No one can question the fact that Mamaearth started out as a digital-native brand, but as it has scaled up, it has preferred to go the traditional route

With 35 brand outlets and presence across 430 modern trade outlets, the startup bolstered its offline play in the past two years and is looking to use the IPO to further fuel this expansion

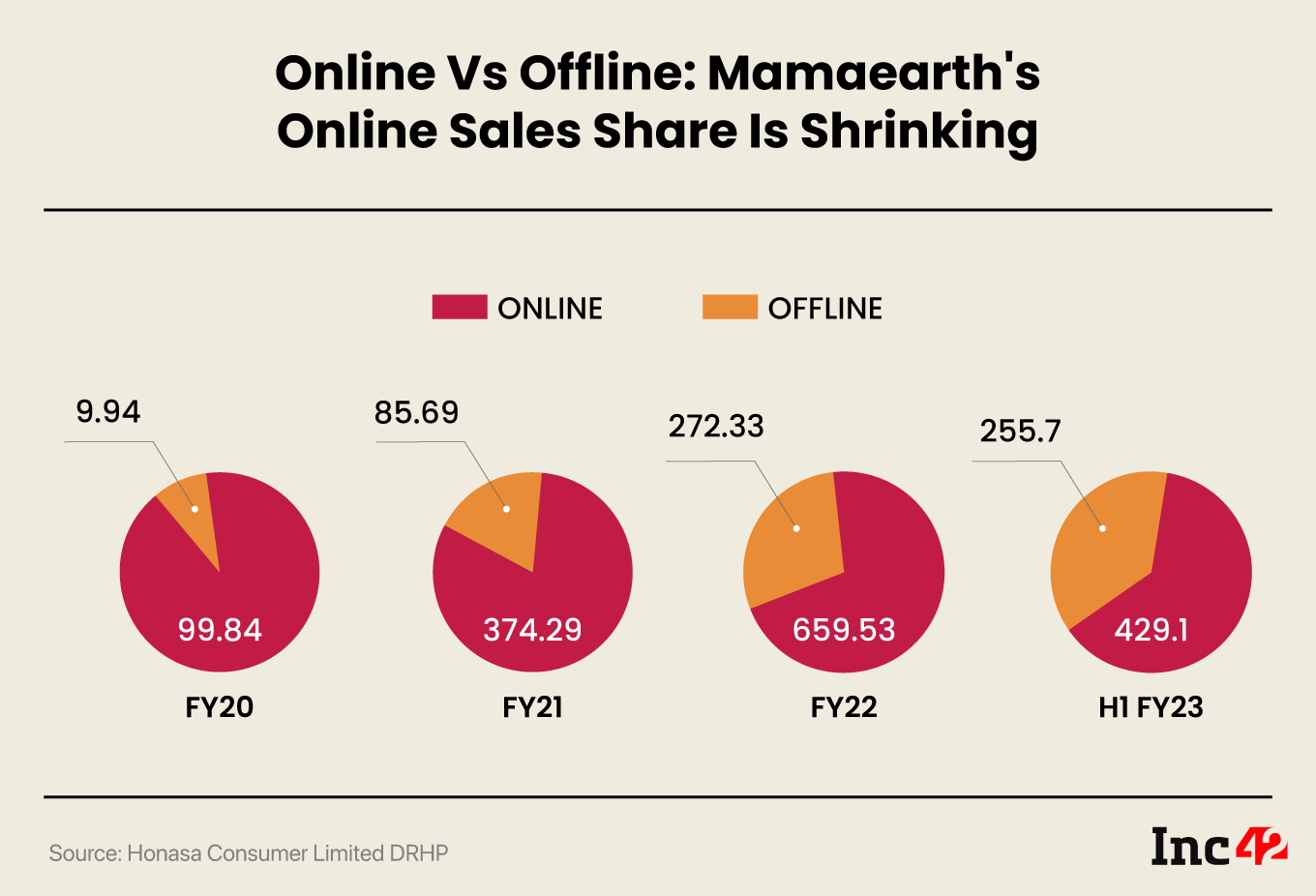

The DRHP includes 75 individual mentions of ‘digital-first’, however, the past few fiscal years indicate a revenue skew towards offline sales

Perhaps the biggest question that needs to be answered when looking at the potential IPO of Mamaearth and its parent company Honasa Consumer Limited is whether this is a new-age digital brand, or a consumer goods company dressed in a digital garb?

Honasa Consumer is not only the company behind flagship brand Mamaearth, but over its past six years it has acquired a slew of businesses The Derma Co, Momespresso, BBLUNT, Ayuga, and Aqualogica.

But Mamaearth is nevertheless the face of the company and one that is synonymous with its founders Ghazal Alagh and Varun Alagh. Before we get into the core business identity of Mamaearth — which is critical to understanding how it might be received in the stock market — let’s get the IPO details out of the way.

Honasa’s initial public offering (IPO) will consist of a fresh issue of shares worth INR 400 Cr and an offer for sale of up to 46,819,635 equity shares, according to the startup’s draft red herring prospectus.

The DRHP states that the company will largely use the fresh funds to scale marketing to improve brand visibility, while also setting up dozens of new exclusive brand outlets or EBOs and establishing new salons for the BBlunt chain.

Since being founded in 2016, Mamaearth and Honasa have raised funding from marquee investors such as Sequoia Capital, Sofina, Evolvence, Fireside Ventures, and Stellaris Venture Partners, among others.

The company has made three acquisitions in the past 14 months. In May 2022, Honasa acquired a majority stake in skincare company Dr Sheth’s for INR 28 Cr, after acquiring beauty salon chain BBlunt in February 2022 and Momspresso in December 2021. The full revenue contribution of Dr Sheth’s will start reflecting in the consolidated books by the fiscal end.

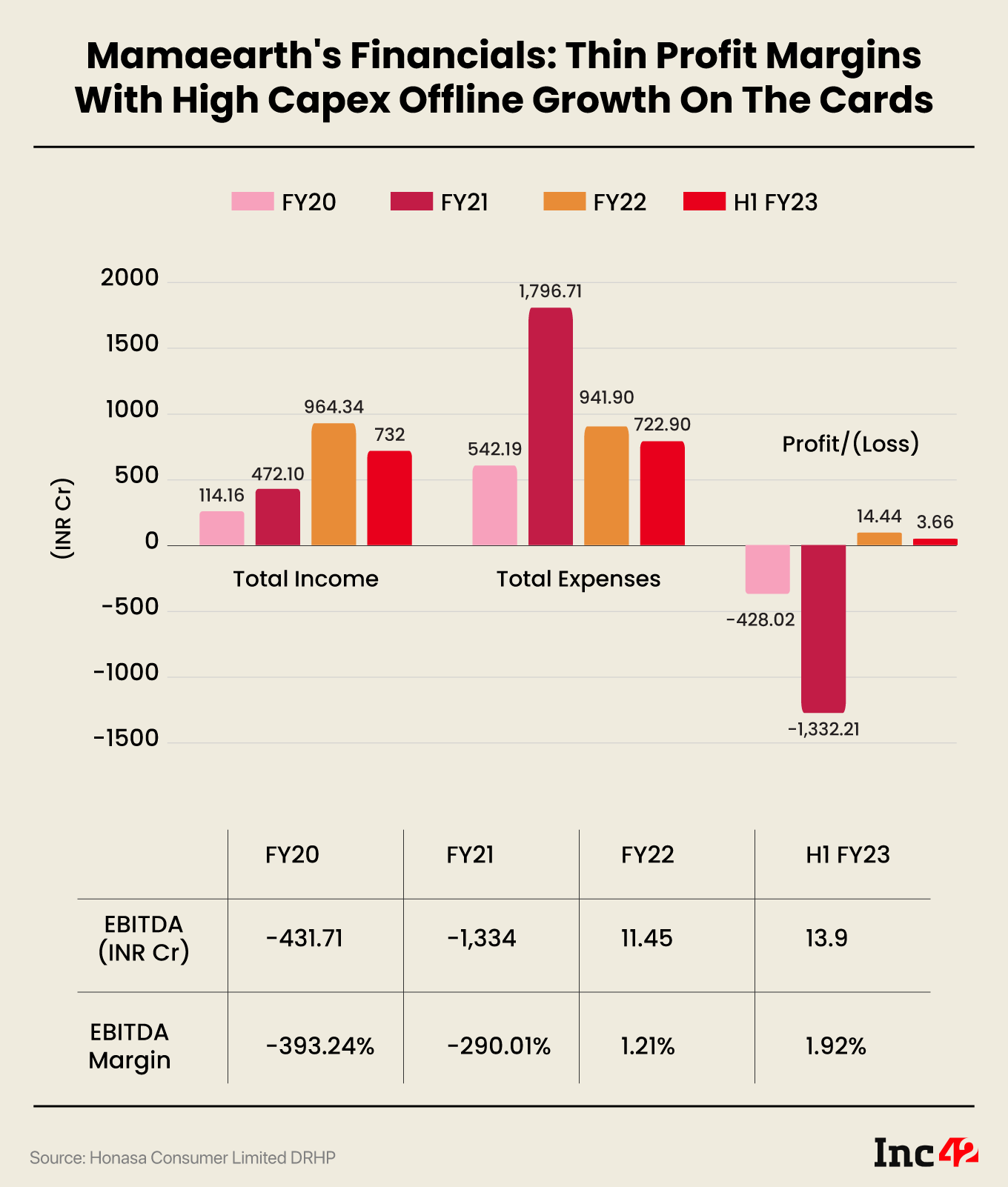

Obviously, Mamaearth’s profitability has grabbed the headlines given that typically startups have not been profitable when going for a listing. Mamaearth’s profit stood at INR 14.44 Cr in FY22 and INR 3.7 Cr in the first six months of FY23 (till September 2022).

Honasa may well see higher revenue in FY23 by March 2023, given it has reached INR 722 Cr in two quarters, compared to INR 943 Cr in all of FY22, but the profit margin seems to have shrunk in FY23. And this may largely be due to the push towards offline channels.

The acquisitions have proven central to Mamaearth’s retail footprint and offline growth has contributed to revenue in a bigger way in each of the past few fiscals.

The company claimed to have 35 exclusive brand outlets (EBOs), nine salons, and 449 distributors, super-distributors and sub-stockists catering to online and offline channels. With 1,388 beauty advisors and 430 modern trade retail chains, the startup has further strengthened its offline play significantly in the past year.

The DRHP states Honasa is also looking to enter new categories and expand its portfolio in adjacent categories such as colour cosmetics and fragrances according to the DRHP.

Why is Mamaearth Pushing For Offline Growth

Offline expansion fits well into Honasa’s product development strategy, which is built around quick iteration and launches. This not only keeps competition on its toes but also allows the company to quickly move in on trends.

For instance, the number of SKUs grew from 159 in March 2022 to 225 by September 2022. This is 2.6X the median number of new SKUs in the industry, according to the DRHP. And this strategy is clearly working in scaling up offline sales.

The company did not give a breakdown of the online sales. However, according to the DRHP, online sales contributed over 60% of its total sales in the first six months of FY23, so yes, the company is still largely reliant on online channels. But it has looked to reduce this in a major way in the past couple of years.

This is quite a transition from a few years ago when most talk about Mamaearth used to be about how it reached INR 100 Cr in revenue faster than most traditional brands. In 2023, it is clearly playing in the same field as many of those legacy retail players, seeing that it has increased its offline focus in recent years.

The DRHP includes 75 individual mentions of ‘digital-first’, however, the past few fiscal years indicate a revenue skew towards offline sales. No one can question the fact that Mamaearth started out as a digital-native brand, but as it has scaled up, it has preferred to go the traditional route.

That’s not a bad thing per se, and indeed only serves to highlight the dilemma of D2C brands in India which cannot rely on the online-only approach.

Single-Brand Reliance

In every way, Mamaearth is Honasa. All operating revenue was attributed to the Mamaearth brand. But this needs to change to justify some of the parent company’s spending on acquisitions.

While the acquisitions are recent and therefore unlikely to have had a significant impact in FY22 or FY23, Mamaearth launched an in-house brand The Derma Co in 2020, which has not contributed much to the revenue either.

The top 10 products contributed 30% of its operating revenue in 2021 and 2022, while the top two products accounted for 12.6% of the operating revenue in FY23 (H1). With 225 SKUs, the company needs to diversify its revenue-generating products in a big way.

It cannot afford to have a long-tail product lineup where a bulk of the products do not bring in much revenue.

The concerted offline strategy suggests the company is going for an omnichannel ‘house of brands’ approach, where several brands will not only feed the sales channels but also the retail sister concerns. Indeed a look at offline sales growth indicates just how central these new brands will be to Honasa’s future.

Through BBlunt, Honasa wants a major piece of the salon services space, which it claimed was an $8 Bn opportunity in 2021 and only set to grow as the economy opened up in the post-pandemic years. Honasa is looking to bolster its BBlunt acquisition through a range of offerings such as beauty-spa, beauty-treatments and other products and services.

Mamaearth’s D2C Identity Crisis

These plans are hinged around the company’s ability to launch new products, as this space is highly competitive. This is quite contrarian to the lean and sustainable D2C way that many brands have gone for post 2022.

And this is also where some of Mamaearth and Honasa’s identity crisis stems from.

New product launches have been rare in the past year in most categories, and even where there have been new launches, the marketing efforts have been muted. Plus, people costs associated with retail expansion are typically higher than in a D2C brand.

Further, most D2C brands have moved towards automation, even as they have looked to cater to offline sales channels. The drive for sustainability given the funding slowdown has dictated online-first strategies. Mamaearth has gone the other way with an offline-heavy approach.

The company has stated that it might go for a pre-IPO round of INR 80 Cr or $10 Mn, which might be enough for the short-term for these higher costs, but it looks like Mamaearth’s IPO proceeds will more or less be going towards offline marketing and expansion.

It is allocating roughly 10% or INR 35 Cr to open 44 new EBOs every year till 2026. A whopping INR 186 Cr would go towards marketing and advertising spending for brand visibility, while INR 28 Cr would go towards BBlunt expansion.

The emphasis on offline sales or presence is clear from this break-up. This is also why comparisons with Nykaa remain a step removed from ground reality. With high capex offline push on the horizon, are the thin profit margins indicative of long-term sustainability?

While Nykaa and Honasa might well have come from the same digital-first mindset, the reliance on one brand for the latter has forced it to become more like legacy players than Nykaa.

In that regard, Honasa and Mamaearth more closely resemble FMCG giants such as Hindustan Unilever, Dabur, Emami, Marico and others. Except that these giants have a lot stronger brand recalls across multiple brands and don’t rely on just one.

Can Mamaearth and Honasa continue to pump out new products, expand its offline footprint without overleveraging its production lines? And is this even the right approach given that only one brand seems to be moving the needle?

Update Note (January 7, 2023 | 10:20 AM)

- We have made minor changes in the article after publication to reflect our analysis more clearly

Ad-lite browsing experience

Ad-lite browsing experience