SUMMARY

Against the 11 Indian startups which listed on the stock exchanges in 2021, only three startups did so in 2022

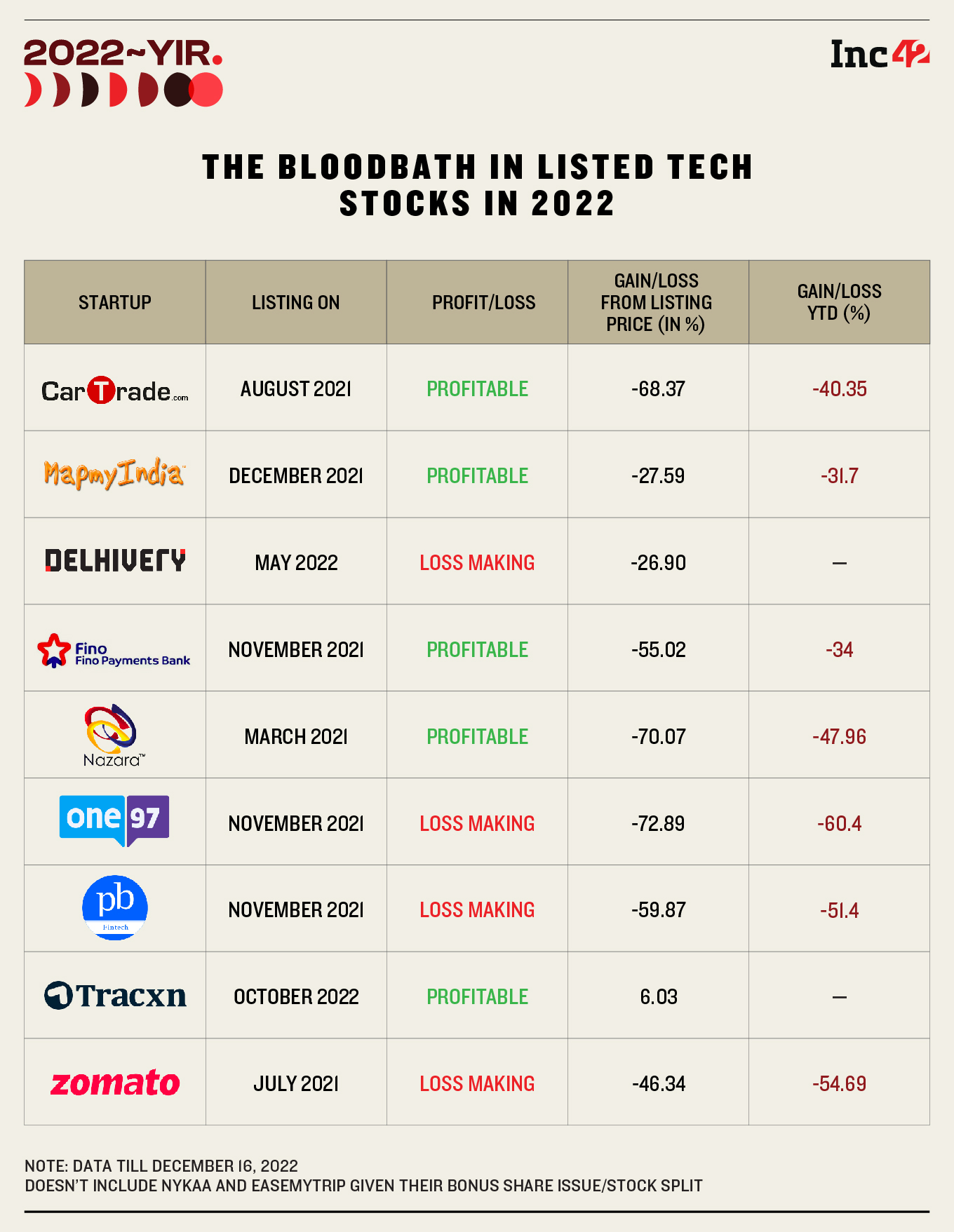

Besides the funding winter and the negative market sentiment, the bloodbath in shares of listed tech startups also made many unlisted startups defer their IPO plans in 2023

OYO, Navi Technologies, and PayMate are among the startups which can go public in 2023, and analysts expect the second half of the year to see an increase in startup IPOs

The year 2022 turned out to be a dull one for tech IPOs as the ongoing funding winter and global macroeconomic uncertainties due to the Russia-Ukraine war, rising inflationary pressure, and fears of an impending recession disrupted the plans of the companies looking to go public. In India, the listed tech startups witnessed a bloodbath on the stock exchanges, following which many unlisted startups shelved their plans to go public.

