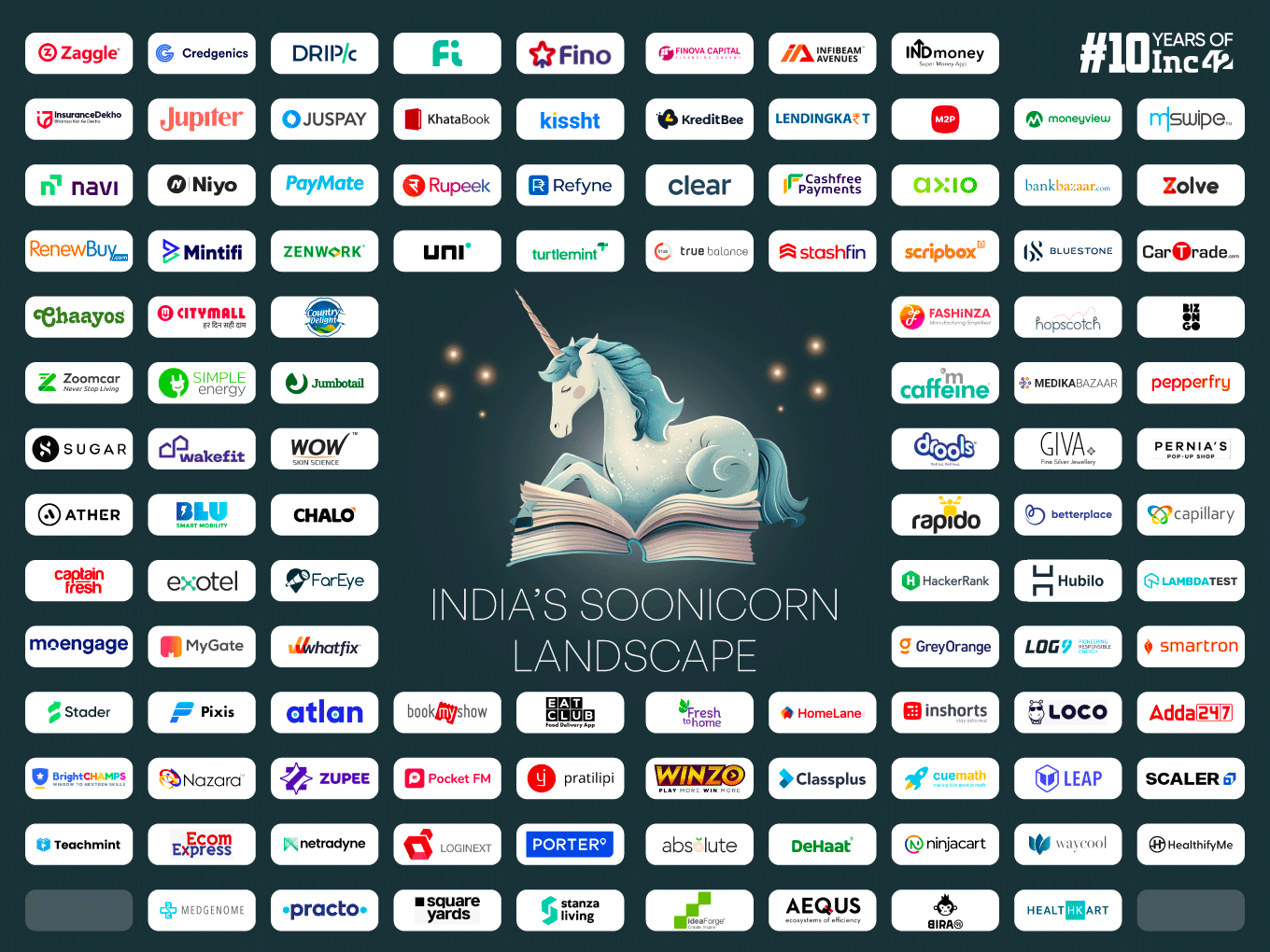

As many as 112 Indian startups (soonicorns, to be precise) with valuations ranging between $200 Mn and under-$1 Bn,are on their way to enter the unicorn club

