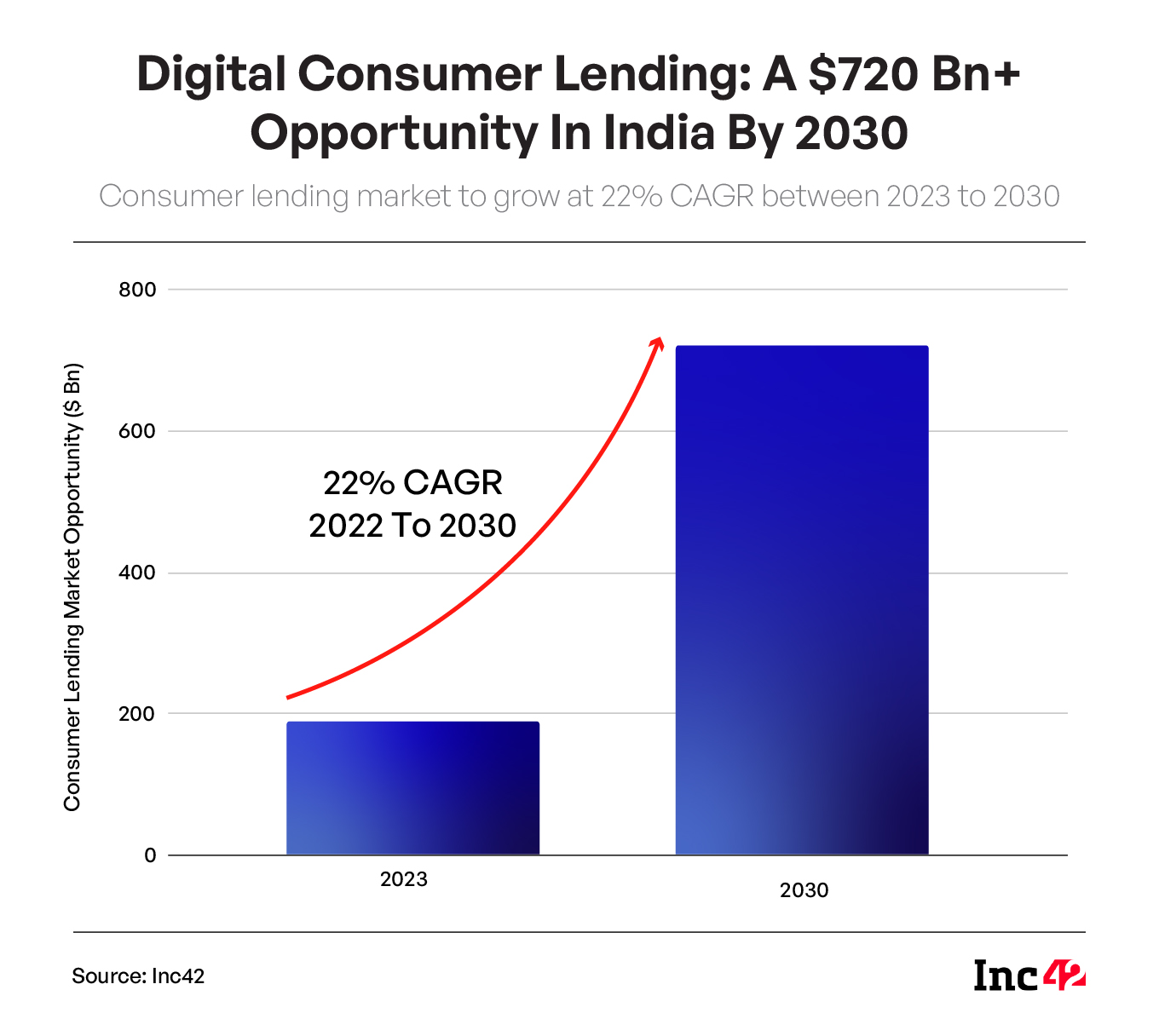

Growing at a robust 22% CAGR, the digital consumer lending market is poised to nearly triple in size by 2030 on the back of several favourable socioeconomic factors and timely regulatory measures

While analysts believe that all consumer lending categories are growing at a similar rate, personal loans are expected to experience faster growth compared to others due to their wide range of applications

