Vinay Singh says that even though there are a lot more potential deals in the funnel, the emphasis on finding founders with deep and precise insights or a clear right-to-win has not wavered

The D2C boom means Fireside sees close to 150-odd deals a month from about 15-20 deals in 2017 but this has not changed the number of investments it makes per year

The Fireside partner says a 5R framework of Reviews, Ratings, Retention Referrals and Returns helps the fund analyse initial product-market fit for any category

There’s little doubt that Shark Tank India has brought startups into everyday conversations and public discourse, but this has also increased the riff-raff that early-stage investors have to wade through to find the right deal. For Fireside Ventures’ Vinay Singh, the wider spotlight on new startups and D2C brands in particular presents a different kind of challenge.

“We have seen our deal flow move up exponentially. Covid was a tailwind not only for D2C brands but also for ecommerce as a whole. The TAM has widened and the growth seen by some of the older brands in the past two years has given a fillip to the whole category,” Vinay Singh told Inc42, adding that entrepreneurs have seen all of this and jumped into the fray.

This me-too bandwagon of brands means investors have to sharpen their particular thesis, look more closely for product differentiation and category insights, especially for funds such as Fireside Ventures that invest early but for the long-term.

Having come on board Fireside Ventures as a cofounder with managing partner Kanwaljit Singh, Vinay Singh jumped into the VC world after a decade and a half at FMCG giant Hindustan Unilever, as well as stints at McKinsey & Co., and Bankbazaar.com. He also founded used automobiles marketplace Stepni.com, which was later acquired by Quikr. And like many entrepreneurs that made the transition, Vinay Singh calls himself an ‘accidental VC’.

Fireside came about as Vinay looked for newer challenges after Stepni. While he initially wanted to start up again, the opportunity to lead a different kind of business i.e venture capital investing excited him. “I had raised funds for Stepni and seen the process up close for Bankbazaar, so I had a fair bit of idea. But as with everything, it’s about learning on the go and adapting to the shifting tides.”

The Indian direct-to-consumer or D2C landscape has definitely seen an upswell. The onslaught of opportunities can easily fox inexperienced angel investors and early funds. Vinay believes there are certain guardrails that they can use as a north star during evaluations.

