The Gurugram-based startup plans to raise a total of INR 7,460 Cr through the IPO which would consist of a fresh issue of INR 5,000 Cr

SoftBank is the largest shareholder in the unicorn with a 22.78% holding by SVF Doorbell (Cayman) Ltd

Sahil Barua, the CEO holds 2.19% stake in the company, but has not put his shares on the block in the proposed IPO

Earlier this week, logistics unicorn Delhivery joined the growing list of Indian startups waiting to go public.

The Gurugram-based unicorn filed its DRHP filing with plans to raise a total of INR 7,460 Cr. Its offer comprises of fresh issue of INR 5,000 Cr and an INR 2,460 Cr offer for sale (OFS) by existing shareholders, including share sale of up to INR 750 Cr by SoftBank.

The INR 2,460 Cr OFS includes stake sale by other investors Carlyle Group, Nexus Venture Partners and Times Internet and Delhivery founders Kapil Bharati, Mohit Tandon and Suraj Saharan.

Gurugram-based unicorn offers logistics services such as express parcel transportation, LTL and FTL freight, reverse logistics, cross-border, B2B & B2C warehousing, end-to-end supply chain services and technology services.

It provides supply chain solutions to 21,342 customers such as ecommerce marketplaces, direct-to-consumer e-tailers and enterprises and SMEs across several verticals such as FMCG, consumer durables, consumer electronics, lifestyle, retail, automotive and manufacturing.

Founded in 2011, Delhivery has raised $1.4 Bn in funding across 13 funding rounds.

In terms of its financials, it has been running into losses. During the first quarter (April-June) of the current financial year (FY22), the logistics unicorn recorded a consolidated net loss of INR 129.58 Cr.

Its revenue from operations for the same period stood at INR 1,317.72. In the pandemic-hit FY21, the SoftBank-backed logistics unicorn registered nearly 55% increase in its net losses at INR 415.74 Cr, compared to INR 268.92 Cr in FY20.

