Shares of Nykaa have been under pressure over the last few weeks and touched a record low of INR 975.50 on Friday

The expiry of lock-in period for pre-IPO investors next month and the overall negative sentiment have led to a sharp decline in the share prices

Despite the increasing competition, analysts are bullish about Nykaa’s performance in the long-term

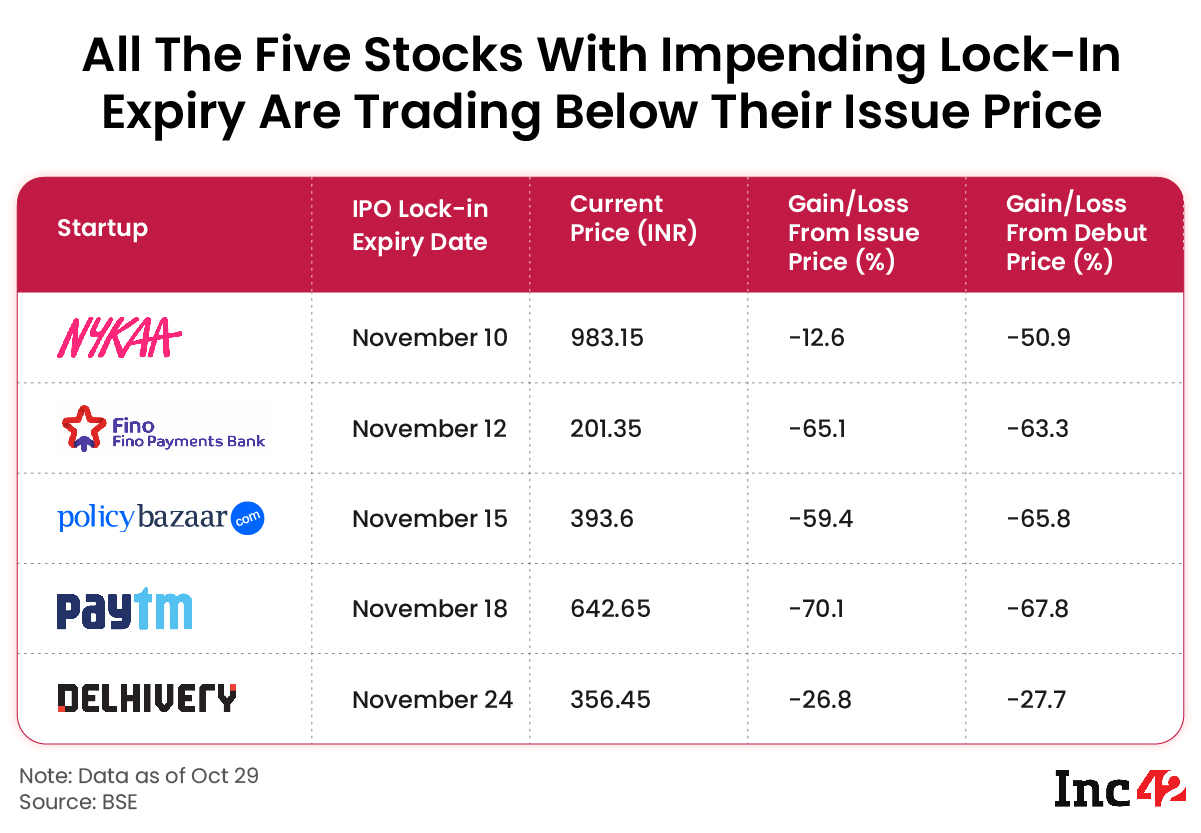

The new-age Indian tech stocks are passing through a difficult period, particularly the ones that have gone public over the last 18 months. These stocks are undergoing massive correction as the hype which surrounded them at the time of public listing has receded.