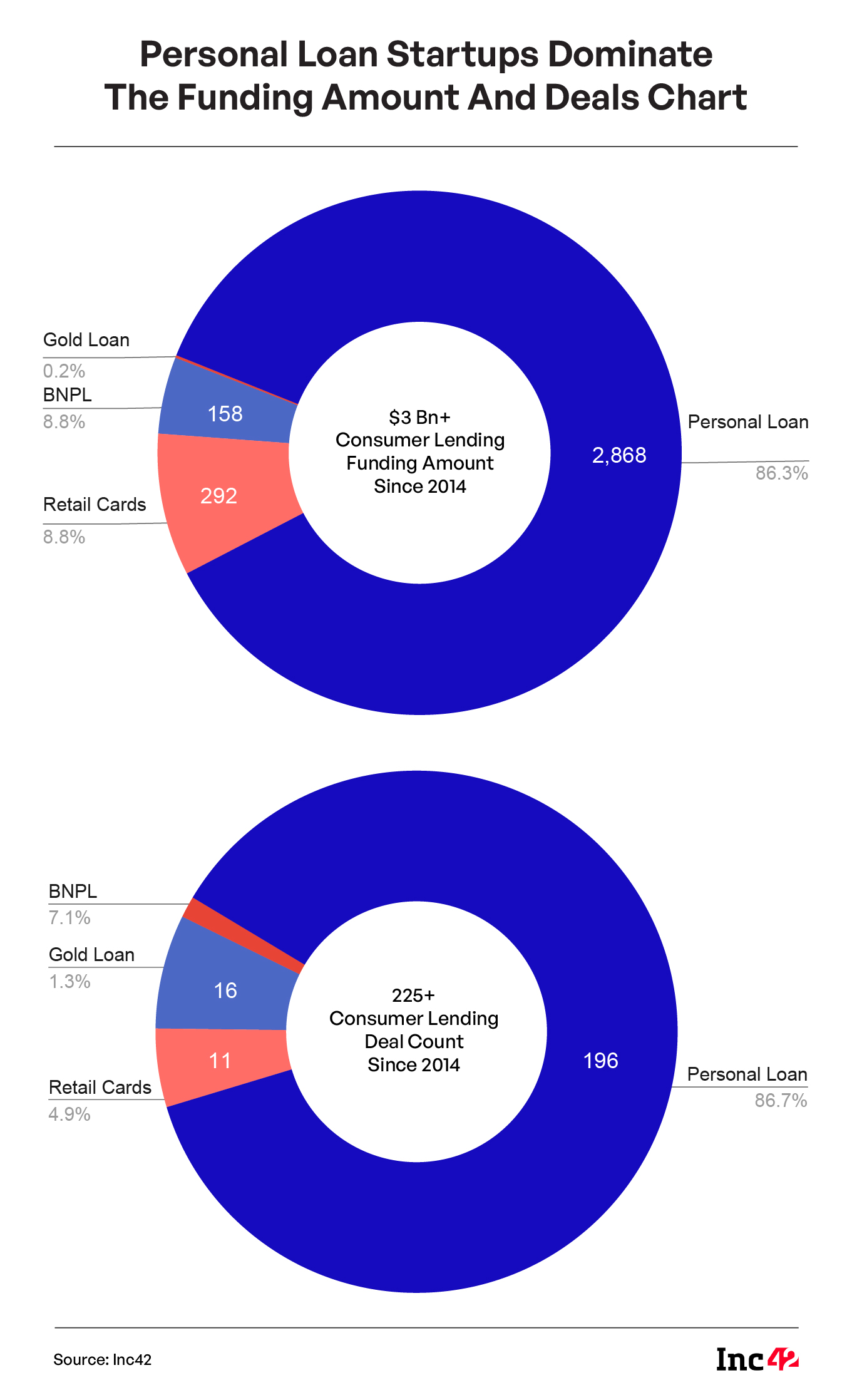

Startups offering personal loans in the digital consumer lending space lapped up a substantial 86.3% or over $2.8 Bn of the total $3 Bn+ raised between 2014 and Q2 2023. This is followed by retail cards at 8.8%, buy now, pay later (BNPL) at 4.8%, and gold loans at 0.2%

The Indian digital consumer lending market is projected to surpass $720 Bn by 2030, representing nearly 55% of the total $1.3 Tn+ digital lending market opportunity in the country, as per Inc42’s State Of Indian Fintech Ecosystem Q3 2023 report.

With a robust 22% compound annual growth rate (CAGR), the digital consumer lending market is poised to nearly triple in size, driven by several favourable socio-economic factors and timely regulatory measures.

Over the years, increased access to credit has been facilitated by the proliferation of digital lending apps, simplified KYC validation, and streamlined repayment options. This has led to a surge in lending through digital channels.

The segment has seen launch of several startups including the likes of — Rupeek, OneCard, Eduvanz Financing, Slicepay, Kissht, Cashe, LoanTap, Propelled, Early Salary, FlexMoney, MyShubhLife, and IndiaGold, among others

The CEO of digital consumer lending startup Cashe, Yashoraj Tyagi, points out that even for larger credit products like auto loans, housing loans, and loans against property, which traditionally relied heavily on physical processes, there has been significant digitisation of procedures such as customer onboarding, verification, customer support, and repayment mechanisms.

