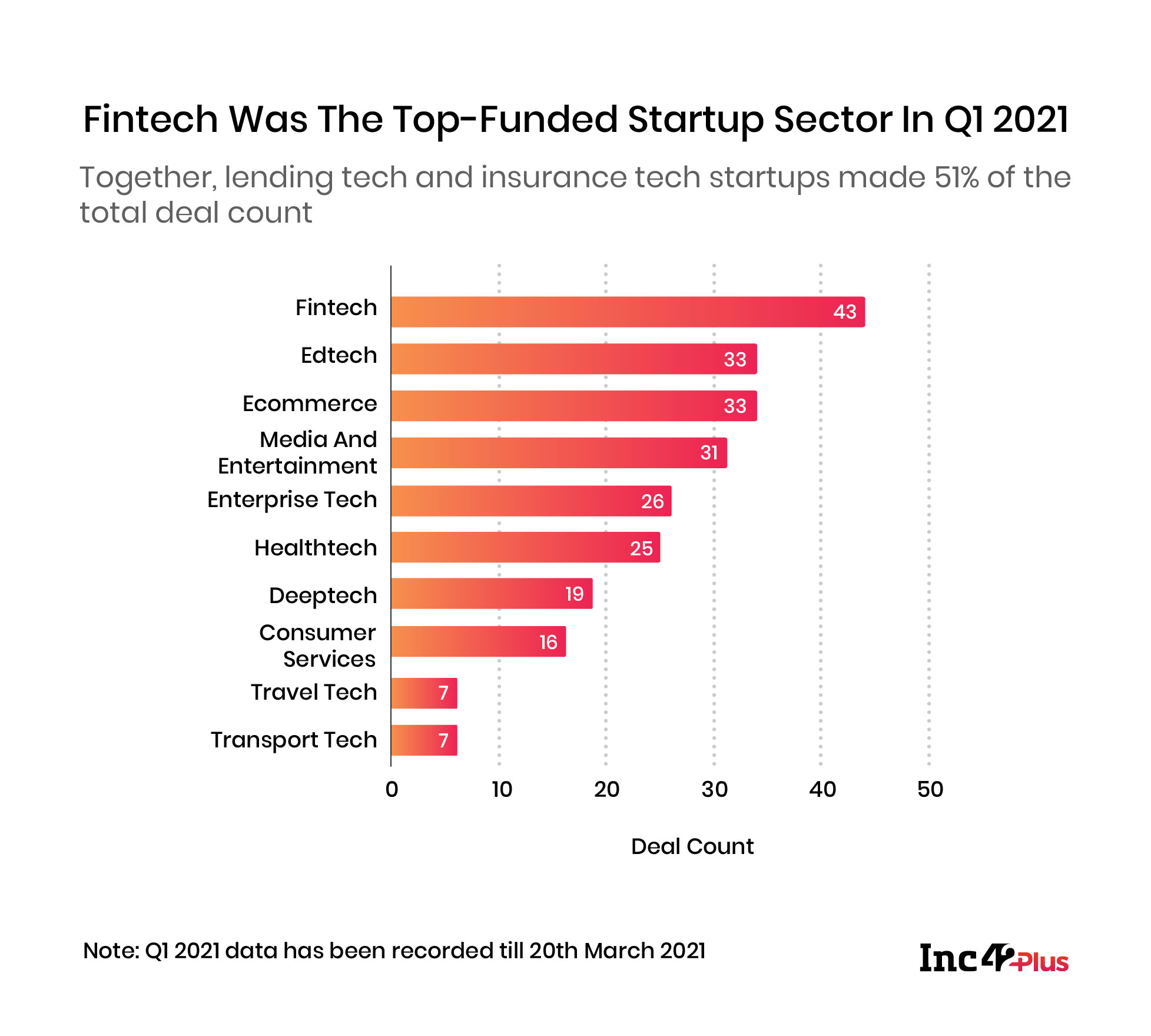

Fintech was the top-funded startup sector in the quarter

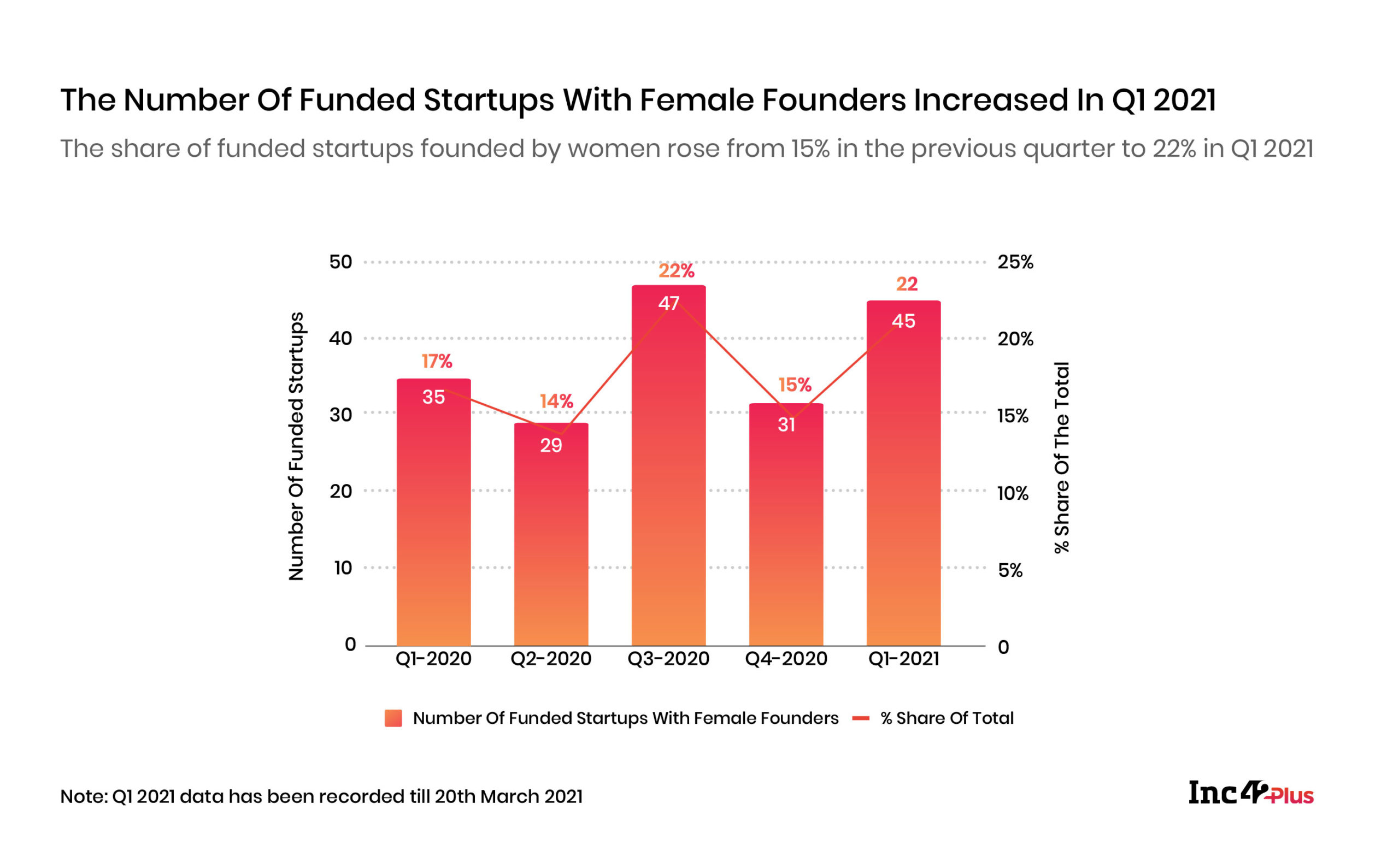

22% of all the startups funded in Q1 2021 had a female founder