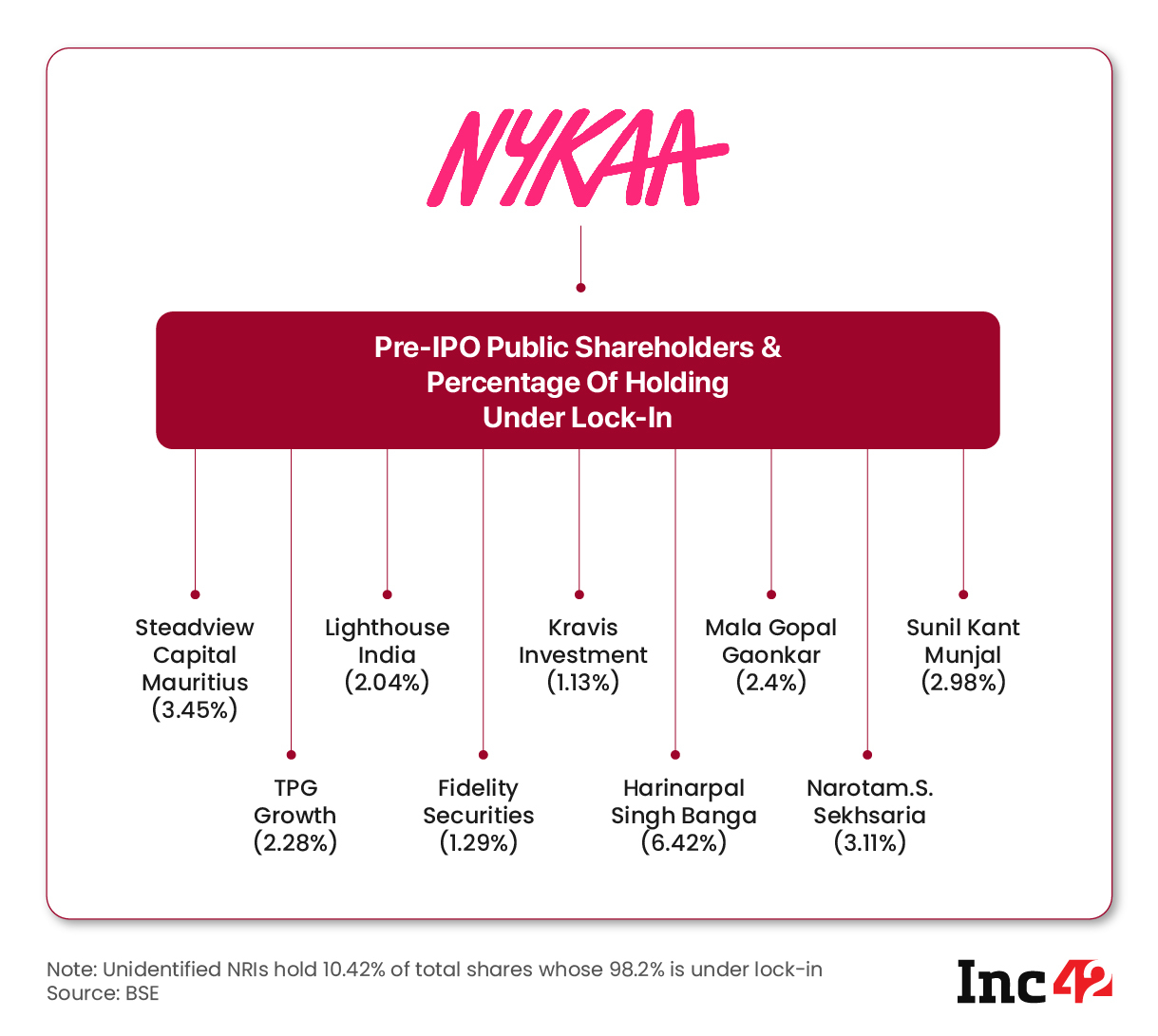

While most of the new-age tech stocks and the broader equity market have seen volatility over the last few months, the current negative market sentiment has taken a heavy toll on shares of Nykaa, Delhivery, Policybazaar, and Paytm. All four stocks have one thing in common – the mandatory lock-in period for their pre-IPO investors expires next month.

