Indian startups are lining up for overseas IPOs and SPACs may be the way for hassle-free listings

Dear Reader,

Sometime in May 2019, India’s renewable energy unicorn ReNew Power shelved its US IPO plans due to the uncertainties surrounding the country’s sustainable energy policy. Unable to land the IPO cash, the company was on the verge of exploring asset sales to raise funds. But what happened next was a piece of financial wizardry.

By February 2021, the Goldman Sachs-backed company was on its way to get publicly listed on the NASDAQ without the shenanigans of an IPO roadshow. The procedure was simple enough. ReNew Power announced plans to merge with New York-based RMG Acquisition Corporation II, a NASDAQ-listed special purpose acquisition company, or SPAC, to kick off the IPO process. Its merger with the SPAC (also known as a De-SPAC) marks the first major global listing of an Indian startup via a route that has become the latest craze of all US-bound IPO seekers.

There are other advantages. During the SPAC merger, the Indian company was valued at $4.4 Bn, a substantial jump from the $4 Bn valuation when it was looking for a traditional IPO. Industry experts say that such valuation would have been beyond the company’s reach in a direct listing.

So, what is a SPAC, and how does it help unlisted companies get U.S. listings? The SPAC route is often called a ‘backdoor’ listing process because the target company (ReNew, in this case) does not have to go through the hoopla of IPO roadshows. Instead, it quietly merges with a listed shell company that wants to invest in the target firm’s area of business. In this case, investing in cleantech is RMG II’s strategy, and the company is led by investors who clearly understand the cleantech policy issues that have crippled renewable energy companies.

As mega startups in India mature and enter the late-stage growth market, they need to list publicly to enable investors’ exits and raise more money for growing bigger and better. But given the many regulatory roadblocks (that is a deep and dark alley we will not explore in this piece) in India, they are looking to float IPOs in the US. And the IPO route that has caught their fancy is through SPACs.

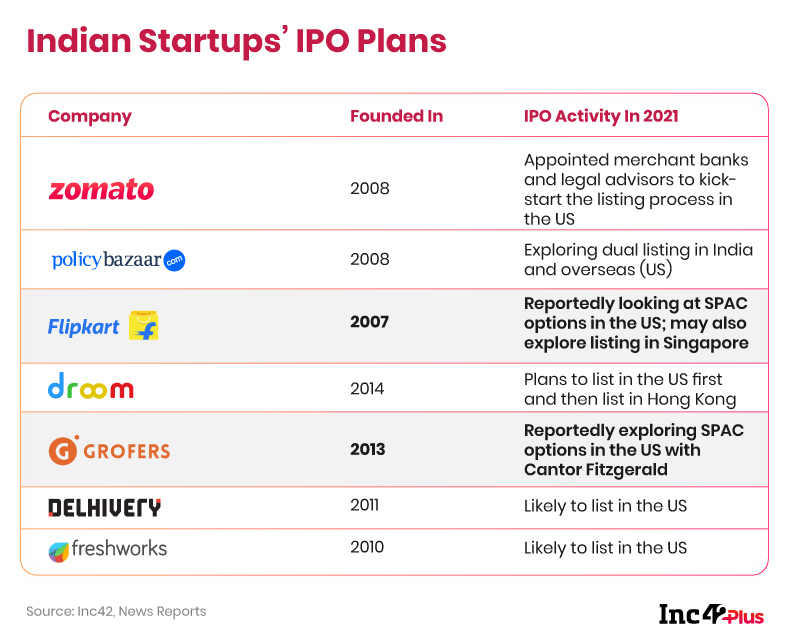

This is not unexpected as several tech startups from India, including Zomato, PolicyBazaar, Flipkart, Droom, Grofers, Delhivery and others, are planning for 2021 IPOs. Today, companies like Grofers and Flipkart are reportedly exploring SPACs, which have become extremely popular since 2020. Although some of the IPO-bound companies are looking at dual listings in India and the US, others are solely considering overseas listings, and SPACs can give their IPO dreams a big boost.

The regulatory scenario is also looking up at home. Last month, the Ministry of Corporate Affairs clarified that Indian companies that choose to list on overseas stock exchanges would not be considered listed companies at home. Hence, they need not comply with the stringent norms meant for listed companies.

