SUMMARY

Family offices and ultra high networth individuals (UHNIs) have been a key source of capital for VC floating new funds

One of the big questions was about how VCs convince LPs about their differentiation strategy

Investcorp’s Varun Laul also applauded family offices on their grasp for strategy, which is getting stronger and clearer in recent times

The Indian startup ecosystem has been grappling with a funding winter for the past 18 months. However, that has not stopped VCs from raising funds. According to Inc42 data, between January 2021 to June 2023, the investors have floated 230+ funds with $32 Bn capital.

Family offices and ultra-high networth individuals (UHNIs) have been a key source of this capital for VC floating these new funds. However with the global economic meltdown, falling value of rupee to dollar and other macroeconomic events, the LPs have become much more cautious. Indeed family offices or LPs are evaluating VCs in the same way that VCs evaluate founders and startups.

As highlighted by Vinod Murali, Managing Partner & Cofounder, Alteria Capital, while approaching family offices during the Covid years, the venture debt fund was asked questions about how much of its portfolio was distressed and the recovery timelines for the slowdown. “You can answer questions around processes, strategies, but those around macros are tough to answer,” he added.

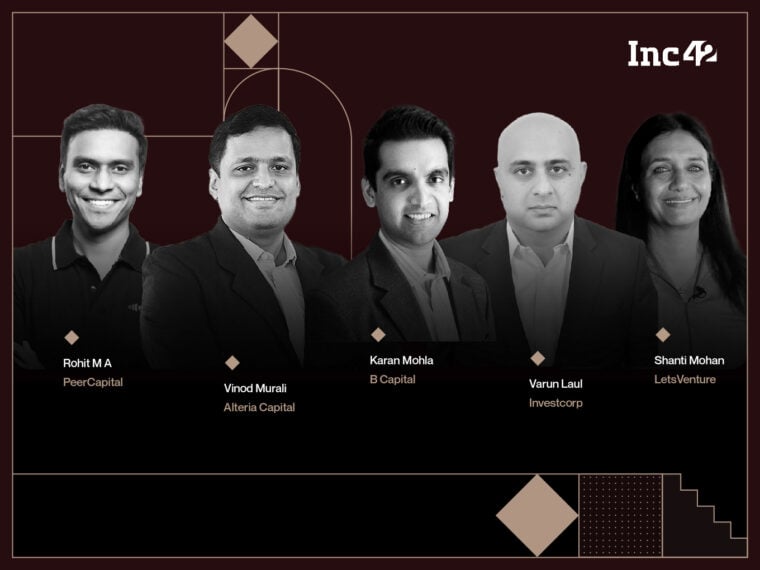

Murali was speaking during a panel discussion on “Navigating The LP Landscape In 2023: Fundraising Strategies For PE-VCs” during the first edition of Inc42’s MoneyX conclave. The panel discussion was moderated by Shanti Mohan, Cofounder & CEO, LetsVenture, and also featured Rohit M A, Managing Partner, PeerCapital; Karan Mohla, General Partner, B Capital; and Varun Laul, Partner, Investcorp.

One of the big questions was about how VCs convince LPs about their differentiation strategy. For instance, LPs are beginning to ask questions about liquidity, returns and exits, IPO potential and frameworks for investments. Limited partners are also wondering how VCs who have board seats are verifying the accuracy and authenticity of revenue figures and sales, given the several corporate governance problems in recent months, said Laul.

Peer Capital’s Rohit MA indicated that being an entrepreneur-turned-VC, he is also often asked what value he brings to the table and why he entered the field of investment. LPs are becoming sharper about asking VCs about not just the capital deployment but also about the value they add to the portfolio.

B Capital’s Mohla highlighted that any investor in today’s market cannot just rely on passion of innovation, but have to align strategies with the competitive landscape, regulations and have to make right decisions for the long run. .

“It’s important to build that confidence in LPs because you cannot do high valuation rounds every three months any more. Fund managers and GPs who are backing startups building for the long-term are really standing out. But this has to be put across to fund investors clearly,” Mohla added.

Investcorp’s Laul also highlighted that more and more family offices are beginning to understand that VCs are not treasury managers. But at the same time, he applauded family offices on their grasp for strategy, which is getting stronger and clearer in recent times.

“They are immediately able to recognise where the white spaces are, where the potential lies. In fact, we find them to be good due diligence partners,” Laul added.

Presented in partnership with Peak XV Partners, supported by Venture Catalysts, JSA, Samsung, IVCA Associates, Indian Angel Network, JIIF and Marwari Catalysts, MoneyX is aimed at bringing the driving forces of the Indian startup ecosystem under a single roof.