Besides, various business- and industry-specific headwinds have also played a major role in the current bearish sentiment surrounding these stocks. The increasing competition and slowdown in ecommerce spending due to inflationary pressure are such headwinds for fashion ecommerce giant Nykaa.

Though Nykaa has made various announcements about its omnichannel expansion, foray into new segments, and acquisitions for business growth, the startup hasn’t disclosed its sales numbers for the 2022 festive season.

While major ecommerce players in India — from Flipkart to Meesho, Amazon to JioMart — have put out their festive sales figures for 2022, Nykaa has not revealed them yet. Nykaa was also not immediately available to respond to Inc42’s questions on the same.

It is pertinent to note that the festive sales in 2022 were somewhat lacklustre as inflationary pressure kept consumer discretionary spending in check. A RedSeer report said that the total ecommerce gross merchandise value (GMV) during the first week of the Indian festive season touched $5.7 Bn, which was a 4X surge from the non-peak season. However, the average user spending during the period hardly witnessed any growth.

While it is not clear how festive season sales played out for Nykaa, some clarity can be expected on November 1 when the beauty ecommerce giant is expected to release its Q2 FY23 results.

Analysts are of the opinion that positive numbers in Q2 can result in a bounce back in the Nykaa stock that’s witnessing massive sell-off pressure.

Analysts Bullish About Nykaa

Falling since last week, Nykaa shares touched a new record low of INR 975.50 on Friday, ending the session over 6% lower at INR 983.15.

At the current levels, the shares are trading 12.6% below their IPO listing price of INR 1,125. Nykaa had one of the best debuts among the new-age Indian tech stocks last year, with its investors witnessing almost 100% return on their investments.

In fact, this could be a major reason behind a possible sell-off after the lock-in expiry, noted brokerage JM Financial in a recent research note.

“While Nykaa is certainly a differentiated play, but the fact that 12%+ shareholding is sitting on 100x returns might even be a reason enough for these investors to diversify their portfolio that might be overweight Nykaa,” the brokerage said. It also noted that any short-term dip might be a great accumulation opportunity for investors who want to build long-term positions.

Analysts are largely of the opinion that this is a short-term headwind and that the startup’s long-term growth trajectory remains strong.

There could be a revival in price after November 10, believes independent analyst Manish Shah.

“An examination of the price action shows that price decline in the last couple of days is accompanied by a massive increase in volumes. This type of price action where we see a parabolic decline with huge volumes is termed as volume climax,” explained Shah.

“Price can often see a very sharp spurt, once aggressive selling comes to an end prices revert back to the mean,” he added.

Similarly, Kunal Shah, senior technical analyst at LKP Securities, recently told Inc42 that a slight bound back is expected in Nykaa shares from here.

Meanwhile, amid the increasing pressure on the stock, brokerage firm Nomura initiated coverage on Nykaa with a ‘buy’ rating last week. It has a price target of INR 1,365, which currently implies an upside of 38.8% to the stock’s last close.

Nomura also has a long-term bullish stance on Nykaa and believes that the stock has the potential to double over the next five years. The brokerage believes that Nykaa, which earns 70% of its revenue from beauty and personal care (BPC) products, could emerge as a key beneficiary of the rise in aspirational spending on skincare and cosmetics from India’s young demographic.

Nykaa reported a 47% year-on-year (YoY) growth in its gross merchandise value (GMV) to INR 2,155.8 Cr in Q1 FY23, with BPC alone contributing 69% to it.

In its latest report on Nykaa, JM Financial also noted that the BPC segment in India would witness decadal growth as disposable income goes up.

“Nykaa will benefit from the growth of the organised sector in both BPC and fashion. We postulate that Nykaa stock can potentially correct due to the selling pressure in the short-term, but the risk-reward ratio is likely to turn particularly favourable for the medium to long term,” the brokerage added.

However, it must also be noted that along with the growth in demand in the BPC segment, new players are also stepping in the market. In fact, currently, Nykaa faces major competition from the booming D2C businesses in the country.

As the number of D2C brands increase, Nykaa has also started focusing more on the offline retail model of commerce.

Nykaa opened eight new physical stores across Pune, Delhi, Coimbatore, Ranchi, Ahmedabad, and Kolkata in Q1. Its total store count stood at 113 stores across 52 cities by the quarter-end.

Earlier this month, it also entered into a strategic alliance with the Middle East-based Apparel Group to recreate omnichannel beauty retail platform in the Gulf Cooperation Council (GCC) region.

Rising Competition

With a total of $2.1 Bn funding, FMCG D2C brands, including BPC brands, top the current list of the total number of funded players in the overall D2C market, as per an Inc42 report.

While Nykaa has grown tremendously over the past few years owing to the uniqueness it had in the Indian market as a multi-brand retailer and a house of brands, the competition is more intense now with startups like WOW Skin Science, Mamaearth, Sugar Cosmetics, mCaffeine, Plum Goodness, and Purplle posing a stiff challenge. Many of these startups use an omnichannel model to reach consumers.

An increasing number of these D2C startups also sell their products on the Nykaa platform, which has further increased the competition for the company’s private labels.

Another major area in which Nykaa is trying to increase its presence is the fashion segment. Apart from tapping on more brands across the globe to join its ecommerce platform, Nykaa has also started launching more in-house brands. The latest such launch was of GLOOT, marking Nykaa’s foray into the men’s innerwear and athleisure category.

However, with over 100 funded D2C fashion brands present in the country right now, including Bewakoof, Bombay Shirt Company, and innerware brands like Zivame and XYXX, the segment is highly competitive.

Nykaa has been acquiring brands to strengthen its presence in the crowded market it operates in. It has acquired skincare startups like Dot & Key and Earth Rhythm, and fashion brands like Kica and Pipa Bella.