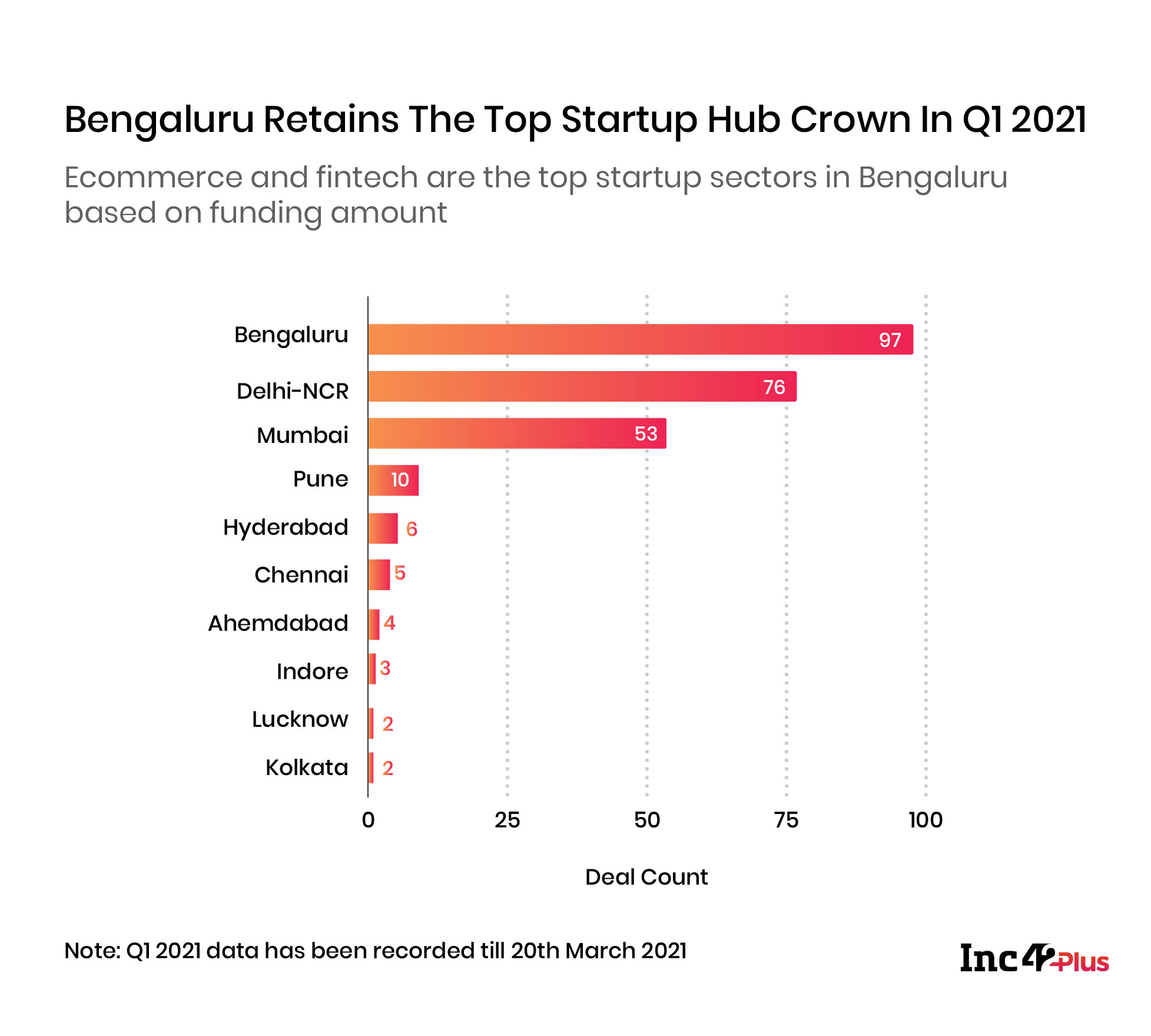

Bengaluru recorded the highest number of funding deals in Q1 2021

Despite the havoc inflicted by the Covid-19 pandemic on the Indian economy, Indian startups managed to raise $11.5 Bn from 924 funding deals in CY2020. Both the funding amount and the deal count were higher than the yearly average (2014-2019) of 18% and 8%, respectively.