Despite the latest craze, we have not heard of SPACs before 2020. Is it a moneymaker that has suddenly turned up in the financial market, maybe as a post-Covid wonder?

No way! SPACs have been around for decades, but the pandemic-driven economic downturn and uncertainties have rekindled people’s interest in stock markets and IPOs. After all, the markets have enabled investors to earn in spite of job losses and lockdowns. And target companies can also raise some much-needed funding via SPACs without waiting for six-eight months to comply with the regular IPO process. The US witnessed $83 Bn worth of collections by 248 SPACs in 2020 alone, and by January 2021, the country saw another $26 Bn. In contrast, only $13 Bn worth of collections were reported by 59 SPACs in 2019.

The Anatomy Of A SPAC IPO

If SPACs are here to stay, the next crucial question is: How does it work?

To start with, there is a ‘minimum disclosure’ advantage when a startup gets into the SPAC mode. In brief, a company needs to explain its logic of cash-burning (or other such issues) to just one SPAC sponsor who will go through the merger and set up the IPO, instead of disclosing its financials for public scrutiny as it happens in traditional IPOs. Post-merger, the sponsor (an investor or a group of investors with domain knowledge or interest) will publicly list the SPAC/merged entity. As mentioned before, a SPAC is a shell company without any active business operations, and hence, there will be no post-merger operational complications.

For investors buying SPAC shares, things may seem dicey as the final target company is not remotely in the picture when they put their money. In fact, investments are made based on the investment thesis and the sponsor’s image and credibility in the industry. Think of it as investors trusting an industry veteran’s research and judgement about a company’s growth potential. The basic idea, in the form of an investment trust, existed in Europe since the early 19th century and later found its way in the US.

SPACs raise their initial IPO capital by selling a share and a warrant at $10. This warrant gives the shareholder the right to purchase an extra share (or a fraction of a share) at a fixed price of $11.50, 30 days after the SPAC merger. Occasionally, SPACs may include a right to 1/10th of a share (at no cost), redeemable when the SPAC finally makes an acquisition/merger.

Collections for a SPAC IPO are placed into a trust and invested in treasury bills (T-Bills) for about two years, during which the SPAC must find a target company. If it cannot find a company within this period, investors get their money back with an average annual return of 9.3%. Once the target company is identified, the proposed merger must be approved by the SPAC shareholders. This step can often make or break the deal in a process that is not too different from investor roadshows, although it involves a shorter turnaround time.

If investors do not approve, they can redeem their shares, draining the cash from the SPAC’s collection. Besides, the SPAC needs to find other investors to replace them. There is another catch. When shareholders redeem their investments, they can still hold the rights to additional shares, resulting in dilution.

In between a SPAC IPO and the merger (or a SPAC liquidation, if no deal happens), the average return for SPAC investors (at the pre-merger level) has been 9.3% a year since 2010, states a Goldman Sachs report published in January 2021. But among the de-SPACs (mergers with target companies) completed in 2020, the post-acquisition median one-month, three-month and six-month excess returns relative to the S&P 500 index were -13 percentage points (pp), -6 pp and -27 pp, respectively.

Are We Looking At A SPAC Bubble?

Of course, most of the SPAC hype is led by one person — Chamath Palihapitiya. He has plans to launch multiple SPACs (dedicated to different investment goals and sectors), with ticker names ranging from IPOA to IPOZ (pre-merger listing tickers to be changed when target companies are finalised) and has already launched six. Three of these have found acquisition targets.

Depending on how a SPAC is structured, a sponsor’s equity may consist of common shares and warrants and up to 20% founder shares of the listed SPAC. The sponsor capital provided during the pre-IPO phase is 7-7.5% of the planned proceeds from the IPO, depending on its size, and therefore, anywhere above $5 Mn generally, say experts. Sponsors are usually well-known investors, PE or VC firms, but they need not fulfil specific eligibility criteria. In fact, one would find celebrity sponsors like musician Ciara Wilson, baseball star Alex Rodriguez and basketball player Shaquille O’Neal almost everywhere, which forced the US Securities and Exchange Commission to warn SPAC investors to tread carefully.

In an interview, Lloyd Blankfein, the former CEO of Goldman Sachs, also called out the current popularity of SPACs and asked investors to proceed with caution. “When the initial SPAC goes public, you are scrutinizing a shell company, possibly the reputation of the sponsor. When that company de-SPACs and merges, it’s a merger, it’s not an IPO that carries with it a lot of diligence obligations,” he said.