As 2022 nears its end, the biggest question among investors and the overall Indian startup ecosystem is whether the new year will bring along with it a change in the tech startup IPO scene in the country.

Many believe that given the battering which listed startups took in 2022, tech startups are likely to be cautious in taking the IPO route in 2023 as well, while others are of the opinion that the funding crunch in the private market would force many startups to go public, albeit at lower valuations.

Download Annual Funding Report 2022In 2022, only three Indian startups went ahead with their IPOs — Delhivery, Tracxn, and DroneAcharya. However, eight startups, including Droom, Snapdeal, PharmEasy, MobiKwik, and OYO, which filed their draft red herring prospectus (DRHP) in 2021 and had the best chance to go going public in 2022, either shelved their IPO plans or withdrew DRHP or are yet to receive the approval from the Securities and Exchange Board of India (SEBI).

In contrast, 11 startups went public in 2021, including the likes of Zomato, Paytm, PB Fintech or Policybazaar, EaseMyTrip, and Nykaa. However, a majority of these startups have seen a significant decline in their stock prices, in the range of 25% to 75%, since their listing on the stock exchanges. Even Delhivery, which went public in May 2022, has seen its share price fall around 30% from its listing price.

This negative sentiment towards the listed startups in 2022 could make the unlisted startups eyeing public listing in 2023 go for lower and realistic valuations, while those not wanting to compromise with valuations might have no option but to defer their IPO plans.

However, it must also be noted that the global equity markets, and tech stocks in particular, took a severe hit in 2022, and the Indian stock market showed more resilience than several of its global peers.

As per an EY report last year, Indian stock exchanges – BSE, NSE, including SMEs – ranked 12th in the world in terms of the number of IPOs till the second quarter of 2021. Though the global slowdown impacted the Indian stock market in 2022, EY, in two of its 2022 reports, said that India was one of the “rare bright spots” amid a bearish market.

“India was one of the brighter spots in what was an underwhelming year for IPOs globally, with the number of deals witnessing an increase of 3% by volume. Though the proceeds for the year were down considerably, India saw one of its biggest ever listings (Life Insurance Corp of India raising $2.7 Bn) this year,” one of the reports stated.

In fact, the tech sector in Asia, inclusive of Israel, the Middle East and India, accounted for 90% of tech IPOs and 87% of the proceeds raised globally.

Particularly speaking about India, the report also said that a more robust capital market activity can be expected in the second half of 2023 as private equity and venture capital funding have also started regaining momentum after a decline.

Startups In Line For IPOs In 2023

The year 2023 could see an uptick in startup IPO activity in India if the startups that are expected to go public succeed in doing so. Though several startups have been delaying their IPOs since 2021, there is a possibility of them going through their plans in the next year.