Ather had the highest share of losses in FY23 among the soonicorns at $108.1 Mn, followed by Rapido and Bira91

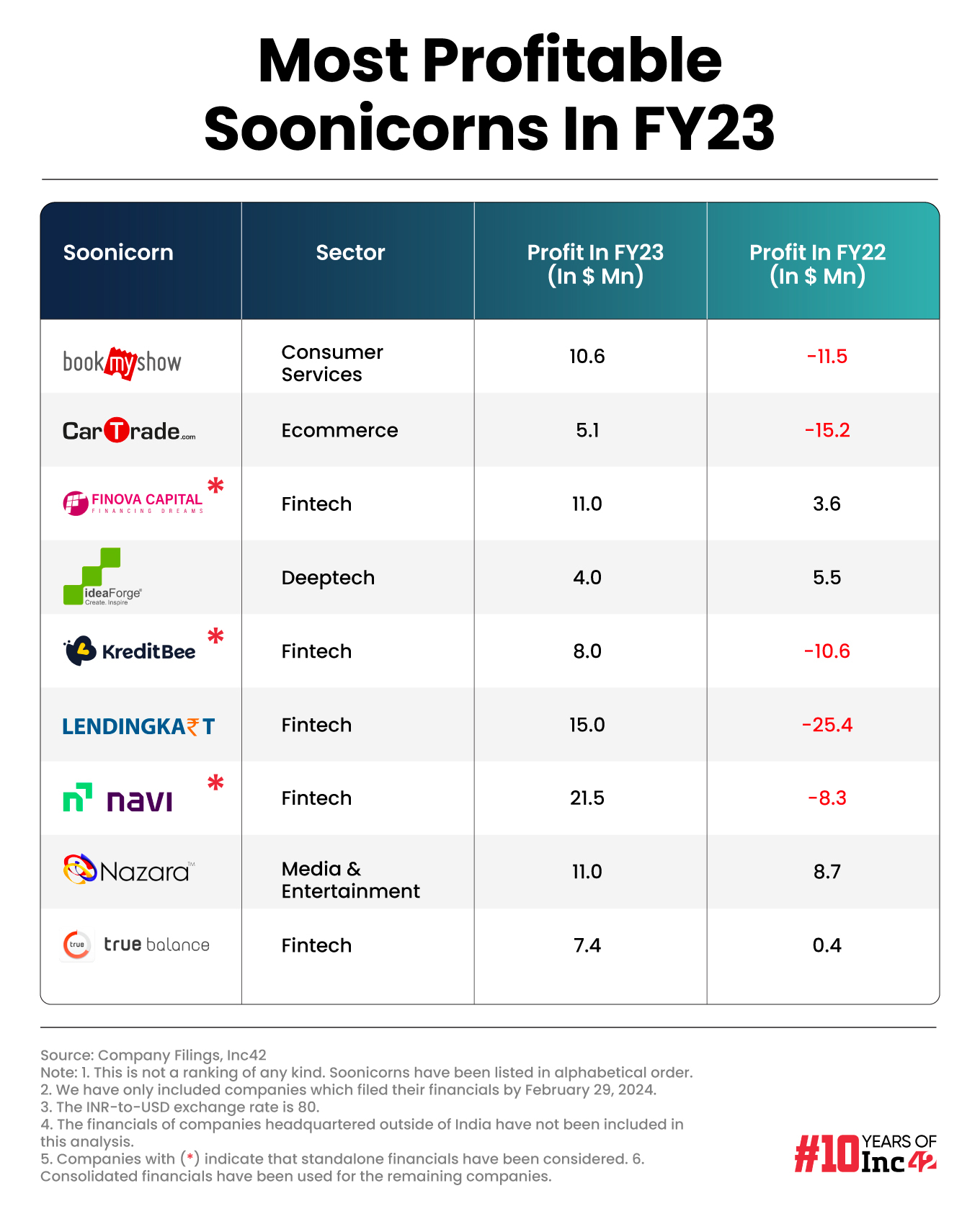

Those who turned a profit included BookMyShow, CarTrade, Finova Capital, KreditBee, Lendingkart, Loco, Navi Technologies, Nazara Technologies, True Balance and IdeaForge

The first quarter of the current calendar year (January-March 2024) started with a shout-out to the newly minted Indian unicorns – Krutrim and Perfios. Last year, economic headwinds, geopolitical unrest and a harsh funding winter made it look like the age of the unicorns (startups valued at $1 Bn or more) might be over soon. But they seem to be out and about once again, and market sentiment has improved amid hype over emerging sectors like generative AI (genAI) and growing investor confidence.

This indicates a venture funding rebound, with the VC community sitting on more than $60 Bn of dry powder, ready to be poured into the startup ecosystem.

The country’s macroeconomic environment has also stabilised and India is expected to register better-than-expected GDP growth in FY25 (ending in March 2025). According to the interim Union Budget 2024-25, India’s real GDP is projected to grow at 7.3%, in sync with the revised upward projections by the RBI from 6.5% to 7%, prompted by strong growth in Q2 (July-September) and a bump in Q3 GDP growth at 8.4%.

As economic growth accelerates and startups continue to focus on profitability and sustainable development instead of indiscriminate cash burning and blitzscaling, Inc42 foresees Indian startup funding to surge by 36% or so year over year in 2024. Consequently, the country’s much-coveted billion-dollar club is all set to welcome more than 100 future unicorns to its fold.

According to an Inc42 analysis titled Unicorns Of Tomorrow – Decoding India’s Soonicorn Landscape Report, 2024, as many as 112 Indian startups (soonicorns, to be precise) are on their way to enter the unicorn club. With valuations ranging between $200 Mn and under-$1 Bn, these companies have a combined valuation of more than $40 Bn and secured $15 Bn+ in funding by March 2024.

However, out of the 112 soonicorns, only 47 made their FY23 annual reports public and barring nine, the rest 38 were in the red. Those who turned a profit included BookMyShow, CarTrade, Finova Capital, KreditBee, Lendingkart, Navi Technologies, Nazara Technologies, True Balance and IdeaForge.

Overall, these 47 soonicorns made a combined operating revenue of $3 Bn+ in FY23. While the combined profits of the nine soonicorns stood at $93.6 Mn+, the remaining soonicorns (38) had a combined loss of $1 Bn+ in FY23.

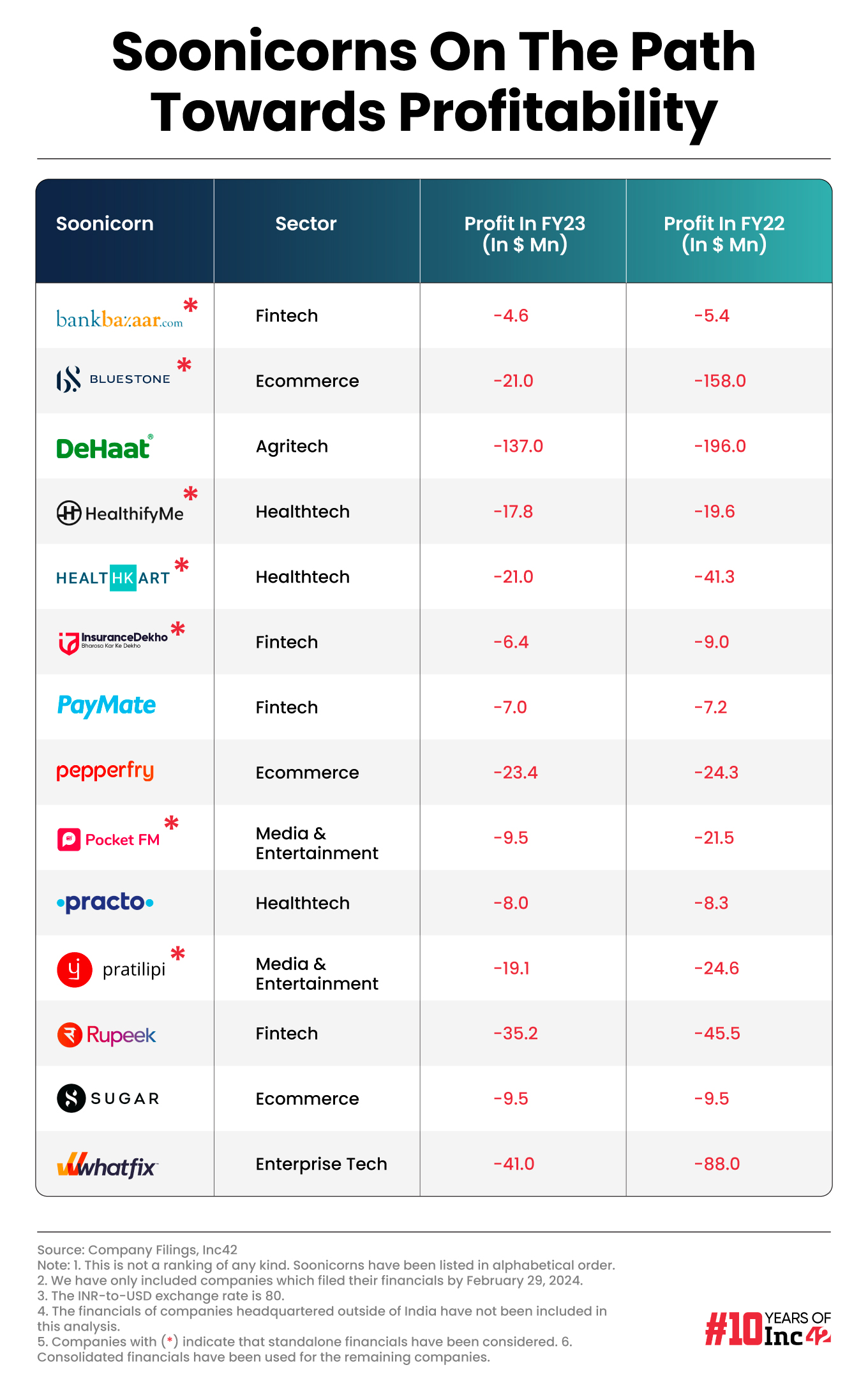

A further slicing of the numbers shows 13 soonicorns managed to pare their losses compared to the previous financial year. Although SUGAR Cosmetics’ losses remained unchanged for both years, Whatfix, Pocket FM, HealthKart and BlueStone reduced their losses by 50% or more in FY23.

Soonicorns That Incurred Maximum Losses In FY23

Out of 38 loss-making soonicorns, as many as 24 or 63% reported an increase in losses in FY23 compared to FY22. Among these, Bengaluru-based EV manufacturer Ather Energy posted $108.1 Mn in losses, a 151% jump from $43 Mn in FY22. Its losses soared despite its operating revenue growing 4.3x to $223 Mn from $51.1 Mn in the previous fiscal.

Fintech soonicorn Cashfree Payments saw the biggest percentage jump in YoY losses at 4,341.5%, followed by Hubilo (174.7%), Bizongo (170.7%) and Ather (151.3%). Cashfree’s net loss widened 42x to $16.6 Mn in FY23 from $0.4 Mn in the previous year, although its operating revenue increased 75.4%, or 1.7x, to $76.7 Mn from $43.7 Mn in FY22. GIVA, Jumbotail and Jupiter also saw their losses more than double in FY23.

On the other hand, Ather had the highest share of losses in FY23 among the soonicorns at $108.1 Mn, followed by Rapido ($84.3 Mn) and Bira91 ($55.7 Mn).

On a positive note, a few soonicorns saw a less than 10% rise in their losses in FY23 compared to the year before.

These included:

- INDmoney: $9.2 Mn loss in FY23 against $8.7 Mn in FY22, a 5.7% increase

- Aequs: $14 Mn loss in FY23 against $12.8 Mn in FY22, a 9.4% rise

- Clear (earlier ClearTax): $29.2 Mn loss in FY23 against $27.8 Mn in FY22, a 4.9% hike

- Ninjacart: $40.8 Mn loss in FY23 against $38.5 Mn loss in FY22, a 6% rise

Why Profitability Eludes Most Indian Soonicorns

Most soonicorns are growth-stage startups, with Series A to Series C funding in their kitty and their valuations typically in the range of $200 Mn to under $1 Bn. They have already achieved product-market fits, but most are trying to scale their revenue above $100 Mn.

Unlike the seed stage, where teams are small and resources are limited, the growth stage requires significant scaling up. Such growth drives call for substantial investments in the team and leadership, product/service enhancement, and sales and marketing without losing track of critical growth metrics like customer lifetime value (CLTV), customer acquisition cost (CAC) and operational efficiency.

As soonicorns constantly look for new markets to drive growth, much of their revenues and/or growth capital is spent on growing the team and marketing products/services.

In FY23, Hubilo spent $14 Mn, of which 83.4%, or $11.7 Mn, went to employee benefits. Clear (formerly ClearTax) spent $43 Mn in FY23, of which $31.4 Mn, or 73%, accounted for employee benefits. On the other hand, mCaffeine spent 42%, or $16 Mn, on marketing in FY23 out of a $38 Mn expenditure.

Download The ReportAs expenditure (and, at times, losses) tend to rise to ensure revenue growth and business expansion, VCs do not shy away from investing in loss-making soonicorns, pushing them closer to billion-dollar valuations.

IPO Or Equity Funding: Where Are The Soonicorns Headed?

Industry analysts believe unicorns are losing steam, with key players piling up huge cumulative losses on dwindling revenues. Given the spotlight and the intense scrutiny the ‘unicorn’ status triggers, soonicorns are gradually moving away from the valuation milestone to keep the hype down and focus on other growth essentials.

For example, B2B marketplace Bizongo raised $50 Mn at a valuation of $980 Mn, while insurtech platform Turtlemint was valued at around $950 Mn during its $120 Mn Series E round. Pushing for billion-dollar valuations might not have been too difficult for these startups, but it’s no surprise that they refrained from doing so.

Moreover, sectors like agritech and deeptech comprising spacetech, dronetech, IoT/Hardware among others have yet to witness the much-hyped valuation game. Interestingly, we find many profitable and fast-growing startups in these sectors but not a single unicorn. Which may well indicate that these startups will no longer focus on venture funding or valuations but will straightaway dive into the IPO market for the next level of growth.

Talking to Inc42 off the record during a previous interaction, an investor also emphasised that growth stage companies past initial rounds would not necessarily require VC funding. “At the growth stage, companies can secure another round to stabilise revenues, strengthen fundamentals and even opt for an IPO at a valuation as low as INR 250 Cr ($30 Mn),” he said.

Will that be an upcoming trend across the dynamic VC landscape after a thaw in the funding freeze? Will storied VCs be in trouble after top-level exits and business makeovers at local and global levels, especially as they sit on dry powder and may be under considerable pressure from limited parts for fund deployment?

It may not be as easy as it sounds. The upcoming general elections may impact stock returns and investor sentiment, although 55% of the investors said 2024 would be a good year for IPOs, per an Inc42 survey.

With markets getting corrected, valuations under control and a massive amount of dry powder ready to be deployed, funding channels will be wide open for Indian soonicorns, and there may be choices galore. It is worth watching which route they take to spearhead sustainable growth.

[Edited by Sanghamitra Mandal]

Download The ReportUpdate: The article earlier mentioned Loco as a profitable soonicorn. It is now corrected and removed from the infographic “Most Profitable Soonicorns In FY23”.

Ad-lite browsing experience

Ad-lite browsing experience