Understandably, the journey cannot be as smooth as one assumes. As only a few disclosures about target companies are needed before SPAC mergers, post-merger investor discontent can trigger litigation if investors feel that the target company is not up to the mark. It reminds one of Nikola, the electric truck-maker that was listed last year via the SPAC, VectoIQ Acquisition Corp, and then landed in the legal soup when investors called it out for “falsifying” disclosures about its customer base and technology.

All That Glitters Is Not Gold

“One should keep in mind that if a company is not operationally ready to list on its own, a SPAC will not make it any easier,” says Pankaj Naik, executive director and co-head of digital and technology vertical at Avendus Capital, an investment bank.

For Indian companies, it is difficult to go through a SPAC merger because the resultant overseas entity must issue shares to Indian investors, which will involve RBI clearances and taxation issues. A direct listing is already difficult, and the SPAC IPO is even more complicated. However, US listings enamour Indian startups because they believe that the investor ecosystem in that country understands tech companies’ growth trajectory better, he adds.

“For companies incorporated outside India, it is easier to go through the process. In the past, we have seen some companies that did not demonstrate a great trading performance after SPAC mergers and did not see great demand on secondary offerings,” says Naik.

Note that in 2016, Gurugram based online travel platform Yatra.com took the SPAC route to list in the US. The company merged with the US-based Terrapin 3 Acquisition Corp (TRTL) for a deal valued at $218 Mn. A year earlier, the direct-to-home broadcast service provider Videocon D2H took a similar SPAC route. Without getting into details, let us say that the investors were not over the moon with the returns.

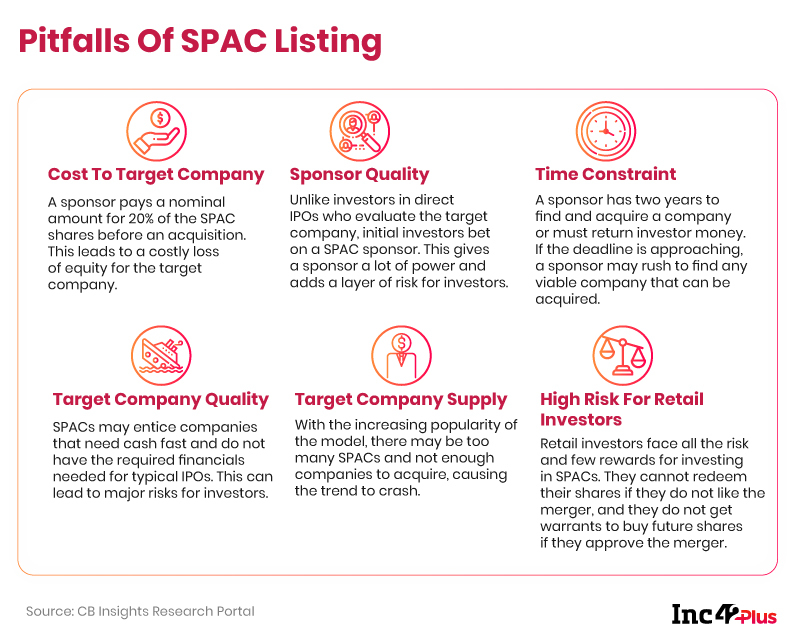

A recent report on the popularity of SPACs by academics Michael Klausner, Michael Ohlrogge and Emily Ruan also calculated its total cost. And the outcome is disheartening. They estimate that for every dollar of cash delivered to the target company when a SPAC merger happens, nearly 50% is lost in transactions.

The real value of $10 shares soon drops due to dilution when the merger takes place. For all shareholders, dilution arises from paying the sponsor’s fee in 20% shares. Moreover, nearly all pre-merger shareholders exit at the time of the merger, either by redeeming their shares or by selling them to retail investors. These secondary investors who buy later and hold shares throughout SPAC mergers bear the cost of the generous deal given to the initial IPO-stage investors.

After a SPAC merger, the merged company’s shares are distributed among the SPAC sponsors, SPAC shareholders, original owners of the acquired company and a group of large private investors known as PIPE (private investment in public equity) who may have taken the risk of buying extra shares in the SPAC company in exchange for additional side deals.

