In its endeavour to make significant strides in India, Xiaomi developed a strong portfolio of Indian companies, including ShareChat, KreditBee, ZestMoney, among others

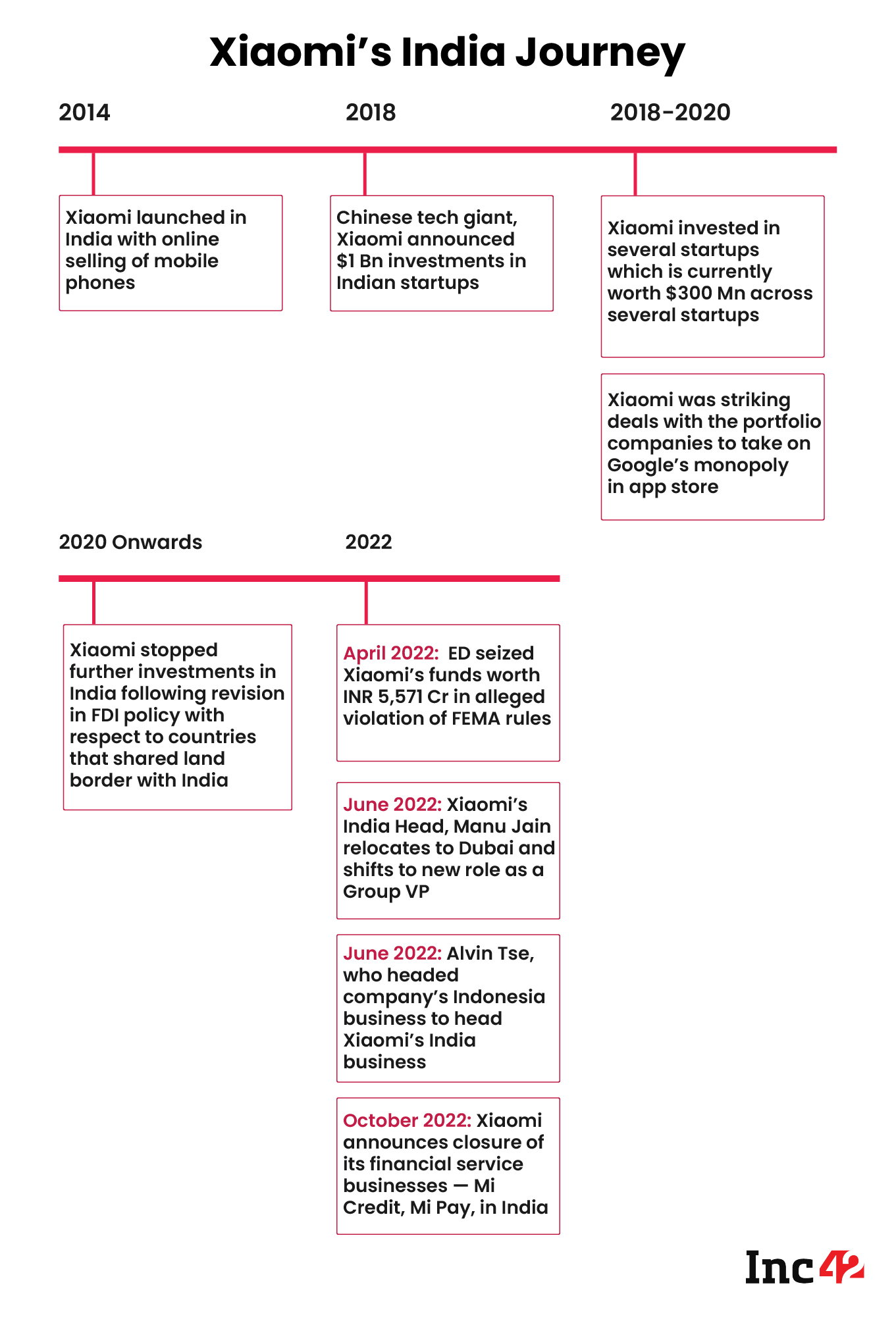

In 2018, Xiaomi announced that it would invest $1 Bn in Indian startups over the next few years

Xiaomi’s investments in Indian startups do not seem to be flourishing, thereby making the smartphone giant reconsider its position in supporting them

Chinese tech behemoth Xiaomi is looking to divest its stakes in Indian companies and exit the country’s startup ecosystem, sources with knowledge of the matter told Inc42. The company’s plans could be the result of the bumpy ride it has experienced in the country so far.