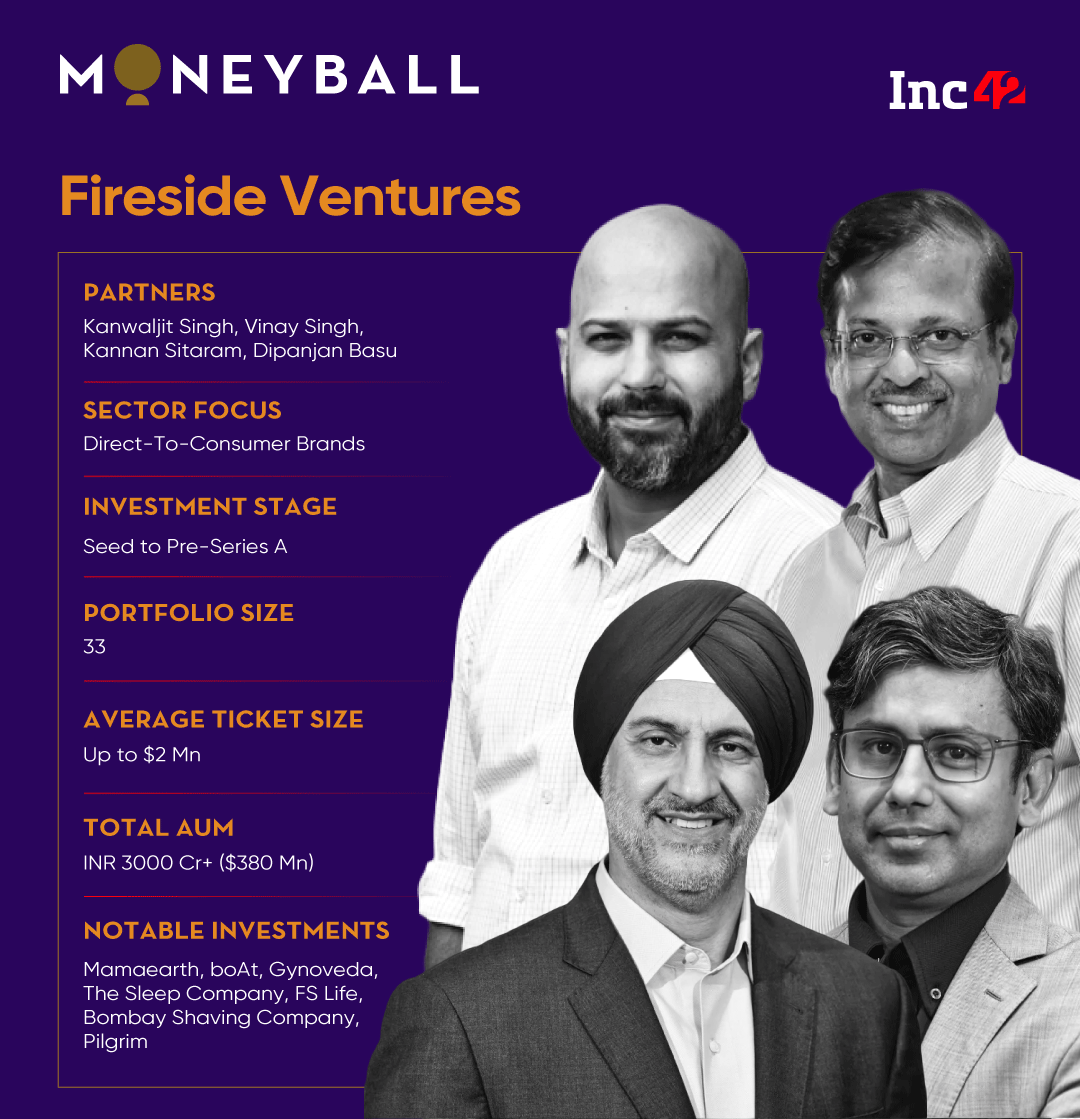

The Fireside Ventures portfolio includes some D2C mainstays such as ITC-acquired Yoga Bar, Bombay Shaving Company, boAt, MamaEarth, The Ayurveda Experience, Kapiva, Azani and others. It saw an exit from Kwik24, after it was acquired by BigBasket and also partially exited boAt after it raised $100 Mn from an affiliate of Warburg Pincus. With Mamaearth on the IPO trail, Fireside could see another major exit soon.

Fireside Ventures closed its third fund in November 2022, and Vinay told Inc42 that even though there are a lot more potential deals in the funnel, the emphasis on finding founders with deep and precise insights or a clear right-to-win has not wavered. Given the D2C focus for Fireside, Vinay’s thoughts are of course largely from that lens, but they are applicable in general for investors vetting other products too, especially when it comes to analysing PMF at the early stage.

Edited excerpts from our conversation

Inc42: As a first-time VC in 2017, before you gathered all the experience, what approach did you bring to the table? Was it about backing your strengths?

Vinay Singh: The exciting thing was partnering with companies at such an early stage. I have always been a growth guy and that’s my forte.

So working with them, setting up the basic systems, we actually published playbooks on how startups can approach this phase of their business. It’s still available on our website. And then of course, helping them hire their first few key team members, getting a process in place where this becomes repeatable.

But also realising that you need to step back at some point of time. I think that was the learning, but also from a Fireside Ventures perspective, there were aspects such as managing limited partners (LPs) and evaluating new deals that were somewhat new for me.

And of course, the whole fundraising for Fireside as well as capital infusion to startups. I had a limited network within the investor community at that point of time, both in the LP community and downstream when it came to founders and other VCs for coinvesting. Those were the learning curves that were both interesting and challenging.

Inc42: Were you a lean fund when you started out, in terms of the number of resources available to scout deals and create the deal flow pipeline?

Vinay Singh: In many ways, it required me to be a generalist, just like in the initial years of running a startup. For me, one of the biggest challenges in the first two years of Fireside was getting the fund to pass the Big Four audit. I am not a CA and wearing the CFO hat was a tough one.

One of the first leadership hires we did was getting on board Dipanjan (Basu) who had been the CFO of Myntra because things were very complex. And that was the point when we needed a specialist.

So the initial years were about finding this balance and understanding when we needed a specialist to handle a particular part of the operation.

Inc42: As an early stage VC, there’s often a big focus on bringing value to the captable, beyond just capital. With your growth-oriented lens, what was the value you looked to bring?

Vinay SIngh: The key was sitting down with our first cohort and identifying the common pain points across the portfolio. We didn’t want to help them solve product differentiation or the understanding of a sub-segment because we believed that’s best left to the entrepreneurs.

But there were pain points across the brands, like it’s easy to get listed on Amazon, but how do we get discovered on the marketplace? And that’s something we worked on because if we can solve it for those six startups, we can solve it for the next 60.

Identifying those problems — whether it was native or marketplace, whether it was media buying, whether it was technology. Setting up at least building blocks was a major agenda in the first year for us.

Inc42: Now, let’s talk about how you honed your evaluation skills or what was the framework that guided you in making a scientific call, beyond the gut feeling of backing the founder’s capabilities. Obviously, it’s a vital skill for investors in the day and age of Shark Tank, and FOMO investing.

