Licious is one of India’s most disruptive consumer brands in the meat and seafood category, tapping into a $30 Bn meat market

The company clocked a 300% YoY growth since its inception in 2015, and its revenue increased 75% from INR 78.96 Cr in FY2019 to INR 138 Cr in FY2020

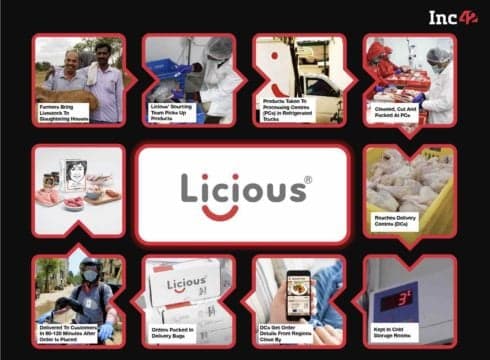

Owning the entire supply chain is one of the critical factors that helped the company scale faster; it also recorded a 6x revenue growth during the pandemic

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The popularity of meat, fish and poultry continues to rise globally. In India, around 71% of the population over the age of 15 are non-vegetarians, and the annual consumption of poultry meat rose to more than 3.9 Mn metric tonnes in 2020. However, over 95% of the fresh meat and seafood industry in the country is unbranded, bringing to the mind unhygienic local markets, filth and stench, and an overall unsavoury buying experience. That was what Abhay Hanjura and Vivek Gupta, cofounders of the Bengaluru-based meat and seafood delivery startup Licious, wanted to change.

The duo (both of them avid meat-eaters) realised that the traditional Indian market had failed to live up to expectations when their NRI friends often shared how they turned vegetarian during their visits home as the quality of the meat and seafood available here was poor compared to global standards. This got them thinking and delving deep to understand what had gone amiss and how to tap into the opportunity to fulfil the growing focus on quality.

Their preliminary research included deep-diving into industry statistics, consulting food industry experts and visits to poultry, goat firms and the coastline to understand how the supply chain operated. They also gained insights into setting up processing centres and building cold chains from evolved meat-eating markets like China, Japan and Korea.

Licious was launched in 2015, with a simple mission statement that it would not sell what the cofounders would not eat themselves. And the daily number of orders was around 100. Six years later, it has emerged as one of the most disruptive consumer brands in India, clocking more than 20,000 orders a day and specialising in meat and seafood delivery across raw and fresh, ready-to-cook and ready-to-eat categories. The company operates in the ‘fresh’ category and claims that it sells no frozen foods. All its products are stored at 0-4⁰ temperature and do not contain antibiotics, chemicals, artificial preservatives, colour and flavouring.

Much like its ‘fresh’ product lines, its growth numbers look impressive. Since its inception, Licious claims to have grown at a CAGR of 300% year on year, delivering 300+ SKUs to customers in 90-120 minutes and clocks around 1 Mn orders every month.

Its overall revenue grew six times between May and December 2020, when doorstep delivery became the new normal due to coronavirus shutdowns. The startup claims that an average customer buys Licious products two-three times a month and spends close to INR 22,000 on a monthly basis. The company also reduced its net losses by 66% to INR 146.3 Cr in FY2019-20 from INR 438.7 Cr in the year before.

Zero Outsourcing Is The Secret Sauce

In the initial years, the company outsourced its customer care operations. But it turned out to be a big business mistake as the team concerned did not know much about its products and could not respond to customers’ queries for prompt and effective resolution of issues. In fact, the cofounders felt it was a major compromise on customer experience. So, the company decided to get all its employees on the payroll and train them extensively on meat and seafood. Now, it has a dedicated team, well-equipped to address customer concerns and deliver an end-to-end gourmet experience.

Simply put, the secret sauce lies in the fact that the company owns the entire supply chain and does not outsource any of its business processes. That earlier experience of poor customer service had ushered in a valuable lesson and benefited all processes within Licious.

“We make sure that our processing centres are compliant with global standards so that the products reaching our customers are of uncompromised quality,” says Gupta. Licious has five processing units, one each in Mumbai, Delhi-NCR and Hyderabad, and two in Bengaluru. The company further stresses the ‘freshness’ factor, saying that the ‘raw’ products are delivered within 24-48 hours after sourcing, and throughout the transit, a 0-4 degree environment is maintained. Products are transported in refrigerated trucks to processing centres and then to delivery centres. Also, delivery executives carry them in insulated bags to retain freshness. Its ready-to-cook (RTC) range has a slightly longer shelf life, up to five days, and the ready-to-eat (RTE) products can last up to 30 days in refrigeration.

