SUMMARY

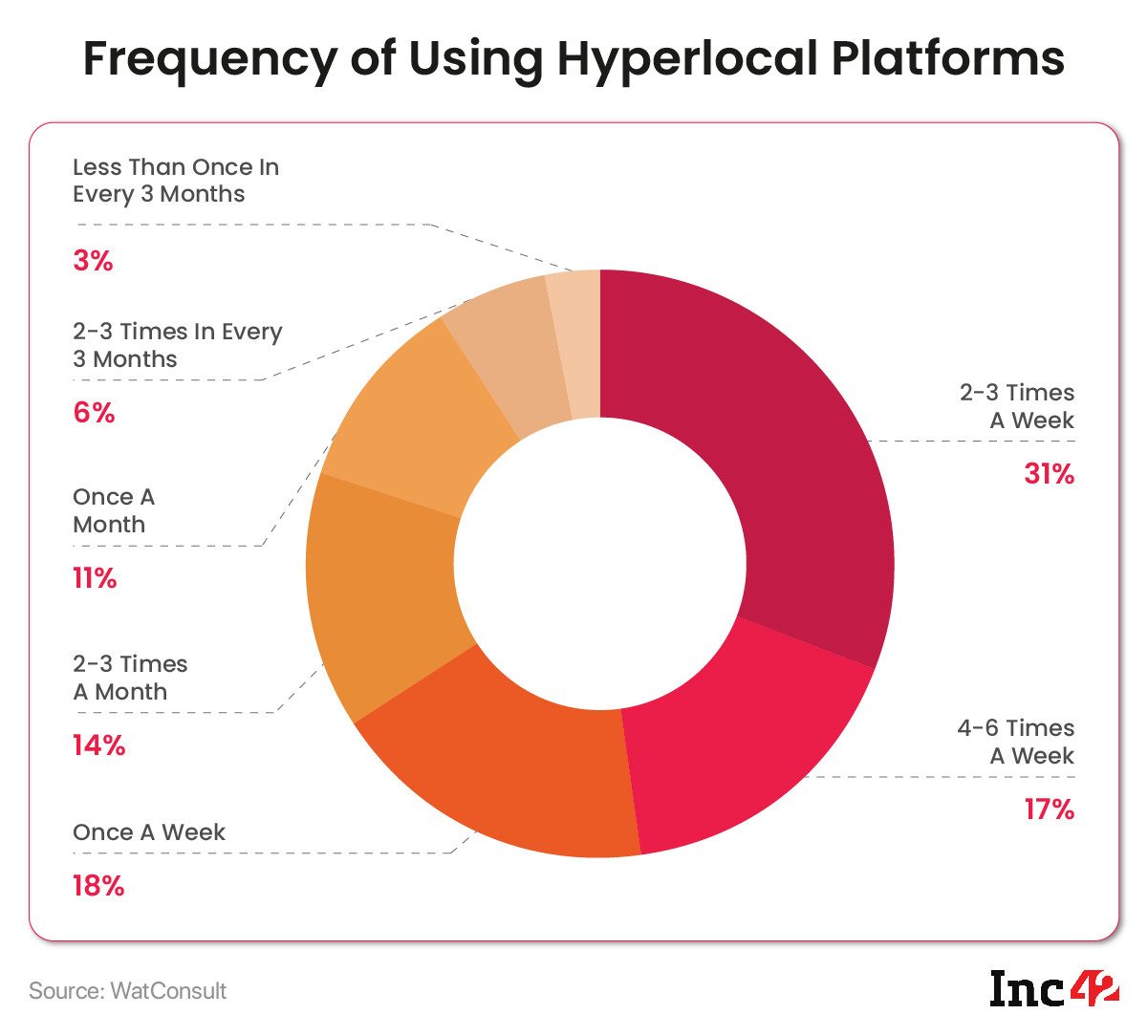

India will have 214 Mn hyperlocal ecommerce shoppers by the end of 2022, up by 52% from 141 Mn shoppers in May this year

Despite the positive projections, hyperlocal comes with its set of growth threats, such as customer acquisition and retention issues

Customer communication and martech solution provider Karix enables both B2B and B2C hyperlocal brands counter these challenges and bolster engagement via multichannel engagement strategies

As new-age businesses gradually shift from sales-based transactional models to experience-driven commerce, consumers crave greater convenience and personalised experience, with no compromise on product quality and options. According to Deloitte’s Global State of Consumer Tracker, 73% of consumers are ready to spend more on convenience.

