Founded in 2009 by Bipin Preet Singh and wife Upasana Taku, MobiKwik has raised over $165 Mn till date

MobiKwik’s revenue from operations fell to INR 288.5 Cr in FY21 from INR 355.6 Cr in the previous year

As part of its public entity conversion process, cofounders Bipin Preet Singh and Upasana Taku have been appointed whole-time directors

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Fintech startup MobiKwik has filed a draft red herring prospectus (DRHP) with the capital markets regulator as it is looking to raise INR 1,900 Cr (around $260 Mn) through an initial public offering (IPO). Founded in 2009 by Bipin Preet Singh and his wife Upasana Taku, Mobikwik has raised over $165 Mn to date. Singh and Taku collectively own about 34.52% stake in the company.

MobiKwik started its journey as a digital wallet but has transformed into a horizontal fintech platform that offers multiple financial services including credit, insurance, gold loans.

As per the DRHP, Mobikwik’s revenue from operations fell to INR 288.5 Cr in FY21 from INR 355.6 CR in the previous year (FY20), which is just over 2X higher than the INR 148.4 Cr reported in FY19 (March 2019). Consequently, total income fell to INR 302 Cr from INR 369 Cr last year. Mobikwik’s total loss for the year jumped up to INR 110.9 Cr from INR 99.1 Cr last year, on the back of an over 20% decline in revenue.

The major revenue decline in the post-pandemic market does not bode well, especially because Mobikwik does not have the same scale as fellow IPO aspirant Paytm in terms of revenue channels or user base. Paytm saw its overall revenue take a hit too, but it only fell 9.9% from the much larger base of INR 3,540.77 in FY20 to INR 3,186.8 in FY21.

As part of its public entity conversion process, Singh and Taku have been appointed whole-time directors. Besides Singh has been appointed the chief executive officer, Taku will hold the designation of chief operating officer. The company’s board has also approved an increase in their compensation for a period of three years from June 23, 2021, to June 22, 2024.

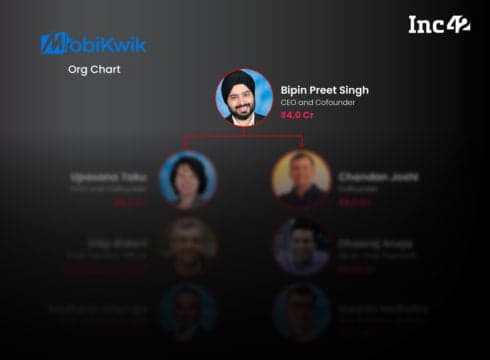

Here’s A Look At The Top Management Of The IPO-Bound MobiKwik

Bipin Preet Singh, CEO & Cofounder

Remuneration: INR 4 Cr

Bipin Preet Singh is the managing director, chief executive officer and co-founder of MobiKwik. He holds a bachelor’s degree in technology, electrical engineering from the Indian Institute of Technology, Delhi. He has been associated with MobiKwik since 2008. He has 19 years of experience in engineering and financial services and was previously associated with Freescale Semiconductor (now NXP India Private Limited) as a Design Engineer, NVIDIA as Systems Architect, and Intel as Component Design Engineer. He is entitled to total compensation of INR 4 Cr for FY22.

Upasana Taku, COO & Cofounder

Remuneration: INR 4 Cr

Upasana Rupkrishan Taku is the chairperson, chief operating officer and co-founder of Mobikwik. She holds a bachelor’s degree in technology from Punjab Technical University and a master’s degree in management science and engineering from Stanford University. She has been associated with the company since 2010. She has 17 years of experience in financial services and payment industries and previously worked for PayPal as Product Manager and HSBC as Business Analyst. She is entitled to total compensation of INR 4 Cr for FY22.

Chandan Joshi, Cofounder

Remuneration: INR 3 Cr

Chandan Joshi, is co-founder and CEO, Payments at Mobikwik. He has been with the company since 2018 and is currently responsible for building its consumer payments business. He holds a bachelor’s degree in technology from the Indian Institute of Technology, Delhi, and a master’s degree in business administration, specialising in finance and general management, from London Business School. He was the founder & CEO of ecommerce logistics startup Paketts, which he sold to Nuvo Logistics. He has previously worked with Nuvo Logistics, Credit Suisse and Futures First. He has 16 years of experience in financial services, trading and logistics. He is entitled to total compensation of INR 3 Cr for FY22.