Tapping Into The Gold Rush

Whatever be the pitfalls, the reality, at least for now, is that cash-hungry and late-stage Asian startups are finding a soft landing in the US through SPACs. As an industry insider who does not wish to be named puts it, “Fantastic startups are mushrooming across South-east Asia and the Indian subcontinent, and global investors are keen to participate in their journey. But they are concerned about the regulatory hurdles, which is why successful marketers (read sponsors) are taking the startups to them via SPACs.”

The S&P Global Market Intelligence data shows that the Asia-Pacific-headquartered SPACs raised $2.4 Bn in 2020, a significant increase from $613 Mn in 2019. That number is on an upward trend in 2021. As of Jan 31, eight SPACs had already raised $1.71 Bn. The US-based SPACs focussed on India include Trans-India Acquisition and Phoenix India Acquisition.

According to experts tracking the space, Indian companies/startups most suited for SPACs are those in the SaaS space as Indian SaaS startups have repeatedly demonstrated good unit economics and growth potential.

Now that we know how attractive homegrown companies are to global investors, what are the ingredients required for a successful SPAC recipe?

It is the same as listing directly, say experts. First, one needs to demonstrate how the target startup syncs with the SPAC’s investment sentiment even when it does not make a lot of sense to the stakeholders.

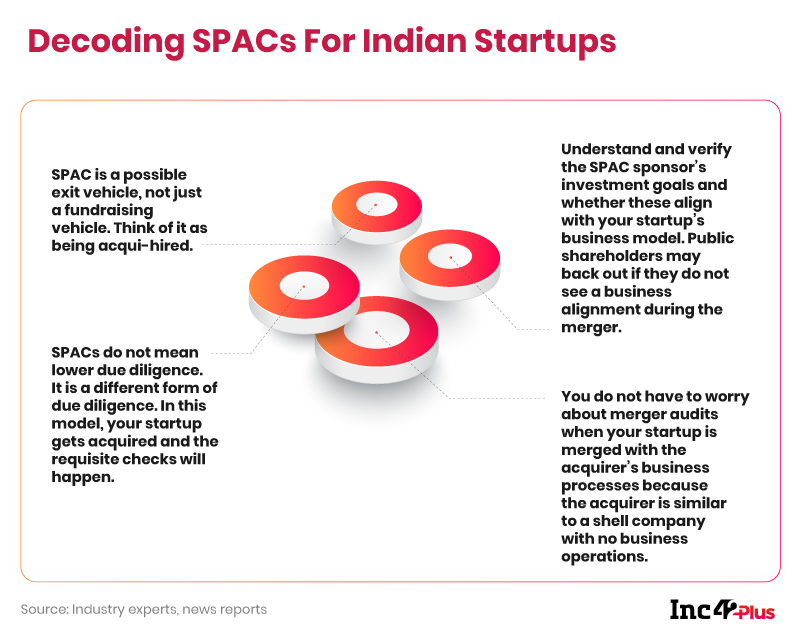

“SPACs sell a very specific business plan to raise money. So, you have to pitch your business offering to the right SPAC. Understand their requirements and if those fit with your model,” says Siddarth Pai, founding partner at 3one4 Capital and co-chair of the Regulatory Affairs Committee at the IVCA.

But SPACs do not traditionally seek out startups for their lead acquisition, maybe tuck-in acquisitions (add-on acquisition made to meet specific business needs), he adds. So, companies have to understand how they want to pitch. According to Pai, the process will not be very different from an acquihire, and startups may lose some operational control in the process. It is a possible exit route for startups. So, they should not expect fewer due diligence from the sponsors, he cautions.

Although a SPAC IPO may look simple, Indian companies have to plan and execute things carefully, keeping in mind the pros and cons of listing abroad, especially when one has to pay huge taxes to transfer the business entity, says Suraj Malik, partner, transaction tax, BDO India, a global tax advisory firm.

For an India-incorporated company, the SPAC has to acquire all the shares of its Indian investors through a swap process, which is not easy due to India’s exchange control regulations, especially for the founders and Indian domiciled investors. Of course, the Indian entity can merge into the US-based SPAC, for which the RBI and corporate law mechanisms exist. “But it entails a significant tax burden to take any business value (shares/IP) out of India even when a startup merges with a SPAC and moves overseas,” says Malik. One should also remember that there will be significant legal and compliance costs involved in the process, even without IPO roadshows.

