Along with the rebranding, Sequoia has also spun off its India investment entity from its US and Chinese counterparts

Sources close to Peak XV told us that the biggest factor for the structure separation and revamped identity is the fact that there is a potential for conflict in Sequoia’s global portfolio

With back-office functions such as legal and finance moving to India from the US, sources close to Peak XV indicate that friction in the investment process will be reduced

Sequoia Capital is now Peak XV Partners. But more importantly, the firm has also spun off its India investment entity from its US and Chinese counterparts, charting a new course for one of India’s most influential startup investors.

The operations that were formerly under Sequoia India & Southeast Asia will now be managed by Peak XV Partners. Sequoia’s US, India and China operations will be run as independent entities.

Elevation Partners (formerly SAIF Partners), Chiratae (formerly IDG) and Athera (formerly Inventus) are other recent examples of VC firms that have rebranded themselves. But while Sequoia India’s rebranding is significant in itself, the bigger change is in the new structure, which separates Peak XV Partners from the US-based parent entity.

We were told that the revamped firm will continue to manage $9.2 Bn across 13 funds, and Peak XV Partners will further invest from $2.5 Bn of uninvested capital over the next few years. Further, the VC fund will retain the leadership that was already managing the portfolio in India and Southeast Asia.

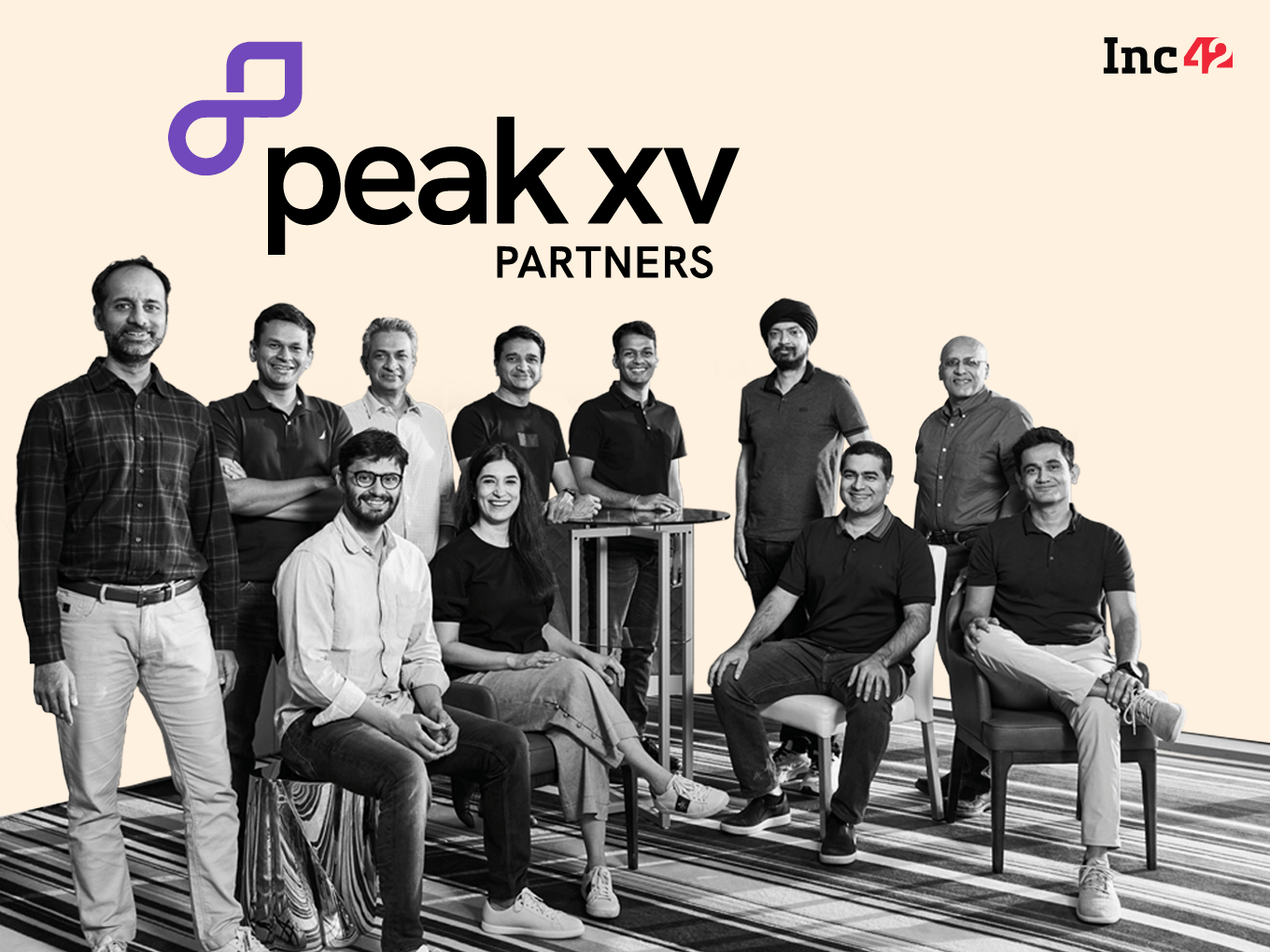

Peak XV will be led by 11 managing directors including the likes of Rajan Anandan, GV Ravishankar, Mohit Bhatnagar, Shailesh Lakhani, Sakshi Chopra and Shailendra Singh.