However, millennials and Gen Zers, currently the most powerful consumer groups worldwide, now look beyond mere digital convenience or digital experience platforms. Their demand for around-the-clock services has led to disruptive business models like quick commerce, where deliveries happen within minutes.

On-demand service providers have influenced people’s consumption habits for nearly a decade.

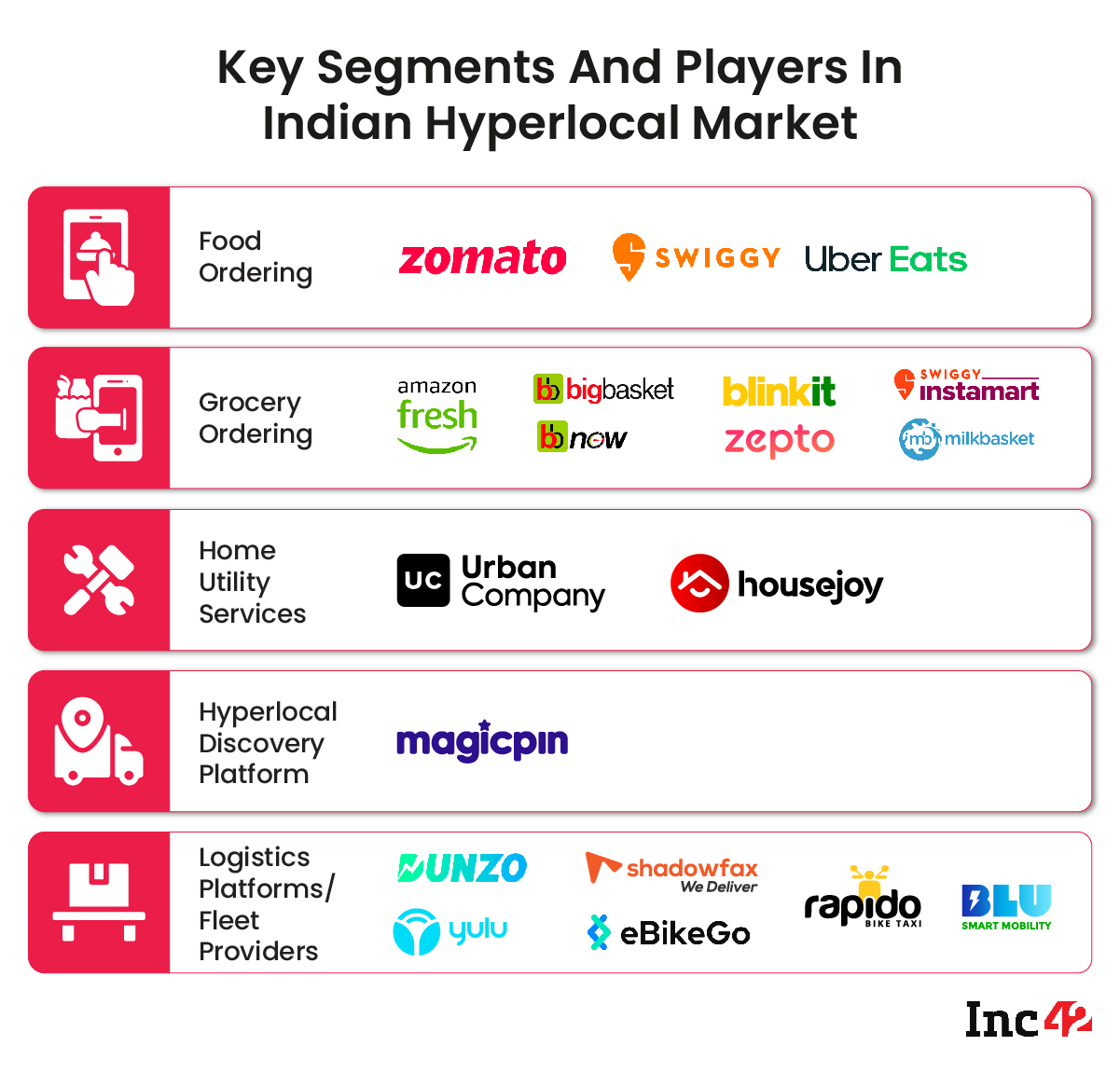

Consider the likes of Housejoy, Urban Company (previously, UrbanClap) or magicpin (backed by Zomato in 2021). While the first two have provided a wide range of at-home utility and personal care services since 2014, the other is a location-based product discovery platform set up in 2015 to help users explore nearby offerings.

The platforms mentioned here have a couple of things in common.

First, their services have robust backend tech support for multipoint operational capabilities and transparency. Second, they help connect local retailers/goods and services providers with consumers in nearby areas. In simple terms, they are the early adopters of pure-play hyperlocal setups or current poster boys like Blinkit (previously, Grofers) and Zepto.

Given our busy lifestyles, need-based ordering rather than buying in bulk and the rising preference for fast deliveries, the hyperlocal model is now permeating across sectors.

Businesses, too, tend to gain more as delivery convenience has become the game changer. Consider this. India is expected to have over 214 Mn hyperlocal ecommerce shoppers by 2022, up by 52% from 141 Mn in May this year.

What’s Hindering Hyperlocal Growth?

What’s Hindering Hyperlocal Growth?

Despite the positive projections, hyperlocal comes with its set of growth threats and challenges, such as customer acquisition and retention issues.

Unlike other ecommerce sub-segments, customer acquisition in the hyperlocal space has to be hyperlocal in nature. Approaching prospects in a generic manner, with a widecast marketing net but without any contextualised or personalised engagement, is not likely to work here.

