The pressure is well and truly on Masayoshi Son and SoftBank, and the next few months pan out will determine the course of several unicorns in the Indian startup ecosystem

“I believe in the future of India. I believe in the passion of young entrepreneurs in India,” SoftBank CEO Masayoshi Son said in December 2021.

But now SoftBank’s situation has flipped and this could have major repercussions given just how large it is. The Japanese VC giant released its Q3 numbers this past week which show the sorry state of some of its investments.

The pressure is well and truly on Masayoshi Son and how the next few months pan out will determine the course of several unicorns in the Indian startup ecosystem. That’s our focus today, but after a short detour in our other top stories of the week:

- Relief For Loan Apps?: After a major scare from MeitY earlier this week, many lending platforms have now been unblocked, but is the worst over for digital lending startups?

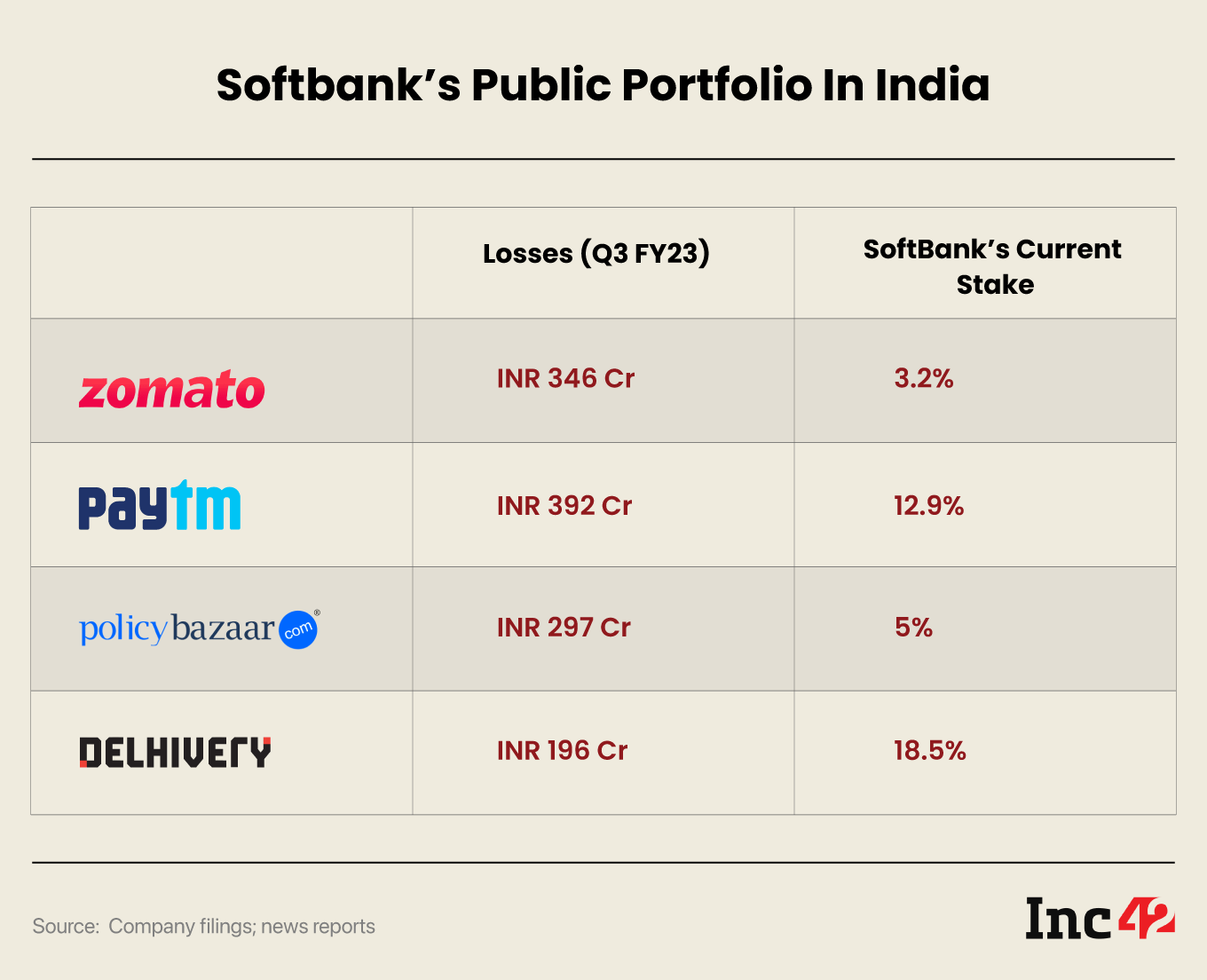

- Paytm’s Good Week: Paytm’s net loss halved year-on-year (YoY) to INR 392 Cr in Q3 FY23, leading to a big spike for the stock.

- Zomato’s Tasteless Q3: On the other hand, Zomato saw a degrowth in QoQ revenue, which is likely to put further unit economics pressure on the company.

SoftBank’s Bull Run Ends

The world’s biggest investors are quaking in the wake of the global macroeconomic slowdown, and we can now count VC behemoth SoftBank with $208 Bn spread across two funds among this.

The cold hard numbers first: SoftBank lost $5.8 Bn across Vision Funds in the December quarter, to add to the $10 Bn loss in the previous quarter, and losses in the previous two quarters.

While SoftBank reported a consolidated loss of $13 Bn in FY22, it saw $38 Bn in profits in FY21, with the Vision Fund accounting for over 90% of this. But now with four straight loss-making quarters, the Masayoshi Son-led fund is under pressure.

From $20 Bn a quarter at the peak volume as per its past filings, the fund has pared its investment back by almost 99% in Q2 and Q3 FY23, investing just $300 Mn in each quarter.

Sorry State Of Indian Investments

Ever since it made its entry into the Indian startup ecosystem, SoftBank had a touch of glamour and the backing of Masayoshi Son was seen as a golden ticket for success. It has invested more into the global startup ecosystem than any other VC in the past decade.