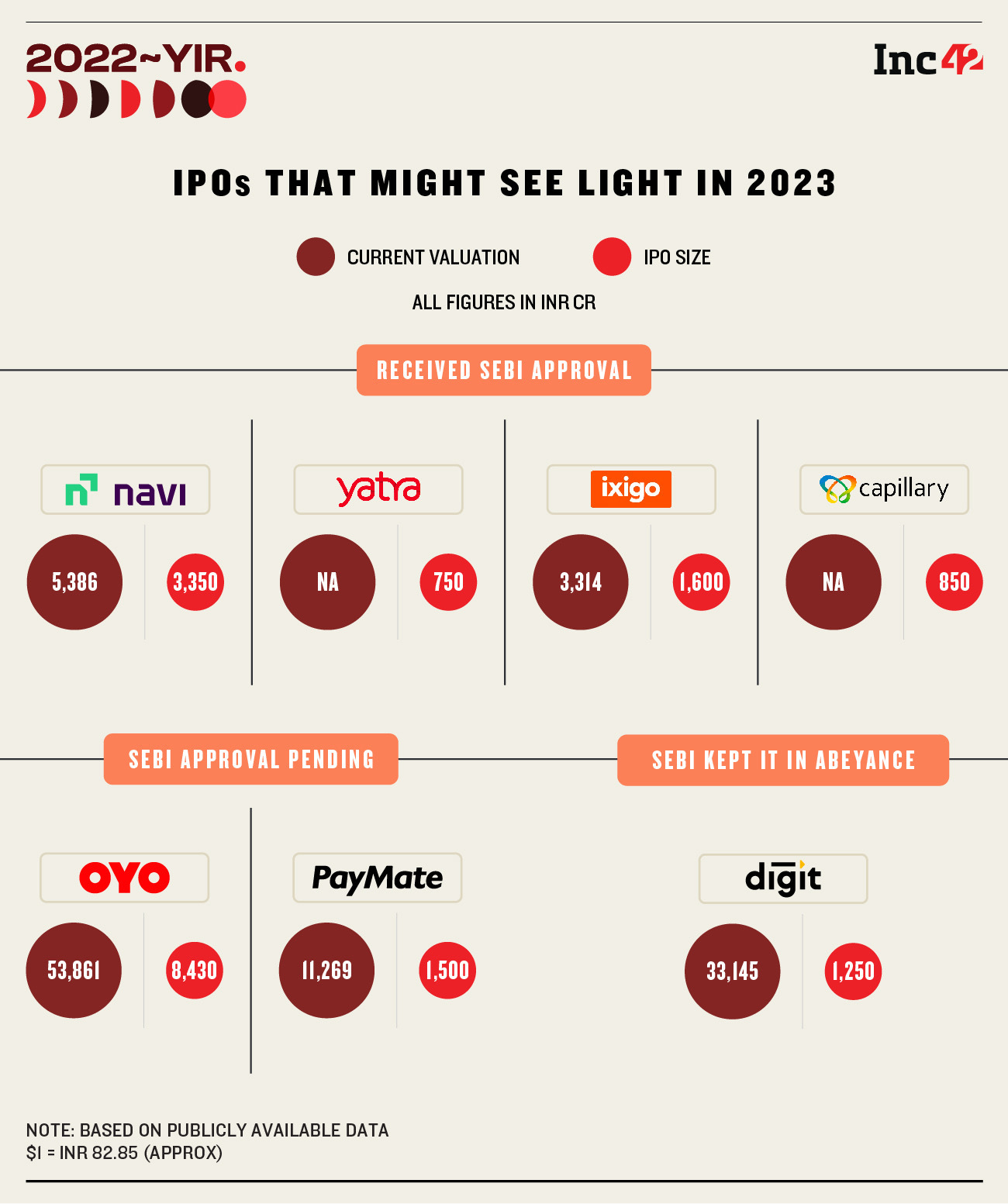

One of the major tech startup IPOs in this list is OYO. The hospitality unicorn filed its DRHP in October 2021 to raise INR 8,430 Cr ($1.2 Bn) through an IPO. However, after deferring its IPO plans, reports earlier this year said that the Ritesh Agarwal-led startup was mulling reducing its issue size to $800 Mn.

Recently, OYO filed fresh financial documents with SEBI to go public next year and in it, the hospitality unicorn reported a second consecutive EBITDA-positive quarter, posting an adjusted EBITDA of INR 56 Cr in Q2 FY23.

However, SEBI’s approval for its DRHP is still pending.

It must be noted that like several other tech companies, OYO also resorted to mass layoffs in 2022 to cut costs. As per Inc42’s layoff tracker, OYO has laid off 600 employees in 2022 so far.

Unlike OYO, Sachin Bansal-led fintech startup Navi Technologies’ IPO journey has largely been straightforward till now. After turning profitable in 2021, Navi filed its DRHP to raise INR 3,350 Cr in March this year. It also received clearance for the IPO from SEBI in September.

Unlike other tech startups which have raised funds to grow, Bansal has alone pumped in around INR 4,000 Cr in Navi and holds 97.39% stake in the company. Gaja Capital and IIFL reportedly hold less than 1% stake each in the startup.

Hence, the decision to go for an IPO in 2023 is at the sole discretion of Bansal.

The capital markets regulator has also approved the DRHPs of traveltech startups Yatra and ixigo for their IPOs worth INR 750 Cr and INR 1,600 Cr, respectively. However, the current status of both the IPOs is not clear.

Besides, Capillary Technologies filed its DRHP for an INR 850 Cr IPO in December last year and received SEBI approval this year. However, it is not clear if the startup plans to go public in 2023 or not.

Fintech unicorn PayMate is another startup which might go public in 2023. The startup filed its DRHP in May this year to raise INR 1,500 Cr via IPO, and is awaiting SEBI’s approval.

Go Digit General Insurance could also go public in 2023 if it manages to get the markets regulator’s nod. The insurtech unicorn filed its DRHP with SEBI in August this year to raise INR 1,250 Cr. However, the market regulator put the IPO in ‘abeyance’. While there were reports that SEBI would restart reviewing it again, there has been no official update so far.

Besides those that have already filed their DRHPs, many startups like Flipkart, PhonePe, Mamaearth, Udaan, and CarDekho have also been eyeing a public listing and have the potential to get listed in 2023. However, there is not much clarity about their exact plans as of now.

Free Fall Of Listed Startup Stocks Hits Morale?

While many startups shelved their IPOs after filing DRHPs, giants such as Ola and BYJU’S, which were earlier mulling a market listing, also seem to have put their IPO plans on the back burner.