Dilip Bidani, Chief Financial Officer

Remuneration: Joined In June 2021

Dilip Bidani is the chief financial officer at MobiKwik. He has been associated with the company since June 29, 2021. He holds a bachelor’s degree in commerce from the University of Calcutta, and a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad. He is also an associate of the Institute of Chartered Accountants of India. He was previously chief financial officer at Dr. Lal Pathlabs, Manpower Services, and Mother Dairy, and has previously worked with Avon Beauty Products, ICI India, Orbis Financial Corporation, Max Healthcare, and Hindustan Lever Limited. He has over 33 years of experience, including leading the finance function in healthcare, cosmetics, financial services, and food processing companies. He has not received any remuneration in FY21 as he was not an employee of the company.

Dheeraj Aneja, Senior Vice President

Remuneration: INR 1 Cr

Dheeraj Aneja is senior vice president at MobiKwik and leads its BNPL (buy now pay later) segment. He has been working at the company since 2019. He holds a bachelor’s degree in arts from the University of Delhi and a master’s degree in business administration from Kellogg School of Management, Northwestern University. He has previously worked with Visa, Ernst & Young, and Discover Financial Services. He has over 15 years of experience in credit cards, financial and payments services. According to MobiKwik’s Draft Red Herring Prospectus, for FY21, the company paid Dheeraj Aneja a remuneration of INR 1 Cr.

Siddharth Dhamija, CEO, Zaak ePayment

Remuneration: INR 35.3 Lakh

Siddharth Dhamija is the chief executive officer of Zaak ePayment. He has been associated with Zaak ePayment since 2020 and is currently responsible for leading its payment gateway business. He holds a bachelor’s degree in commerce from Hemwati Nandan Bahuguna Garhwal University. He has previously worked with PayPal, RazorPay, and Panamax Infotech. He has 23 years of experience in the sales function in digital payments, financial services, IT & telecom sectors. For FY21, Zaak ePayment has paid Dhamija a remuneration of INR 35.3 Lakh.

Gaurav Malhotra, Vice President, Strategy

Remuneration: INR 24 Lakh

Gaurav Malhotra is the vice president (strategy and investor relations) at the fintech company. He has been working with the company since 2020 and is currently responsible for leading the strategy and investor relations portfolio. He holds a bachelor’s degree in commerce from Sydenham College of Commerce and Economics, University of Mumbai and a master’s degree in business administration from Narsee Monjee Institute of Management Studies. He is a certified Chartered Financial Analyst. He has previously worked with PinPoint Asset Management Limited, Citigroup Global Markets, Fitch Ratings and JP Morgan Chase. He has 16 years of experience in investment banking, equity research and asset management. He was paid a remuneration of INR 24 Lakh in FY21.

Chirag Jain, vice president, technology

Remuneration: INR 64 Lakh

Chirag Jain is the vice president, technology at MobiKwik. He has been associated with subsidiary Zaak ePayment and Mobikwik since 2012 and is currently responsible for leading the companies’ engineering teams. He holds a bachelor’s degree in technology, computer science and engineering from Uttar Pradesh Technical University. He has previously worked with BNP Paribas India Solutions and Rave Technologies. He has 12 years of experience in software engineering. He was paid a remuneration of INR 64 Lakh in FY21.

Preety Pandey, Vice President, Corporate Finance

Remuneration: INR 72.7 Lakh

Preety Pandey is vice president, corporate finance of the company. She has been associated with the company since 2016 and is currently responsible for financial planning and analysis, investment decisions and commercial negotiations. She holds a bachelor’s degree in technology from National Institute of Technology, Silchar and a master’s degree in business administration from Booth School of Business, University of Chicago. She has completed the certificate programme in advanced financial risk management from Indian Institute of Management, Bangalore. She has previously worked with Grofers, Flipkart and HSBC. She has over 10 years of experience in corporate finance, financial planning and analysis. Pandey was paid a remuneration of INR 72.7 Lakh in FY21.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.