Paytm is on track becoming free cash flow positive by the year-end said CEO Vijay Shekhar Sharma

Just over 15 months ago, Paytm founder and CEO VIjay Shekhar Sharma claimed the company would break even on an EBITDA level by September 2023. “Importantly, we are going to achieve this without compromising any of our growth plans,” Sharma had said in April last year and it now looks like Paytm is well on track to hit this milestone.

If we look closely at Paytm’s trajectory after its Q1 FY24 results yesterday, it would seem that indeed the company is on track to hit this milestone later this year.

On the back of the growth in the lending and the merchants business, the CEO even said in the latest earnings call that Paytm is on track becoming free cash flow positive by the year-end.

So we thought we’ll take a stock of how the fintech giant might get there, but first a look at the top stories from the inaugural edition of Inc42’s MoneyX, India’s largest VC and angel conclave.

- Dry Powder Season In India: Peak XV Partners managing director Rajan Anandan believes that the funding winter has receded and now is the time for dry powder to find its way to the right startups

- The Question Of Domestic Capital: Even as family office investments have grown exponentially, the need of the hour is investor education as startups continue to be a risky asset class, said Waterfield Advisors founder Soumya Rajan

- GIFT City Boost: Despite being around for just over two years, more than 70 AIFs and 50 fund management entities have set up shop in the GIFT IFSC, which is fast becoming a new gateway for the global PE/VC ecosystem

- Navigating LP Waters: Family offices, HNIs and other limited partners (LP) are evaluating VC funds in the same way that these VCs evaluate founders and startups, changing the dynamics of investors raise new funds

- The Founder-VC Dynamics: While corporate governance debacles at Indian startups are alarming, investors cannot be expected to teach ethics to founders, said Pine Labs CEO Amrish Rau in conversation with Peak XV’s Mohit Bhatnagar

Paytm’s Q1 Snapshot

While there are indeed many positive takeaways from the Q1 results — the fintech major nearly halved its losses for instance on a YoY basis — there are red flags too. For instance, on a sequential or QoQ basis, the net loss more than doubled from Q4 FY23.

The silver lining for Paytm came from its revenue growth across segments, which will hold it in good stead once the ESOP costs of Q1 FY24 are nullified in the next quarter or two.

Overall revenue grew by nearly 40% YoY to INR 2,342 Cr, led largely by momentum in the payments GMV, merchant subscription revenues, and loan disbursals. The losses in Q1 were primarily due to the higher employee benefit costs, which ballooned to INR 2,800 Cr, thereby dragging Paytm into the red this quarter.

ESOPs Eats Into Profits

One of the reasons for the higher QoQ losses was that ESOP costs surged 32% to INR 730 Cr, which is typically seen in the initial few years after a public listing. While the fintech giant reported a third consecutive EBITDA positive quarter, this did not account for ESOP costs.

Even as ESOPs continue to be a major pain point for the company, it has not shied away from dishing out stock options. Just hours before its result, the company announced that it would grant an additional 1.7 Mn ESOPs to its workforce. This is likely to continue eating into the profit margins for the company in the next few quarters.

These employee-related costs are indeed part-and-parcel of Paytm’s fairly recent public listing in November 2021. But it remains to be seen when these costs will be finally out of the picture for Paytm.

Where Will Growth Come From?

One area that most fintech players are eyeing is obviously the lending business, where Paytm is using its wide acquisition funnel to pump out some serious numbers.

The platform disbursed 1.28 Cr loans (compared to 85 Lakhs last year) worth INR 14,845 Cr in Q1 FY24, which is a huge 167% jump from the INR 5,554 Cr of disbursed loans last year. Currently, it boasts of over 10 Mn unique borrowers from a monthly transacting user base of 92 Mn, with lending and financial services (BNPL included) contributing INR 522 Cr in revenue.

In comparison, the payments revenue rose 31% YoY to INR 1,414 Cr during the quarter under review. Indeed, when you look at the QoQ growth, revenue from payments has fallen from the INR 1,467 Cr Paytm logged in Q4 FY23, while revenue from lending has grown from INR 475 Cr in the March quarter.

