India is home to over 80 micro VC funds and amid this boom and competition for early-stage bets, portfolio management has become a competitive moat

A sharper focus on portfolio management for micro VC funds involves opening up go-to-market routes, product development, hiring support and more, which goes a long way beyond the capital invested

Typically, micro VCs have looked to stay lean and offer higher engagement to the startups they back, but this approach is slowly giving way to larger micro VC funds with huge cohorts

As India’s startup ecosystem has matured, the investor pool has grown significantly and become diverse. From a small pool of angel investors, private equity players and mammoth VC funds a few years ago, today, the startup ecosystem has avenues such as micro VC funds, family offices, corporate venture capital and syndicated funds.

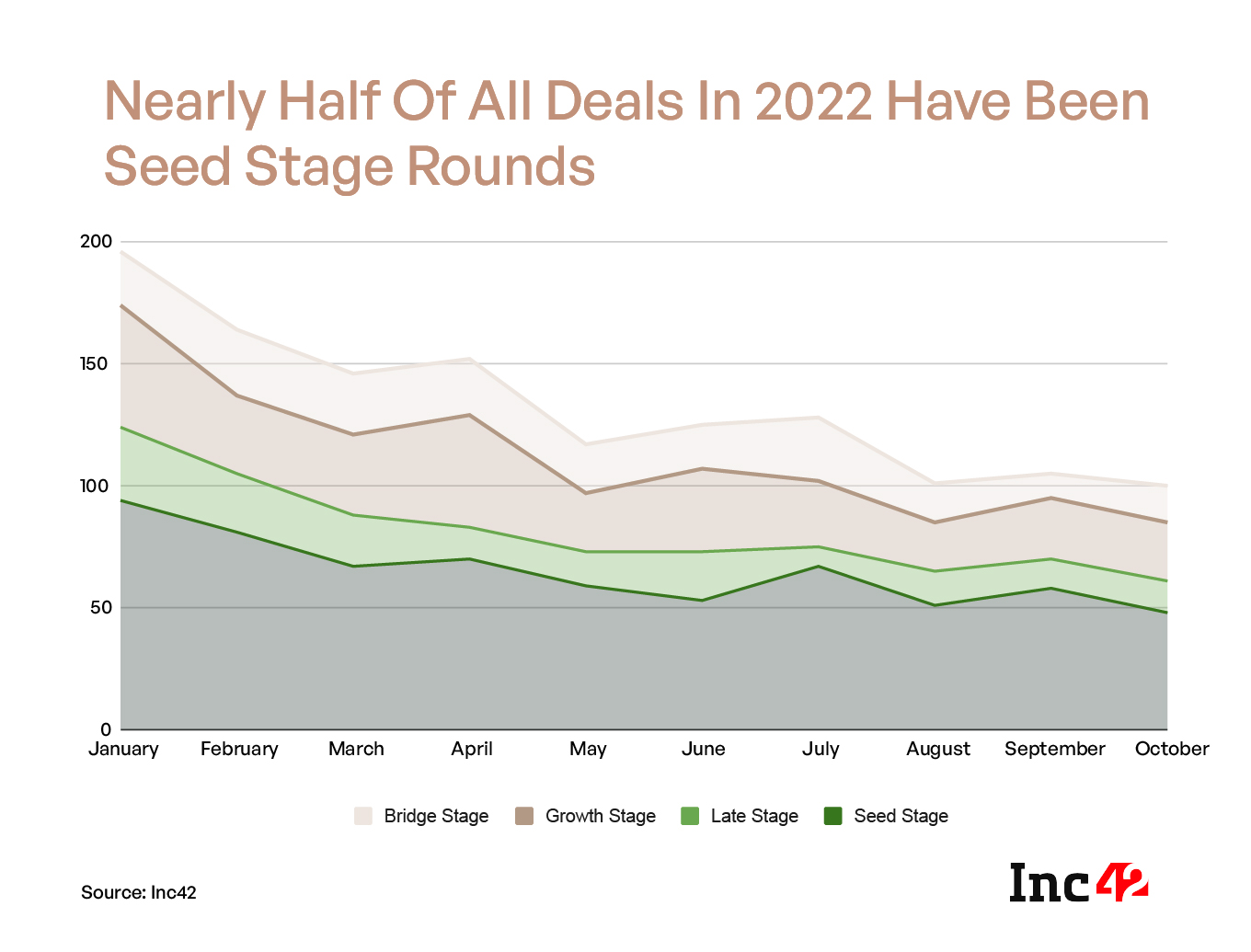

Given the current economic slowdown, however, most of these investor classes are playing the wait-and-watch game. We say most because seed and pre-seed funding has continued to buck the trend of funding slowdown, and this is best seen in the number of micro VC funds emerging in the past 12-18 months and the increased activity.

What early stage founders want is more than the conviction that funding brings. They also need these investors to engage with the portfolio often at all early phases of the business. Unfortunately, large VCs cannot always take these bets or are not in the position to spend too much time in portfolio management, which is why we are seeing so many micro VCs emerge.

As per Inc42 estimates, India is home to over 80 micro VC funds and together with angel investors, these funds are fuelling the next wave of innovation.

The enthusiasm around the micro VC model has spurred Inc42’s next big initiative — CapitalX — where we would enable investment analysts, entrepreneurs, and angel investors, to learn the art and the science of building and managing a micro VC fund from the very people who have successfully navigated this journey.

Join CapitalXThese funds, with a corpus ranging from $5 Mn-$50 Mn or more, are typically seen as more agile and adventurous, given their focus on pre-seed and seed stages. But there’s something more they bring to the table other than their capital — and this is why micro VC funds are rising in prominence.

Going Beyond Capital

“It’s not only about the capital at this stage. Actually micro VC funds are like institutional angel investors. See, the funds we invest will definitely help the founder get to the MVP, but there’s a huge lot of ancillary support that we bring which is why founders are more keen to work with us than angels,” according to Arjun Rao, founding partner of Speciale Invest, a deeptech-focussed micro VC fund.

Founded in 2017, Speciale has seen the landscape of micro VC funds change, but one thing Rao says has not changed is the sharp focus on portfolio management.

When we spoke to micro VCs such as Pi Ventures, Ideaspring, Good Capital, Speciale Invest and others, one recurring theme was the balancing act that is necessitated by the stage at which micro VCs invest. Micro VCs cannot afford to spread themselves too thin with their portfolio as they come in at a stage when founders typically require a lot of hands-on guidance and support.

Often, angels and large seed-stage VC funds or offshoot funds are not able to allocate enough time to the startups in their portfolios. So that’s another area where micro VCs are able to differentiate themselves.

Whereas a typical angel investor will have a portfolio of about 20-30 startups in the first couple of years and a venture capital fund will have dozens of companies in their portfolio, micro VCs look to stay lean and offer higher engagement to the startups they back.

Fund managers at micro VCs make the most out of being early movers and have a larger say in the course that a startup takes.

Often they are able to set the tone for the branding and marketing of early startups, guide founders on product-market fit, and develop strong engagement and relationships before larger VCs take the front seat in Series A rounds and beyond. This is also why the yearly micro VC cohort is typically much smaller.

The Lean Way For Portfolio Management

Staying lean is a mantra not only in terms of the portfolio, but it also dictates the team size, the footprint and corpus of a micro VC fund. This again feeds back into the approach of having a small portfolio that grows steadily each year.

Good Capital founding partner Arjun Malhotra, for instance, told us that the micro VC fund has a hard stop at six investments per year. This is a factor of the small corpus that Good Capital has at its disposal, but also because of the investment approach.

“If we don’t have a hard number, we will not be forced to think sharply about our conviction in the founder. It would be much easier to spend all the capital on low-conviction bets, but that’s not how micro VCs should operate,” he added.

Similarly, Speciale Invest’s Rao said the fund only backs 5-6 startups every year, but his reasoning is that he and Vishesh Rajaram, his fellow partner at Speciale Invest, are then able to give a lot more attention to these startups and their existing portfolio.

“We have about 14 companies from our first fund (INR 60 Cr), and any new companies we add to our portfolio cannot take precedence over those 14 companies. We need to be able to give adequate time to the existing portcos as well as new ones that we back from our larger second fund (INR 300 Cr).”

This is also a reason for Speciale’s smaller footprint — it has a team of just six employees running operations from Chennai and Bengaluru. With this lean structure, the fund is able to have a sharp focus on portfolio management as well as deal flow.

Micro VC Models Evolving

But that does not mean that all micro VC funds are cut from the same cloth.

For instance, Mumbai-based 100X.VC has taken a Y Combinator-like approach and has a massive portfolio of more than 100 startups. It is looking to add another 75-100 startups to its roster by next year.

Similarly, Artha Venture launched its INR 225 Cr micro VC fund called Artha Access in September 2021 to invest in up to 10 startups per year till 2025 with an average ticket size of INR 25 Lakh per deal.

Another micro VC fund that has come to the fore recently is Propell, founded by LetsVenture co-founder Shanti Mohan. Propell said it would invest around INR 50 Cr over the lifetime of the fund and has already made 15 startup investments since its launch in 2021.

But then this approach also requires a wider management base to manage this burgeoning portfolio. Sanjay Mehta-led 100X, for instance, has five individuals at the partner or founder-level to manage this large portfolio.

These larger micro VC funds — often backed by existing venture capital firms — and their considerably larger portfolios are a factor of the increasing competition for early stage investments, even within the micro VC ecosystem.

“If 2021 was about massive deals and unicorns coming out of FOMO by investors, then 2022 is the same situation for micro VC funds. Today, everyone knows that seed stage has the best chance of emerging relatively unscathed from the slowdown, which is why there’s a micro VC boom,” according to the founding partner of one micro VC fund, who did not wish to be named in this case.

Going big is a luxury that most micro VC funds do not have, so they have to counter by closely working with founders, getting limited partners involved in go-to-market strategies and more. Niche micro VC funds such as for web3 and deeptech are also gaining prominence because they can specifically solve the needs of founders in these spaces, in addition to the capital infusion.

The large funds have the ability to attract co-investors and offer larger ticket sizes, whereas the smaller micro VC funds are sticking to the traditional course and can unlock greater value by being more hands-on with the portfolio. Having said the popular feeling is that newer micro VC funds will need to enter the market with larger corpuses to compete better.

The competition to back the right technology and founders at the early stage will be between these two corners of the micro VC ecosystem. In either case, early stage startups are emerging as the winners.

Ad-lite browsing experience

Ad-lite browsing experience