2019 has been quite a hit-and-miss year as far as venture capital is concerned, but for most in the startup world it is business as usual. Inc42 examines the reasons behind this polarity

Towards the end of 2019 the startup ecosystem had woken up to a problem that traditional businesses and stock markets saw coming for some time. The Indian economy was grinding down to its worst slowdown in years and no amount of prodding and cajoling managed to revive investor sentiment. The always-judicious Indian consumer seemed to have gone into hibernation for the winter.

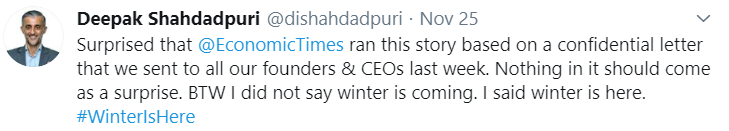

Alarm about penny-pinching customers and the slowing economy was sounded out by an Economic Times report in November citing a letter by prominent VC and head of DSG Consumer Partners, Deepak Shahdadpuri, asking founders to tighten their belts. Replete with the inevitable Game of Thrones references about an impending funding winter, the letter warned founders that VCs were losing their appetite for risky bets and founders will have to lower expectations about valuations of their startups.

(Screen grab from Deepak Shahdadpuri’s Twitter timeline)

The Singapore-based VC warned founders saying that: “Investors want to see a solid business model with fundamental unit economics when they scale. Too many VCs have backed consumer businesses that were reliant on discounting at launch but who then failed to maintain sales when discounting was stopped. VCs have their hands full dealing with issues within their portfolio and not looking as aggressively at new deals until they sort out their current issues.” (you can read the full letter here)

Tech startups — companies that promised near-magical growth, whipped up massive markets in a jiffy, harnessed the power of data in ways not seen before — have hit a roadblock of their own. With stock markets cutting Uber and WeWork to size, tech startups around the world are being asked the most fundamental question — Where are the profits?

The warning was symptomatic of the year which has been quite a hit-and-miss for as far as venture capital is concerned. A closer look showed that while some in the startup ecosystem echoed Shahdadpuri’s dismal outlook, most VCs and startups are shrugging this off as a cyclical slowdown and are still upbeat about the market.

Macro Troubles Aplenty

In India, the second quarter of the year kicked off with news that GDP growth had hit a low of 5.4% and fresh investments had hit a 15-year low. The government’s rushed attempt to resuscitate the slumping economy did not take with the private sector and October saw wary venture capitalists and private equity players on the fence about closing investments.

“VCs could be requiring more traction before considering investing… The economic slowdown might drive deal sizes down for some VCs but global investors may sustain funding,” Rick Tsing, Founder and CEO of OneOneDay, an adtech platform said.

With the economy facing both structural and short term issues (outlined in an analysis by former Chief Economic Advisor Arvind Subramanian), India’s GDP growth not only slowed down further to 4.5% by the third quarter but was now in such a state of despair that it even international industry bodies were raising the alarm.

Citing the sharp decline in leading economic indicators in the last few months such as electricity demand, rural wage growth, and manufacturing output in India, the International Monetary Fund said that it would be revising its growth forecast of 7% for India in 2020 to a lower number.

Yogita Tulsiani, cofounder of a human resource tech company called iXceed Solutions told us that investors are going for B2B startups rather than B2C, as there is a continuous revenue stream from larger business in B2B.

“B2C requires large initial funding to do marketing, which VCs are refraining from,” Tulsiani said, adding that the “Recent meltdown of valuation of businesses like WeWork is keeping VCs risk-averse.”

Business As Usual For Some?

“Even though the government did make some attempts to help the supply-side pick up pace, results did not really show up till November when the investment sector finally wowed us by clocking up nearly $5 Bn worth of transactions,“ Vinay Nair of Nair Ventures, a deeptech investor, said.

Early-stage investors are however reading the signs differently. “Slowdown is more at the macro level for large corporations who have stopped investing in new projects but for early stage stage startups it is business as usual,” said Sanjay Mehta, founder of venture capital firm 100X.VC.

While Nair said fintech will be the sector to attract investments after the slowdown is arrested, Mehta said that B2B startups will enjoy a warmer welcome in the current scenario.

Pallav Kumar Singh from Draconis Capital, a Delhi-based $100 Mn venture fund investing in infrastructure-tech startups and waterways also shrugged off the notion of a funding winter, saying that such cyclical slowdowns do not affect long-term projects such as transport and municipal contracts.

According to Datalabs by Inc42, the total venture capital funding in 2019 was 5% lower than 2018. However when analysed by the quarter, the funding data shows a clearer picture of a decline. While the first quarter of 2019 was stronger than the same quarter in 2018 in terms of VC investments, the following three quarters were significantly weaker.

Sandipan Mitra, founder and CEO of HungerBox, an institutional foodtech player which just closed a $12 Mn funding round said that the mood among VC’s is very positive as this has been a phenomenal year for VCs with multiple exits, mergers and acquisitions etc and more importantly the recession is acting as a cleanup exercise and VCs are now focussing on startups with strong fundamentals.

“Not Necessarily A Bad Thing”

While VCs have kept up a brave front in the face of very unattractive macros, a Moody’s report released this week is bound to raise some eyebrows. The industry ratings company downgraded India’s outlook to” negative” from “stable” saying that the investment-led slowdown has now broadened into weakening of consumption.

There are a lot of negative vibes in the market, from slowing consumer spending to the WeWork debacle, also there is a lack of fresh ideas in the market,” Nair said, confirming the downturn and said that many investors may be waiting for January when traditionally a lot of deals are signed.

Terming it as “not necessarily a bad thing,” Nair added that the slowdown “will help in the maturity of the market as investors are looking for fresh ideas and business models which are more frugal.”

Investor sentiment has also been buoyed by the fact that unicorns Ola and Byju’s have announced measures to achieve profitability and perhaps take the IPO route. “This will spur huge investment in the startup scene as now VCs can see a real path to liquidity,” 100X’s Mehta said.

“Nothing changes for me. The core India market opportunity, quality of founding teams are very real so there is no reason to change how we invest…Look at successful companies like Facebook, Google, Udaan, Flipkart, OYO – none of them were started when the market was super hot,” Vaibhav Agrawal, a partner at Lightspeed India Venture Partners said.

Ad-lite browsing experience

Ad-lite browsing experience