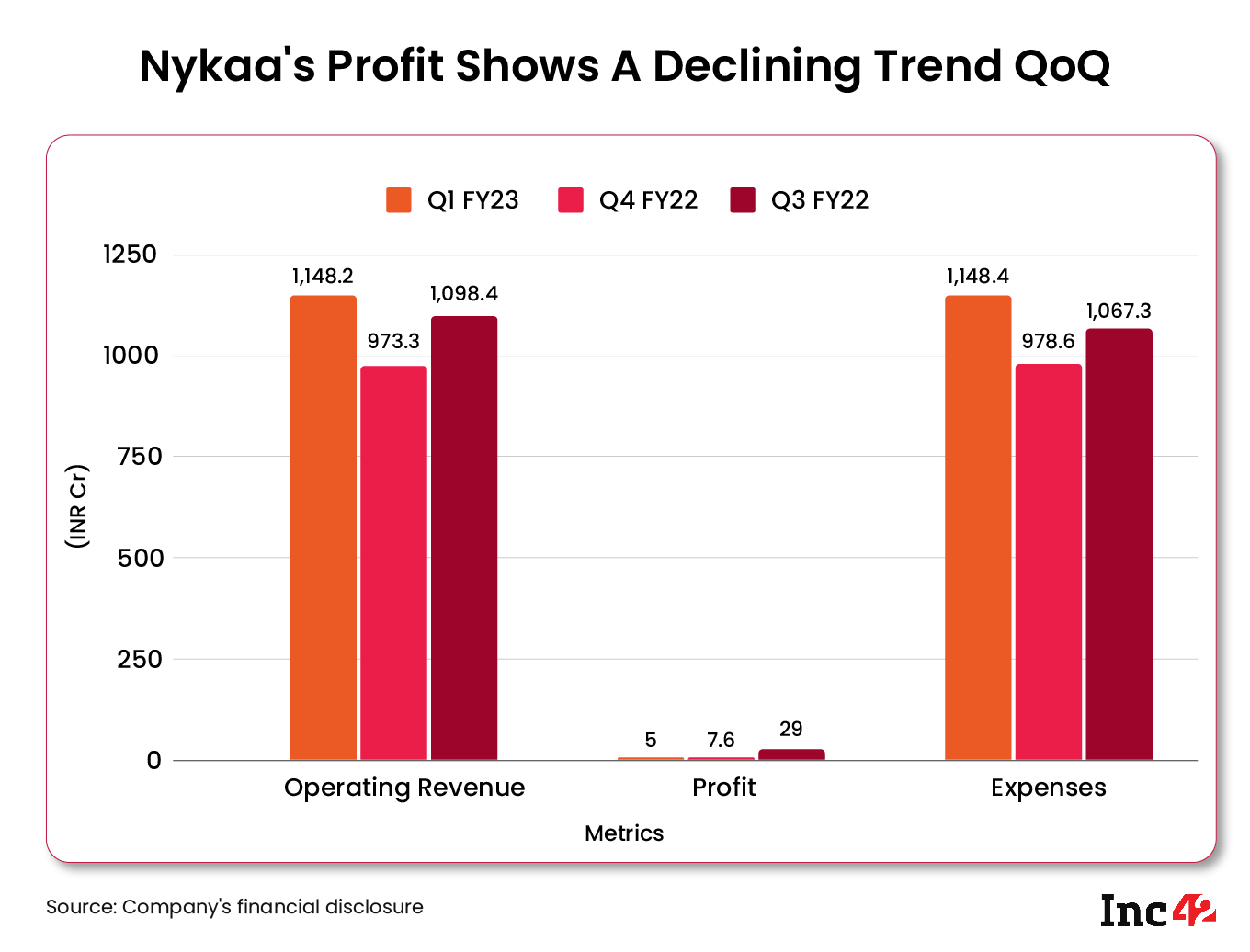

However, Nykaa has witnessed a decline in its sequential profit on growing expenses. Its net profit declined 33% to INR 5 Cr in Q1 FY23 from INR 7.6 Cr reported in Q4 FY22. The decline was also stark compared to a profit of INR 29 Cr in Q3 FY22.

Besides the D2C brands, the competition from legacy conglomerates is also growing. Recently, there were reports about Tata Digital mulling launching a new ecommerce platform to exclusively sell beauty and cosmetics products. If it happens, it would pose a direct competition to Nykaa.

On the other hand, Reliance Retail’s integrated omnichannel ecommerce platform AJIO is also growing. In Q2 FY23, AJIO witnessed another all-time high quarterly performance with its lingerie business more than doubling on a yearly basis. “AJIO Luxe booked revenue up 3.5x YoY; over 450 brands with 42k+ options live,” Reliance Industries said in its Q2 FY23 investor presentation.

In its report, brokerage ICICI Securities pointed out the increasing competition for Nykaa.

“Competition will likely intensify from both vertical and horizontal peers,” it said. “While we expect BPC revenues to grow, we believe Nykaa’s journey could be different – it will have to go more mainstream to drive this growth (tougher decisions about brand stretch along the way).”

The brokerage also noted that the launch of Nykaa everyday was a necessary step to help drive higher frequency, but its success would be difficult given Nykaa is not the cheapest place for BPC products and it also doesn’t solve the authenticity in the segment.

Nykaa is also trying to diversify its revenue and the launch of its eB2B platform SuperStore was an effort towards that direction. However, ICICI Securities raised concern over this foray, saying that though it would help Nykaa achieve scale, SuperStore might have lower value creation than its core business.

Overall, while most brokerages are positive about the long-term performance of Nykaa, the current headwinds, including the lock-in expiry, are likely to keep the shares under pressure in the short term.

Ad-lite browsing experience

Ad-lite browsing experience