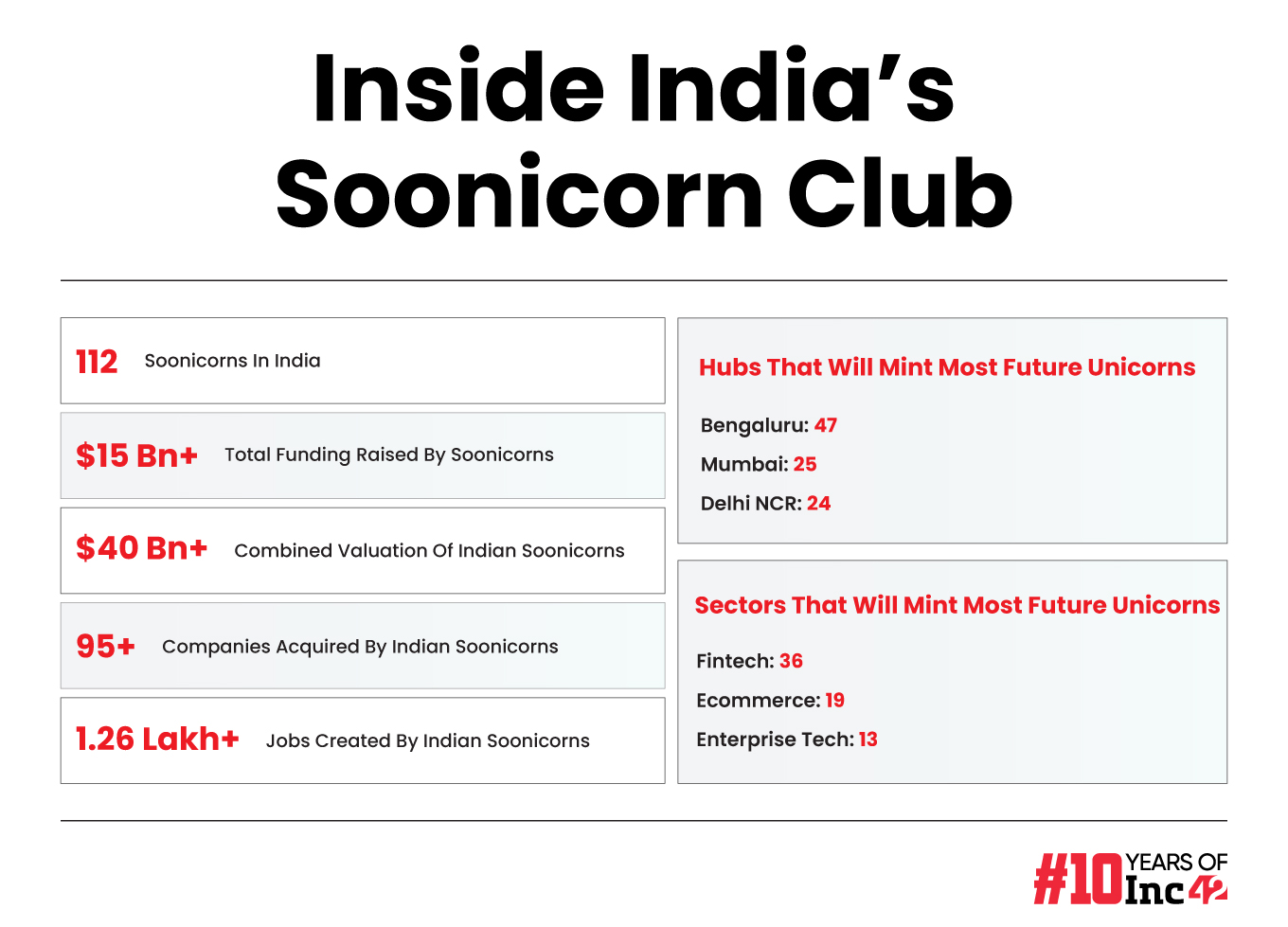

With valuations in the range of $200 Mn to under $1 Bn, these startups together boast a combined valuation of over $40 Bn and have netted more than $15 Bn since 2014

