The $4.5 Mn round saw participation from Multiply Ventures, Soma Capital, Java Capital alongside several angels

BharatX aims to increase the credit stack on offer by launching new product verticals such as UPI Credit, Pay in 3 and 15/30 day cycle products like credit cards

It plans to reach 100K users in 2022 and build a loan book of $10 Bn by 2025

Bengaluru-based fintech startup BharatX has bagged $4.5 Mn in its seed round. The fresh investment round was led by Y Combinator, 8i Ventures, Multiply Ventures and Soma Capital.

Existing investor Java Capital also participated in the round, along with angels such as Dropbox’s Arash Ferdowsi, Razorpay’s Harshil Mathur and Shashank Kumar, CRED’s Kunal Shah, Mamaearth’s Varun Alagh, Dunzo’s Ankur Aggarwal and Jio’s Vikas Choudhury.

The startup plans to use the funds to build and expand its team, work on its product and expand its footprint. BharatX aims to increase the credit stack on offer by launching new product verticals such as UPI Credit, Pay in 3 and 15/30 day cycle products like credit cards.

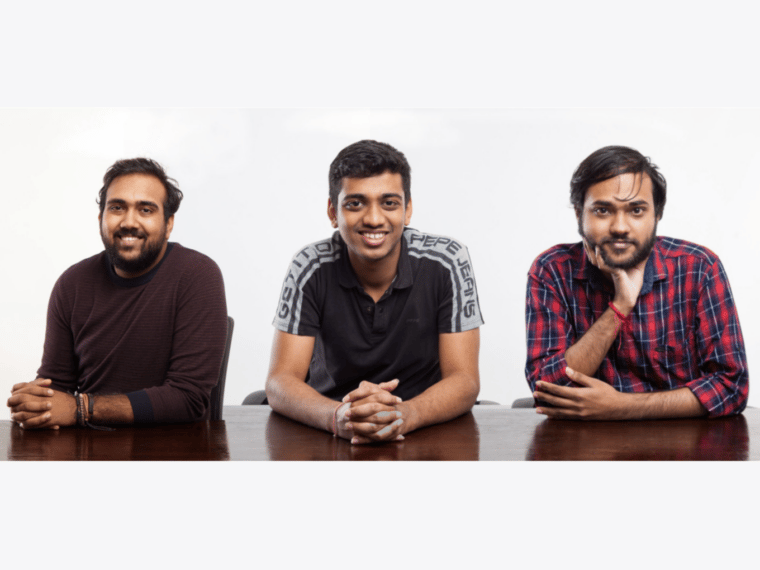

Founded in 2019 by Mehul Nath Jindal, Eeshan Sharma and Shyam Murugan, BharatX launched its premier offering in 2020 – a white-label, embedded credit product that can turn any consumer internet company into a credit/loan provider with 30 lines of code.

BharatX is a consumer credit venture that provides embedded credit on 50+ consumer-facing platforms via its Application Programming Interfaces (API) and software development kit (SDK).

The startup was a part of Inc42’s ‘30 Startups To Watch’ – January 2022 edition. It enables consumer internet companies to offer credit to their users, be it in the form of UPI credit, instalment payment, pay later option or a wholly customised offering. Some special offerings include Khata, where users can buy groceries and daily essentials on credit, try-and-buy fashion on loan, pay later for food delivery and payment apps and postpaid features for ride-hailing apps.

BharatX acts as the intermediary credit provider and risk-taker, charging a value-based interest rate from consumers and a transaction fee from embedding companies. The startup has a personal loan approval rate of 45% against the industry average of 30%.

According to Jindal, the middle class of India lacks credit availability and compared to South Africa or Brazil, India stands way behind in credit penetration.

“By using our embedded credit approach, we are able to reach out to these prime customers in a scalable manner and at almost zero cost, compared to spending between $15-$150 per person like other fintech players, saving us hundreds of millions in the long term on CAC alone,” Jindal added.

Currently, nearly 480 Mn Indians don’t get access to credit due to lack of documentation, high interest rates and inadequate supply of credit in the informal sector. There is a $1 Tn credit gap in the Indian middle class and less than 3% of India has credit cards for making purchases using credit, according to BharatX.

The startup plans to reach 100K users in 2022 and build a loan book of $10 Bn by 2025. It competes with the likes of PayU’s LazyPay, Falcon, Rupifi, among others.

Meanwhile, India’s overall fintech market opportunity is estimated to be $1.3 Tn by 2025 and the lending tech is likely to account for 47% ($616 Bn) of it.

Update | May 12, 2022, 8:05 AM

The amount in the heading updated to reflect the correct figure of the funding – $4.5 Mn.

Update | May 12, 2022, 9:15 AM

One of the investors’ names – Sajid Rehman – has been removed.

Ad-lite browsing experience

Ad-lite browsing experience