While many startups are waiting for the market conditions to become more conducive for a public listing, the sharp decline in the share prices of tech startups, which listed at mega valuations in 2021 and 2022, has also upended their IPO plans.

The biggest loser among the listed new-age tech startups is fintech major Paytm. Its shares have plunged over 70% so far since their listing in November last year. Shares of gaming startup Nazara Technologies, which listed in April last year, have also tanked 70% from its listing price.

Meanwhile, foodtech giant Zomato, which has been in the news for questions on its corporate governance to the acquisition of loss-making quick-commerce startup Blinkit, has seen its shares slump over 40% from their listing price.

Recently, questions were also raised on Nykaa’s corporate governance after its lock-in expiry for pre-IPO investors coincided with the bonus share issue date. The move cushioned the stock from a free fall for a temporary period as pre-IPO investors couldn’t sell their full stake in the company immediately after the lock-in expired.

Nykaa also witnessed a significantly poor 2022 compared to the stellar market debut it made in 2021.

Nykaa, Paytm, and Zomato have also witnessed some of their major investors and prominent names such as Sequoia, TPG Capital, Lighthouse India, Tiger Global, SoftBank, Alibaba, Uber, among others offloading chunks of their stakes and in many cases existing fully over the last few months.

Amid this, traveltech startup EaseMyTrip has largely remained and continues to trade above its listing price.

Shares of Delhivery, which went public in 2022, have also fallen almost 30% from its listing price. However, the recently-listed Tracxn Technologies, which was under pressure in the first few weeks after its listing, is currently trading almost 8% above its listing price.

“The year 2022 will be a year, which most startups hitting the Indian IPO market, would gladly love to forget, given the dismal performance of their stocks leading to significant investor wealth destruction,” said Amar Deo Singh, head advisory at Angel One.

Singh believes that 2023 is also unlikely to turn out to be an easy year for startup IPOs.

“Startups face a serious challenge and the majority of them are loss-making, and so far it’s been their valuations and future plans which helped them raise capital. Now capital is becoming scarce…even more likely in 2023,” he said.

As per Singh, if startup IPOs are to succeed in 2023, they will have to be priced attractively for investors and market conditions will also have to be favourable.

Lessons From 2022 And The Way Ahead

While 2022 taught important lessons to IPO-bound startups, analysts believe that it has also given a fair idea about market valuation to promoters.

“The high-valuation companies, due to global issues, crashed…now the investment bankers, as well as the promoters of the new IPO companies, know how to value the company right now,” said Prashanth Tapse, research analyst at Mehta Equities.

“Going forward, the new-age stocks will face very difficulty in raising money as earlier they were priced with high valuations. And even if companies like OYO go the IPO way, they will come with a very decent valuation,” he said.

Tapse also believes that only a few new-age companies would be able to stand the test of time in the next year or two and be able to reward shareholders.

While the short-term sentiment towards startup IPOs has taken a hit, many believe that listing at right valuations can help the startups raise capital as well as reward all stakeholders. Many market experts also believe that it would be unfair to pass a verdict on the listed tech startups based on their performance over the last year or so when the overall global stock market was impacted.

Pointing out that the significant fall in the tech stocks this year has been in line with the broader market, Siddarth Pai, the founding partner of 3one4 Capital, said, “The one trend that people seem to be forgetting is that the Indian market has now developed a strong appetite for large, household names that are going to IPO. They still accept losses if it’s offset by strong growth. These are fundamental changes to the IPO mindset of Indian investors that are not going to go away anytime soon.”

“Every boardroom of every startup across the country is now actively debating listing as a viable future path and exit for shareholders. That was not the case even two years back,” he said.

Besides, many of the listed startups have also given a clear timeline for achieving breakeven or turning profitable, which can also change the fortunes of their shares once they manage to achieve the target.

It is for this reason that brokerages like Credit Suisse, Goldman Sachs, and Bernstein are positive in the long-term about battered tech stocks like Paytm, Zomato and Nykaa.

While the overall market downturn hit startup IPOs in 2022 and its effect is expected to last in the first half of 2023, the second half of 2023 is expected to be better. As per a latest Redseer report, India is likely to have over 100 matured, large-scale profitable/ path-to-profitability startups in the next five years. With about 20 of them already being listed, about 80 startups have the potential to consider an IPO journey over the next five years, it said.

Download Annual Funding Report 2022It remains to be seen if any of these potential startups begins this IPO journey in 2023 or the startup ecosystem will have to wait longer for it. After all, as Pai said, entering the IPO market at the right time is as important as the fundamentals of the company, and the startups should not be in a hurry for public listing if they deem that the market sentiment is not favourable.