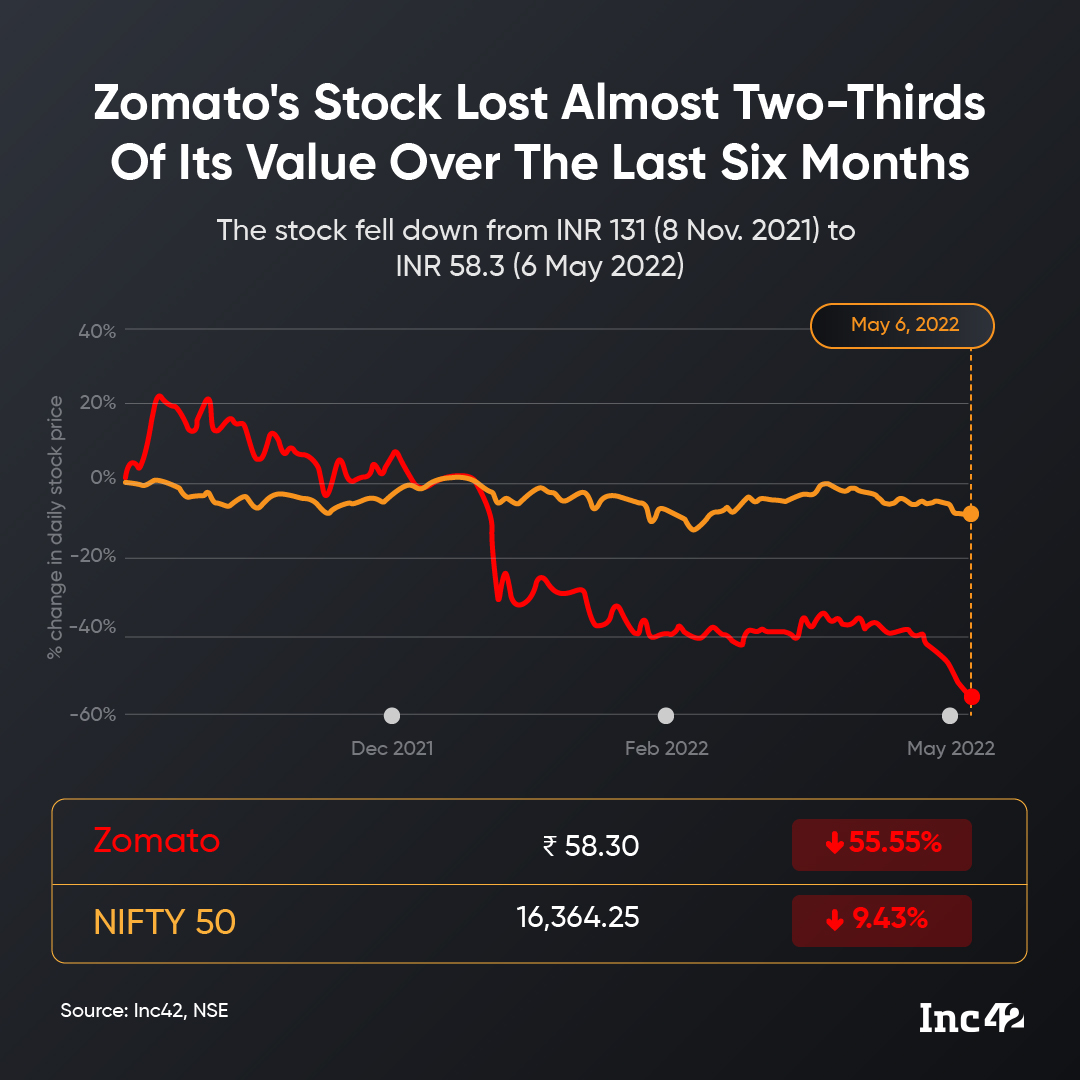

Zomato shares price has sunk to the below INR 60-mark on Friday, hitting an all-time low of INR 57.95

On Friday, Zomato’s market capitalisation dwindled down to INR 44,724 Cr, its lowest since listing

The food delivery giant has, since its peak in November 2021, managed to wipe off more than INR 88,000 Cr off its peak m-cap

Zomato

Currently (May 6, 01:30 PM IST), shares of Zomato are trading at INR 58.50 apiece, shortly after hitting the all-time low of INR 57.95 on the same day.

Its market capitalisation dwindled down to INR 44,724 Cr, its lowest since its listing. This is INR 88,420 Cr less than its peak cap of INR 1,33,144 Cr in November when the stock had scaled an all-time high of INR 169.10.

The unicorn’s shares were offered at INR 76, and compared to that, the share price has sunk by 23%. However, if compared to the peak of INR 169.10, the share price is now trading at only about a third of that value.

Zomato made a stellar stock market debut on July 14 last year, opening at a 53% premium over its IPO price and clinching a market capitalisation of INR 1 Lakh Cr.

The overwhelming response to the IPO had reaffirmed the appetite of investors for the new-age tech startups in the country. The momentum kept strengthening and Zomato shares reached their all-time high of INR 160.30 on November 15, 2021.

However, the stock started seeing a gradual fall after it, ending at INR 137.45 at the end of 2021. Since then, the startup’s shares have continued to fall. The share price had stabilised somewhat since March, hovering in the range of INR 80-82. However, the downward trend starting in late April has since taken the share price to the 60s.

This downward spiral comes as institutional investors continue to reduce their stakes in Zomato. Foreign Institutional Investors (FIIs) have decreased their holdings to 10.44% in March 2022 quarter from 11.31% in the December 2021 quarter. Mutual Funds have also decreased holdings to 2.82% in March 2022 quarter from 3.88% in the December 2021 quarter.

As the shares started declining significantly in January, Zomato CEO Deepinder Goyal said in a note to its employees, “This is the thing about stock markets and public companies – valuations can swing massively without any change in the fundamentals of the business depending on macro-economic factors like inflation, interest rates etc … we had no control on our valuation going up from $8 Bn in the IPO to $17 Bn at our peak, and vice versa now…”

India’s antitrust watchdog the Competition Commission of India’s (CCI) order for scrutiny on the Bengaluru-based foodtech giant’s business has heavily affected its market sentiment.

While there was major volatility in the stock since the beginning of the year, Zomato shares have continued their losing streak since April 4, after CCI ordered a probe against it over unfair pricing practices.

CCI said last month, “The Commission is of the view that there exists a prima facie case with respect to some of the conduct of Zomato and Swiggy, which requires an investigation by the Director-General (DG), to determine whether the conduct of platforms have resulted in contravention of the provisions of Section 3(1) of the Act read with Section 3(4) thereof.”

Zomato had said at that time it would continue to work closely with the antitrust watchdog to assist with its investigation.

According to the latest report, the CCI is also tweaking the interpretation of the ‘relevant market’ for the digital players, which is also leading to investigations against several tech companies including Zomato.

Ad-lite browsing experience

Ad-lite browsing experience