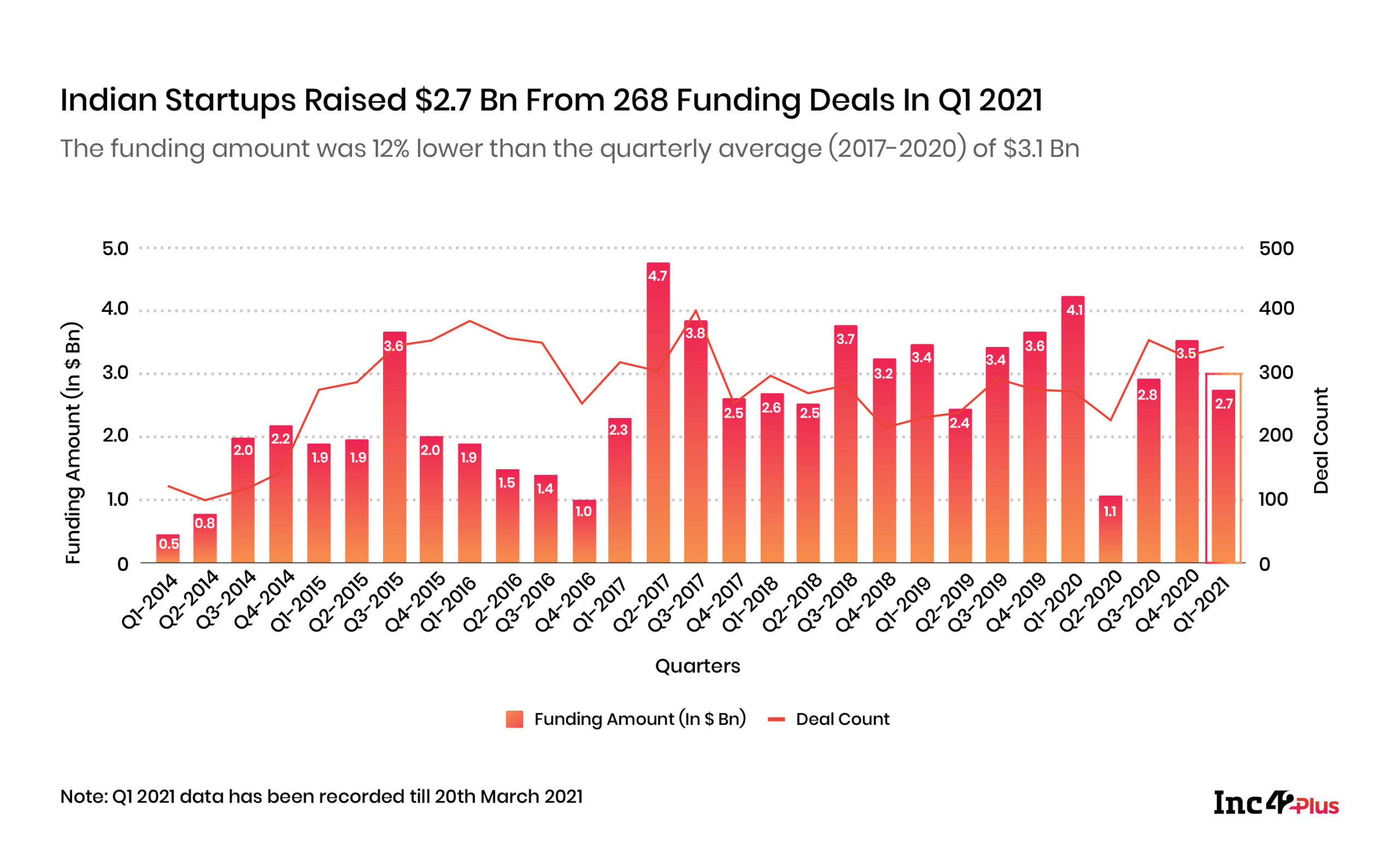

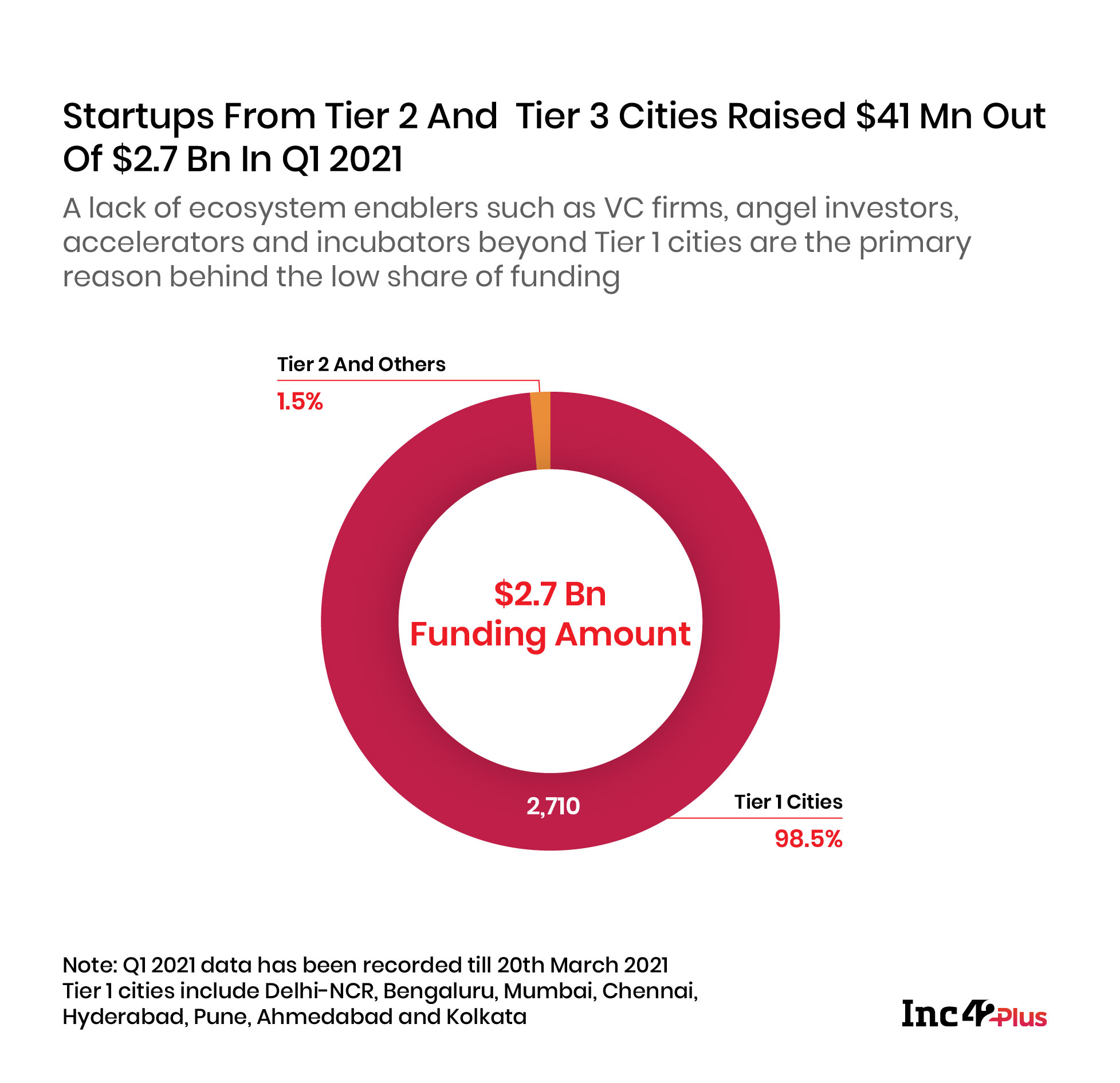

In the first quarter of 2021, Indian startups raised a total of $2.7 Bn from 268 funding deals. However, the funding amount was 12% lower than the quarterly average (2017-2020) of $3.1 Bn.

On the other hand, the deal count was 20% higher than the quarterly average (2017 to 2020) of 223. The combination of a downward trend in the funding amount and an upward trend in the deal count can be attributed to the lower number of mega funding rounds ($100 Mn and above) recorded in Q1 2021. The number of eight mega-rounds recorded in this quarter was 20% lower than the previous quarter Q4 2020 (10) and 27% lower than the 11 deals recorded in Q1 2020.

Fintech was the most preferred startup sector in Q1 2021. Compared to the previous quarter (Q4 2020), the number of funding deals was 26% higher. It was also the top startup sector in 2020. A primary reason for the rising investor confidence in the fintech sector is that products like digital payments, loan discovery and insurance discovery are among the tech products with the highest user penetration in India. The growing internet penetration, clubbed with the government’s push for fintech adoption, is set to expand the addressable fintech market further.

Funding Plummets By 22% In Q1 2021 Compared To The Previous Quarter

Overall startup funding in Q1 2021 saw a depletion compared to Q1 and Q4 2020. Total funding was 35% lower than Q1 2020 and 22% lower than Q4 2020.

As for deal count, Q1 2021 recorded 268 funding deals, which was 4% higher than Q4 2020 (257) and 26% higher than Q1 2020 (212). Seed-stage funding deals that made a majority share of 47% (127 out of the total 268) were higher in Q1 2021 than Q1 and Q4 2020.

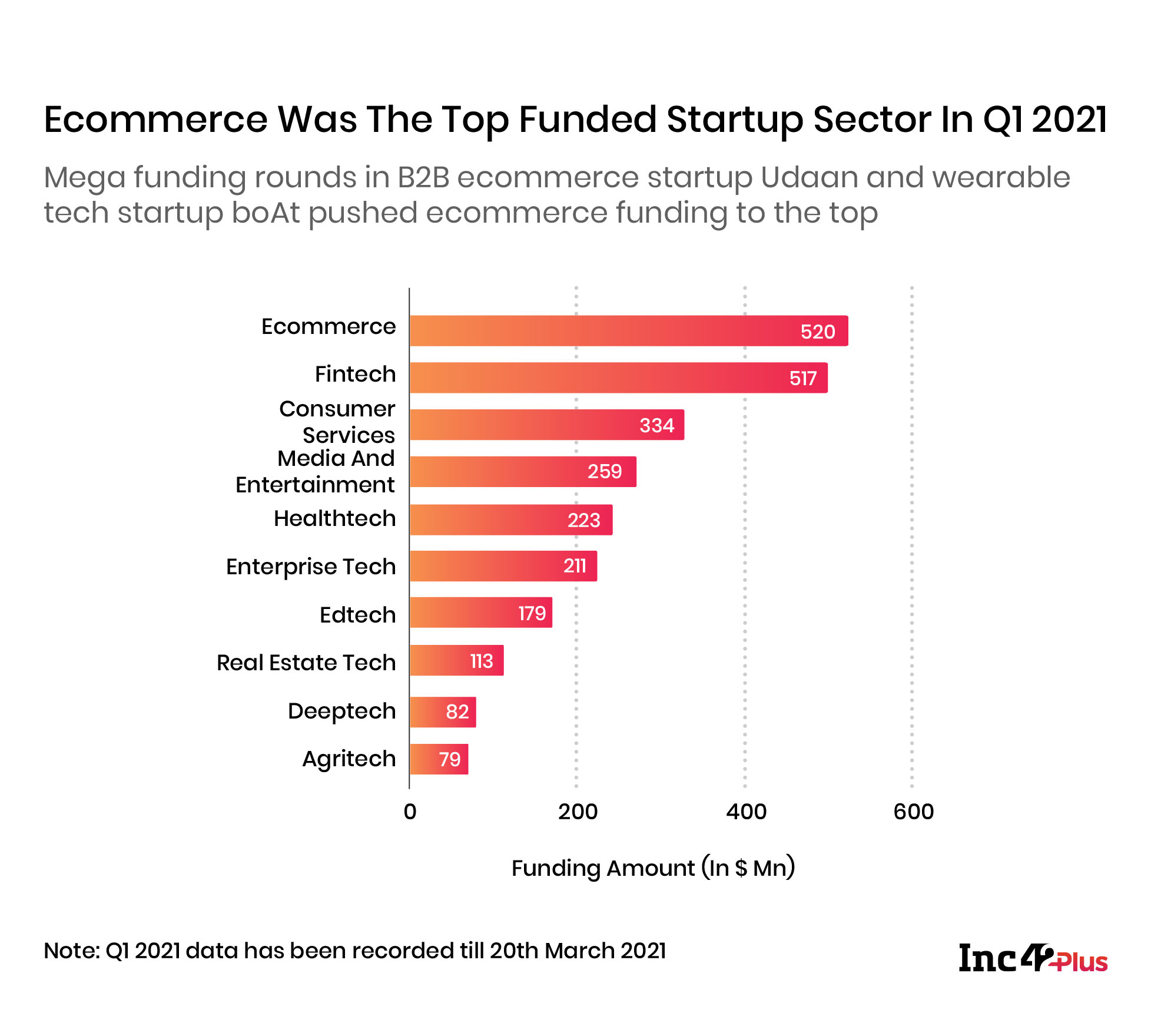

Top Startup Sectors In Q1 2021

Fintech was the top startup sector in Q1 2021 as it recorded the highest number of funding deals. We prioritise deal count as a better indicator of sector/hub performance because there is no impact of outlier funding rounds on the number as opposed to funding amount. However, in the context of capital inflow value, ecommerce was the top startup sector in 2021, bagging a total of $520 Mn (or 19%) of the $2.7 Bn total funding raised by Indian startups in Q1 2021.

“In the fintech sector, investor confidence in lending tech and insurance tech startups is higher, while in ecommerce, D2C brands are gaining traction like hotcakes.”

Top-Funded Startup Hubs In Q1 2021

Bengaluru is widely regarded as India’s startup capital and the investment scenario by the end of Q1 2021 solidifies this claim. Interestingly, in all 29 quarters between 2014 and Q1 2021, Bengaluru retained the top spot in 24 quarters or 83% of the time.

“Among Bengaluru, Delhi-NCR and Mumbai, the Delhi-NCR startup ecosystem saw the highest growth (33%) during Q4 2020-Q1 2021, followed by Bengaluru (1%), while Mumbai’s deal count remained the same at 53 in both quarters.”

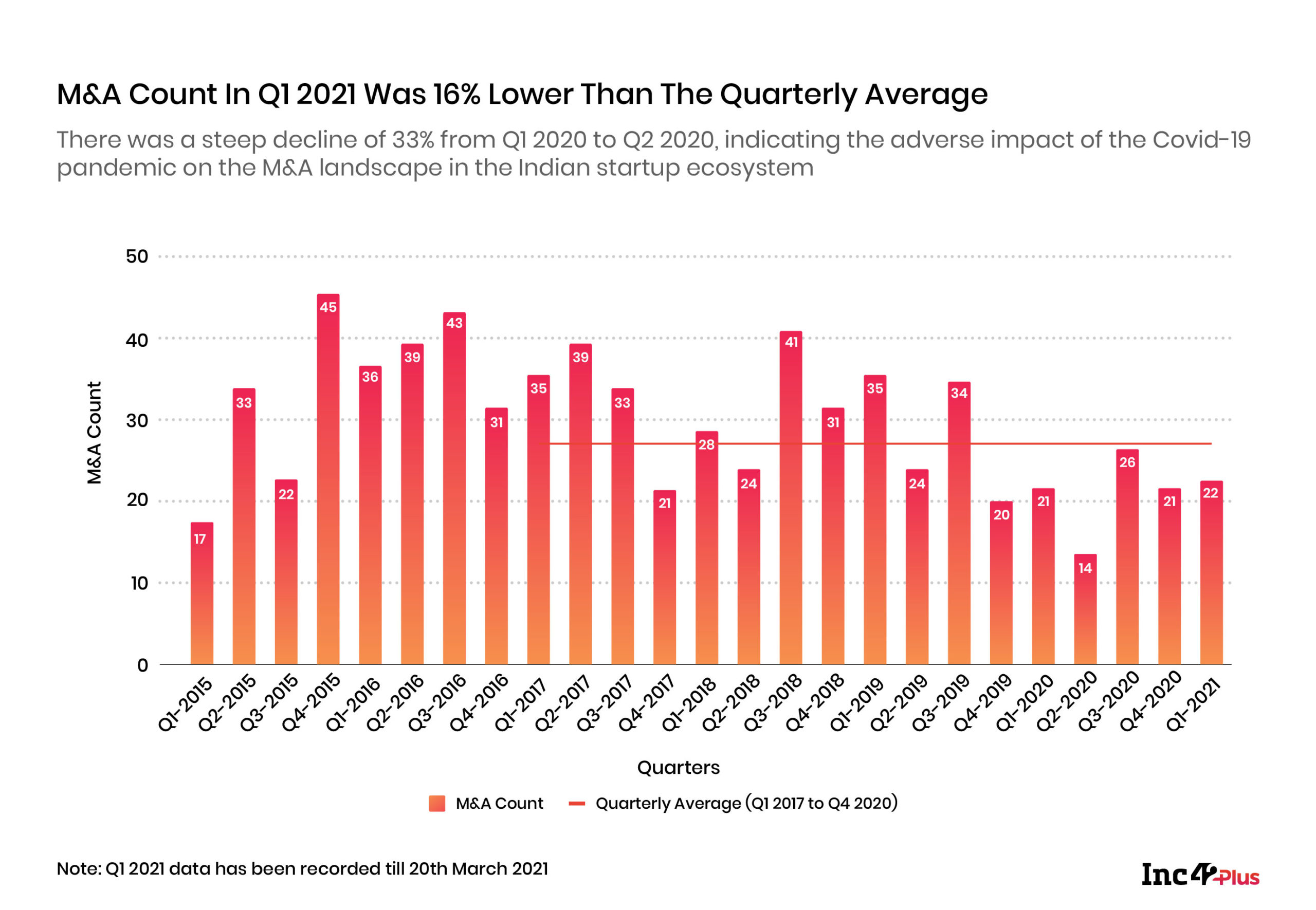

M&As And The Investor Ecosystem

In Q1 2021, the total count of M&A deals in the Indian startup ecosystem stood at 22, which was 16% lower than the quarterly average (Q1 2017-Q4 2020) of 26. Edtech and media and entertainment startups recorded the highest number of mergers and acquisitions in this quarter.

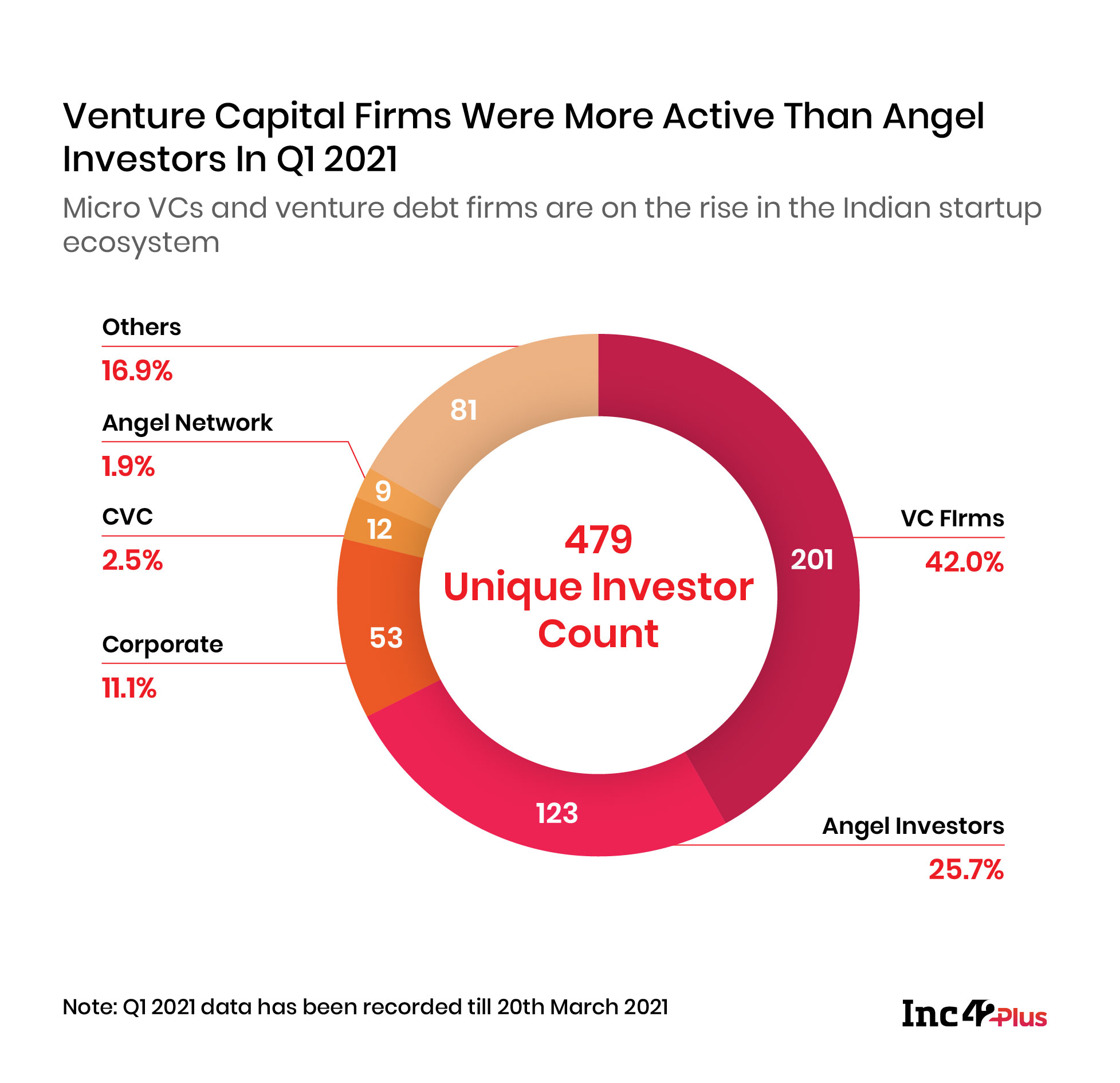

In the first quarter of 2021, the total number of active investors in the Indian startup ecosystem stood at 479, out of which VC firms made the majority share, accounting for 42% (or 201) of the total.

More insights into Indian startups’ performance in Q1 2021, including funding stage-wise analysis, investor type split, hub-wise startup funding and more, are available in our upcoming report in association with Dell. The Indian Tech Startup Funding Amount Q1 2021

Ad-lite browsing experience

Ad-lite browsing experience