To cater to the five new cities, including Jaipur, Coimbatore, Vijayawada, Visakhapatnam and Kochi where Licious launched its services between November 2020 and January 2021 that do not have a processing centre at present, the company uses an AI-based demand-supply algorithm that predicts demand and products are shipped accordingly from nearby processing centres. Take, for instance, Jaipur. In this case, products are shipped from Delhi-NCR, and within two days from the time of procurement, these are out for delivery in that city. Licious is all set to enter Puducherry and Kolkata soon and plans to foray into more markets where the same delivery dynamics will be followed.

Zero outsourcing also means its 90+ delivery centres (DCs) catering to 12 cities, including Delhi-NCR, Mumbai, Hyderabad, Bengaluru, Chandigarh, Pune and Chennai, are appropriately temperature-controlled and operated by trained employees. This also gives them the opportunity to train delivery executives to handle products correctly during transits.

“The fact that we do not outsource any of the job roles guarantees greater accountability and a sense of ownership across the organisation. All Licious products undergo more than 150 quality checks at various stages of sourcing and processing,” says Hanjura.

The company has adopted a farm-to-fork model and partners only with livestock producers/animal farmers and fishermen. Besides, the procurement team is thoroughly trained in quality control for maximum taste and freshness. Gupta says that the company has provided a high degree of hand-holding to its suppliers from day one to ensure that they follow all Licious protocols.

Besides, the company deploys a sourcing team that trains farmers to develop biosecure farms with zero external contamination. On these farms, birds are given the correct feed, not pumped with antibiotics, provided enough open space to roam around and allowed a stipulated growth period. Licious also conducts regular quality checks at all partner farms.

This is also the reason why Licious has expanded slowly. Although it started operations in Bengaluru in 2015, it moved on to Hyderabad and Delhi-NCR in 2017.

“We wanted to gain an in-depth understanding of the business before we speeded up expansion. For us, it was more important to do it right than do it in a hurry,” says Hanjura.

Given that the startup owns, controls and manages all its processing centres, Licious could also respond swiftly to the changing ground realities in the wake of the Covid-19 pandemic. Initially, when the nation-wide lockdown was announced with four hours’ notice, the breadth and depth of such a challenge impacted the company’s procurement and logistics to some extent, and several users complained of product unavailability. But efforts like airlifting some part of the raw material helped.

The company also decided to temporarily discontinue its express delivery (within 90 minutes) service. The reason: Orders could not be processed so fast due to reduced workforce, restricted operating hours and night curfews. Consequently, ‘express deliveries’ were moved to the next day’s slotted deliveries (four slots a day). But given the prolonged shutdown, slotted deliveries were possible only because the company had control over the entire process, it claims. Customers used to 90-minute deliveries also moved to slotted deliveries. They were not too keen about the on-time service guarantee and just wanted to get their orders home-delivered. According to Licious, the number of total deliveries went up by 1.5-2x, with a 30% increase in average order value.

During the entire lockdown period, there was a 200% surge in demand across Bengaluru, Hyderabad, Delhi-NCR, Chandigarh, Mumbai, Pune and Chennai, the company says. To fulfil customer requirements, the startup eventually ramped up hiring across delivery and backend operations and now claims to operate at 1.5x the capacity of pre-Covid times.

Data Ownership And Other Advantages Of A D2C Brand

When Licious took off six years ago as a direct-to-consumer (D2C) brand, the business model was not much heard of. Today, it is one of the most popular D2C brands in India. Looking back, the cofounders feel that the D2C module has given them a good chance to address the last-mile complexity of time and temperature requirements. Today, 98% of its revenue comes from D2C and the remaining from third-party aggregators such as Dunzo, Swiggy and Zomato. Using D2C as a direct marketing channel to reach out to consumers has also helped the company achieve 90% repeat customers who account for 85% of its business.

A quick look at the D2C operations may justify what Licious is doing. For example, this is how a traditional meat supply chain had worked before D2C days.

Farmers → Middlemen → Wholesalers → Butchers → Retailers

But in the D2C space where Licious and a few other startups like FreshToHome and Zappfresh are operating, the supply chain only involves:

Farmers → Butchers → Startups

This ensures that the companies have a 30-40% profit margin.

For Licious, another big advantage is the ownership of customer data it has acquired over the years through direct feedback. “It helped us determine key metrics and gave us insights into consumer habits. These led to all-round improvements and better focus on product innovation,” says Gupta.

A careful analysis of the data further helps the company track the trends in a specific city/area and stock up its offline stores with the ‘right’ products. Licious has already launched two exclusive offline stores, called Experience Centres. One is located at Gurugram’s Galleria Market and another at the Ascendas Park Square Mall in Bengaluru. It plans to add more brick-and-mortar stores in 2021.

Coping With Shelf Life Issues In Supply Chain

With more than 200 stock-keeping units (SKUs) in its inventory, ensuring timely delivery and zero or minimum wastage is critical for the brand. It claims to work on that by leveraging tech tools and in-house algorithms to forecast and track customers behaviour online and revisiting the strategies accordingly. For instance, if a particular product was not available on the platform, customers used to abandon the cart or buy fewer products. However, the quantity would be less than what they originally intended to purchase.

Observing this, Licious decided that a customer should be able to place an order even if the product was not available at the moment, and the person would be informed about the delay in delivery. Therefore, a customer may get a message like this one: Three selected items will be delivered in the next 90 minutes, and the fourth product will be delivered after four hours or the next day.

With this model in place, the company’s revenue increased by 8% in a single day. This has increased over time, and previous day’s orders (to be delivered the next day) currently account for 30-35% of the revenue. “After all, it is almost impossible to make 100% of the product catalogue available all the time,” says Gupta.

The company says that leveraging artificial intelligence (AI) has helped predict consumer behaviour, reducing wastage and enabling customised offering and continuous availability of desired products. Additionally, Licious ensures that only select SKUs with slightly longer shelf life (such as Licious Spreads and kebabs) are sold through offline retail stores like Ratnadeep and Spar where the company is present.

Licious is mostly a D2C brand, but some of its lower-shelf-life products are sold through online marketplaces and aggregators such as Dunzo, Swiggy and Zomato. In such cases, monitoring for temperature control may not be an easy task, although Licious claims that it only partners with brands which it trusts in terms of quality. But there is a point to ponder. Considering that the company wants to own the entire process to have complete control over product quality, delivering through other platforms could be tricky. Yet, this is essential for the company to reach out to more customers who may not be aware of its presence.

The drawbacks do not end there, though.

Will Ambitious Plans Yield Positive Outcomes For Licious Going Ahead?

In the long run, the company wants to continue as a D2C brand that does not outsource any business process. However, it could not manage the deliveries alone during lockdowns and partnered with several delivery fleets like DriveU, Shadowfax and Yulu to carry out slotted deliveries throughout the day. According to the founders, Blue Dart’s newly introduced six-hour delivery model worked well for its highly perishable products during that time.

This is not surprising as the pandemic compelled most companies to deviate from their core business strategy, at least temporarily. But the question is: Should Licious be open to partnerships (logistics or otherwise) as and when it is required or as it scales?

Licious could be confident about sticking to its guns and owning the supply chain. But it could not possibly ignore a few other challenges. For instance, it has to consider the growing competition from the likes of Bengaluru-based FreshToHome, Delhi-NCR-based Zappfresh, Chennai-based TenderCuts and other players like Venky’s, Nandu’s and Suguna Foods, which have a huge offline presence and are currently building online reach. Moreover, big players like BigBasket, Reliance JioMart and Amazon have ventured into the fish-and-meat space. Companies like BigBasket are also scaling up their private labels.

Customer behaviour is changing as well. In the era of Covid-19, people mostly preferred to have hassle-free, restaurant-like food at home, and hence, the brand’s RTC-RTE range got a boost, the startup claims. It is now planning to grow these categories. Incidentally, its RTC products such as pre-marinated meats and seafood account for a big chunk of its revenue while the RTE segment, introduced in 2019 and featuring Licious Spreads (comes in two variants, chicken and prawn) is another growing category. While red meat and seafood contribute 40% of the total revenue, chicken accounts for another 40% and the RTC range contributes 18-20%.

However, with restaurants reopening and consumers back to eating out, the RTC-RTE range may not be in as much demand as during the lockdown. So, the company may have to work on its marketing strategies to ramp up the same.

Overall, Licious seems to have found its niche. The company’s revenue had gone up from INR 78.96 Cr in FY19 to INR 138 Cr in FY20. It seems to have cracked the supply chain by owning all its processes to ensure on-time delivery without compromising its USP of freshness. And its 2021 expansion plans look well-timed as moving beyond metros means growing its customer base further.

This requires working on the consumer mindset and educating them about fresh supplies and other quality parameters such as no-antibiotic food products, rarely followed in traditional wet markets. But it may not be an arduous task any more as the pandemic has ushered in better awareness regarding organic and hormone-free food. Add to that an uptick in the D2C adoption and the company looks well set to tap into the Indian meat industry, valued at around $30 Bn.

Correction Note | 12:20, February 11, 2021

The Licious logo used in the feature image was an old one. The same has been corrected.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.