SUMMARY

The Union Budget 2020 is likely to shift from supply-side to demand-side economics as India’s economy

As PM Narendra Modi often turns to Indian startup industry in the hope of job creation, economic growth, technology and innovation, the PM’s cabinet and the government has taken some bizarre decisions on private investments and other policy flip-flops. The tech startup industry can not grow standalone and is also affected by the current macroeconomic indicators. And in the upcoming Union Budget 2020, the questions of slowdown and economic decline will stare down the Modi government.

In 2019, in our budget preview articles at Inc42, we heard the demands of the startup ecosystem, many of which were addressed in FM Nirmala Sitharaman’s announcements — angel tax abrogation or GST rate cuts for EVs and higher budget allocation to boost MSMEs and rural entrepreneurship.

As we are heading to the new year and the Union Budget 2020 in early February, we are again asking the startup ecosystem — investors, businesses and enablers — their expectations. While demands will vary from sector to sector, the biggest challenge for startups will be to overcome the slowdown in a slew of economic indicators.

Take The Inc42 Survey NowTo begin with, let’s take a look at the current economic situation, which presents immediate challenges for Sitharaman that need to be fixed on priority.

If former RBI governor Raghuram Rajan, PM Narendra Modi’s former chief economic advisor Arvind Subramaniam and many other economists say India’s economy is in the ICU, there are a bunch of reasons. Primarily, these stalwarts point to the low consumer spending and rising balance deficit.

Three economic growth engines i.e private consumption, private investment, and exports, the output of eight core infrastructure industries, GDP growth rate, consumer spending and joblessness — Sitharaman has a plethora of macroeconomic issues to deal with.

The continuous low GST collection, direct taxes have added to the revenue crisis woes. Thanks to former finance minister Arun Jaitley’s initiatives and announcements such as demonetisation, GST rollout and more, Nirmala Sitharaman, yet again, has very limited options to explore and experiment in the Union Budget 2020, and none of the options may please the market.

Budget 2020: Don’t Look To RBI For Quick Fixes

In August 2013, amid GDP growth rate continuously going downward, then finance minister P Chidambaram, shifting the blame game to the then RBI governor D Subbarao who had refused to give in to pressure from industry and government had said,

“If the government has to walk alone to face the challenge of growth then we will walk alone”

The outgoing governor had then responded,

“I do hope Finance Minister Chidambaram will one day say, ‘I am often frustrated by the Reserve Bank, so frustrated that I want to go for a walk, even if I have to walk alone. But thank god, the Reserve Bank exists’.”

Subbarao had refused to tamper with repo rates as demanded by the government, something the current government had no problems convincing the RBI on.

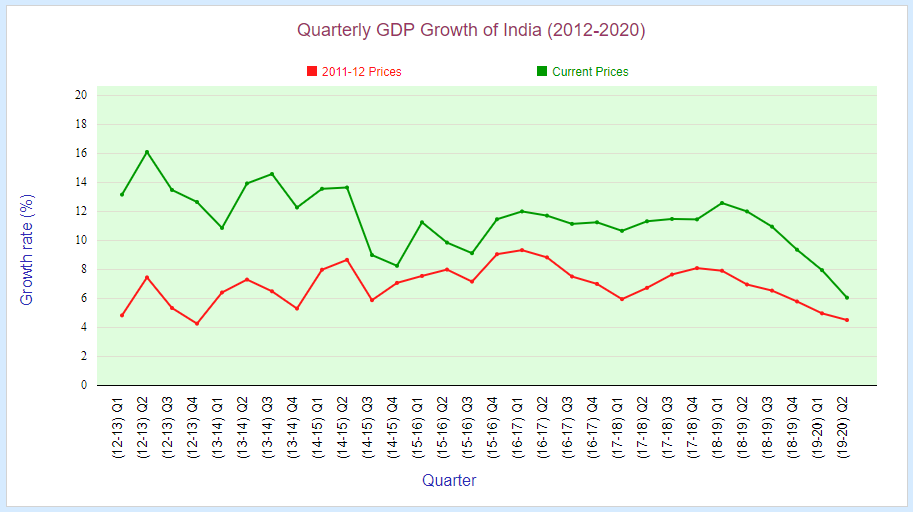

With GDP growth lowest in the last 26 quarters, new private investments at 16 years low, as the economic crisis mounts, the Modi government had yet again looked to the RBI for some quick fixes.

The government of the day finally has a ‘Yes Man’ as the RBI governor who has not only agreed to hand over INR 1.76 Lakh Cr to the government but has also cut interest rates by 135 basis points in five moves this year, the most by any central bank in Asia.