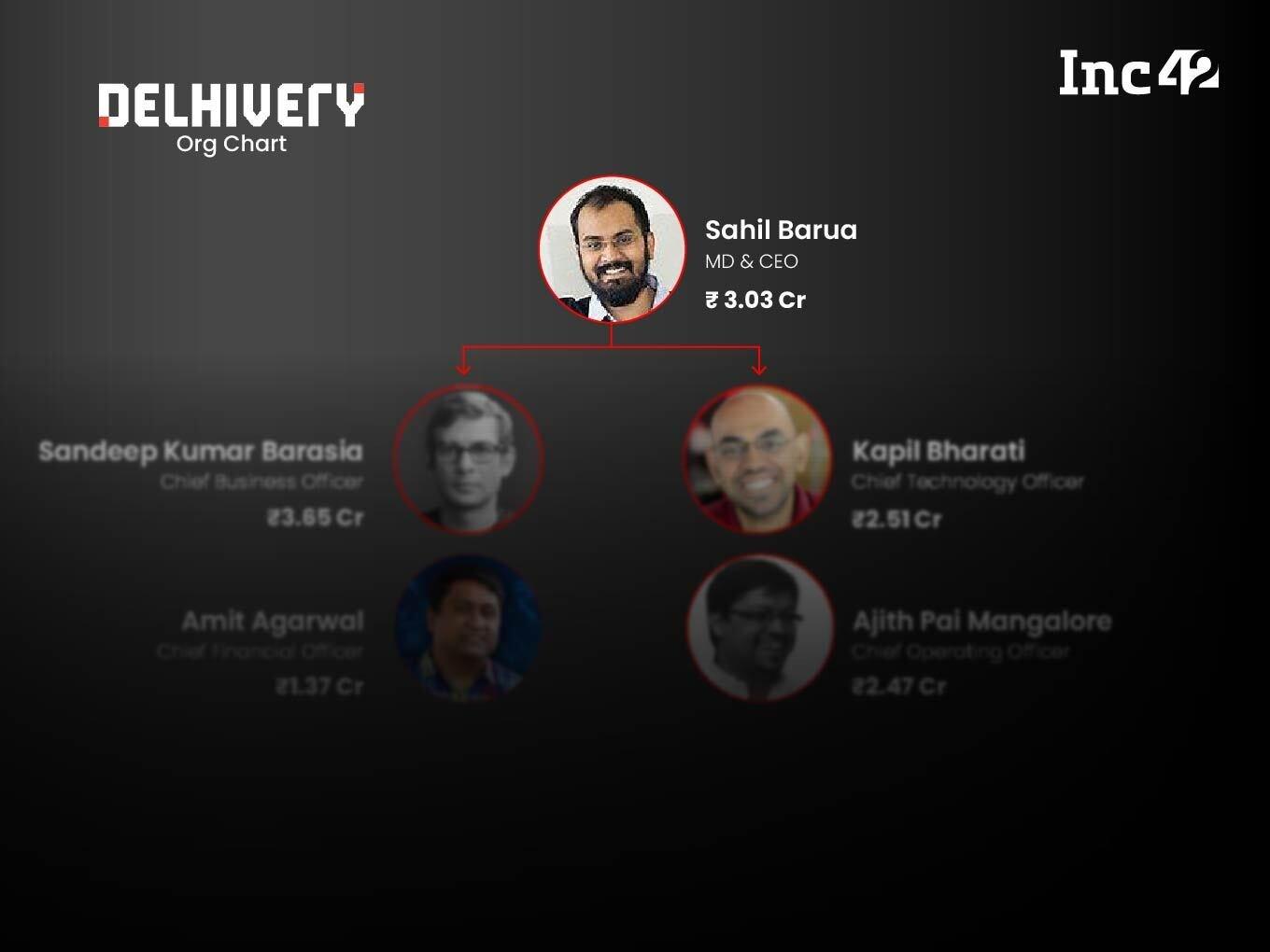

Here’s a look at the key people with power at IPO-bound Delhivery

Sahil Barua, Managing Director And Chief Executive Officer

Barua holds a bachelor’s degree in mechanical engineering from the National Institute of Technology, Karnataka and a post-graduate diploma in management from the Indian Institute of Management Bangalore.

He was previously associated with Bain & Company as a Consultant and holds 2.19% stake in Delhivery. He, however, has not put his shares on the block in the proposed IPO.

The CEO of IPO-bound unicorn received an aggregate remuneration of INR 3.03 Cr in the last financial year (FY21).

According to Delhivery’s DRHP, Barua is entitled to the remuneration and other employee benefits, including fixed salary with merit-based annual increments in the range of INR 2.5 Cr – INR 10 Cr per annum.

He is also entitled to performance-related pay, annual bonus and additional benefits, including gratuity, medical insurance and other perquisites and benefits.

“In Fiscal 2021, he received an aggregate compensation of INR 30.31 million (including INR 3.44 million accrued as variable pay for the period between October 1, 2018 and December 31, 2019) from our company,” Delhivery said in its DRHP.

Further, in FY22, he was paid a variable pay of INR 48.8 Lakh, which accrued between January 1, 2020, and March 31, 2021.

Sandeep Kumar Barasia, Chief Business Officer

Barasia holds a bachelor’s degree in commerce from Bond University and a master’s degree in business administration from the London Business School, University of London.

He also was previously associated with Bain & Company as a Vice-President (Partner).

During the last financial year, he received an aggregate compensation of INR 3.65 Cr, including INR 34.5 lakh accrued as variable pay between October 1, 2018, and December 31, 2019, from the company.

In the current fiscal, he has received INR INR 52.5 Lakh accrued as variable pay between January 1, 2020, and March 31, 2021.

His benefits and remuneration include a fixed salary with merit-based annual increments in the range of INR 4 Cr per annum to INR 12 Cr per annum. According to DRHP filing, he availed a loan from the company aggregating to INR 5.14 Cr, out of which INR 2.6 Cr is outstanding as of October 30, 2021.

Kapil Bharati, Chief Technology Officer

Before joining Delhivery, Bharati founded Athena Information Solutions Private Limited and worked as Senior Manager Technology at Sapient and Publicis Sapient.