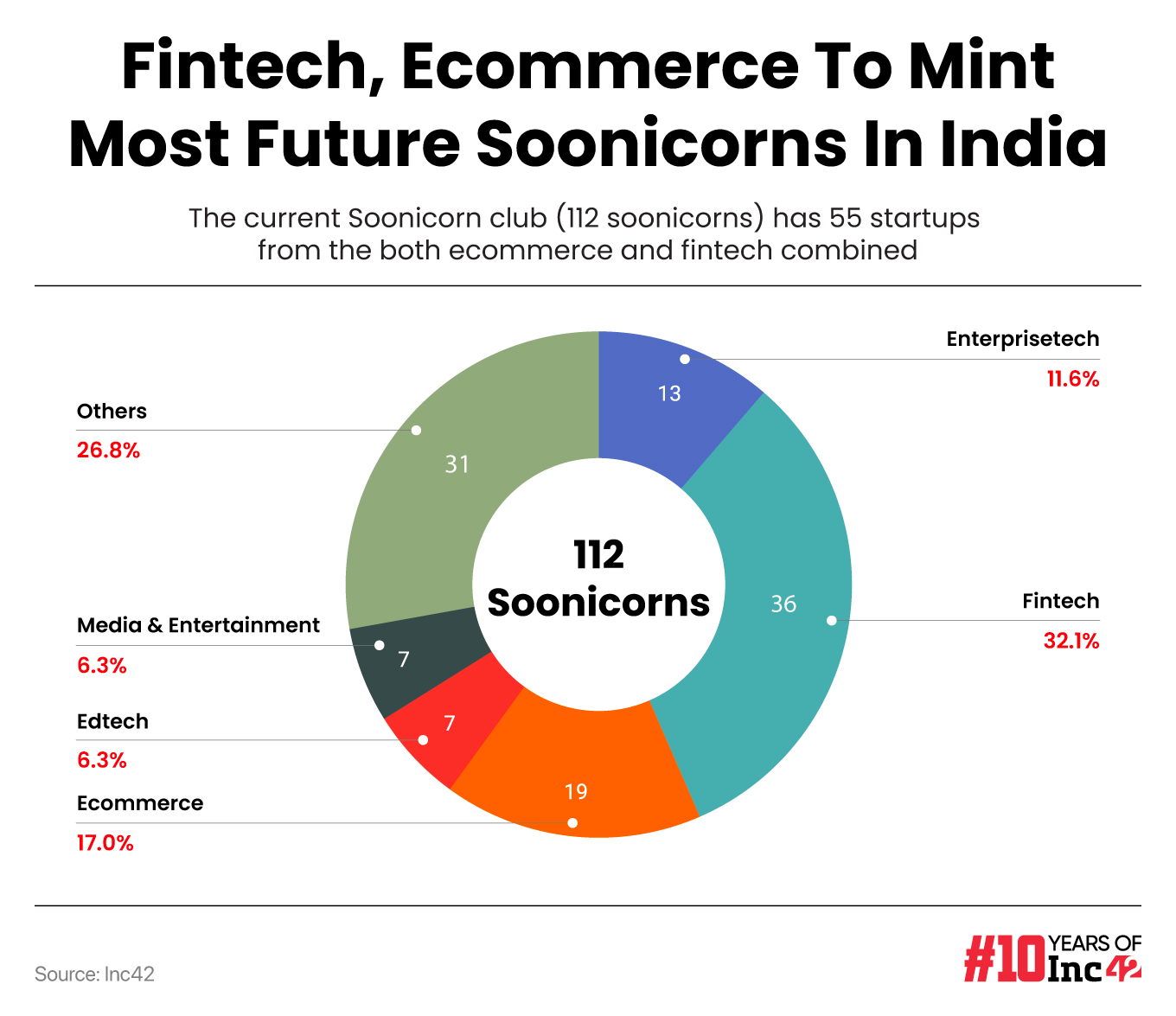

The Indian fintech sector fosters the most number of soonicorns at 36, followed by ecommerce at 19 startups.

IPO-bound B2B payments solutions provider PayMate takes the top spot on the soonicorn valuation podium at $930 Mn

The dread of the ongoing funding winter has been such that the world’s third-largest startup ecosystem could mint only two unicorns — Zepto and InCred — last year. Well, with only two startups — Krutrim and Perfios entering the country’s cavalry of unicorns, taking the total number of unicorns in India to 115, the year so far has been no consolation either.

However, what is interesting is that an equivalent number of Indian startups have formed a beeline to wear the crown of the country’s next unicorns.

According to Inc42’s “Unicorns Of Tomorrow – Decoding India’s Soonicorn Landscape Report, 2024”, as many as 112 Indian startups are on their way to mark their entry into the coveted unicorn club.

With valuations in the range of $200 Mn to under $1 Bn, these companies together boast a combined valuation of over $40 Bn and have netted more than $15 Bn since 2014.

Unfortunately, a deeper dive into the fundamentals of these to-be unicorns reveals that only 8% of the total number of soonicorns identified by Inc42 are profitable, with only 41 startups making their FY23 financial results public.

Some of the profitable soonicorns include names like BookMyShow, CarTrade, Finova Capital, KreditBee, LendingKart, Loco, Navi, Nazara, True Balance, and IdeaForge.

Interestingly, over 60% of total soonicorns founders, identified by Inc42, bear the prestigious IIT & IIM tags. On the diversity front, we observed a wide gap, as 93% of the aspiring unicorn founders are male.

Where Are India’s Future Unicorns Grazing?

According to the Inc42 report, the Indian fintech sector fosters the most number of soonicorns at 36, followed ecommerce at 19 startups. This trend is in line with the country’s unicorn landscape. To be sure, both sectors (fintech and ecommerce) today cradle a blessing of 24 unicorns each.

Moving on, IPO-bound B2B payments solutions provider PayMate takes the top spot on the valuation podium (at $930 Mn) among Indian soonicorns. The soonicorn managed to narrow its consolidated net loss by a marginal 3.5% year-on-year (YoY) to INR 55.7 Cr in the financial year 2022-23 (FY23).

Next in line is insurtech startup Turtlemint, which raised $120 Mn in 2022 at a valuation of $900 Mn.

Taking the third spot on the valuation podium is one of India’s oldest startups BookMyShow, which is currently valued at $800 Mn. The online ticketing platform reported a net profit of INR 85.1 Cr in FY23, with its revenue nearing the INR 1,000 Cr mark at INR 975.5 Cr.

Meanwhile, Indian soonicorns that are sitting with valuation in excess of $500 Mn are Refye ($750 Mn), Jupiter ($711 Mn) Clear ($700 Mn), IndMoney ($635 Mn), MoneyView ($625 Mn), Infibeam Avenue ($616 Mn), Bizongo ($600 Mn), Khatabook ($600 Mn), and M2P ($600 Mn).

Investors With The Most Soonicorn Count In Portfolio

A total of eight VCs hold the highest number of soonicorns in their portfolios.

These investors are Peak XV, Accel, Tiger Global, Elevation Capital, Innoven Capital, Matrix Partners, Blume Ventures, and Alteria Capital.

Peak XV, which has invested in Absolute Foods, Healthkart, and Nazara, recently launched a permanent capital vehicle or evergreen perpetual fund called Peak XV Anchor Fund to make smaller investments in emerging startups. It is also backing coworking space provider Awfis, which filed its IPO in December last year.

Similarly, Tiger Global, which is considered a unicorn maker, has its investments in soonicorns such as Inshorts, Scaler, and NinjaCart.

Further, having announced the first close of its new opportunity-cum-continuity fund, Fund 1Y, in June 2023, Blume Ventures has been investing in startups like Bambrew and SuperK over the past year. The VC currently backs three soonicorns Classplus, GreyOrange, and LambdaTest.

What’s Next For Soonicorns?

With Indian investors sitting on dry powder worth more than $18 Bn, Inc42 anticipates Indian startup funding to increase approximately 36% YoY in 2024.

Despite this, many soonicorn are finding it difficult to raise funds. This trend was reflected in the state of Indian startup funding in Q1 2024. Late stage funding fell 53% YoY to $0.9 Bn from $1.9 Bn in Q1 2023, growth stage funding fell 13% YOY to $659 Mn. This could be because many growth and late stage startups have yet to emerge in the black.

Cognisant of this, investors are selective in handing out cheques. On the contrary, the investor attention seems to be leaning towards AI startups.

While this trend has its perks, it could very well have an adverse impact on non AI-driven startups.

Speaking about increasing investor interest in the space, Bharat Innovation Fund’s cofounder and partner Ashwin Raguraman said that the buzz around GenAI has pitted AI startups at the forefront of investment plans.

“In India, we have had a SaaS wave before, the next wave we are seeing is of enterprise-led AI solutions providers who capitalise on the hype of AI as well as the increasing investor interest in deeptech,” he said.

While funding raised by Indian GenAI startups between 2019 and 2023 may not look very appealing at only $580 Mn+, it must be noted that the space is ticking with opportunities. According to Inc42, the Indian GenAI space is projected to grow exponentially in the next few years, surpassing $17 Bn by 2030 from $1.1 Bn in 2023.

Ad-lite browsing experience

Ad-lite browsing experience