founders or the leadership team, and an impeccable track record works in their favour.

In fact, the execution risk is significantly reduced when founders have prior experience or come from leadership roles in big tech companies or successful Indian unicorns.

“The VC funding and valuations for this particular niche of founders come from the principle of demand and supply. While investors are willing to take a bet on and ownership into the company, a founder’s unwillingness to dilute equity keeps pushing up the valuations,” explained Maanav Sagar, manager at early-stage VC Bharat Founders Fund (BFF).

Founders of fintech unicorns such as PhonePe (former Flipkart executives set it up) and CRED (launched by the former Freecharge founder Kunal Shah, who got an exit at $400 Mn) are clear examples of this. Both companies took just three years to attain billion-dollar valuations. We also have the likes of Cure.Fit (Mukesh Bansal, Ankit Nagori), 1mg (Prashant Tandon), Glance & Inmobi (Naveen Tewari) in this category.

Things get even better if founders bring strong business fundamentals across the most critical valuation metrics like revenue, operating profit margin and unit margin during their journey.

VC-Led Valuation Bubble To End

As BFF’s Sagar pointed out, what the investors missed between the growth curve of 2021 and the downturn of 2022 were the principles of milestone-based investing in a bull market. And this can pose a challenge for both investors and founders at times.

One of the major challenges the founder may face is not raising funding at crucial times. While the investors may have to look for a possible down-round impacting the exit strategies with their portfolio companies.

What can startup unicorns do now that the pandemic-induced growth of 2020-21 is no longer there and the funding exuberance of the past has all but disappeared? The market correction (and volatility, given the early signs of a global slowdown) has put downward pressure on the high-flyers, threatening their valuations, delaying their IPOs, and aggravating consolidations.

We are now witnessing the end of the VC-led ‘bubble’ resulting in huge funding rounds, especially in the edtech and fintech space, and the subsequent rise in unrealistic valuations. The rapidly shrinking growth funding has also triggered a survival-of-the-fittest scenario, bringing some sanity to inflated valuations.

From now on, it will be a game of the alphas and the betas. Unicorns with solid fundamentals (the alphas) will continue to attract investors. Others must tie the loose ends and strengthen their business basics.

Simply put, startups need to pivot from a high-burn, high-growth, and diversified approach to a profit-focused, slightly lower-growth but less cash-burn model. If this is not addressed, the ecosystem may see further consolidations (and layoffs) in the coming days.

We saw it happen during the global meltdown in 2008 and then again in 2013 and 2016. The highs and lows of the Indian startup ecosystem have continued to give heartache to the investors and founders alike.

Overall, the ongoing fund crunch is a strong message from the VC community to startup founders that the latter cannot raise more funding at previous valuations unless they rationalise their financials and show a path towards profitability. According to the analysts,

“If companies can survive the next two years and have enough cash runway for 18-24 months, they will be in a good place. But if they need funding in the next 6-12 months, valuations will certainly be lower by 25-30%, going by the public markets, which are down by almost 50%.”

Of course, some companies may choose different routes to keep their valuations intact. Founders may consider options like debt funding or revenue-based financing. Or we may see more complex funding structures in which overall valuations may not be impacted, but underlying securities are pushed to investors with preferential rights.

Also, milestone-based investing is resurfacing as a popular investment strategy, and many investors are now looking at down rounds and more cautious bets.

But that would be nothing more than pushing the problems away for the time being. Eventually, valuations will remain sentiment-based, but robust fundamentals must support those eye-popping numbers.

[Edited by Sanghamitra Mandal]

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech