Banks are actively adopting new-age technologies for better growth prospects and to serve new-age customers

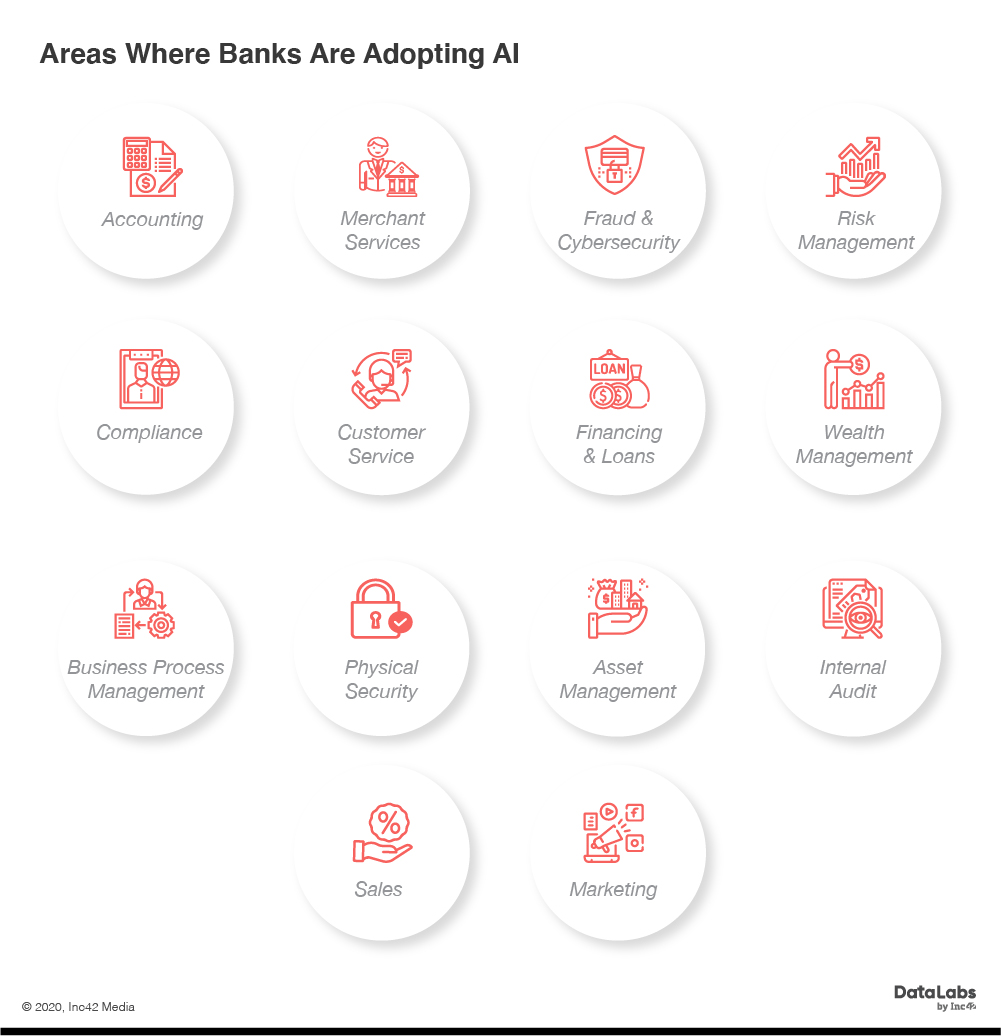

From accounting to sales to contracts and cybersecurity, AI is helping banks transform operations across the board

With data analytics, blockchain and machine learning, banks are future-proofing their offerings and services

“AI is probably the most important thing humanity has ever worked on.” – Google CEO Sundar Pichai

