Zomato had reported a consolidated net loss of INR 186 Cr in the first quarter of FY23

Operating revenue stood at INR 2,416 Cr in Q1 as against INR 1,413.9 Cr in the year-ago quarter

Zomato said its quick-commerce business Blinkit also turned contribution positive for the first time ever in the month of June 2023

Foodtech major Zomato

Zomato’s net loss stood at INR 188 Cr in the preceding March quarter, when it also turned adjusted EBITDA positive, excluding Blinkit.

The Deepinder Goyal-led startup also reported an operating revenue of INR 2,416 Cr in the reported quarter as against INR 1,413.9 Cr in Q1 FY23.

This was also a 17.5% rise from INR 2,056 Cr operating revenue reported in the previous quarter – Q4 FY23.

In a statement, Zomato said its quick-commerce business Blinkit also turned contribution positive for the first time ever in June 2023.

“We have been working hard to make our business less complex, and putting the right people at the right spots within our businesses. These things do not have definite/ measurable impact, and I can in hindsight say that most of our seemingly “risky” bets have changed the trajectory of the business significantly, much faster than we expected,” MD and CEO Goyal said.

However, we must note that Zomato reported INR 15 Cr in loss before tax in Q1. A deferred tax of INR 17 Cr helped the company post its first-ever profitable quarter.

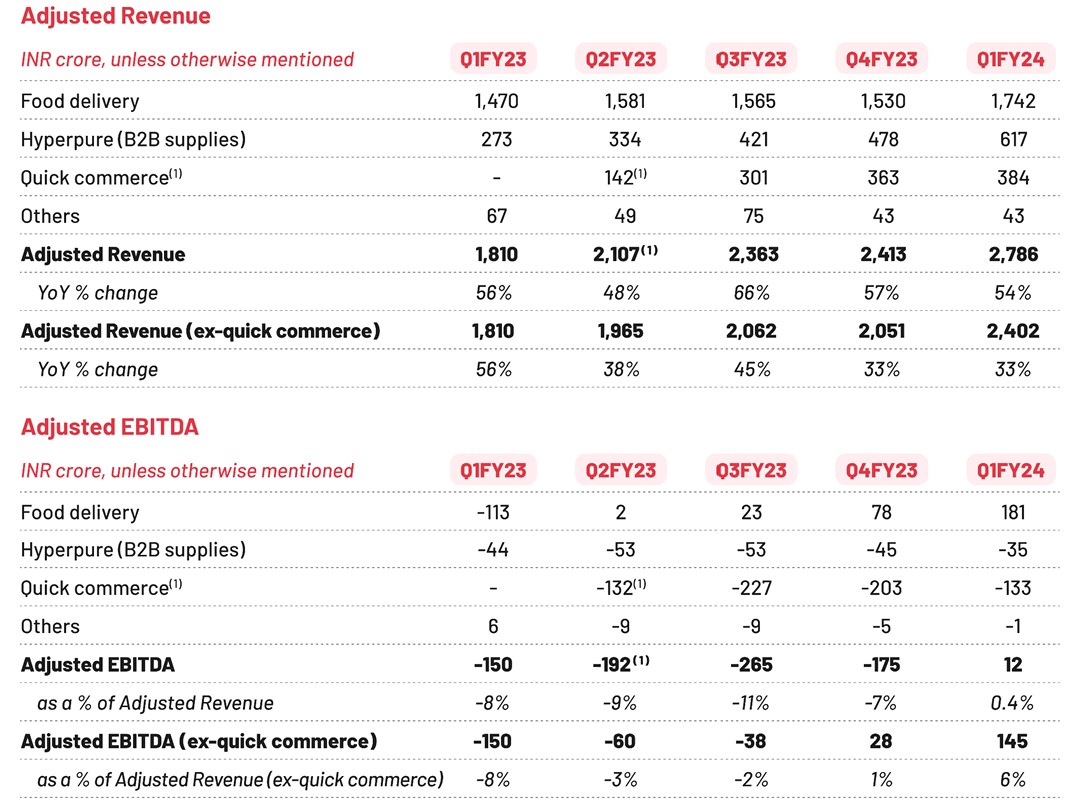

Adjusted revenue of the food delivery business stood at INR 1,742 Cr in Q1 FY24, registering an 18.5% year-on-year (YoY) growth. It also increased by almost 14% from INR 1,530 Cr reported in Q4 FY23.