In spite of these hurdles, there is one benefit of listing abroad, either via SPAC or through direct IPO. In India, startup founders may increasingly see their holding get diluted through multiple rounds of funding. But in Western markets, there is a provision for a separate class of shares with special rights. Note that Indian regulations have been amended to give differential voting rights in 2019, but businesses are yet to decipher the fine print. The option to list abroad gives founders some control despite dilution, adds Malik.

The global hype around SPACs may give startup founders something to look forward to, even as the Indian capital market regulator SEBI is now reportedly examining regulations for SPACs. But as we have discussed throughout, SPAC is a complicated process and it always helps if you review things thoroughly before signing on the dotted line. More importantly, one needs to question if a cash-guzzling, loss-making startup really needs a quick listing. Shouldn’t it wait a bit to fix its business model before announcing that the world is its oyster? After all, growth and profitability (and good returns to stakeholders) must go hand in hand if companies want to stay ahead in the race for the longer term.

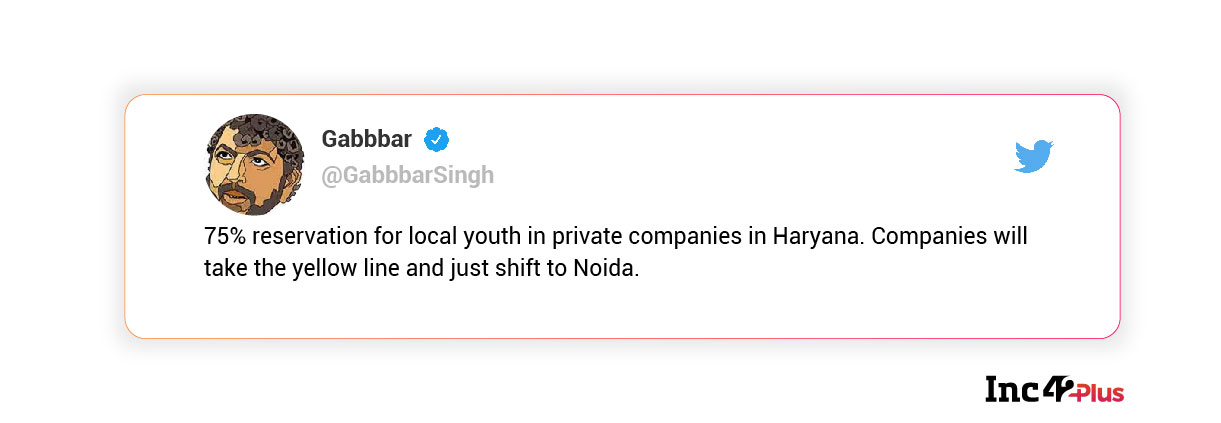

Policymakers Take The Wrong Turn

Whether we like it or not, government policies may compel startups to take their offices elsewhere from the state of Haryana and its buzzing startup hubs. The Haryana government’s decision to mandate 75% reservation for local people in private jobs (with a monthly salary ceiling up to INR 50,000) has not gone down well with the startup and investor community. Of course, nobody is averse to local hiring, but the latest regulation may affect meritocracy, say companies, many of whom took to social media to express their concerns.

Putting The Focus Back On Products

As more and more Indian startups reach the much-coveted unicorn status (currently, there are 45), there will be a rush for tech IPOs. In such golden times, the startup ecosystem cannot possibly take its eyes off the ball. What truly matters now is that the country’s tech companies are aggressively focussing on building great products. Valuations and public listings are just notional landmarks.

After the successful Day 1, The Makers Summit 2021 is ready for the Day 2 with a stellar lineup! If you haven’t logged in yet, you are missing out on actionable insights from the best product minds of India across 40+ carefully crafted sessions and 100+ speakers.

While the jury is still out on SPAC IPOs being the fastest and the most effective route to a public listing in the US, building great products makes good sense for every company and you are bound to benefit. If we could rephrase Aamir Khan’s dialogue in 3 Idiots, we would definitely say: Products ke peeche bhago, valuation jhak marke tumhare peeche aaegi!

Until next time,

Romita

![[The Outline By Inc42 Plus] Indian Startups' SPAC-tacular Dreams](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2021/03/Outline_56-Feature.jpg)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Indian Startups’ SPAC-tacular Dreams-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience