With the Indian central bank (and more than a dozen countries) launching CBDCs and the world witnessing a leap to Ethereum Merge, a robust and sustainable network update, all is not gloom and doom in the crypto space in 2022

While incidents like the FTX collapse, Vauld bankruptcy and the Terra-Luna crash have exposed the dark side of the global crypto giants, leading Indian exchanges, currently rated ‘poor’ by Nomics, need to be more transparent

Stakeholders expect the Indian government to regulate crypto and lower the taxes on the same in 2023

When disruptors cement their dominance in the global economy, there is always an unashamed paean of praise to mark their achievements. Over the past year or so, the value of cryptocurrencies took a drubbing, à la the stock market. But the industry’s fate was never in doubt for the long term. After all, in a decentralised world, nothing less than a tech wonder like crypto can be considered the future of money.

Although incumbents upholding fiat money continued to trash crypto’s intrinsic value and warned about its fiscal risks, many investors are attracted by the quick and fabulous returns seen in the past. In fact, the Reserve Bank of India recently started the first-ever pilot of the digital rupee to cater to the growing demand within a regulatory framework.

Download Annual Funding Report 2022The Indian central bank is not alone. More than a dozen countries, such as Russia, Thailand and South Africa, have launched similar pilots, while China has already entered into second phase of its pilot.

Add to that the Ethereum Merge, a sustainable network update for a more inclusive Web3 (of which DeFi and crypto are core components) and the rise of India’s Polygon that brings together Web3 technologies and use cases to build a global ecosystem. In brief, investors and enthusiasts considered it the year of the crypto (and Web3, as the next logical extension) until the fear of a dark future came home.

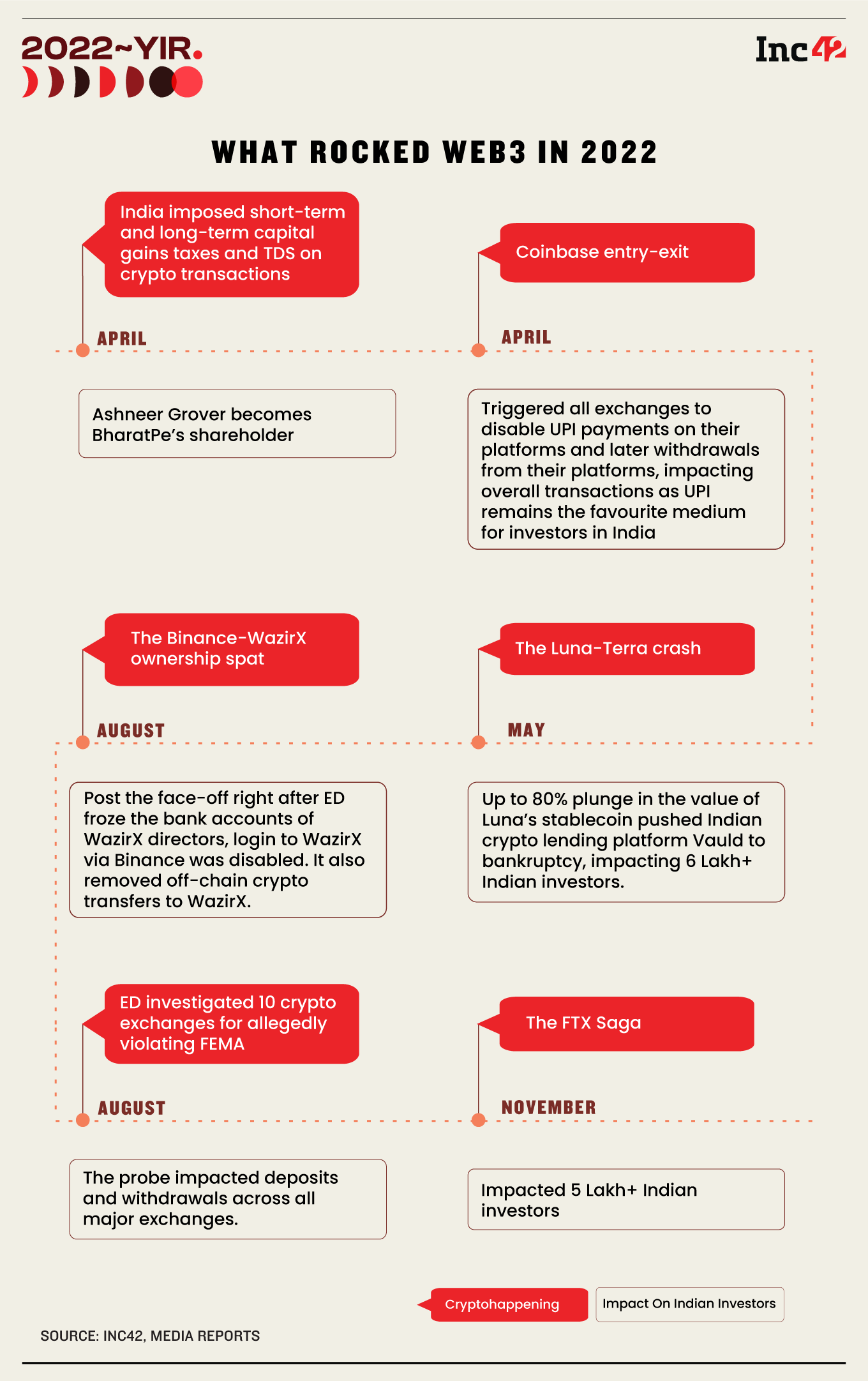

Incidentally, Indian crypto exchanges saw a significant lull in the bull run since April this year after the new crypto tax regime kicked in. What followed next was a spate of charges around financial irregularities and alleged violation of laws, leading to several investigations by the Enforcement Directorate (ED).

Globally, things got ugly enough after the Terra-Luna crash and the FTX collapse. As crypto investors in India and across the world still grapple with the humbling downfall of the industry giants, the demand for operational transparency and consumer protection grows more insistent.

The crypto saga and the companies in that space have entered a bleak winter. And given the uncertain legal status of cryptocurrencies in India – they are still not recognised as an asset class, but income from the same falls under the highest tax bracket – crypto companies at home are weathering a more turbulent storm than the West.

How The Ground Got Shakier At Home And Abroad

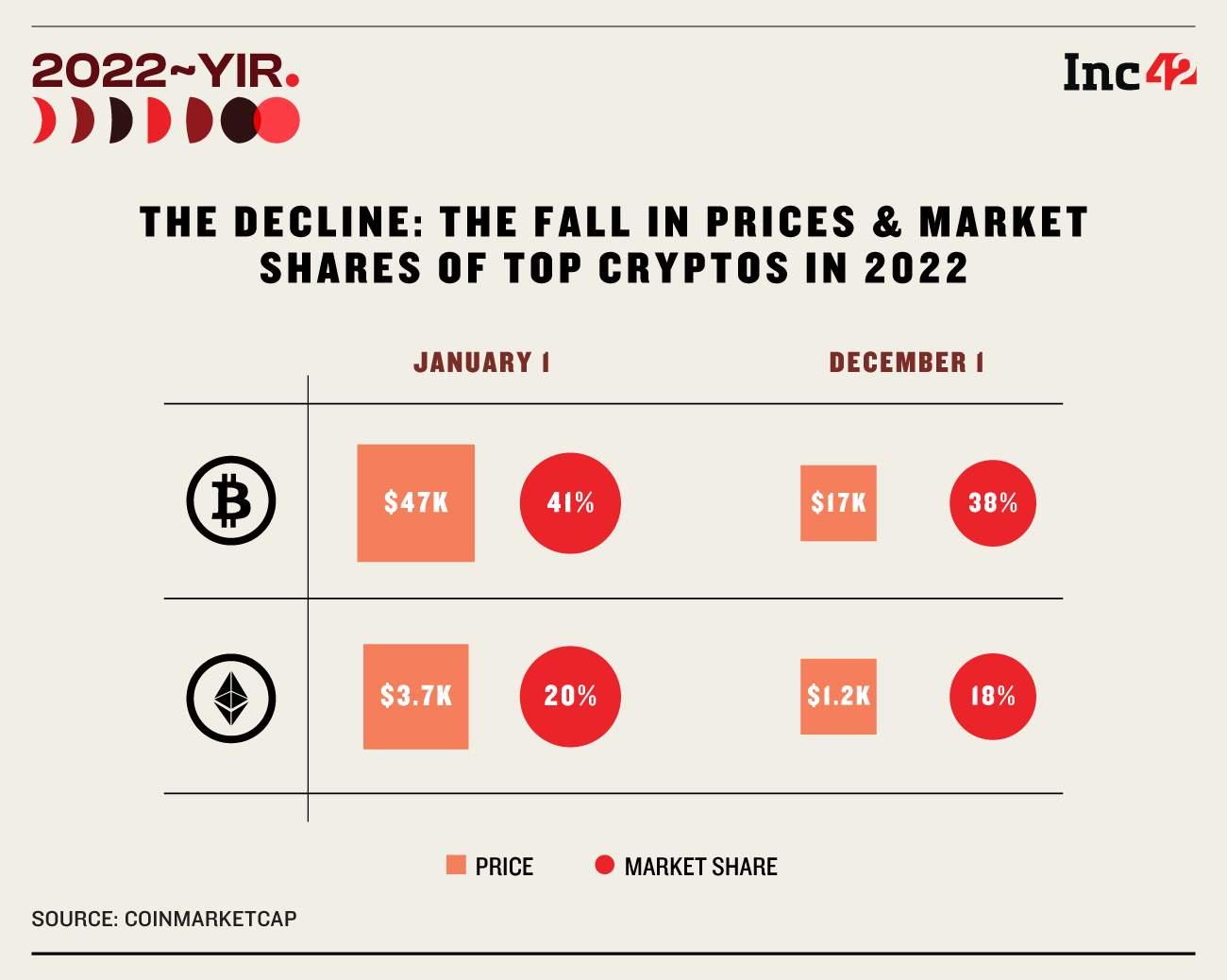

In spite of all the odds, crypto pundits never shied away from putting their weight behind the industry’s poster boy – the bitcoin. But bitcoin has also lost its charm in 2022, as its price and market share slumped by 60% and 3%, respectively.

Crypto’s credibility was further challenged by the demise of TerraUSD (UST), an algorithmic stablecoin pegged to the U.S. dollar (but not fully backed by reserves), and its sister coin Luna. Few questioned the kind of returns (around 20%) that the linked borrowing and lending platform called Anchor provided to all UST buyers who lent it to the protocol.

Soon enough, there was a bank run as most investors wanted to pull out their money after the stablecoin collapsed in May 2022, pulling down the crypto market cap by almost $1 Tn.

There was more bad news. The world’s leading NFT marketplace OpenSea’s trading volume dropped by 99% between May and August 2022, according to the analytics platform DappRadar. The marketplace processed nearly $5 Mn worth of NFT transactions on Aug. 28 compared to its record high of $405.75 Mn on May 1.

The sector suffered another setback when Meta shut down its digital wallet Novi and sold its stablecoin project Diem Payment Network’s assets worth $200 Mn this year.

However, the Indian market was impacted more by local incidents rather than global developments.

Take, for instance, the GainBitcoin scam, one of the oldest and biggest crypto Ponzi schemes. A recent report by Inc42 estimates that the overall size of the scam can be around INR 90,000 Cr (based on the wallets operated by its key masterminds, the late Amit Bhardwaj and his associates). Earlier, the Pune police put the scam size at INR 2,000 Cr, and later, the ED estimated it to be INR 20,000 Cr.

The year started with the crypto trading platform WazirX knocking on the door of the Delhi High Court. The company filed a writ petition, seeking to set aside ED proceedings. In August, ED temporarily froze WazirX bank accounts with assets worth INR 65 Cr after raiding its parent company Zanmai Labs.

However, the probes were not limited to WazirX alone. The agency soon conducted search operations against 10 major exchanges, including WazirX, Binance, CoinSwitch Kuber, CoinDCX, Vauld, ZebPay, BuyUCoin, Bitbns and Giottus, for Foreign Exchange Management Act (FEMA) or Prevention of Money Laundering Act (PMLA) violation.

It also summoned crypto exchange founders to appear before the agency and submit certain details. Understandably, the industry-wide inquiries worried India investors, but there were more triggers.

The abrupt exit of Coinbase, a US-based crypto exchange, within a few days of its India launch and the Binance-WazirX merger-demerger also put them in a tizzy. Although many found it amusing when Binance and Wazirx started a fight on Twitter to disown each other after ED probed the latter for alleged money laundering, the high drama cost investors who owned WRX tokens. Each token now costs $0.17, again a more-than-substantial dip from its price of $4.

However, India’s harsh tax policies slapped on crypto-based incomes have done the maximum damage.

A Close Look At The Tax Burden That Slashed Crypto Transactions By 10x

In February, 2022, the Indian government announced stringent tax regulations, sending a wave of shock and disappointment, especially among retail investors.

According to these mandates:

- Profits from crypto transactions will be subject to 30% taxation.

- Crypto investors cannot offset the gains from one cryptocurrency against losses from another to claim tax benefits.

- 1% TDS will be deducted for all crypto transactions from July 2022.

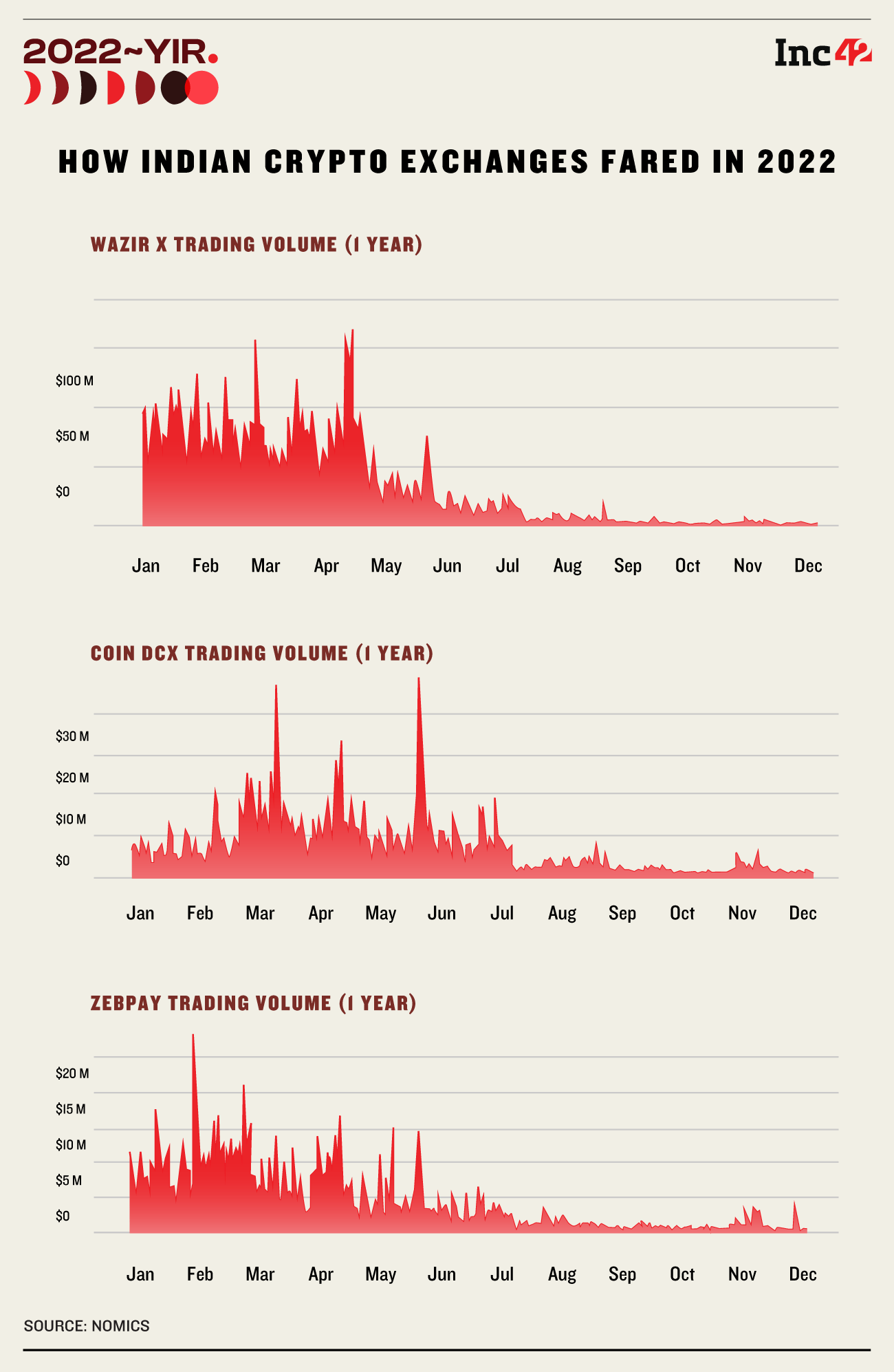

The news crippled the trade activities across Indian crypto exchanges. For instance, WazirX, the country’s leading crypto exchange at the time, saw its average daily transaction value dip to $1-5 Mn from July onwards compared to $100 Mn clocked earlier. Other exchanges also saw a massive drop in daily transactions due to an overwhelming tax burden.

Crypto Fell Prey To Funding Winter

India is home to more than 450 Web3 startups, of which crypto entities are a core component, and mainstream VCs have been quick to launch Web3-specific funds despite a harsh funding winter.

Sequoia Capital announced two new funds – a $2 Bn corpus for early-stage, venture and growth-stage startups in India and an $850 Mn dedicated fund for Southeast Asia. Sequoia India also invested in crypto companies like Polygon and CoinSwitch Kuber.

Again, Lightspeed Venture Partners, another leading VC firm, unveiled three U.S. funds worth $6.6 Bn and an early stage fund of $500 Mn for India. It also set up Lightspeed Faction, an independent team dedicated to building the blockchain infrastructure.

Despite these big announcements, capital inflow in Indian crypto startups remained low. According to Inc42 data, $513 Mn was invested across 32 crypto/Web3 deals in 2021. The momentum continued in H1 2022, as more than $773 Mn was raised across 39 deals. But there was a catch.

Unlike the rise in early stage funding across most startup sectors, most of the big funding was grabbed by the big names in the Web3 space during the first half of 2022. For instance, Polygon alone raised $450 Mn from Sequoia, Tiger Global, Softbank, and others.

Additionally, 5ire, a fifth-generation Layer-1 (L1) blockchain network, raised $100 Mn in Series A from the UK-based conglomerate SRAM & MRAM at a $1.5 Bn valuation. Barring these two mega deals, crypto funding had shrunk by around 75% this year as H2 failed to clock impressive funding.

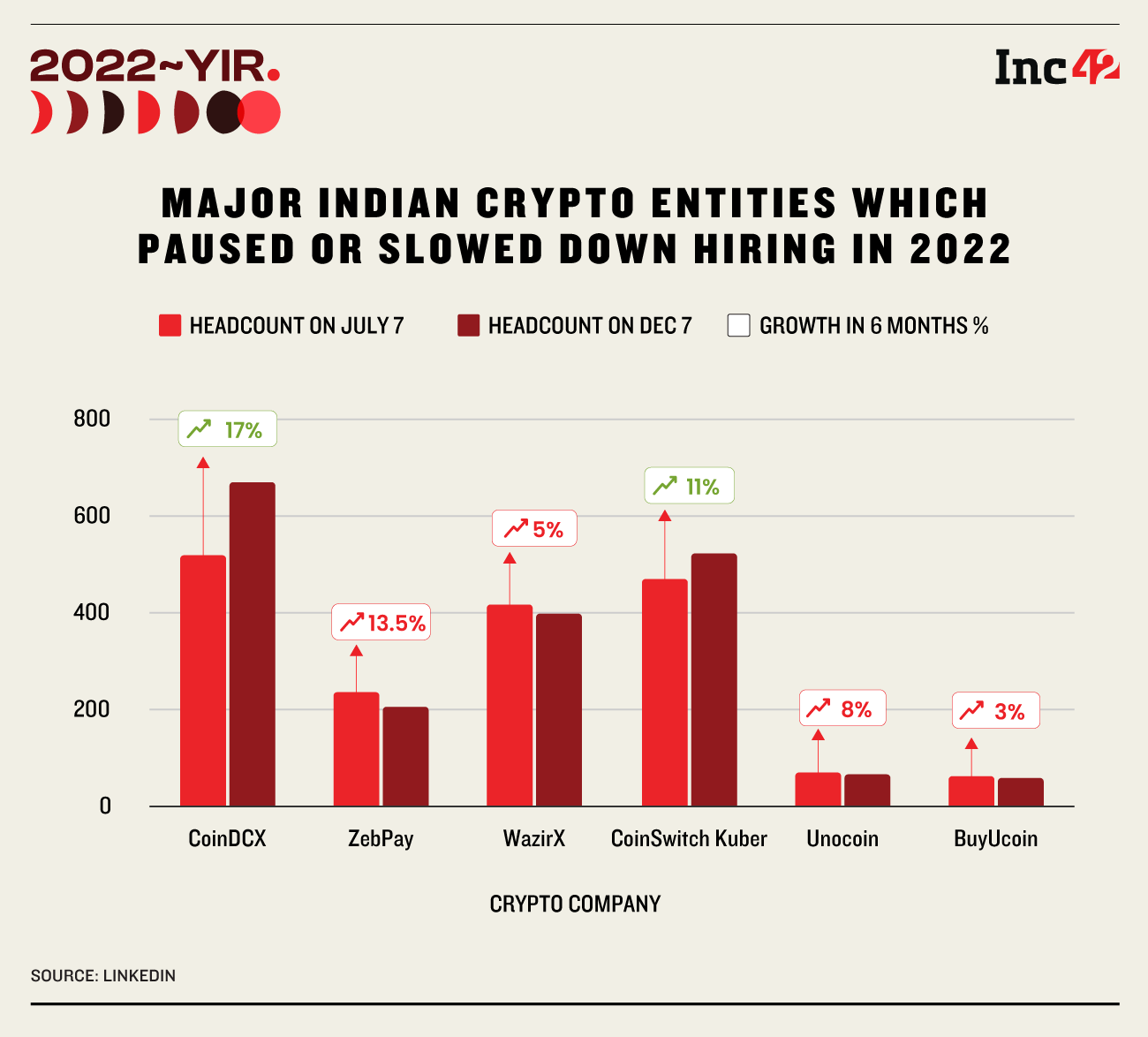

The funding crunch also led to a reduction in headcounts and an indefinite cap on growth plans in many crypto/Web3 startups as investors chose to wait and watch amid regulatory uncertainties, strict tax norms and ongoing government probes.

While some of the crypto entities have laid off some of its staff, CoinSwitch Kuber which had earlier announced plans to double its staff this calendar year has also slowed down its hiring. In the last six months, their headcounts have increased by just 11%.

Founders’ Exodus Hurts The Indian Ecosystem

The proverbial ‘brain drain’ may have been a thing of the past, but India is currently witnessing a mass exodus of HNIs and startup entrepreneurs looking for greener pastures to grow and thrive. A deep dive by Inc42 into the migration issue has revealed that the existing tax policies as well as the lack of crypto regulation in the country, make India a bad choice despite offering a good market.

It is one of the key reasons why 70% of the Indian crypto entities have moved their headquarters/administrative offices outside the country.

For startup founders, it is a clear choice – grow globally or languish at home.

After WazirX, ZebPay, Polygon, Coinswitch Kuber and CoinDCX (Primestack Pte) shifted their headquarters outside India, WazirX founders – Nischal Shetty and Siddharth Menon – reportedly moved to Dubai this year. Both have launched their brand new Web3 projects – Shardeum, an L1 blockchain, and Tegro, a Web3 gaming platform. But the Indian startup ecosystem may no longer gain from their entrepreneurial journeys.

Again, former top executives of CoinSwitch Kuber, including chief financial officer Sarmad Nazki, chief business officer Sharan Nair and head of new initiatives Krishna Hegde, resigned from the company to start their venture in July. The trio has launched PYOR, which aims to provide high fidelity insights into Web3 via a desktop analytics tool.

In fact, dozens of startups have shifted their base to Dubai, Singapore, Delaware or the British Virgin Islands or are in the process of doing so. Some, like EPNS, have already opened their office in Dubai. Other startups like CricStox are still exploring the best options abroad.

How Global Setbacks Dragged Down Crypto Investors In India

The Terra-Luna crash or the fall of FTX did not happen in isolation. When the TerraUSD (UST), the third-largest stablecoin, slumped from $1 to $0.000099 in May this year, it triggered the fall of several big crypto players, including Celsius, 3AC, Voyager Digital and Vauld, an India- and Singapore-based lending and borrowing platform.

The fall of Vauld: Post the TerraUSD meltdown, Vauld’s assets were valued at $330 Mn while the liabilities stood at $400 Mn, a net deficit of $70 Mn. On July 4, Vauld suspended all trading, withdrawals and deposits, citing ‘financial challenges’ due to massive withdrawals since June 12.

It also filed for creditor protection in a Singapore Court to keep the operations free of any lawsuit under Section 64 of the Singaporean Bankruptcy Law. What happened at Vauld reportedly impacted more than 8 Lakh crypto investors from India.

Incidentally, the Vauld impact has snowballed beyond monetary losses and raised questions about the transparency and accountability of the crypto platforms. Then again, dozens of finfluencers did paid promotions for the brand and asked people to lend on Vauld. Capital market regulator SEBI and the Advertising Standards Council of India (ASCI) took notice of the same and issued fresh warnings and guidelines regarding finfluencers promoting financial brands.

For context, Vauld is backed by a host of investors, including Peter Thiel’s Valar Ventures, Pantera Capital, Coinbase Ventures, and raised $27 Mn.

FTX decimation adds to India’s woes: Set up by Sam Bankman-Fried (SBF), the FTX saga exposed the shady side of the business. On Nov 2, the cryptocurrency news site CoinDesk published the balance sheet of Almeda Research (sister company of FTX), revealing that its single biggest asset was not held in bitcoin but in $3.66 Bn of unlocked FTT, an in-house token developed by FTX.

Once again, the exposé sent a shockwave across the industry. Binance, an early investor in FTX, had 23 Mn of FTT tokens it wanted to sell. But instead of issuing statements to clarify the balance sheet muddle, both SBF and Almeda’s CEO Caroline Ellison blamed Binance founder Changpeng Zhao (CZ) for the collapse.

In a repeat of a Terra-like incident, FTX halted all withdrawals on the platform following a rush of asset outflow worth about $6 Bn. Its implosion rocked the crypto space, leading to a record bitcoin outflow in November worth $1.5 Bn and the onset of a bearish market. Later, FTX filed for bankruptcy along with 130 affiliate companies.

In India, 5 Lakh/Mn people have reportedly invested in FTT and lost their money.

The FTX fallout has some critical learnings for investors, exchanges and policymakers. Although Federal prosecutors have charged SBF with ‘defrauding investors out of billions of dollars and making illegal campaign contributions’, there are still grave concerns about the safety of user funds held by centralised exchanges (CEX).

As John Ray III, the new CEO of FTX, said in a statement that the company had collapsed from shoddy management and “old-fashioned embezzlement,” regulations need to be tightened at all levels to ensure enhanced business transparency.

Interestingly, leading crypto exchanges in India, such as CoinDCX and CoinSwitch Kuber, have already released statements regarding their proof of reserves. But given how deep the rot is, there is little scope for self-regulation. India needs to do away with the policy paralysis at the centre of all crypto discussions if the sector has to win back user trust.

Year 2023: Reality Checks & Wish List

In Dickensian parlance, the year 2022 was paradoxically at its best and worst for the crypto/Web3 sector. A quick look at this space will help us understand what has gone well and what needs to be addressed to reduce risks and enhance benefits.

No restrictions on innovation, says govt: For the first time, the Indian government recognised cryptocurrencies by defining them under virtual digital assets. According to experts, the authorities have bestowed some legitimacy on crypto trading by taxing crypto-based income.

Speaking to Inc42 on an earlier occasion, Rajeev Chandrasekhar, the Union minister of state (MoS) for skill development and entrepreneurship, and MoS, electronics and information technology, said there was nothing to prevent anyone in India from innovating in crypto or the Web3 space.

“But when a crypto user/entrepreneur decides to start a crypto exchange and start gatewaying the rupee directly into crypto in violation of the foreign exchange rules [sending money abroad using crypto without complying with FEMA], there is a problem,” he added.

Demand for a regulatory framework grows: Given the recent catastrophic incidents across crypto markets, most stakeholders think India’s digital assets ecosystem needs a robust regulatory framework to protect users and ensure operational transparency.

Investors today demand that all crypto exchanges must provide proof-of-reserve and periodic transparency reports. Currently, it is not mandatory for crypto entities to disclose their proof-of-reserve data. However, CoinDCX recently published its data, while WazirX said it would share the information soon. The latter also publishes its transparency reports periodically.

Nevertheless, transparency tends to remain opaque in most Indian crypto exchanges, and Nomics has rated all as ‘D’ category entities, indicating ‘poor’ transparency.

“Regulations could have helped tackle situations like FTX collapse,” Punit Agarwal, founder of the crypto tax platform KoinX, earlier told Inc42. “For example, proof of reserves and proof of liabilities must be provided by an exchange so that there’s clear transparency between a CEX and its users.”

Incidentally, a successful framework will require stringent user data reporting from exchanges. The Organisation for Economic Co-operation and Development (OECD) recently published its framework designed to help tax authorities administer tax rules when taxpayers invest in crypto assets outside their country of tax residence. The crypto-asset reporting framework requires exchanges (and certain other businesses transacting crypto assets on behalf of customers) to submit the following data to the tax authorities with jurisdiction over them:

- Customer identity

- Trading activity

- Transfers to personal wallets

With India having taken over the G20 presidency this year, experts believe that India would once again push for a global framework over crypto and rightfully so.

Web3 employees want ‘fair’ incentives: This is crucial as NASSCOM estimates that the Web3 ecosystem currently employs more than 75,000 professionals, accounting for 11% of the global talent. For Indian workers, the remuneration has often been split into INR and crypto. But with crypto tax and TDS coming into play, employees are now doubtful about crypto-based incentives and how these will convert in absolute terms.

Recently, Bharat Web3 Association (BWA), a newly formed crypto advocacy group with members like CoinDCX, CoinSwitch Kuber, Polygon, Coinbase, ZebPay, WazirX and ANQ Finance, submitted a letter of concerns and recommendations to the finance ministry, demanding a significant reduction in TDS. During the upcoming Budget Session in February 2023, the stakeholders expect the finance ministry to lower the TDS from 1% to 0.2-0.5%.

The bottom line: Will these course corrections finally bring crypto back on track in India? Founders of crypto startups think so. Investors have waited far too long for the government nod to end a financially vulnerable, murky era associated with crypto. Once the authorities ascertain its legal status, markets will be bullish, and a good startup project will attract local and global funding.

Although 2023 may not be as dark a year as 2022, do not expect it to be in its prime like 2021. The previous crypto winter lasted from 2018 to 2020, and the current one could be longer, many believe.

However, it will be an eventful year as the RBI will expand its pilot projects to give the e-rupee a firm footing. Polygon will announce some grand Web3 projects as it plans to hire more than 200 engineers by 2023 and invest more. More importantly, we may see some new cryptocurrencies making a foray and gaining popularity.

Think of Cardano, a proof-of-stake blockchain platform that plans to introduce a stablecoin in 2023. Crypto/Web3 may soon get over the current chaos and again fascinate ‘changemakers, innovators and visionaries’ to bring about meaningful changes.

[Edited By Sanghamitra Mandal]

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience