With India’s regulations for IPOs posing a hurdle to tech startups, unicorns such as Zomato, Flipkart, OYO, Paytm and others are looking at overseas listings in the near future

While Sebi and lawmakers have tried to encourage domestic IPOs through startup listing platforms, these have seen lukewarm reception from the startup ecosystem

But is the dream of an overseas IPO all that it’s made out to be, and will opening up dual listing actually hurt startups more than it helps them as many experts and VCs claim?

After putting in their blood, sweat and hard work in the startups they founded, a slew of Indian founders have announced plans in the past few months to take their companies public within a couple of years. In a country running high on jingoistic slogans like Atmanirbhar Bharat and Vocal for Local, it should be a moment of pride as entrepreneurs look to contribute to public wealth creation through IPOs.

But the reality couldn’t be more different than the expectation in this case.

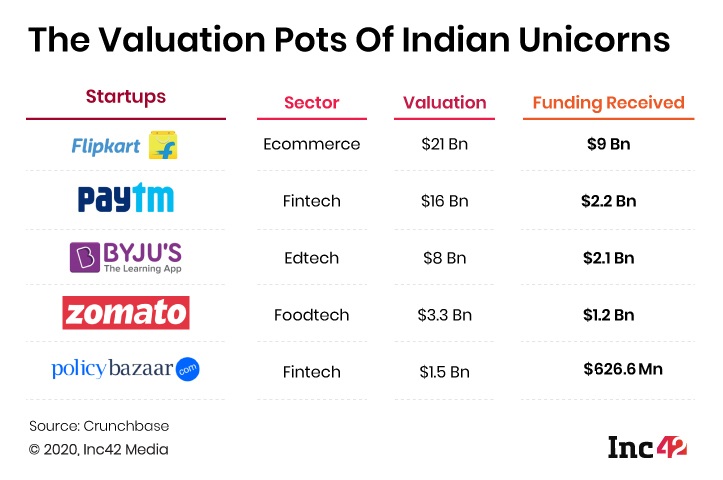

The idea of seeing Indian startups listed in India appears to be a far cry, at least for many of those who have announced plans. With unicorns such as Zomato, Paytm, Flipkart, BYJU’S, Paytm reportedly looking at public listing in the near future, the question nagging India today is: Can the country hold on to the wealth that will follow from their listing on stock exchanges?

As things stand today, a large number of startups are interested only in listing outside India.

Take, for instance, the case of ecommerce behemoth Flipkart which is registered in Singapore. While it has attained a $21 Bn valuation thanks to the Walmart acquisition and business growth, the company’s holding structure — the Indian business being a subsidiary of the Singapore-registered company — means that any sale or purchase of equity between investors will not be taxed as per the Indian laws. And if the company lists in Singapore or the US, Indian public market investors will have to jump through hoops to invest in the company.

Like Flipkart, the likes of InMobi, Curefit, OYO, Lenskart, Urban Company have such “flipped structures” registered in overseas jurisdictions such as Singapore, UK and Mauritius, due to better tax rates or finding opportunities to unlock capital in those regions. While the government has been okay with this template for attracting FDI through VC investments, this also means that these startups might use this route to venture overseas when it comes to listing.

Against this backdrop, the primary debate is whether startups will create long-term wealth in the Indian economy, or is India just a home base for them with an eye on the massive market?

With so many of the leading tech companies looking to go overseas to tap the public markets in those geographies, India is at risk of remaining just a marketplace for the world, while the long-term wealth generated by companies gets distributed among foreign nationals and institutions. Plus, as we will see, there’s more at stake than boiling it down to an India-vs-the-world question.

What Attracts Indian Startups To Foreign Listings?

“The investor community in India doesn’t have confidence that the startups can become multibaggers. So when they try to sell their story to such investors in India, they’re not able to get them excited. When they pitch it to overseas investors, who are more mature in understanding the value proposition, the response is ‘If you want our money, why don’t you shift base to a jurisdiction where we are more familiar with the laws? This is often driven by the perception of hassles of India’s legal and taxation system?’” — Suraj Malik, partner at management consulting firm BDO India.

Overcoming the lack of interest on part of India’s stock market investors and the stringent norms set by market regulator SEBI is no easy feat, particularly given the thirst for capital from startups in the growth phase. In an effort to dissuade startups from registering holding companies abroad in preparations for listings, the Indian government has considered the possibility of allowing Indian startups and companies to list in multiple jurisdictions.

But would that still mean that Indian retail investors would be largely left out of the value creation? Not quite.

“Despite listing abroad, MakeMyTrip still pays taxes in India for the business that it does in India so there’s no loss from that perspective. But the intangible loss is that the Indian investor base is not getting an opportunity to invest in the company,” said Santosh N, a valuation expert and managing partner at financial consultancy firm Duff & Phelps India.

But there’s another thing to be considered — Easing overseas listing rules does threaten the possibility of Indian startups listing in India at all.

That’s because most funding agreements between late stage startups and VCs have a clause that mandates future public listing , like in the case of Paytm with Softbank piling on IPO pressure. But while for Indian startups that currently means listing in India, any potential rule changes with regards to dual listing, could result in VCs mandating listing in a particular geography.

Gerald Manoharan, partner at J Sagar Associates, a corporate law firm that advises startups on funding deals, believes that the nature of late-stage funding might change with amendments in regulations easing dual listing.

“Investors doing Series F or Series G rounds may start having stipulations in the contract saying that the company will have to list in a foreign jurisdiction. I think see, because the government has obviously come up with this because there are people who are lobbying and there is probably a direction where some people are seeing such investment flows could be made practical,” he told Inc42.

India’s Listing Norms Are The Bottleneck

The Indian government and market regulator are evidently aware of the immediate problem.

The policy related to public listing has changed several times over the years. For instance, the startup ecosystem in the country cheered in June last year when the limit of differential voting rights (DVRs) for tech companies was increased from 26% to 74%, making the process easier for the promoters of such companies to go for IPOs.

Essentially, DVRs allow founders to have a greater say in key board decisions in case the board has too many external directors. It has been employed by the likes of Tata Motors and Future Retail to empower the founders and promoters to retain control of the board even if they have a minority stake.

Elated at the government’s decision, Ola founder Bhavish Agarwal had tweeted at the time: “Welcome SEBI’s move to allow Differential Voting Rights for Indian tech companies. I‘m certain this will encourage Indian companies to list within the country, backed by our own people. Made in India businesses and entrepreneurs can control their destiny and build for the world!”

The key change in the law was the removal of the earlier requirement of distributable profits for three years before a company was eligible to issue shares with DVRs. Similar profitability requirements have been quite the thorn in the flesh for startups looking to list on the Indian bourses.

But BDO India’s Malik points out another problem-the traditional parameter of profitability to assess the potential of a startup. “Historically, investors in Indian stock markets have looked at a company’s ability to make profits and pay dividends. Most startups will not have that as they might continue to be in burn or have accumulated losses which might impact the ability to pay dividends. Startups also usually fail to satisfy profitability track record criteria of the main board exchange,” he added .