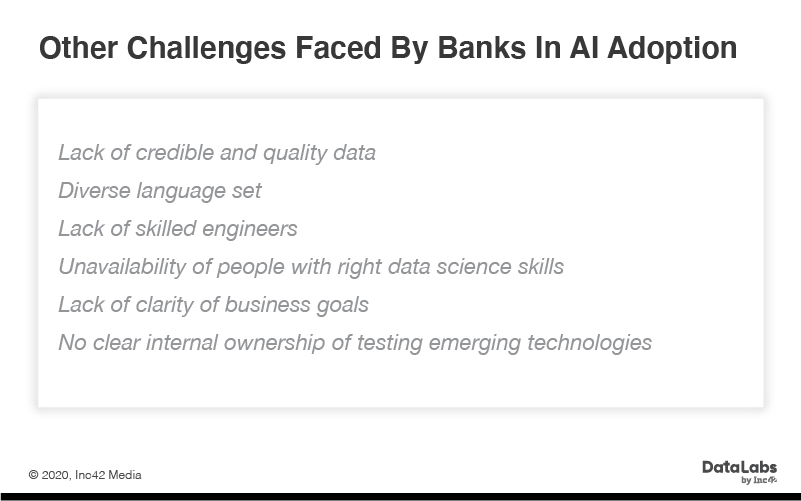

This statement from Google CEO has become quite relevant in the Indian banking industry, especially after demonetisation. With an average Indian consumer getting at ease with online banking, making internal operations efficient and the customer experience more effective has certainly become a challenge. Poor data quality and customer segmentation are one among the many challenges banks face today.

Further, with the rise of technology-oriented payments banks like Airtel Payments Bank, Paytm Payments Bank, etc; entry of neo banks and neo banking platforms, as well as rise of NBFCs, has also made it impossible for banks to survive with the traditional mode on.

AI In Banking: Definition And Use-Cases

As they say, ‘necessity is the mother of invention’, banks are now finding solace in new-age technologies such as artificial intelligence (AI), blockchain and more. Since 2016, many traditional banks have collaborated with fintech startups or devised solutions in-house to offer modernised banking solution to their customers.

The term “artificial intelligence” was first used in the mid-1950s. Although many definitions are present, in the context of banking, Accenture defines AI as,

“A computer system that can sense, comprehend, act and learn. In other words, a system that can perceive the world around it, analyse and understand the information it receives, take actions based on that understanding, and improve its performance by learning from what happened. And by enabling machines to interact more naturally – with their environment, with people and with data – the technology can extend the capabilities of both humans and machines far beyond what each can do on their own.”

There are multiple reasons for the increased adoption of AI in the banking sector. This includes:

- The immense competition in the banking sector

- Push for process-driven services

- Introduce self-service at banks

- Demand from customers to provide more customised solutions

- Creating operational efficiencies

- Increasing employee productivity

- To help focus on profitability and compliance

- A vision to augment human work through the use of software robotics

- To reduce fraud and security risks

- To manage huge volumes of data at record speed and derive valuable insights

- To bring in effective decision making

Which Indian Banks Are Using AI?

About 32% of financial service providers are already using AI technologies like predictive analytics, voice recognition among others, according to joint research conducted by the National Business Research Institute and Narrative Science. Of many Indian banks, there are 12 banks which have gained continuous media attention for their AI initiatives over the last few years. The list includes:

- SBI

- Bank of Baroda (BoB)

- Allahabad Bank

- Andhra Bank

- YES Bank

- HDFC

- ICICI

- Axis

- Canara Bank:

- City Union Bank

- Punjab National Bank

- IndusInd Bank

State Bank Of India (SBI): SBI is currently using an AI-based solution developed by Chapdex, the winning team from its first national hackathon, “Code for bank”. On the front desk, it uses SIA chatbot, an AI-powered chat assistant developed by Payjo, a startup based in Silicon Valley and Bengaluru. It addresses customer enquiries instantly and helps them with everyday banking tasks just like a bank representative.

Bank of Baroda: BoB has set up of hi-tech digital branch equipped with advanced gadgets like artificial intelligence robot named Baroda Brainy and Digital Lab with free Wi-Fi services.

Allahabad Bank: In a media statement earlier, the Allahabad bank said that its app ’emPower’ is scheduled to get major enhancements like Chatbot and artificial intelligence-based ecommerce payments.

Andhra Bank: Bengaluru-based AI startup, Floatbot has launched AI Chatbot integrated with Core Banking Servers of Andhra Bank, to digitally engage and automate customer support for its 5 Cr customers. Floatbot will also develop a chatbot for 20K+ internal employees of Andhra Bank to automate onboarding and training.

YES Bank: It has partnered with Gupshup, a bot platform, to launch ‘YES mPower’ – a banking chatbot for its loan product. Another AI product YES ROBOT is equipped to answer consumer’s banking related queries anytime, anywhere, without the hassle of waiting for on-call or searching online. Also, YES BANK was the 1st Bank in India to introduce chatbot based banking with the launch of YES TAG in April 2016 which allows customers to perform banking transactions on various social messengers.

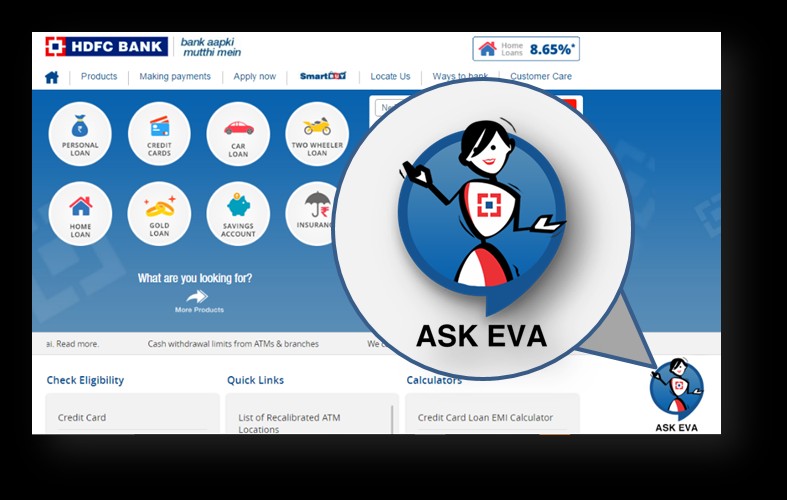

HDFC Bank: It has developed an AI-based chatbot, “Eva”, built by Bengaluru-based Senseforth AI Research. Eva can assimilate knowledge from thousands of sources and provide simple answers in less than 0.4 seconds. Going forward, Eva would be able to handle real banking transactions as well. HDFC is also experimenting with in-store robotic applications and launched a prototype robot IRA (“Intelligent Robotic Assistant”).

ICICI Bank: It has deployed software robotics in 200+ business processes across various functions of the company, created mostly in-house using AI features such as facial and voice recognition, natural language processing, machine learning and bots among others. The software robots at ICICI Bank are configured to capture and interpret information from systems, recognize patterns and run business processes across multiple applications to execute activities. One such product is its AI-based chatbot, named iPal, which helps in answering queries, helping in financial transactions and discovering new features.

Axis Bank: It launched an AI-enabled app that uses natural language processing to enable conversational banking that helps consumers with financial and non-financial transactions, queries and product information.

Canara Bank: It launched Mitra, a humanoid robot developed by Bengaluru-based Invento Robotics which helps customers navigate the bank. Another one Candi, which is slightly smaller than Mitra is supplementing the human resource.

Image credit: DQIndia

Punjab National Bank: In 2018, the bank announced its plan to implement AI in account reconciliation as well as using analytics to improve its audit systems. The move came in after the infamous debilitating fraud of approximately INR 20K Cr, carried out by the pair of Nirav Modi and Mehul Choksi in February 2018, which almost paralysed the bank’s operation for a short time.

IndusInd Bank: It has launched Alexa Skill, ‘IndusAssist’, using which bank account holders can conduct financial and non-financial banking transactions with Alexa, Amazon’s virtual assistant.

City Union Bank: It launched the banking robot, Lakshmi. The robot can interact with customers on more than 125 subjects. Apart from answering generic questions, the robot is also programmed to connect with the core banking solution.

Image Credit: Indiatimes

What Are The Regulatory Challenges Faced In Implementing Technologies Like AI?

Justice Srikrishna Committee has opined that the biggest challenge in regulating emerging technologies such as AI lies in the fact that they may operate outside the framework of traditional privacy principles.

As Supratim Chakraborty, associate partner, Khaitan & Co, said in a recent media statement, the RBI will have to play a proactive and more dynamic role in framing regulations to balance the business interest of banks and at the same time ensure customer privacy and information protection.

Also, with India yet to finalise its data protection and data privacy policy, the banks in India will have to build AI systems with GDPR and similar privacy regulations in mind.

What Does The Future Hold For AI In The Indian Banking Sector?

According to Deloitte, AI will provide the foundation for increased product and service innovation. Further, artificial intelligence has the potential to transform customer experiences and establish entirely new business models in banking. To achieve the highest level of results, there needs to be a collaboration between humans and machines that will require training and a reassessment of the future of work in banking. Also, mass customisation is the key to unlocking significant opportunities in the future and can be tapped only through technologies like AI and blockchain.

The need of the hour is to help the underserved populace experience mainstream banking with technology. The banks are harnessing the power of AI to deliver new customer experiences with various solutions and are setting new standards for the Indian banking ecosystem, thereby charting a new wave by embracing tech intensity.

Ad-lite browsing experience

Ad-lite browsing experience