In 2018, Xiaomi announced that it would invest $1 Bn in Indian startups over the next few years. Following this, Xiaomi, along with Shunwei capital, made a series of investments and developed a strong portfolio of Indian companies, including ShareChat, KreditBee, ZestMoney, among others.

However, the company, which once envisioned developing an app ecosystem as big as Google Play Store in India, now seems to be shying away from making further strides in the country, especially after being cornered by the Enforcement Directorate (ED) for allegedly violating the Foreign Exchange Management Act (FEMA) with illegal foreign remittances.

In its quarterly report published on August 19, 2022, the company acknowledged that the ongoing investigations in India could take a long time to settle and adversely impact its operating results or cash flows.

The Chinese tech major has also seen a churn in its leadership, with its former India head, Manu Jain, relocating to Dubai and the appointment of Alvin Tse as the new head of the business in India. According to various media reports, Jain, in his new global role, has been made the group vice president of the company.

Xiaomi recently dissolved its financial services business in India, including its lending and payment verticals. Two years ago, with investments in Indian fintech companies like ZestMoney and KrazyBee, Xiaomi’s foray into the Indian financial services space gathered a lot of applause, as it aimed to tap the $1 Tn market opportunity in India’s lending and payment services space. Unfortunately, Xiaomi can now be seen bidding adieu to its ambitious plans.

Several people in the Indian VC ecosystem who spoke with Inc42, requesting anonymity, said that Xiaomi’s investment splurge in the Indian startup ecosystem has slowed down since the pandemic, ironically when the new-age companies were receiving record investments triggered by rapid digitization.

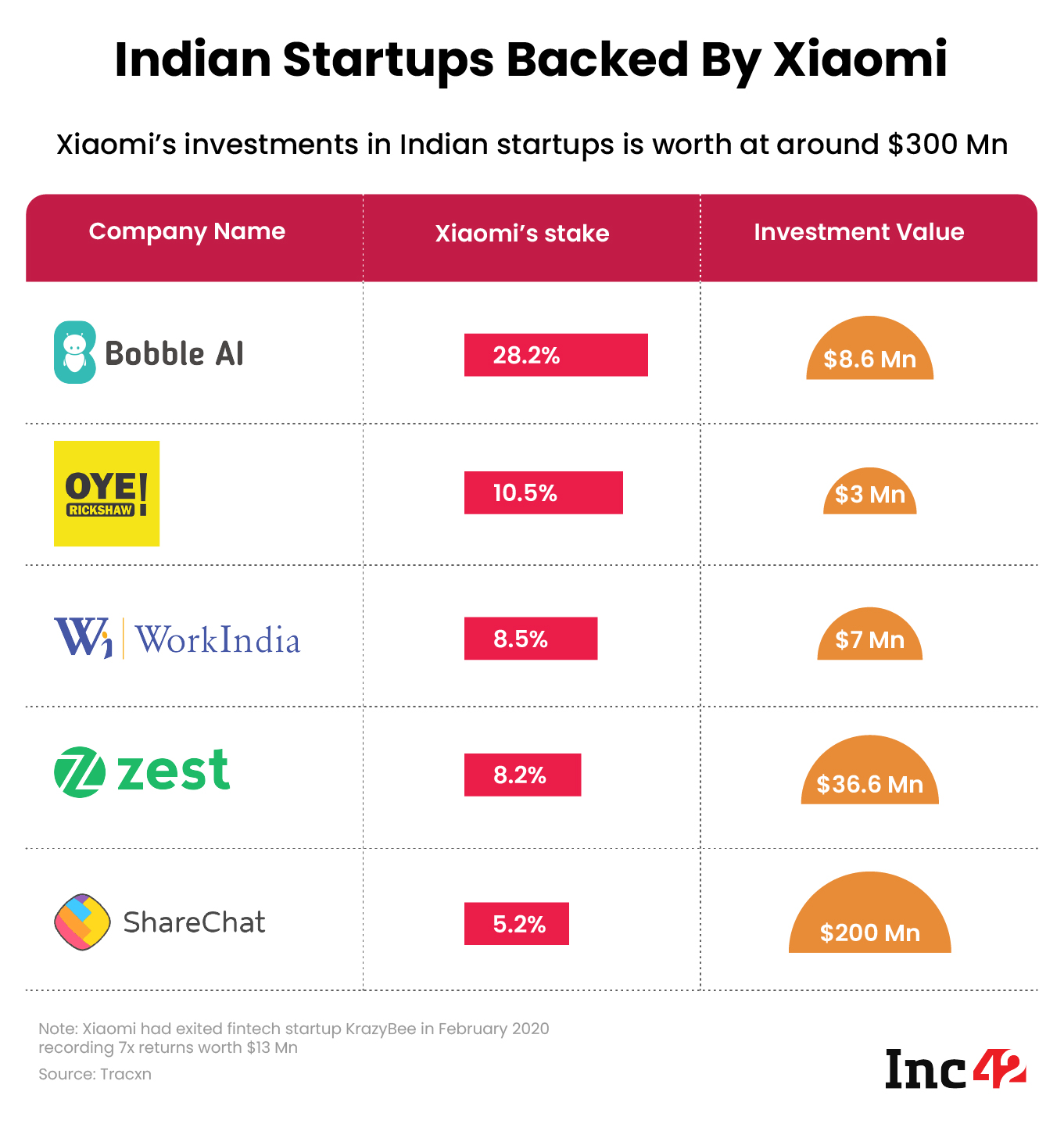

Xiaomi’s $300 Mn Equity In Indian Startups Could Be Up For Sale

Before we delve into Xiaomi’s current state of affairs in terms of investments, it’s pertinent to note that Xiaomi was well placed within the tech ecosystem of India. The company also enjoyed the first-mover advantage when it introduced mid-price segment smartphones in India. Pushing its limits, the company then decided to go big on startup investments.

If one takes a deeper look at some of its big bets so far, the Chinese tech company made some strategic investments in Indian startups before COVID to leverage its market share in the android mobile ecosystem in India.

Xiaomi-backed companies such as microlending startup KrazyBee, consumer credit firm ZestMoney, social media platform ShareChat, recruitment company Work India, EV mobility platform Oye Rickshaw, and conversational media company Bobble AI, being the prominent ones. Further, the launch of Xiaomi’s payment services Mi Pay and Mi Credit in 2019 complemented the app ecosystem the Chinese company was trying to build in India by backing local firms, utilising the massive user base of its smartphones and eventually aiming to grab a large share of the growing market.

“The idea was to compete with Google, which was sitting at more than 90% market share in the android Play Store and was facing heat from app developers, OEMs, etc. for in-app purchases and other alleged anti-competitive practices. Xiaomi would have found the perfect opportunity to launch a parallel app store in India like it has Xiaomi Market in China. However, with rising geopolitical tensions between China and India, the investments and focus of China internet giants towards India slowed down and that seemed to be the case with Xiaomi,” a senior analyst with a Gurugram-based tech research firm told Inc42.

Speaking of a slowdown in investments, data sourced from Tracxn show that Xiaomi’s last major investment in India was in an EV mobility startup, Oye Rickshaw, in January 2020. Meanwhile, Tracxn’s data showed us that Xiaomi has so far exited Krazy Bee only, with a 12x return on its investments in 2020, by selling its stake through a secondary share sale for $24.8 Mn.