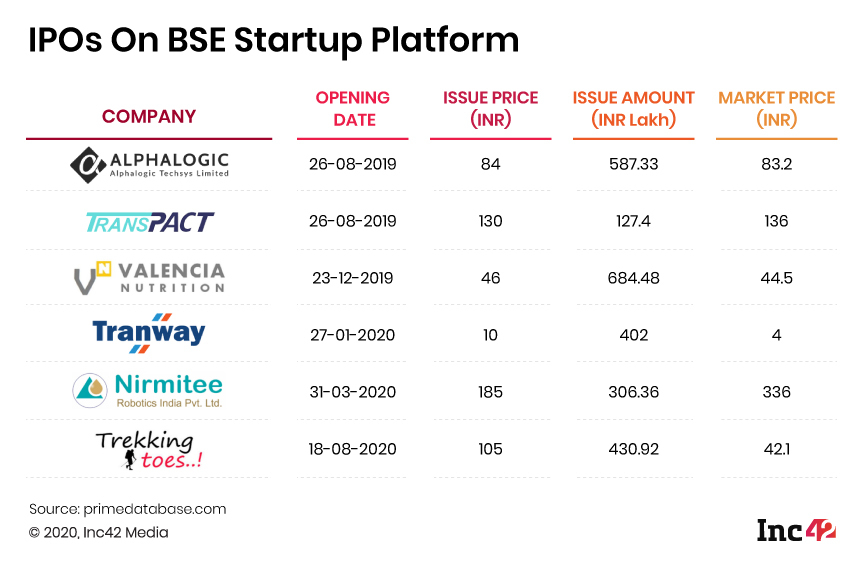

Though the Sebi and the top exchanges in the country have come out with relaxations in the profitability norms for listing through the Institutional Trading Platform (later renamed as the Innovators Growth Platform), startups haven’t warmed up to the idea — to put it mildly.

“Most large and well-known startups would like to list on the main board and not alternate platforms like Startup Platform, Innovator Growth Platform (IGP) or Institutional Trading Platform,” believes Pranav Haldea, managing director of Prime Database, a capital markets information provider.

Similarly, the BSE Startup Platform, which was floated in 2018, to attract tech startup listings hasn’t seen a lot of activity either; only six companies have signed up and none of them are names familiar to the tech ecosystem, according to Haldea.

Realising the tepid response to these so-called reforms, in 2019, Sebi made an attempt to attract startups to the IGP by revising norms to transfer to the main board. But all the changes hinge on one key point — a company has to first list on the IGP for a year, a factor that is bound to deter any big startup from pursuing this route.

Will Dual Listing Arrest India’s Wealth Drain?

Experts suggest one way for India to retain startup listings in the country while also giving companies the option of access to foreign capital markets is a twist on the conventional dual listing approach — essentially mandating an Indian IPO within a specific time frame after listing overseas.

Conflicting media reports on the issue in the past couple of months and the lack of any official communication from the ministry of corporate affairs have not helped matters. The fear among startups is that this could also lead to regulatory overlap, increase in compliance costs and plenty of grey areas in taxation policy, which have stumped even mega corporations such as Vodafone in the past

“If you list your shares of the Indian entity overseas, your larger foreign investors may still be liable to taxes in India and the Indian entity would be subject to compliances under the Companies Act.,” said BDO’s Malik.

He added that if an Indian company is listed on the NYSE, a lot of things will change such as founder compensation, insider trading laws, financial reporting norms, board composition and tax regulations. In absence of change to tax laws, it may not be practical for startups to go with dual listing

The compliance burden of listing in two jurisdictions would be too much for most startups — in developed markets such as the US, direct listing for startups would mean closer scrutiny as the onus would be on their regulators to ensure that unlisted foreign companies looking for capital have clean books and digital practices. Apart from the cost of completing all the due diligence procedures, the top management would also need to deploy a lot of time in roadshows and liaising with investment bankers.

“Listing again in the space of one or two years will kill them literally. If you ask Paytm or Ola to do that, it will probably say ‘What the hell and why should I list in two markets and split the liquidity of the shares”, exclaimed Duff & Phelps’ Santosh N.

But the problems with an overseas listing aren’t restricted to the foreign shores. A private company in India which wants to list overseas has to first convert itself into a public company, which means it has to make a lot more disclosures within the country as well.

These problems mean that mandating dual listing would be a damp squib as startups would rather take the easier route of predecessors such as MakeMyTrip and Yatra who shifted their companies overseas before listing on the Nasdaq.

The Case For Listing In India

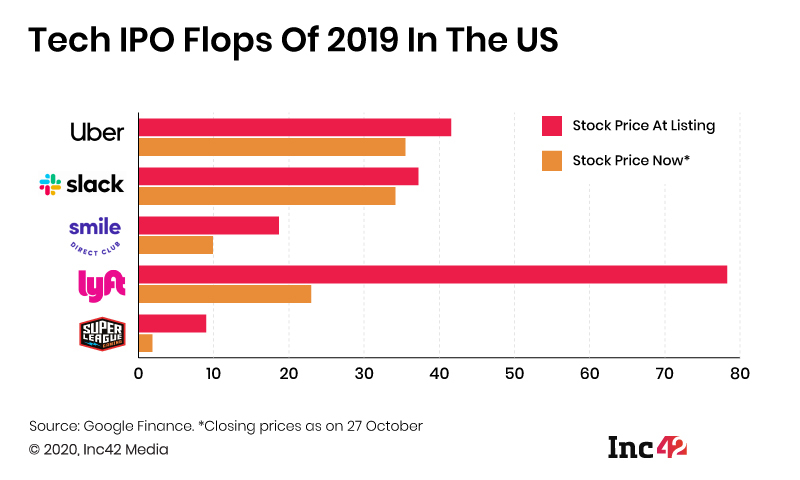

Apart from listing norms, the reason cited for startups heading outside is that retail investors in developed markets such as the US have a better appetite for technology companies that may be loss-making or burning a lot of cash.

Zerodha founder and CEO Nithin Kamath told Inc42 “Retail investors here track price to earnings ratio of a stock. Even if a loss-making startup lists here, it would be tough for them to raise money. From a raising money point of view, listing in the US is the better option because investors there have already got good returns from these types of companies and are open to investing in such startups.”

However, Kamath clarified that when Zerodha itself decides to go public it would make sense to list in India to allow its customers to invest.

It makes sense since customers who have used the product enough to understand that it fills a critical gap in the market are great potential retail investors who actually see the long-term value. Not only would Indian tech startups be foregoing this pool of high-quality investors, but they will also miss out on the hype that follows a listing.

But even the assertion that tech companies get better valuation outside India is weak. Take the example of Uber, Slack, Lyft and SmileDirectClub- all of these companies have had disappointing listing on the forieng bourses.

According to Siddarth Pai, founding partner at 3one4 Capital, the view that Indian retail investors are too dividend-minded to invest in stocks of tech startups isn’t entirely correct as any scrip today is evaluated as a growth stock or a dividend stock.

“From a visibility perspective, especially if tech companies started listing in India, most mutual fund houses would actually create a separate scheme for this and the acceptance rate from retail investors would be very high. Everybody wants to participate, but not everyone has the time required to sit and do detailed analysis for stock selection — they would prefer to make a sectoral or stage bet instead.”

A large number of people have investment philosophies to look for more growth stocks that are riskier but deliver faster returns as opposed to dividend-oriented stocks that are steadier but offer lower returns. And there are enough dividend stocks in the country already.

Plus, from a taxation perspective, dividend is now taxed as ordinary income in India since the additional dividend distribution tax has been scrapped from FY21. “So, if you’re under a high tax rate, say for example in the 30% income tax bracket, you would prefer capital gains which gets taxed at 10%,” Pai added.

Echoing Pai’s argument, Prime Database’s Haldea also believes that not all arguments in favour of an overseas listing are valid, as Indian capital markets have opened up tremendously in the last 30 years.

“In the early 90s, one could argue that that there were not too many foreign investors who had access to Indian capital markets or that Indian market wouldn’t provide the right valuation. However, our capital market is now highly evolved with a huge presence of institutional investors. Nearly 10,000-11,000 FPIs are registered with Sebi, and recent IPOs have seen a lot of demand from retail and HNI investors. There’s no dearth of demand,” he said.

Given that both sides of the argument are strong, what does it mean for India and its stock markets? While the regulators and lawmakers try to balance the scales and find a middle ground, for Indian startups, the dream of an IPO remains distant and blurry.

Ad-lite browsing experience

Ad-lite browsing experience