Overall, India currently boasts over 100 digital consumer lending companies, categorised into four primary sectors — personal loans, buy now, pay later (BNPL), retail cards, and gold loans.

Download The ReportThese startups have garnered support from prominent Indian investors such as Peak XV Partners, Blume Ventures, Accel, India Quotient, and others.

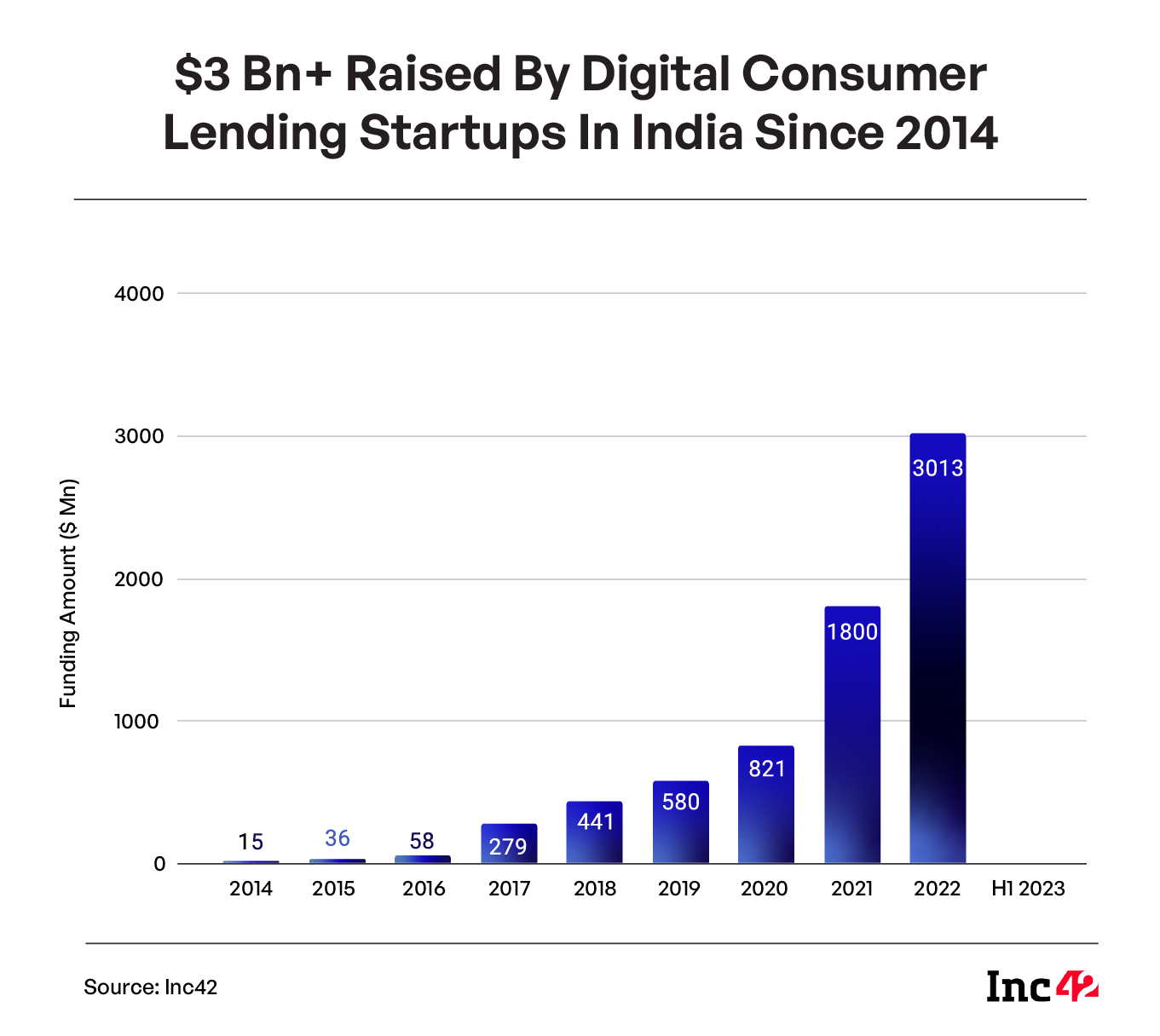

Collectively, Indian fintech companies in the consumer lending sector raised more than $3 Bn since 2014. Notably, funding in the consumer lending sector experienced substantial growth post-Covid, growing at a 73% CAGR between 2014 and 2022, outpacing B2B lending in terms of funding growth.

According to Vaas Bhaskar, Principal at early stage VC fund Elevation Capital, when we exclude those with low income and low credit scores, there is a potential audience of at least 300-400 million serviceable individuals. However, from this group, the formal channel is only able to serve around 100-120 million. This represents a significant gap, 4x of what is served today.