Vinay Singh: The first part of this is something very vital for Fireside Ventures. I think at every point of time, no matter what the market conditions, we seek founders who can educate us on what’s around the corner. When they can see much beyond what we can see, that’s a great starting point of a conversation.

For instance, with Mamaearth, the idea was a channel disruption, because when it launched, the category of beauty or personal care did not have any new-age brands. The insight was that consumers would move online and there was an opportunity to be the first mover. Today that opportunity does not exist.

Mamaearth built its strength by understanding and playing the Facebook, Google, Amazon, Flipkart, BigBasket game and created a brand with decent products.

Similarly, when you look at Gynoveda, their insight came from a very precise target market. The TAM for women who searched for general menstrual advice was huge, but there is a subsegment of women who needed menstrual advice because they were trying to get pregnant. It allowed Gynoveda to have a very sharp focus.

Another example was a company that we missed investing in.

Wakefit came to us and pitched its idea of a D2C mattress brand. But we thought this category would not take off online because of the lack of touch and feel. The founder Chaitanya (Ramalingegowda) and Wakefit proved us wrong, so when it was our turn to evaluate The Sleep Company, we had to find out how exactly that startup would differentiate itself.

And the answer was in the form factor and the materials used, which was a different insight for a different time. And their advantage was that they moved first to this polymer whose IP had expired in 2015 and it entered the public domain. So the insight keeps changing as per the time and market conditions, but there’s always one insight that will hit the mark.

Inc42: But then if you are looking at a long-term bet, then how do you build conviction that these insights can be sustained over the next lineup of products down the years?

Vinay SIngh: That’s where the D2C ecosystem comes into play. We have app usage analytics, visitor and shopper analytics, social media listening, sentiment analysis and a lot more at your disposal to continue refining a product around the core insight.

How do you use this data and bring it into your new product development process to quickly figure out which products are finding consumer currency and killing products that are not.

At Fireside Ventures, we have co-developed with our founders this 5R framework of Reviews, Ratings, Retention Referrals and Returns for analysing initial product-market fit or not very quickly.

And there are benchmarks across categories — like what brands can expect in 15 days from launch, 30 days from launch, 60 days from launch and so on. All of that has now become tribal knowledge within the ecosystem, right?

That then allows founders to very quickly discover products No. 2, 3 and 4, where they can start investing big money to really build scale on revenue. This is also part of the common pain point we are trying to solve across the portfolio and even for our future cohorts.

Inc42: Obviously, the D2C segment saw a big boom during the pandemic years but now there’s some slowdown and consolidation. How do you prioritise which startups need the most attention at Fireside Ventures?

Vinay Singh: Covid was a Black Swan, as many have said, but even 2019 was not a great year for fundraising and 2021 was an aberration, the effects of which we are seeing now. But during Covid and even now, we talked to the founders about the runway situation and whether they have enough in the bank to last 15-18 months. And if not, what are the costs they can cut without cutting into the muscle to get to this position?

And if even after doing that, we don’t get to a 18-month runway, then where can we as fund managers and our LPs come in to enable them to get past this period, because if they make it to the other side, the economic tide will turn.

In some cases, where we can’t see this path, we have a very honest conversation with the founders about how to extract the best value for the time and effort spent on the business. Some founders will just say, it’s not working out so let’s shut it down.

But for us, there’s no point in shutting down a company, you have got to find a logical exit such as a merger or acquisition or something like that or even a BTA (business transfer agreement). Those were the key intervention points with our portfolio. Obviously today while the funding environment is a little tepid, there’s no need to raise alarm bells.

Of course, global events such as the Russia-Ukraine situation cause us to do a very detailed study of the potential impact. But the consistent advice is to build mindfully even when the market seems to be fine.

Inc42: Are there any signs of the D2C segment slowing down in terms of new brands?

Vinay Singh: If anything, we have a lot more potential deals to filter through nowadays. We used to see or evaluate about 15-20 deals in a month when we started, but now that’s close to 150-odd deals a month across various consumer sub-segments.

I think early on the disruption was limited to beauty, personal care and maybe some fashion. But today we’re seeing categories such as electronics, home goods, furnishing, pets, kitchen and multiple others getting disrupted.

I think we are always going to be measured investors. That’s our DNA. I think we will still do only seven to eight deals in a year, despite seeing so many more startups. We will spend enough time to get comfortable with the idea and the founding team. And of course the insight. That doesn’t change.

As you can imagine, when you see so many new ideas, it takes something special to get our excitement going. So if anything our bar has risen.

Ad-lite browsing experience

Ad-lite browsing experience