However, the question is, did this solve the issue of revenue crisis, liquidity?

Absolutely not. The transmission of rate cuts has been fractional. The benefit of lowering the rates has not reached to the common man.

And, did the INR 1.76 Lakh Cr resolve the revenue crisis of the government. Not a chance.

Barring November, which is in the middle of the festive season, the government has consistently fallen short of INR 1 Lakh Cr in nationwide GST collection. The government has now aggressively set the new monthly target at INR 1.1 Lakh Cr.

According to reports, out of the INR 13.35 lakh Cr direct tax collection target, about INR 6 lakh crore or only 45% of the annual target, has been collected till October (first seven months).

In fact, the revenue crisis is so big that the government has been unable to pay state GST or SGST quota back. In November, five states — Kerala, West Bengal, Delhi, Rajasthan, Punjab — had released a joint statement and said that they are facing “acute pressure” on their fiscal situation due to the delayed payment from Centre.

Right before the GST Council meeting in December, the centre released about INR 35,000 Cr to states and UTs as pending compensation.

However, the bigger question is unlike the last budget, will the finance minister hit the right buttons this time? And, to delve into the right buttons, she will have to first acknowledge the facts as facts.

This year, besides having extended to INR 75K Cr to farmers’ welfare programme PM KISAN and INR 70K to public sector banks, the FM had also announced a massive 10-12% reduction in taxes for corporates, which along with other tax cuts will cost the government further INR 1.45 Lakh Cr.

After the market sank by over 10% a month after the Budget 2019 announcement, Sitharaman in a series of reformative actions, exempted investors from tax hikes, dropped plans for a surcharge on long and short-term capital gains. She also announced that an additional INR 20K Cr will be given to housing finance companies to revive the real estate.

In layman terms, while the government’s income kept on shrinking, its expenditure kept on increasing

Trade Deficit At Record High

Let’s take a look at another parameter — imports and exports. According to the ministry of commerce and industry, India’s trade deficit has hit a record high at $176 Bn in 2018-2019. The government failed to hit the export target of $350 Bn for the last two years.

Curbing Inflation Alone Won’t Help The Economy

Jaitley’s economics had been revolving around curbing inflation to around 3% which once used to be in double digits in the Manmohan Singh government. However, inflation alone doesn’t fix anything.

source: tradingeconomics.com

According to a research paper Inflation Targeting In Emerging Economies: Panel Evidence by Ricardo D. Brito and Brianne Bystedt dampening inflation has often resulted in lowered output growth. The paper analysed a data set of 32 emerging market economies.

The inflation in India has also increased sharply with food inflation at a 39-month high.

Take Our Budget 2020 SurveyWhat’s Wrong With Supply-Side Fiscal Policies

Be it RBI cutting tax rates by 135 basis points, the finance minister announcing a slew of packages for the supply-side hoping that it would generate the demand and get consumers to consume more — none of these changes has been effective. Will Union Budget 2020 bring relief in these areas?

The basic issue of the Laffer Curve which embodies the supply-side economics is that it was designed and developed for fixing the Western models of economics, which are usually completely organised. In contrast, despite a market size of over $700 Bn, over 90% of India’s retail sector is unorganised.

Since the demonetisation and GST which has hit India’s unorganised sector badly, there has not been much done to fix the unorganised sector. This is also because it does not have an apt representation to make the FM listen to their voices. The PM KISAN programme offers too little to address the issue.

Let’s take onions, for instance. Amid rising prices, the government instantly decided to import over 100K tonnes of onions from Turkey and other countries. This should address the consumption issues. However, this will again adversely affect Indian onion farmers. This simply implies that the government is looking for short-term solutions.

The bigger issue has been the acknowledgement — or lack thereof — from the government’s end about the major issues.

According to the Indian government’s National Statistical Office, joblessness is at a four-decade high, household consumer spending has at a four-decade low. Both, in sync with each other, raise serious concerns related to the demand side. The government’s GDP data further validate these.

However, the Modi government not only sat on the report and dismissed its credibility, but it also went with the supply-side economic policy.

In such a time, there is a need to tilt the initiatives to demand-side economics with the Union Budget 2020, in order to balance the unbalanced. Macroeconomic issues are often solved at the microeconomic level too. Sitharaman could look up to her JNU colleague and Nobel laureate Abhijit Banerjee’s Good Economics for Hard Times. At one point, Banerjee and his co-author and fellow Nobel laureate Esther Duflo write:

“We have already seen that growth is hard to measure. It is even harder to know what drives it, and therefore to make policy to make it happen. Given that, we will argue, it may be time to abandon our profession’s obsession with growth.”