“As the cost of service becomes increasingly substantial, companies with a digital-first approach provide a more efficient means to serve and underwrite these consumers compared to traditional channels,” he added.

Personal Loans Gain Prominence

According to an Inc42 analysis, startups operating in the personal loan segment raised a substantial 86.3% or more than $2.8 Bn of the total $3 Bn+ raised in the digital consumer lending space between 2014 and H1 2023. This is followed by retail cards at 8.8%, buy now, pay later (BNPL) at 4.8%, and gold loans at 0.2%.

While analysts believe that all consumer lending categories are growing at a similar rate, personal loans are expected to experience faster growth compared to others due to their wide range of applications.

Furthermore, over the years, the income of Indian households has increased, leading to a rise in personal loan disbursements across various segments, including short-term low-ticket-size personal loans and long-term high-value personal loans.

According to a report by CRIF, the majority of personal loans disbursed in FY22 were under INR 1 Lakh in terms of volume, but in terms of value, most personal loans disbursed were in the range of INR 5 Lakh to INR 10 Lakh.

“We’re witnessing significant upward mobility, where the segment of affluent aspirants is expected to grow by a substantial 250 Mn in the coming years. This upward mobility is set to fuel the largest growth and income opportunities in the country,” said Krishnan Vishwanathan, founder & executive director of a digital lending app, RING, which operates the personal loan startup, Kissht.

Although the Indian economy is often characterised as savings-oriented, compared to credit-driven Western economies, the average Indian today is willing to take on credit to lead the lifestyle they desire.

This trend is further fuelled by major online shopping events like Flipkart’s The Big Billion Days Sale or Amazon’s Great Indian Festival Sale, which generate interest in offerings like BNPL and retail cards. These options provide flexibility, coupled with enticing discounts, rewards, and cashback incentives, which in turn attract consumers and accelerate the adoption of consumer lending.

Download The ReportWhat’s Fuelling The Rise of Consumer Lending In India?

Two key factors bolstering growth in the digital lending space are the increasing internet penetration (reaching nearly 49% of the Indian population) and the robust digital infrastructure, encompassing India Stack, which comprises components such as e-KYC, UPI, and account aggregator frameworks. These are collectively driving a comprehensive transformation of the digital lending economy.

Moreover, there is a growing understanding among regulators and policymakers that digital is the right approach to target financial inclusion, and much support is being given to meet the segment’s growth needs, Vishwanathan of RING added.

The digital lending guidelines provide much-needed regulatory clarity for regulated entities (REs) and Lending Service Providers (LSPs), addressing multiple grey areas and introducing transparency into lending processes. This strengthens due diligence and corporate governance on the startup’s end while increasing investor trust.

From a macroeconomic perspective, India has demonstrated resilience and growth even during challenging times. The expansion of consumer lending is also fuelled by the entrepreneurial mindset among the young population and Gen Z, who are actively shopping online. According to Inc42’s analysis, consumers across age groups, from 18 to 65 years and beyond, are exploring various digital lending options.

For instance, 17.74% or 250 Mn young adults between 18 and 24 years of age are seeking options such as buy now, pay later (BNPL) or instant personal loans, while 14.34% or 202 Mn middle-aged individuals in the 35 to 44 age group are interested in BNPL, corporate credit cards, secured lending, and instant loans.

Navigating The Next Phase

With the Indian government launching initiatives such as the BharatNet Project, Digital Saksharta Abhiyaan (DISHA) Program, and numerous apps offering services in regional languages, the ability of digital lenders to connect with consumers across the country has enhanced significantly.

However, as Cashe’s Tyagi points out, while the challenge of acquiring customers has largely been addressed, the real challenge now lies in practising prudent lending.

“Lending is about building a portfolio in the right manner, ensuring control, and refining underwriting strategies. It’s intriguing to observe how and when players will distinguish themselves and expand while optimising costs,” he said.

Furthermore, it is now evident that the next phase of growth in the digital lending sector will come from Tier II cities and beyond. Therefore, it is crucial for digital lending startups to build business models that can sustain growth and accommodate the necessary innovations along the way.

Importantly, given India’s current level of digital literacy, a hybrid model may be more suitable for long-term success, even though a fully digital model is more viable as a business concept.

Not to mention, the importance of investing in data privacy and protection for digital lending entities is paramount. The Digital Data Protection Act has come at an opportune time, placing customers at the centre of regulation and adding another layer of trust to the ecosystem.

Finally, with the expanding opportunity, digital consumer lending startups will be expected to develop more specialised products tailored to specific niches.

Download The Report

Ad-lite browsing experience

Ad-lite browsing experience