As part of the deal, Zenifi's cofounder and chief executive Padam Kataria will join BharatX to spearhead its healthcare vertical

Founded in 2023 by Kataria, Harshit Shrivastava and Rajendra Kulkarni, Zenifi claims to offer affordable payment options through zero-cost and low-cost EMI solutions to increase conversion rates for healthcare providers

Founded in 2019 by Jindal, Eeshan Sharma and Shyam Murugan, BhatratX enables embedded credit on consumer facing platforms with zero risks to the platforms and easy integration

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

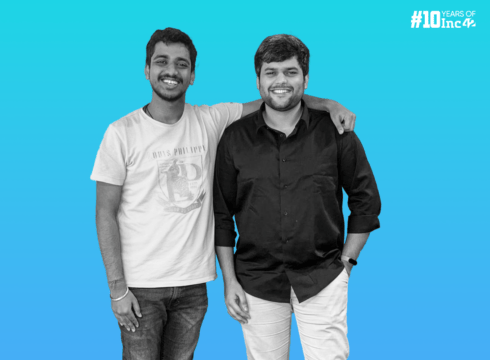

Buy-now-pay-later (BNPL) fintech startup BharatX has acquihired healthcare finance startup Zenifi for an undisclosed sum, thus making its foray into the healthcare lending space.

As part of the deal, Zenifi’s cofounder and chief executive Padam Kataria will join BharatX to spearhead its healthcare vertical. Kataria has held key roles in companies like Navi, Zenly, Asteria Aerospace Ltd and Sprinklr.

Mehul Nath Jindal, cofounder and chief executive of BharatX said that this acquisition will allow BharatX to go deeper into the healthcare vertical where currently no fintech or traditional players can disburse credit instantly, which is critical in emergency healthcare.

“Joining forces with BharatX is a good opportunity for Zenifi. We have firsthand experience of making medical lending easy and accessible and with BharatX’s well-established credit as a service, the synergies between the two companies will ensure that we can accelerate the speed with which we capture the market,” said Kataria.

Founded in 2023 by Kataria, Harshit Shrivastava and Rajendra Kulkarni, Zenifi claims to offer affordable payment options through zero-cost and low-cost EMI solutions to increase conversion rates for healthcare providers. It has tied up with multiple hospitals and aggregators, generating an annual rate of demand worth INR 1.2 Cr.

Founded in 2019 by Jindal, Eeshan Sharma and Shyam Murugan, BhatratX enables embedded credit on consumer facing platforms with zero risks to the platforms and easy integration.

For instance, it provides financing as an option to more than 125 brands in the likes of Snitch, Zepto, HealthKart, Sleepcat, Prestige, boAt and Masaba among others.

In the past five quarters, it claimed to have grown 33 times and raised over $4.7 Mn.

BharatX competes with companies like Credy, Flexmoney, ZestMoney, Lazypay, Paytm Postpaid, Amazon Pay Later, Ola Money Postpaid in the BNPL segment.

This acquisition comes two years after BharatX raised $4.5 Mn in its seed funding round led by Y Combinator, 8i Ventures, Multiply Ventures, Java Capital and Soma Capital.

Alongside, existing investor Java Capital, angel investors such as Dropbox’s Arash Ferdowsi, Razorpay’s Harshil Mathur and Shashank Kumar, CRED’s Kunal Shah, Mamaearth’s Varun Alagh, Dunzo’s Ankur Aggarwal and Jio’s Vikas Choudhury also participated in that round.

At the heart of this acquisition is the ongoing developments in the broader credit as a service segment. Earlier this month, banking tech unicorn Zeta launched a digital credit-as-a-service product for banks.

Inc42’s State Of Indian Fintech Ecosystem Q3 2023 report underlines that the Indian digital consumer lending market is projected to surpass $720 Bn by 2030, representing nearly 55% of the total $1.3 Tn+ digital lending market opportunity in the country.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.