Meanwhile, the gross order value (GOV) of Zomato’s food delivery business stood at INR 7,318 Cr in the quarter under review as against INR 6,425 Cr in the corresponding quarter of the last fiscal.

The business segment’s contribution margin, as a percentage of GOV, stood at 6.4% as against 2.8% in the year-ago quarter and 5.8% in Q4 FY23.

Zomato said the rise in GOV was driven by robust growth in the number of orders as well as by a modest uptick in average order value.

The company said that the recovery in demand, which began in February this year, continued in Q1. However, Q1 is also a seasonally stronger quarter for Zomato, it noted.

Besides, the growing adoption of the Zomato Gold program drove higher frequency of ordering and now contributes to over 30% of GOV in the food delivery business, it added.

On the other hand, Zomato’s quick-commerce business Blinkit reported adjusted revenue of INR 384 Cr, which grew 5.7% sequentially. Its GOV saw a 4.6% rise quarter-on-quarter (QoQ) to INR 2,140 Cr.

“The slower sequential GOV growth in Q1 FY24 was mainly due to the temporary business disruption we had in the month of April resulting from the change in the delivery partner payout structure,” said Blinkit’s cofounder and CEO Albinder Dhindsa. “Due to this, some of our dark stores were shut for a few days in certain parts of the country, which caused a decline in overall order volumes during the quarter.”

In April, Blinkit delivery executives in Delhi NCR went on a strike, which resulted in closure of many of its dark stores for a few days. Zomato then said that the strike would have no material impact on the financial performance of the company.

However, the company now said that while the operations were resumed within a few days, it faced a challenging period of around 45 days where the overall gig workers available to work in its system were 15-20% lower than normal.

Despite the slow GOV growth, Blinkit’s adjusted EBITDA loss narrowed to INR 133 Cr in the reported quarter from INR 203 Cr in Q4 FY23.

Zomato said it expects Blinkit to achieve breakeven on an adjusted EBITDA basis in the next four quarters.

Meanwhile, Zomato’s B2B business Hyperpure registered a 29% QoQ and 126% YoY jump in adjusted revenue to INR 617 Cr in Q1, driven by growth across its core restaurant supplies business and the Blinkit business.

Overall, Zomato expects its consolidated business to remain profitable going forward and continue delivering more than 40% YoY topline (adjusted revenue) growth for at least the next couple of years.

On the expenses front, Zomato saw a 7.4% QoQ rise in its total expenses to INR 2,612 Cr, which was a 48% jump from INR 1,768 Cr in the previous year’s quarter.

However, the startup managed to bring down its employee benefit expenses both on a QoQ and YoY basis to INR 338 Cr. Its ESOP expenses stood at INR 100 Cr during the quarter under review as against INR 157 Cr a year ago and INR 84 Cr in Q4 FY23.

It is pertinent to note that Zomato took up a restructuring exercise in the December quarter of last year when it laid off several of its employees, which has now started getting reflected on the company’s books.

During its earnings call today, Zomato said that it has a July to July appraisal cycle and the impact of the same will be seen in employee cost in the September quarter – Q2 FY24.

Advertising and sales promotions rose 13% YoY to INR 314 Cr, while delivery and related charges jumped 41.6% YoY to INR 810 Cr.

Shares of Zomato ended today’s trading session 1.5% higher at INR 86.22 on the BSE.

Ad-lite browsing experience

Ad-lite browsing experience