Speaking about the rebranding and the new structure of the firm, Peak XV Partners’ managing director Shailendra Singh said, “This is a new beginning for us as Peak XV Partners,” adding that new ‘structure’ will open up an unbounded global opportunities for Indian founders and Sequoia’s LPs.

“Companies are emerging from every region with global ambitions. Strategies for each region and business unit have diverged. Scale, market leadership causing brand confusion, portfolio conflict,” Singh added in a statement to Inc42.

Given that the new brand identity and structural changes have come at a critical time for Indian startups, the biggest question is why now, and what are the real benefits that Singh has alluded to.

Sources close to Peak XV told us that the biggest factor for the structure separation and revamped identity is the fact that there is a potential for conflict in Sequoia’s portfolio in the US, India and even China.

What Are The Potential Conflicts?

As a global VC, Sequoia has a lot of overlaps in its portfolio and the changing market dynamics have necessitated the move to separate the investment entities.

For instance, Sequoia India (now Peak XV) has invested in data management unicorn Druva, which overlaps with the business model of Cohesity, a Sequoia US portfolio company. Similarly, Peak XV portfolio includes the likes of Sirion Labs (competes with IronClad); Atlan Data (competing with Stemma); Clevertap (competes with Kahuna) and Pingsafe (competition includes Wiz).

In the China portfolio, Sequoia has stakes in Bytedance, which is competition for Dailyhunt parent VerSe Innovation’s short video app Josh.

Of course, these are not new developments. Indeed, some of these companies have been in Sequoia’s India and US portfolios for years, but the changing market landscape, particularly around generative AI, large language models (ChatGPT et al) have necessitated a rethink of potential conflicts in 2023.

Sources close to the VC firm added that the advent of the AI age and geopolitical implications of AI development has in many ways compelled Sequoia to create Peak XV Partners as a separate entity for the Indian market.

Earlier, a spokesperson for Peak XV Partners told Inc42, that US, China and India each have market leaders in various domains and that it is increasingly complex to run a decentralised global investment business.

So far, Sequoia US was providing shared services for legal, finance and other functions for all its offices across the world. With the changed structure, Sequoia India will have more autonomy in these areas and will be more agile to regulatory changes as well.

The VC firm has invested in 34 Indian unicorns till date including BYJU’S, Unacademy, CRED, Razorpay, Dailyhunt, Freshworks, Innovaccer, Eruditus, Groww, MPL among others. Further, it has also invested in more than 25 soonicorns, or roughly 25% of the total number of aspiring unicorns in India.

As such, a significant number of the largest startups in India are dependent on Sequoia’s management and infrastructure, which will now be completely managed from India.

What Changes With Peak XV Partners

Sources also told us that the decision was welcomed by many founders in Peak XV’s portfolio, because it reduces some of the operational friction that typically comes with shared back-office functions.

The Peak XV spokesperson had also told Inc42 that central back-office functions have proven to be a hindrance more than advantage in a dynamic market.

Several key founders in the Peak XV portfolio welcomed the new structure on Twitter, with some even calling it a pivotal moment for Indian startups given the significance of Sequoia and the greater control implied with the new independent structure under Peak XV.

“Founders appreciated the fact that the Indian fund will be completely managed by people in India. This means fewer restrictions, and potentially also a faster investment process,” our source added.

If anything, a lot about Peak XV will remain unchanged from its Sequoia days. For instance, Peak XV inherits the $9 Bn+ assets under management from Sequoia India & Southeast Asia. It will also manage the portfolio across 13 funds which comprises 400+ companies.

It will have 11 managing directors along with a portfolio management support team, employees in strategic development, human capital, finance, public policy, marketing, legal.

Further, Sequoia’s incubator and accelerator programs such as Surge, Spark, Build, Guild and Pathfinders will continue to be operated by Peak XV and its management team.

Incidentally, the structure and the brand identity changes comes after a series of fires in Sequoia’s portfolio since early 2022. From GoMechanic, where founders admitted to financial misreporting, to BharatPe and Zilingo, where founders have been accused of fraud. Sequoia also had to take a nearly 80% loss on its investment in Trell after exiting the startup in 2022.

Ad-lite browsing experience

Ad-lite browsing experience