But retention is the toughest task of all in this space as customer experience is paramount for success. A 2022 CX trends report by Zendesk states 61% of customers will switch to another brand after just one bad experience, a 22% jump from the previous year.

In a previous interaction with Inc42, Geetanjali Purohit, director and head of marketing at the hyperlocal delivery startup Shadowfax, said, “The minute a person places an order, they watch it like a hawk. The only way to deliver on time (and retain the end users) is through a collaboration between tech, communication and marketing teams of a company.”

How Fleet Players Are Dealing With Retention Challenges

As speed and efficiency are critical to time-bound last-mile deliveries, many logistics providers and EV rental startups have entered this space as ‘enablers’ to help ecommerce brands and small-scale retailers make hassle-free deliveries.

Among these are 3PL startups like Shiprocket, Xpressbees and Blowhorn, last-mile delivery players such as Shadowfax and NOW Delivery and EV rental startups like eBikeGo, BluSmart and more.

These players have varied business tie-ups. In the first case, rental startups like Rapido provide EV fleets and driver partners to aggregator platforms (Zomato, Swiggy and others), hyperlocal marketplaces, ecommerce brands and offline retailers to run time-sensitive last-mile deliveries.

On the other hand, a few startups like eBikeGo and Shadowfax tie up with individual gig workers and rent them vehicles so they can work with the platforms mentioned above in their personal capacity.

In spite of varying business models, driver partners remain at the core of hyperlocal logistics, and the biggest challenge lies in engaging and retaining these gig workers.

“Our current business revolves around B2B brands and delivery partners. Of course, it is comparatively easy to acquire driver partners, but retaining them is not a piece of cake, especially amid rising competition in the hyperlocal space,” said Irfan Khan, founder and CEO of Mumbai-based eBikeGo.

The startup’s portfolio of B2B clients includes major marketplaces like Amazon, Myntra, and D2C meat brand Licious.

In the past, the poaching of delivery personnel by new entrants such as Dunzo and Zepto hurt even deep-pocketed players like Swiggy and Zomato. Things came to such a head that in May 2022, Swiggy temporarily shut its quick-delivery vertical Genie’s operations across major metros as it struggled to hire delivery personnel.

To counter these retention issues, eBikeGo regularly collects feedback from its riders to measure their job satisfaction and develops strategies around the findings for better engagement. Besides, it focuses on lead generation, performance tracking and brand marketing across communication channels.

Many hyperlocal mobility startups are also following suit to ramp up engagement with gig workers.

Anmol Jaggi, founder and CEO of Gurugram-based BluSmart, says that the startup uses push notifications, in-app pop-ups, SMS, email messages and social media as touchpoints to reach out to its riders. “Our compelling multichannel strategy enables us to personalise messaging based on their specific needs and interests,” he added.

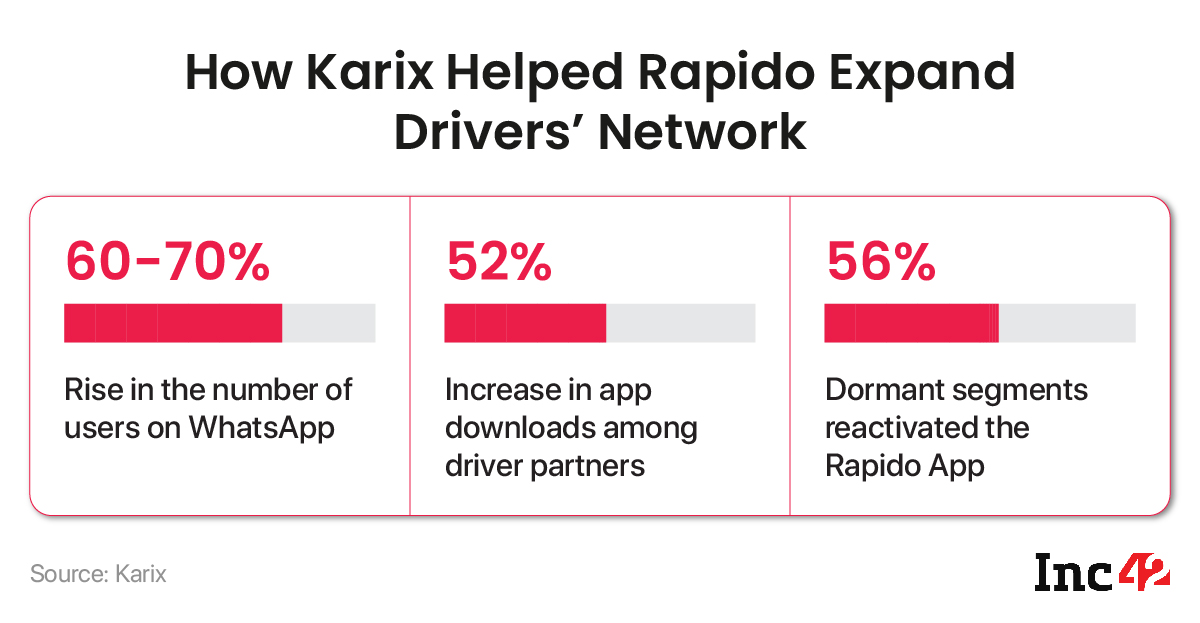

But all was not hunky-dory with every enabler. For Bengaluru-based Rapido, engaging with its network of driver partners (called captains) turned out to be a regular hassle. It sought help from Karix, a customer communication and engagement solution provider for increased engagement. They collaborated to introduce the use of WhatsApp as a channel to onboard captains and run targeted campaigns and improve outcomes.

Gamooga ( Karix’s marketing automation platform) helped Rapido design interactive message templates in English and vernacular languages to target driver partners and onboard suitable people. This further increased Rapido’s app download among gig workers and enabled efficient feedback capturing.

For the inactive drivers, Karix helped Rapido offer an opt-out route to drivers by introducing a clear unsubscribe communication from the latter. This way, the brand could identify the dormant driver segment and filter out those who unsubscribed.

“Our collaboration with Karix helped us engage our driver partners actively and revive the dormant segments. Its targeted messages helped us streamline our efforts and deliver better services,” a Rapido representative said.

How Multichannel Marketing Ensures Better B2C Engagement

Besides engaging with local carriers, hyperlocal brands would do well to target the right set of customers to grow their businesses, say industry experts.

“Marketing and targeting the right customers is crucial for hyperlocal brands because they cater to a specific audience. Think of referrals, a low-cost but surefire way of acquiring customers. This can be done by promoting app downloads or informing shoppers about discounts through popular communication channels like WhatsApp,” said Sonia Kaul, VP of product marketing and digital enablement at Karix.

Convenience through communication is important for consumer-facing brands in the hyperlocal segment. According to Zendesk, 80% of customers will leave a brand for its competitors after more than one disappointing experience.

“Sending timely updates about order confirmation, order status and order tracking, keeps customers informed and engaged,” said Kaul.

Here is another case in point. Karix partnered with Gurugram-based Urban Company to help the brand retain customers and acquire new ones. The latter realised significant impact in less than a year’s time, it claimed. Urban Company ensured that its users stay informed throughout their journey by sending them well-timed and contextual SMS alerts that went a long way in building stronger customer bonds for them.

Furthermore, Karix helped the brand develop and deploy targeted campaign messages which were unique to every pin code where UC is present.

“This helped Urban Company micro-target its customers by creating localised promotional offers and content,” said Kaul. “Keeping your prospects hooked until they convert to paying customers, repeat customers, and ultimately, loyal customers is critical for expansion,” she added.

Another interesting case in point is Xpressbees. The logistics unicorn was quick to adopt a change in its outreach and communication strategy with Karix by adding communication channels such as WhatsApp to complement its traditional messaging channels like SMS. It revealed that it was able to elevate consumer experience through timely updates on order movements and delivery and could bolster consumer trust.

As for partner brands, proactive communication led to reduction of turn around time (TAT) for non-delivered goods and made reverse logistics smoother than before.

However, strategic multichannel marketing is not the only way brands target customers.

“Today, omnichannel marketing is the de facto approach towards customer communication,” said Amit Gupta, cofounder and CEO of Yulu, a Bengaluru-based EV mobility platform catering to B2B and B2C segments, especially businesses in the hyperlocal space.

It rewards its regular riders with free rides and discounted pricing based on completed trips and the miles covered. The data gets recorded in its central system during any battery swapping at Yulu EV stations. The startup claims that these on-ground incentives have helped it achieve a customer retention rate of 67%.

Is Hyperlocal A Fad Or The Future?

Over the years, digital commerce tapped the hyperlocal trend due to its convenience and cost-effectiveness. However, the model went into full bloom during the pandemic when global and nationwide supply chains virtually froze due to long patches of lockdowns. The rise of local brands (including D2C) and local services were a given in such a situation.

According to a report by Allied Market Research, the global hyperlocal service market, valued at $1.71 Bn in 2020, is estimated to reach $5.1 Bn by 2030, growing at a CAGR of 14.9%. It suggests that the spurt in urbanisation, changing consumer preferences and lifestyle changes are key growth drivers of this market.

India is no exception, either, as the rapid adoption of digital infrastructure has boosted the convenience commerce model.

As consumer proximity and localised/personalised approach are critical for hyperlocal success, most players are now partnering with martech platforms like Karix’s Gamooga, Moengage, CleverTap and the ilk for geo-contextual insights into consumer behaviour and demographic-specific campaign launches.

Can these enablers help solve the retention issues faced by logistics players and serve users through contextual targeting? Will hyperlocal businesses live up to their promise? And finally, will investors be concerned about putting their money into a niche during a funding winter?

It will be interesting to see how hyperlocal entities reimagine consumer services and engage shoppers. After all, when there is customer engagement, there will always be money around it.

What’s Hindering Hyperlocal Growth?

What’s Hindering Hyperlocal Growth?