“Prepaid and credit are the flairs that could add extra margin to payments in India,” said Sharma in response to an analyst query during the earnings call. He added that loan EMIs and credit card payments have seen much improved GMV, which in turn improved the fintech giant’s net payment processing margin.

More than anything, this is the biggest indication of just how reliant Paytm is on lending business.

Will Merchant Services Step Up?

One other area that Paytm would look to tap is the payments aggregator licence, for which RBI approval is still pending. This would allow merchants to accept payments from customers by integrating Paytm’s tech into their apps or websites and thereby bypassing the traditional bank accounts or credit cards.

This would make Paytm a lot more useful for retail and online merchants, who currently need a banking layer to accept these payments. It would also bring features such as instant settlements and faster refunds that merchants can leverage to reach more customers.

Paytm already has a steady line of merchants on its platform and a PA licence would significantly boost the product proposition for these merchants.

The number of merchants registered grew 25% to 3.56 Cr in Q1, compared to 2.83 Cr a year ago. Further, the transaction value on merchant devices such as soundboxes, PoS machines and QR codes grew by 55% to INR 796 Cr in Q1 FY24.

New Dawn For Paytm

Essentially, both lending and merchant services have outperformed the payments business for Paytm in the quarter ending June, compared to the previous three months. This goes to show that Paytm is no longer payments-first, but has diversified to financial services areas that are actually delivering the revenue growth.

Indeed, we had raised this question at the end of the Q4 FY23 as well. Lending margins are higher on the personal and merchant loans side, so cross-selling on both fronts will be key for Paytm in the near future.

The fintech giant has tied up with several banks to underwrite and offer the loans, but getting a banking licence Paytm Payments Bank would be the real coup de grace for the Vijay Shekhar Sharma-led company.

Perhaps, the steady revenue momentum from the lending and merchants business will give Paytm enough room to navigate and manoeuvre itself through the regulatory maze. Analysts will undoubtedly be bullish about Paytm after the Q1 results, and this next week could see Paytm rally even more strongly than in the past few months, where its share price has grown steadily.

This is definitely an optimistic time for Paytm and Sharma for one would be brimming with confidence about what the rest of 2023 and 2024 will bring.

Startup Spotlight: Pixxel & India’s Spacetech Dreams

Founded in 2019 and already attracting some of the world’s biggest tech companies, Pixxel has become something of a spacetech pioneer in the Indian startup ecosystem. The company’s primary thesis was that the extant satellite data was not enough for advanced applications, and so it went about revamping this domain with hyperspectral imaging satellites.

Today, the biggest use cases for Pixxel are related to hyperspectral imagery for agriculture fertiliser makers, oil and gas companies and mines. Having raised $71 Mn from the likes of Google, Blume Ventures and Lightspeed, Pixxel is now gearing up to launch the first six of a 24-satellite constellation — named Fireflies — by next year that it claims will make it India’s spacetech leader.

Sunday Roundup: Startup Funding, Tech Stocks & More

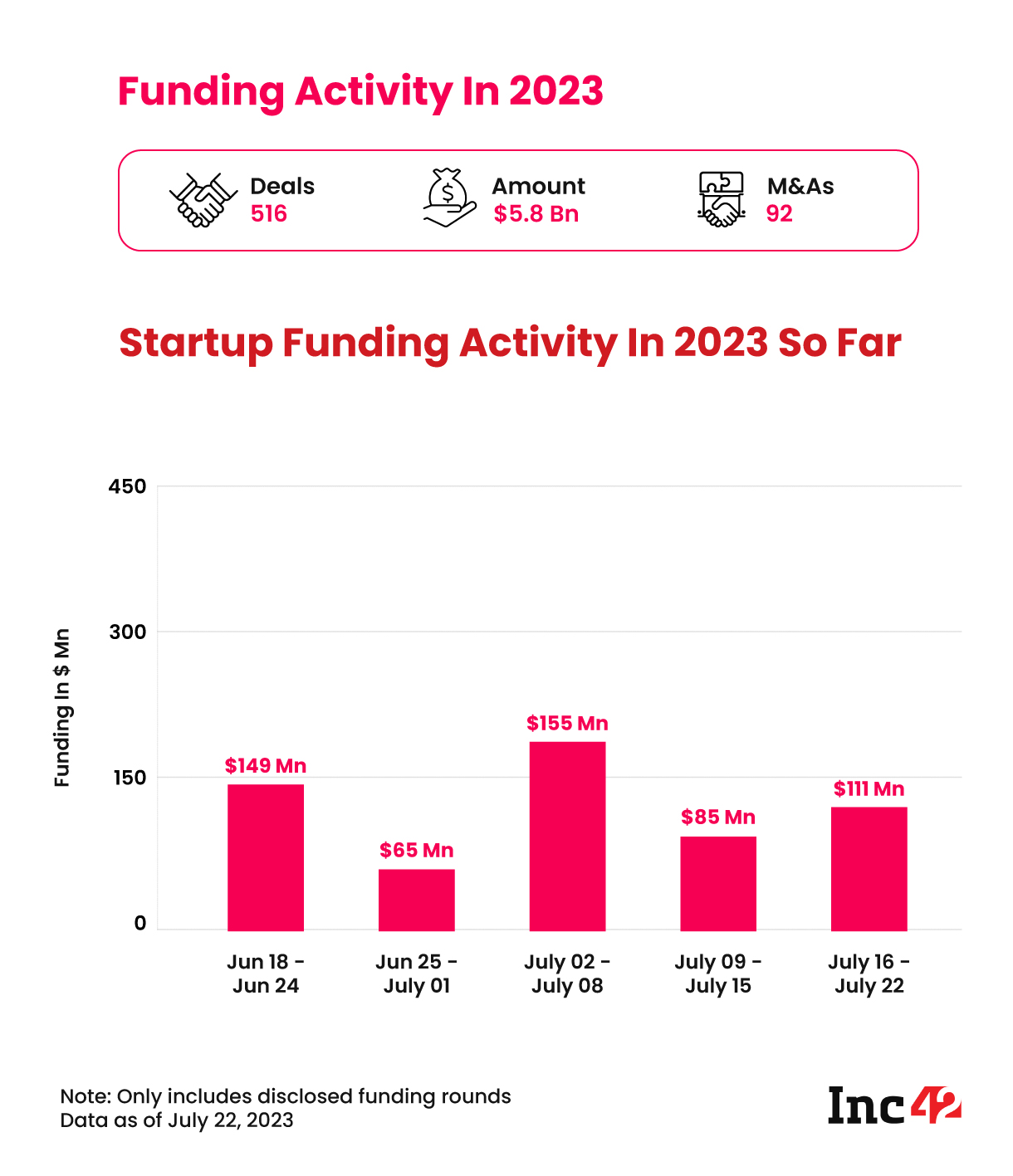

- Furlenco Gets Funding Raft: The furniture rental startup got a cash infusion of $36 Mn amid a minor bump in Indian startup funding this past week when a total of $111 Mn was raised in 19 deals.

- Reliance’s Q1 Results: While Reliance Retail’s digital and new commerce businesses contributed 18% to the total revenue, the same as the last quarter, Jio Platforms saw a 12.5% bump in net profits for Q1 FY24

- Dunzo Takes A Hit: The hyperlocal delivery startup has started another round of layoffs amid major cash flow issues which has grown more serious in the past few weeks

- Return Of Startup IPOs: The likes of Paytm, Zomato and others have seen a significant upward rally after a torrid past 18 months. Will this signal a revival of startup IPO plans?

That’s all for this week. We will see you next Sunday with another weekly roundup, and till then you can follow Inc42 on Instagram, Twitter and LinkedIn for the latest news as it happens.

Ad-lite browsing experience

Ad-lite browsing experience