If sources are to be believed, the Chinese company is also seeking to exit Bobble AI, a conversation media platform, with which the former entered into a strategic alliance to develop the default keyboard for its smartphones. In June 2019, Xiaomi led an INR 21 Cr Series A round and ended up acquiring a 30% stake in the startup. As of now, Xiaomi has a 28.2% stake, worth INR 68.3 Cr, in Bobble AI.

To get a clear picture regarding Xiaomi’s exit plans, Inc42 reached out to Bobble AI, but the company refused to comment.

Further, the fact that Xiaomi has made little gains versus its investments in Indian startups so far only seems to be solidifying the claims that the company is looking to divest its stakes. If true, this will imply that Xiaomi’s $300 Mn equity in Indian startups could be up for sale, according to Inc42’s estimates.

Inc42 reached out to Xiaomi to enquire about its plans to exit the Indian startup ecosystem, but the company declined to comment.

No Bang For The Buck

Xiaomi does not seem to be enjoying the bang for its buck against its investments, thereby making the smartphone giant reconsider its decision to continue supporting Indian startups.

Here it is imperative to mention that recruitment company Work India, which got Xiaomi to invest INR 42 Cr in February 2020, incurred a loss of INR 28 Cr in FY22 versus INR 15.63 Cr in FY21.

Further, Xiaomi’s bet on Oye Rickshaw has also failed to generate a satisfactory return on investment, with the latter’s losses widening to INR 20.7 Cr in FY21 from INR 10.3 Cr a year ago.

Similarly, ZestMoney, a buy now, pay later startup, has seen its losses surge a whopping 216% year-on-year to INR 398.8 Cr in FY22. Xiaomi holds an 8.2% stake, worth $36.6 Mn, in the company.

Another key challenge for Xiaomi is ShareChat, a social media platform, in which it holds a 4.3% stake. According to Mohalla Tech Private Limited, the parent company of ShareChat, the annual losses of ShareChat surged 115.8% year-on-year to Rs 1,460 Cr during FY21. The social media unicorn is yet to file its financials for FY22.

As far as Bobble AI is concerned, the FY21 numbers of Bobble AI, which also hasn’t filed its FY22 financials yet, indicate that its losses grew to INR 12.3 Cr from INR 6.49 Cr a year ago.

The only silver lining here is that being one of the early investors of ZestMoney and ShareChat, Xiaomi is looking at 5x and 9x returns, respectively.

“A 4x to 10x return isn’t bad after all. However, the question still remains that there aren’t many big rounds happening right now, which would make Xiaomi’s exit in both the companies all the more challenging,” an investor said.

Regulatory Headwinds Another Reason To Worry

Increasing geopolitical tensions between China and India, and the Indian government banning Chinese apps has not only impacted Xiaomi but also the investment sentiment from the neighbouring country.

Xiaomi was unarguably impacted by the new investment rules, which came into existence in April 2020 and required investors from countries sharing a border with India to seek government approval before acquiring stakes in Indian firms.

According to the VC industry, this was seen as a significant move to prevent opportunistic takeovers, especially by Chinese tech investors during the pandemic. Companies such as ByteDance, Ali Baba, Xiaomi and Shunwei Capital were seen as some of the Chinese tech giants that were eyeing takeovers in India, but the new regulations slowed their plans.

According to various media reports, out of 382 FDI proposals received by the Centre from Chinese firms, only 80 were approved in July 2022. Further, when it comes to FDI investments in India, China was a notable absentee in 2021-22 among the nations which invested in India.

Meanwhile, some industry experts opine that Xiaomi will have a better chance of survival in India if it resists the urge to make further bets and restricts itself to the smartphone business, the company’s only profitable venture in this geography.

Ad-lite browsing experience

Ad-lite browsing experience