In FY21, he received an aggregate compensation of INR 2.51 Cr, including INR 28.7 Lakh accrued as variable pay between October 1, 2018 and December 31, 2019. In the ongoing financial year, he also received a variable pay of INR 41.3 Cr between January 1, 2020 and March 31, 2021.

He holds 1.11% stake in the logistics major and has offered to sell stocks worth up to INR 14 Cr.

He holds a bachelor’s degree in technology (mechanical engineering) from the Indian Institute of Technology, Delhi.

Amit Agarwal, Chief Financial Officer

Agarwa has been associated with the Company since August 4, 2012. He holds a master’s degree in science (Chemistry) from the Indian Institute of Technology, Kanpur. He was previously associated with Inductis India Private Limited and Insight Guru Inc.

In Fiscal 2021, he received an aggregate compensation of INR 1.37 Cr (including INR 16.6 lakh accrued as variable pay between October 1, 2018 and December 31, 2019). Further, between January 1, 2020, and March 31, 2021, INR 25 lakh was accrued as variable pay, which was paid in Fiscal 2022.

Ajith Pai Mangalore, Chief Operating Officer

He has been associated with the company since April 6, 2013. He was previously associated with the Lodha Group as Associate Vice President – Procurement.

In fiscal 2021, he received an aggregate compensation of INR 2.47 Cr (including INR 25.4 Lakh accrued as variable pay between October 1, 2018, and December 31, 2019). Further, between January 1, 2020, and March 31, 2021, INR 41.3 Lakh accrued as variable pay, which was paid in fiscal 2022.

He holds a bachelor’s degree in mechanical engineering from the National Institute of Technology Karnataka, Surathkal and a post-graduate diploma in management from the Indian Institute of Management Bangalore,

Pooja Gupta, Chief People Officer

Gupta joined Delhivery on April 1, 2021 as the Chief People Officer.

She holds a bachelor’s degree in arts from Bangalore University and a post-graduate diploma in personnel management and industrial relations from XLRI, Jamshedpur.

Previously, she was associated with SAP Labs India Private Limited, Myntra Designs Private Limited and Kalaari Capital Advisors Private Limited.

Sunil Kumar Bansal, Vice President – Corporate Affairs

Bansal is also the Company Secretary and Compliance Officer at Delhivery and has been associated with the Gurugram-based startup since August 23, 2021.

A member of the Institute of Cost and Works Accountants of India and a Fellow Member of the Institute of Company Secretaries of India, Bansal was previously associated with Sneha Kinetic Power Projects Private Limited, IDEB Projects Private Limited, SKS Microfinance Limited, LML Limited, GMR Infrastructure Limited and Global Health Limited.

Suraj Saharan, Head of New Ventures

Saharan joined Delhivery on December 20, 2011. He holds a bachelor’s degree from the Indian Institute of Technology, Bombay. He was previously associated with Bain & Company and ICICI Lombard Insurance.

He was on a sabbatical leave in FY21 and did not receive any compensation from the Company for Fiscal 2021. However, he received INR 12.5 Lakh accrued as variable pay for the period between October 1, 2018, and December 31, 2019.

Abhik Mitra, Managing Director and Chief Executive Officer, Spoton

In August this year, Delhivery acquired Bengaluru-based Spoton Logistics for $200 Mn. As part of the deal, Mitra joined the company.

He holds a bachelor’s degree in technology (chemical engineering) from the Banaras Hindu University, Varanasi. He was previously associated with TNT India Private Limited, RPG Enterprises Limited and Hindustan Unilever Limited. In FY 2021, he received an aggregate compensation of INR 1.9 Cr from Spoton.

According to the terms of acquisition, Mitra is entitled to a one-time deferred bonus of INR 4.52 Cr. The bonus will be paid to him on expiry of two years from August 24, 2021, subject to “him not having breached any agreements executed with our Company and/ or Spoton, and adjustments, if any, for payments required to be made by him to our Company or Spoton”.

Ad-lite browsing experience

Ad-lite browsing experience