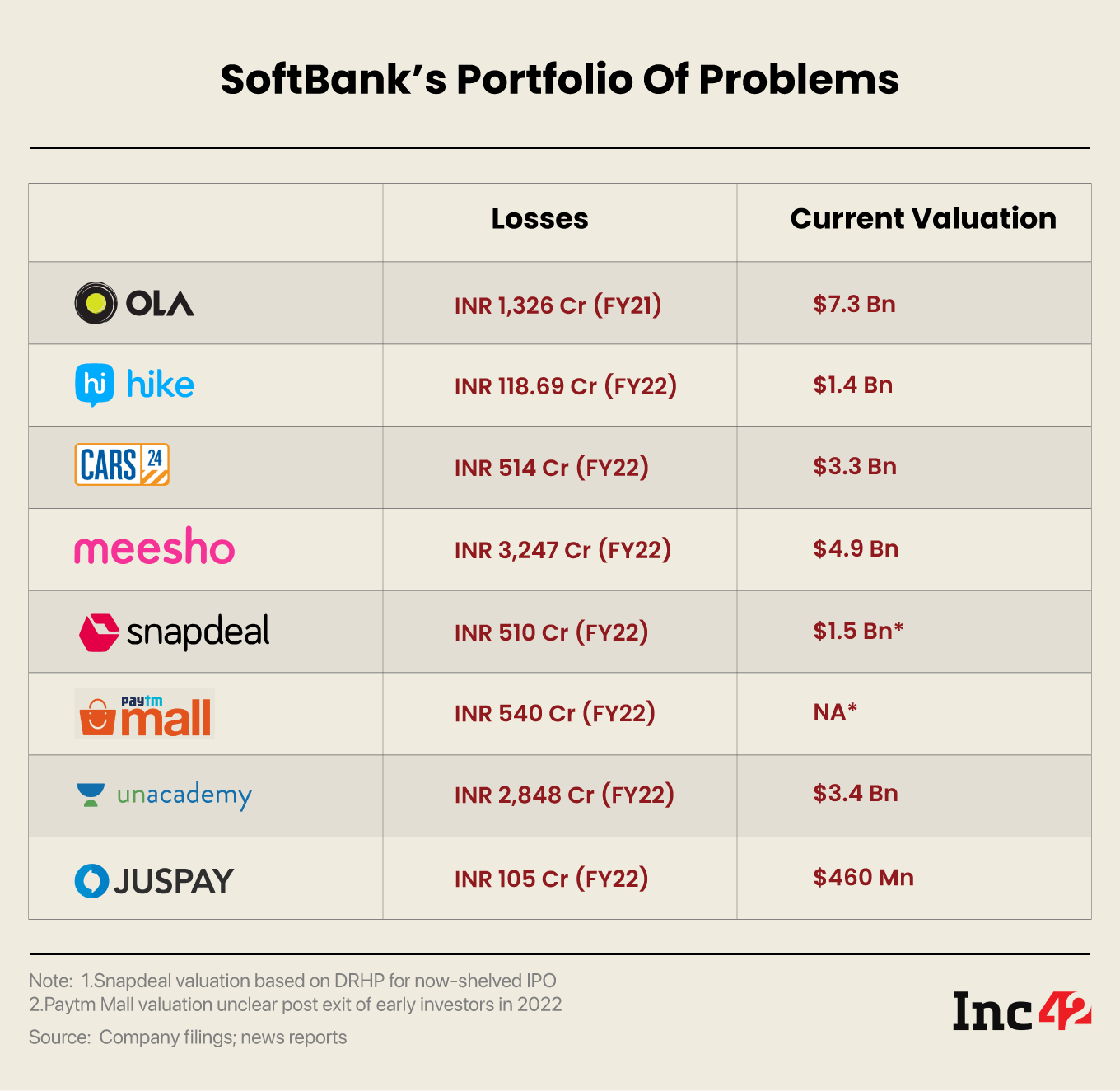

Between the two SoftBank Vision Funds, it has deployed nearly $160 Bn across the world, and is a key backer of a number of Indian unicorns, including ones such as Hike and Paytm Mall that have gone through severe valuation corrections since becoming unicorns.

But over the past couple of years, SoftBank has slowed down its India investments. In 2021, the VC invested over $3 Bn across 17 deals. In stark contrast, it participated in just four rounds in 2022, with Polygon’s $450 Mn round being the largest.

Even among the Indian startups that Masayoshi Son has backed with great vigour, the cumulative losses are well in excess of INR 30,000 Cr (or roughly $4 Bn at today’s exchange rate). Flipkart alone accounted for INR 7,800 Cr loss in FY22.

Since the peak of the funding boom in 2021, the fortunes of many of the SoftBank-backed Indian startups have soured.

SoftBank has even trimmed its optimism in OYO, one of its most celebrated investments in India. It reportedly slashed the valuation of its stake in OYO to $2.7 Bn from $3.2 Bn as per its previous quarterly results.

Despite a profit of $4.2 Bn on its Coupang investment, SoftBank has lost more than $9 Bn in Didi and $5.1 Bn in WeWork in the quarter.

Public Bets Paying Off

The situation is similar even among the public-listed companies where SoftBank continues to hold a stake, where the losses in FY23 so far have crossed INR 1,200 Cr ($150 Mn).

But to be fair, SoftBank has seen healthy returns from Delhivery, where it had invested $300 Mn and seen earnings of $200 Mn and 18% stake still in the company, according to the earnings report.

It sold 5.1% of its Policybazaar holding for INR 1,043 Cr after investing close to INR 1,500 Cr in the company.

In fact, across the two funds, SoftBank is sitting on big losses in the public portfolio. Vision Fund I’s holdings in publicly listed companies have a fair value of $19.9 Bn, compared to the $31.4 Bn that SoftBank has poured in. The situation is worse in the second fund, which has seen a loss of $17.6 Bn — a fair value of $30.7 Bn as against $48.3 Bn invested.

As it looks to improve profitability, SoftBank may sell off portions of its India portfolio depending on market fluctuations in the coming year. Of course, this could also help SoftBank gain performance fees that are due to fund managers from their LPs based on profits generated by the fund.

The Next SoftBank Vision Fund

Back to back losses have put SoftBank and its founder and CEO Son under pressure. When it was raising commitments for its first two Vision Funds, the atmosphere was friendly, with zero interest capital available freely.

Investors raised record capital between 2019 and 2021, but now the going is tougher and the pressure is on VCs to show performance. SoftBank’s profits during this period helped it raise funds for the second fund.

In the process, the Japanese giant is likely to push its portfolio harder for exits. We have seen this happen in the case of Paytm. It’s not all bad news — the performance of companies such as Lenskart, Zeta, ofBusiness should provide plenty of confidence.

Zeta halved its losses in FY22, and even though Lenskart fell deeper into the red, its revenue growth was more than encouraging. On the other hand, ofBusiness is a rare profitable unicorn in India.

The context may be different but speaking to Inc42, Ideaspring Capital founder Naganand Doraswamy told Inc42 last year, ”By the time you are in your second fund, you will know whether you can raise a third fund. There are enough proof points by that time to say whether you are a good fund manager. By the third fund, you’re either in it or you’re not in it.”

Despite mounting losses SoftBank is reportedly in the process of launching a third Vision Fund. A significant portion of the fund would make use of SoftBank’s cash, but this is speculation at the moment, and reports did not specify how large the fund would be.

Even at half of the Vision Fund II’s $108 Bn corpus, the third fund would be one of the largest ever launched for startups.

Besides looking to turn around its existing portfolio, SoftBank is looking at its new fund as a way to fuel the next generation of technology, where it is likely to see major upside in the next 7-8 years. Developments such as the major boost for OpenAI, large language models and generative AI have kicked down some doors, while Web3 potential is yet to be fully realised.

Many VCs make bold bets, but SoftBank always goes big and bold. It’s something of a defining characteristic of Son and the VC. For instance, as a result of some of the large bets, Son owes SoftBank about $5.1 Bn on side deals. The problem is that big bold bets don’t always survive run-ins with the bear market.

Sunday Roundup: Startup Funding, Tech Stocks & More

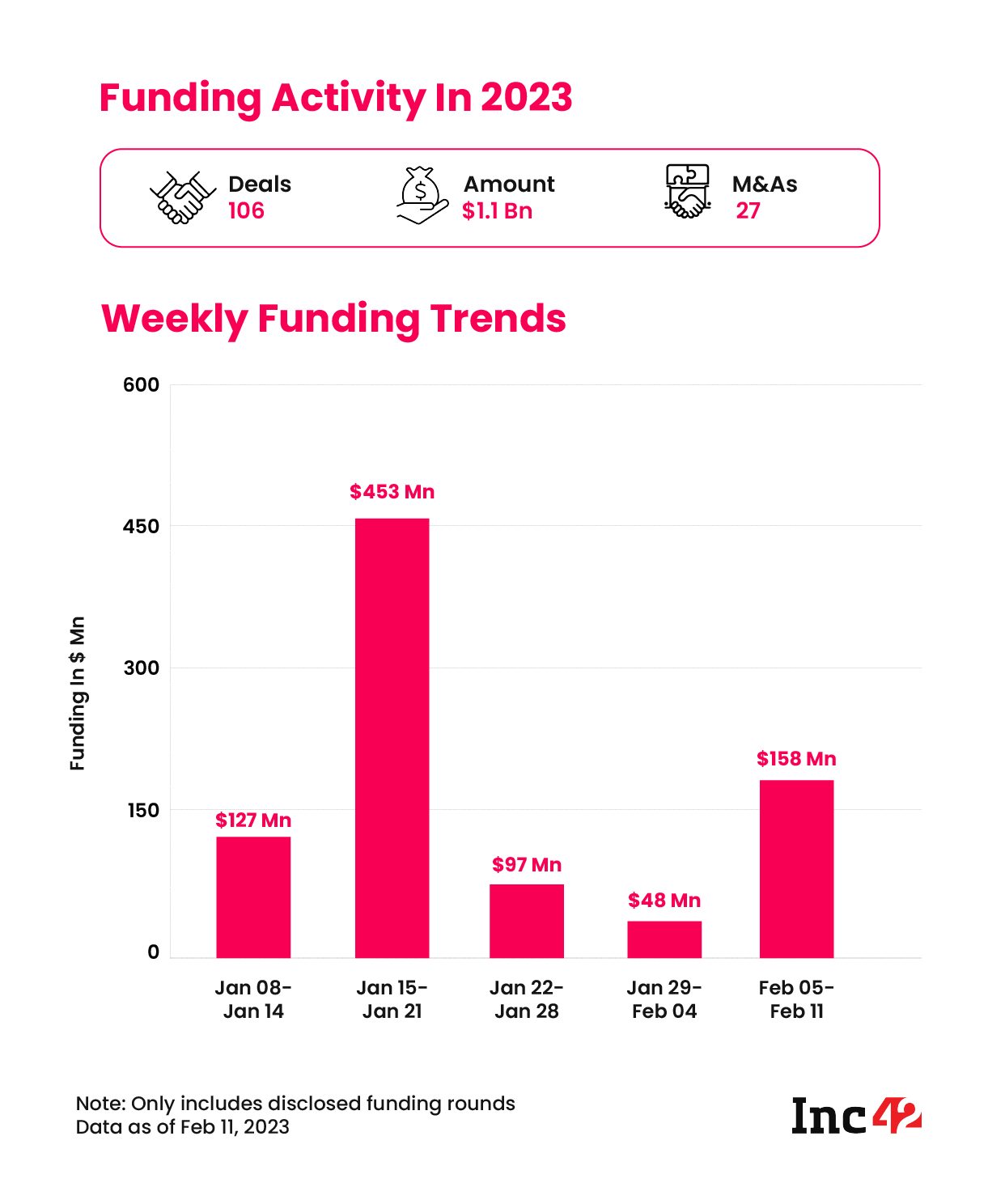

⏬ Funding Picks Up: After witnessing the all-time weekly low earlier this month, Indian startup funding saw some momentum in the past week. Indian startups raised $158 Mn across 24 deals, but this is still far from the highs seen in the past.

? Amazon In Talks To Acquire MX Player: The ecommerce giant is said to be close to acquiring Times Internet-owned MX Player, but rival platforms are also in the fray

? ideaForge IPO: Qualcomm-backed drone startup ideaForge has filed its DRHP with SEBI ahead of a potential IPO. Will it recreate the Droneacharya magic?

? Govt Vs ePharmacies: The Drug Controller General of India (DCGI) has sent show-cause notices to 20 epharmacies, including Tata 1mg, PharmEasy, Amazon, and Flipkart, for operating without licences

⏬ Info Edge’s Dud Bet: Internet major Info Edge has written off its entire investment in 4B Networks, the startup run by former Housing.com founder Rahul Yadav

We’ll be back next Sunday with more insights and a roundup of the top stories from the world of Indian startups. Till then follow us on Instagram, Twitter and LinkedIn to get the latest news as it happens

Ad-lite browsing experience

Ad-lite browsing experience