Eleven out of 15 stocks under Inc42’s coverage ended the week with gains, rising in a range of 0.3% to almost 10%

Tracxn Technologies slumped 10.5% this week after reporting weak Q1 FY24 earnings, while Fino Payments Bank, ideaForge, and EaseMyTrip also declined

RBI’s MPC meet, inflation data, ongoing Q1 FY24 earnings season, crude oil inventories, US inflation data expected to drive the market in the coming week

Foodtech giant Zomato reporting its first net profitable quarter this week seems to have completely turned the investor sentiment towards Indian new-age tech stocks. While it might be a bit too early to say if these stocks are out of the woods, it is clear that the market has started seeing the long-awaited positive signals from these companies.

Riding on the back of Zomato’s surprise delivery of profit, 11 out of the 15 new-age tech stocks under Inc42’s coverage gained this week.

While Zomato jumped almost 10% this week, DroneAcharya rose 9.6%. PB Fintech soared 9.2%, while the likes of Nazara Technologies, Delhivery, and Paytm rose in a range of 0.3%-5% on the BSE.

However, despite an overall positive sentiment towards IT stocks in the domestic equity market, Tracxn Technologies slumped 10.5% this week after its weak Q1 FY24 earnings report. Fino Payments Bank, ideaForge, and EaseMyTrip also declined in a range of 1%-4% on the BSE this week.

Benchmark indices Sensex and Nifty 50 slumped earlier this week but regained their momentum on Friday to end the session in the green at 65,721.25 and 19,517, respectively. However, both the indices fell 0.7% in the week.

Commenting on the performance of the market, Siddhartha Khemka, head of retail research at Motilal Oswal, said domestic equities saw some respite on Friday after witnessing selling pressure in three consecutive sessions on the back of India’s services activity rising sharply to 62.3 – the highest level in 13 years.

“A niche sector like ecommerce was also in focus after Zomato reported an excellent set of numbers and turned PAT positive. Global markets remained cautious after the US reported poor service PMI data and US jobless claim data, thus increasing rate hikes bets,” said Khemka.

“Next week would be crucial from the domestic point of view as the Reserve Bank of India (RBI) is set to announce its interest rate decision. Thus, markets are likely to move in a broader range with some volatility,” he added.

Meanwhile, it is pertinent to note that Morgan Stanley upgraded India’s status to “overweight” this week while downgrading China to an “equal-weight” rating. The brokerage believes that India is poised for substantial and sustained economic growth at a time when the rest of the world is slowing down.

Arvinder Singh Nanda, senior VP of Master Capital Services, opined that the market will react to the upcoming RBI policy, inflation data, forex reserve data, ongoing Q1 FY24 earnings season, crude oil inventories, US inflation data, US Initial jobless claims, and UK GDP data in the coming week.

Amid a rebound in the Indian IPO market, another new-age tech stock, Yudiz, launched its public issue this week. The blockchain and IT development company will get listed on the NSE SME platform.

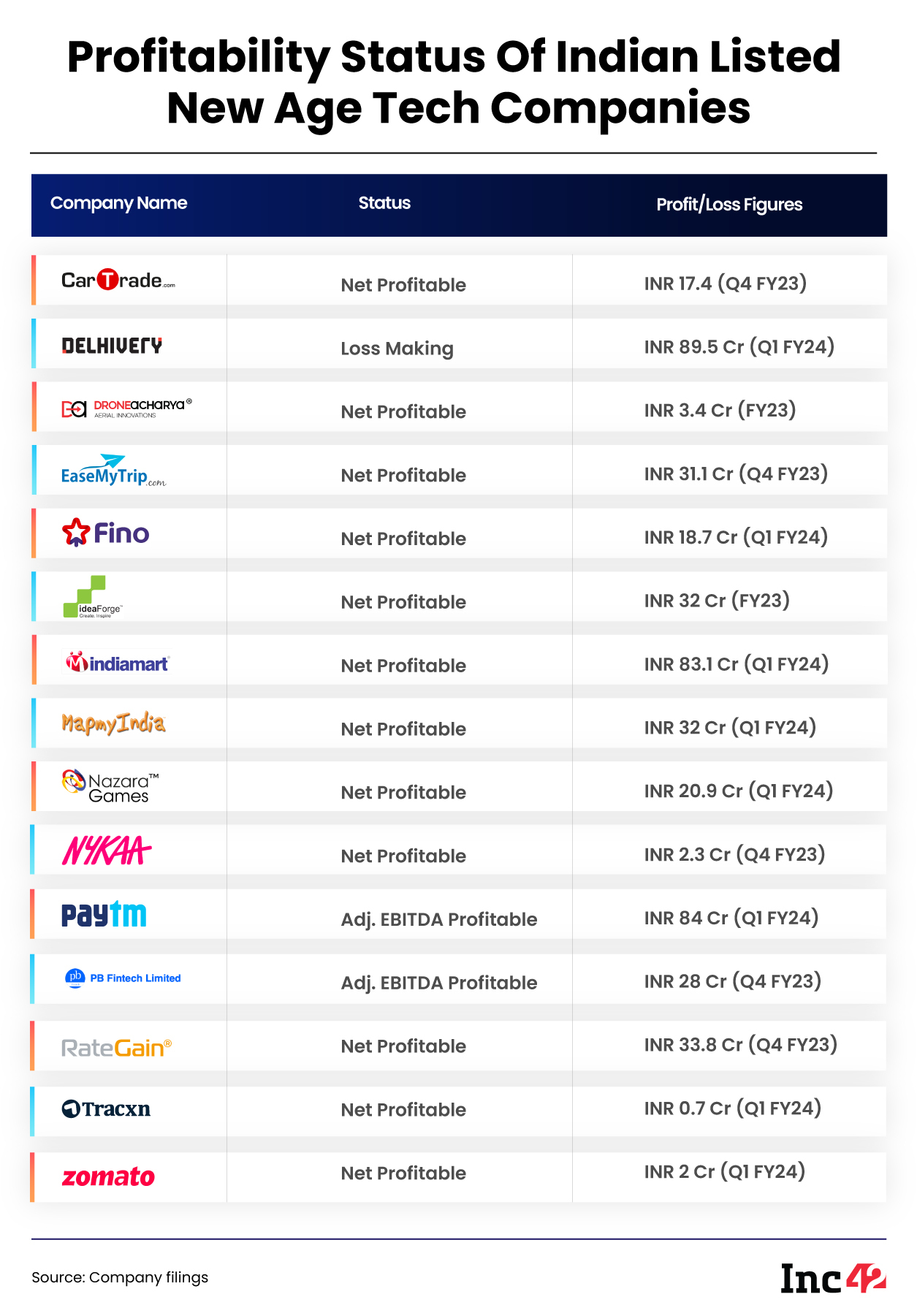

Before we further analyse the performance of the new-age tech stocks this week, let’s take a quick look at the financial health of these companies.

As evident, most of the listed new-age tech startups are now profitable or are marching ahead on their path towards profitability.

Now, let’s dig deeper into the performance of some of the new-age tech stocks this week.

The 15 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $36.33 Bn as against $33.24 Bn last week.

Zomato Delights Investors

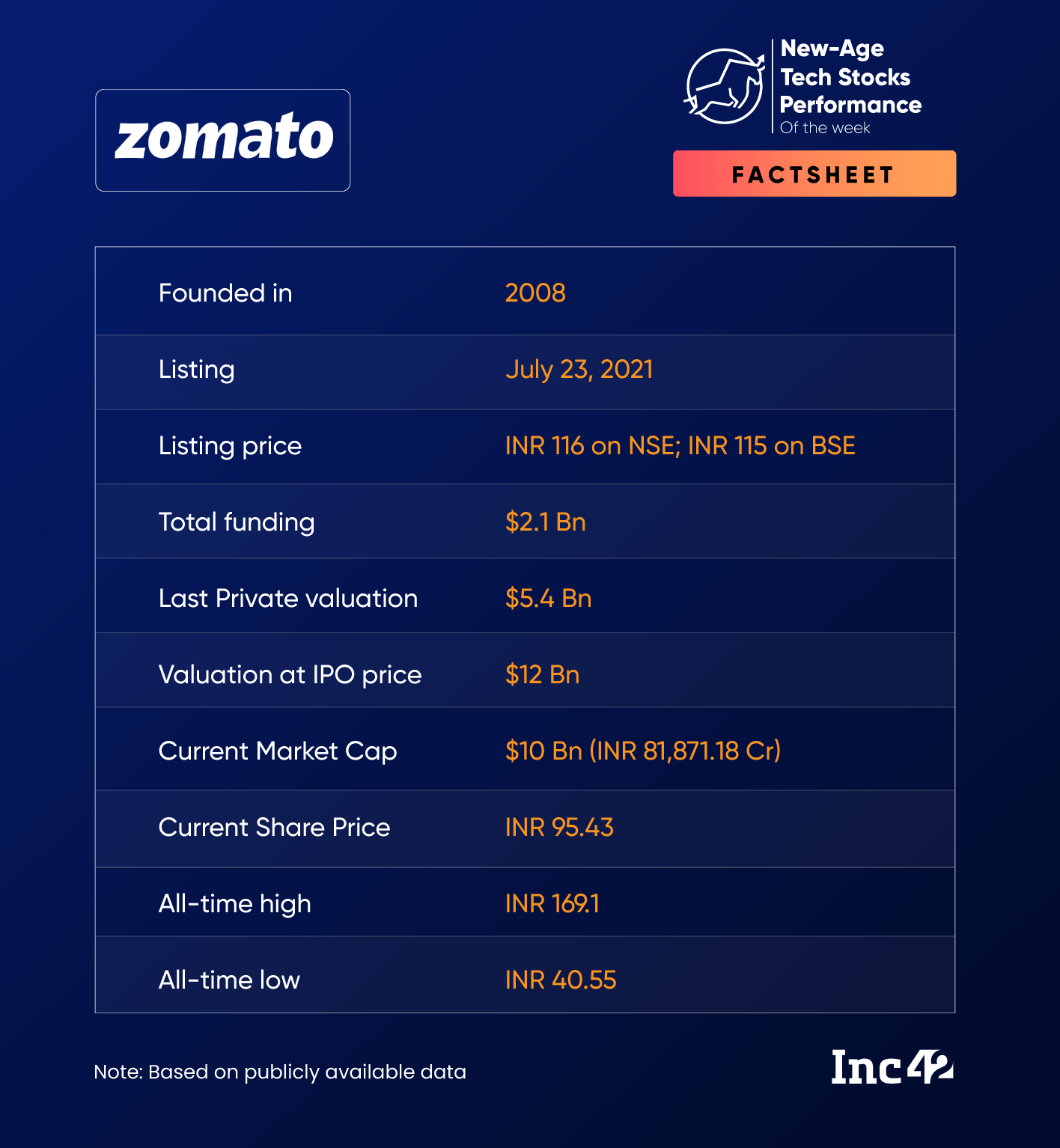

Shares of Zomato surged 10.7% to INR 95.43 on the BSE on Friday, a day after the food delivery major reported its first-ever net profitable quarter, way ahead of its target and Street estimates, in Q1 FY24.

Zomato shares also touched their 52-week high of INR 98.39 in the early trading hours of the last session of the week.

In The News For:

- Zomato reported its first profit after tax (PAT) of INR 2 Cr in Q1 versus a consolidated net loss of INR 186 Cr in the last year’s quarter. This was also a significant improvement from INR 188 Cr of net loss reported in the previous quarter – Q4 FY23.

- While a deferred tax of INR 17 Cr helped the company post the consolidated net profit, the growth in its food delivery business and operational efficiencies played a bigger role in helping it achieve profitability.

- Zomato’s quick-commerce business Blinkit posted a slower sequential GOV growth in Q1 FY24, hurt by delivery partners’ strike and incessant rains in the northern part of the country.

- Zomato said it has a July to July appraisal cycle and the impact of it will be seen in employee costs in the next quarter – Q2 FY24. Meanwhile, the startup also approved INR 2.52 Cr shares as ESOPs to select employees this week. It remains to be seen how the company manages to maintain its profitability in the coming quarter and years.

- Zomato has now also started levying a platform fee of INR 2 per order for some users on its platform.

Zomato’s market capitalisation surged to $10 Bn (INR 81,871.18) this week.

Several analysts raised their price targets (PTs) on Zomato following the impressive performance and now expect the stock to cross INR 100 mark. JP Morgan expects Zomato to evolve into a “triple engine profit machine” over FY24.

Speaking to Inc42, Ganesh Dongre, senior manager, technical research, at Anand Rathi, said that the resistance for the stock is currently at INR 125 while the downside support is at INR 85-INR 80.

“One should wait and watch this counter. If one wants to enter this, the comfortable zone would be INR 80-85,” he said, adding that the stop loss for the stock would be INR 75. “One can also buy on dips.”

Dongre said that the broader market is in a correction mode right now and Zomato can correct a bit in the short term from here on.

Delhivery Cuts Its Losses

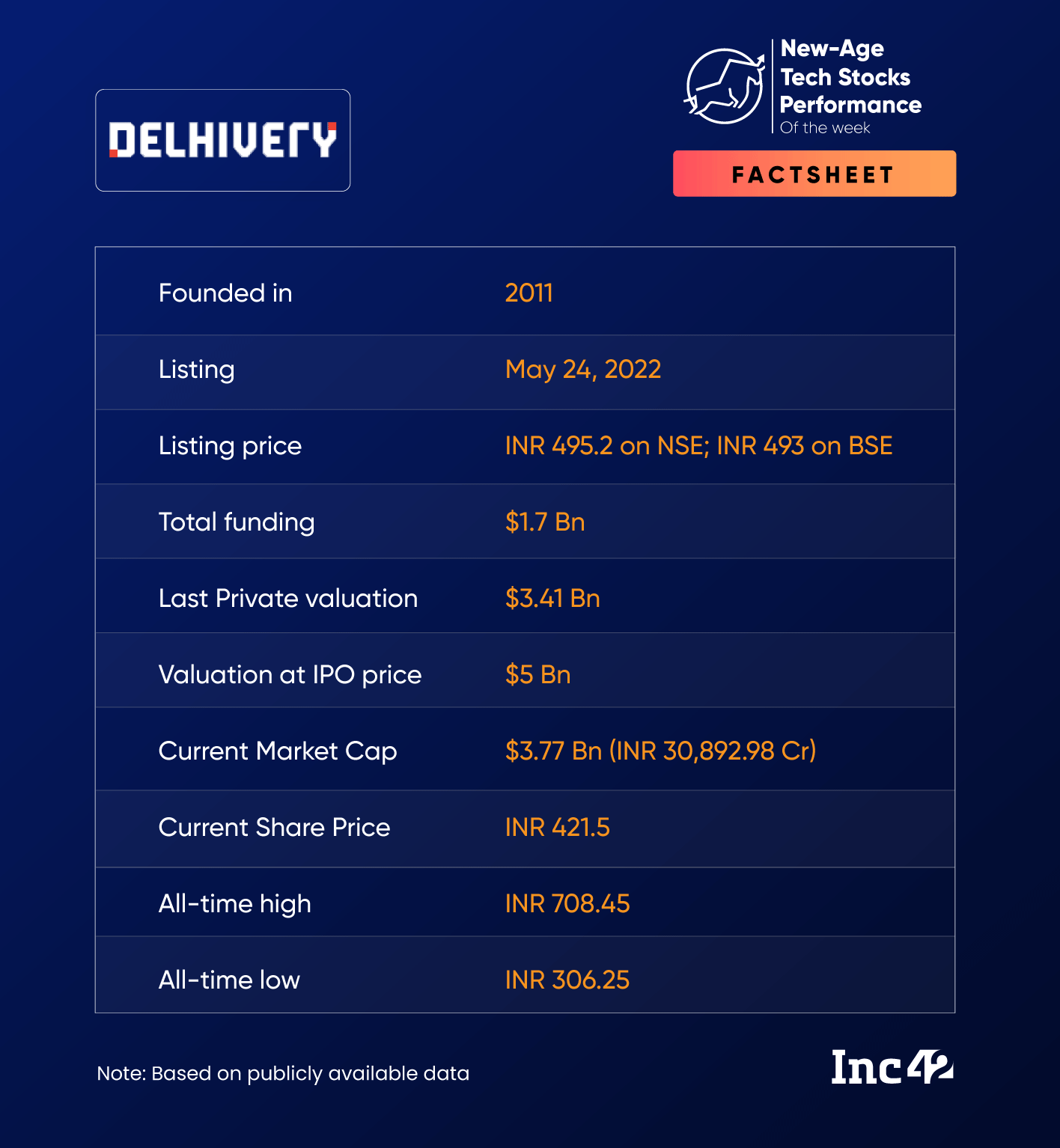

Among the new-age tech startups under our coverage, logistics unicorn Delhivery is the only one right now that is loss-making both on adjusted EBITDA level and overall. However, the startup is also marching ahead towards its target of achieving breakeven.

Delhivery reported a 78% year-on-year (YoY) and 44% quarter-on-quarter (QoQ) decline in its net loss to INR 89.5 Crin Q1 FY24.

The startup also managed to bring down its adjusted EBITDA loss by 89% YoY to INR 25 Cr in the quarter. Express parcel, as well as part truckload (PTL) revenue, jumped in the quarter.

Helped by the rally in new-age tech stocks post Zomato’s earnings, Delhivery shares ended the week at the highest level since October 20, 2022.

After seeing extremely choppy trading sessions earlier in the week, the logistics startup’s shares jumped almost 6% on Friday to end the week at INR 421.5 on the BSE. Overall, Delhivery gained about 5% this week.

Anand Rathi’s Dongre said that a bigger rally is possible in the stock in the coming week, with it racing towards the INR 500 mark. The stop loss for the stock would be at INR 380, while the target would be around INR 460-INR 480 zone, he added.

Tracxn Becomes The Biggest Loser

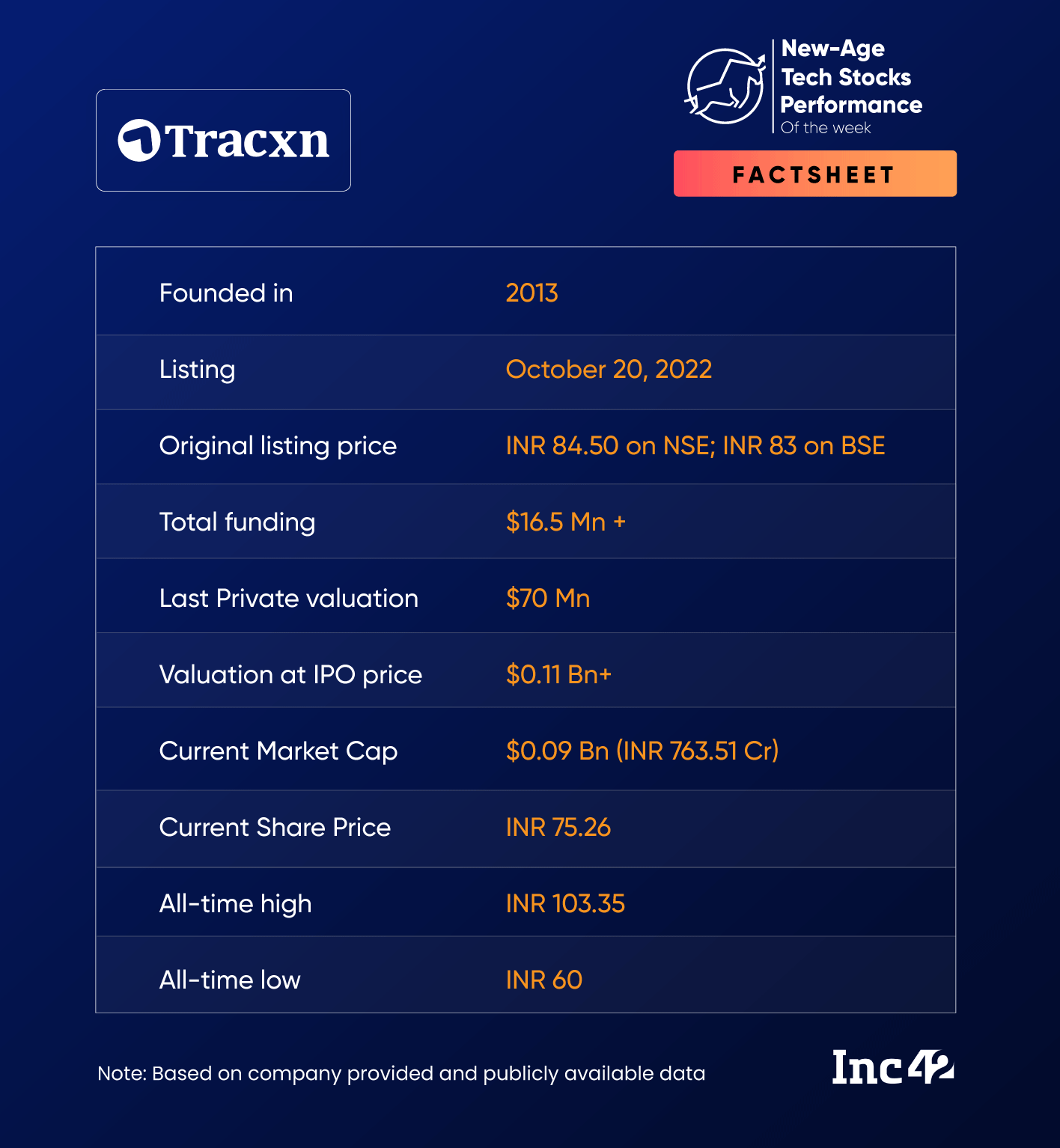

Shares of market intelligence startup Tracxn Technologies nosedived in three consecutive sessions this week after the startup reported a sharp decline in its profit.

The startup on Tuesday (August 1) said its net profit nearly halved QoQ to INR 0.69 Cr in Q1 FY24, which was also an 18% decline compared to the profit in the corresponding quarter of last fiscal.

Operating revenue also fell 2.5% sequentially to INR 19.82 Cr in the reported quarter.

Tracxn shares plunged over 13% in three sessions ending Friday. The stock ended the week’s last trading session 4.1% lower at INR 75.26 on the BSE.

Overall, its shares plunged 10.5% this week.

Commenting on the stock, Dongre said that selling pressure is visible in the counter on the technical charts. Those looking to invest should wait till the share price comes down to INR 70.

The stop loss for the stock is at around INR 60. After correcting in the near term, it can again bounce back to INR 84-INR 85, Dongre added.

Ad-lite browsing experience

Ad-lite browsing experience