Even as WhiteHat Jr ventured into international markets and added music and maths classes in the past two years, it has not been able to fix its high customer acquisition costs.

BYJU’S CEO Byju Raveendran said the focus will be on slower organic growth for WhiteHat Jr given the challenges in scaling up this vertical

With a total loss of INR 1,118.25 Cr in FY21, according to BYJU’S unqualified financial report, WhiteHat Jr contributed 26.73% to the total loss of INR INR 4,588 Cr

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

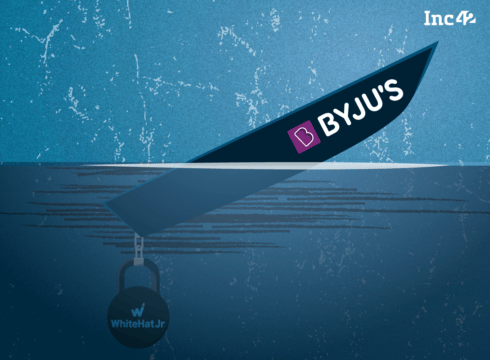

After months of delays and postponements, edtech giant BYJU’S finally announced its financials for FY21 with nearly 20X higher losses in comparison to FY20. While much of this is due to changes in revenue recognition by BYJU’S, the biggest individual contribution to the loss has come from WhiteHat Jr.

The edtech company, which offers live coding, maths and music lessons, was acquired in August 2020 for $300 Mn, but since then it has been in a thick of controversies — whether it be for misleading advertising, layoffs or the exit of its founder Karan Bajaj. Bajaj left WhiteHat Jr in August 2021, with Ananya Tripathi being appointed CEO earlier this year.

Over 800 full-time employees of WhiteHat Jr had resigned in May 2022 as the company rejigged operations and decided to bring the workforce back to its Gurugram, Mumbai and Bengaluru offices, as reported exclusively by Inc42.

Even as WhiteHat Jr ventured into international markets and added music and maths classes in the past two years, it has not been able to fix its high customer acquisition costs.

WhiteHat Jr Drags BYJU’S Down

Calling WhiteHat Jr the “under-performer” among the bevy of companies, BYJU’S cofounder and CEO Byju Raveendran told Inc42 that the focus will be on slower organic growth. He added that future growth for WhiteHat Jr is likely to involve high cash burn, even as other acquired companies continue to march towards positive unit economics.

“It’s still a little too early for us to say (about profitability), but we are reducing the burn significantly by cutting down on marketing costs. Most of our acquisitions have also seen a a one-time optimisation on people across the verticals,” Raveendran said in a brief conversation about the financial state of BYJU’S and its subsidiaries.

In absence of audited standalone financials for WhiteHat Jr for FY21 — as per BYJU’S new revenue recognition standards — there is no clarity on exactly how much revenue WhiteHat Jr has contributed to the INR 2,280 Cr that has been reported by BYJU’S as income for the year.

The change in revenue recognition pertains to how BYJU’S was accounting for revenue from users that was collected for subscriptions that extended beyond the fiscal year when they were sold.

With a total loss of INR 1,118.25 Cr in FY21, WhiteHat Jr contributed 26.73% to the total loss of INR INR 4,588 Cr. This is the second largest contributor to the overall loss after the parent company.

The reason for the high CAC is because of the startup’s primary focus on scaling up internationally, particularly in the US. “We are focusing on scaling that in the US and other markets. In India, one-on-one teaching is expensive and WhiteHat Jr has a limited TAM in India,” Raveendran explained.

The total loss stated by BYJU’S in its financials is lower than WhiteHat Jr’s own filings for FY21 which were released last year. The startup had posted a total loss of INR 1,690 Cr in FY21 as per its filings, on a revenue base of INR 483.9 Cr and expenses of INR 2,175.2 Cr.

It’s not yet clear why these numbers have changed because standalone financials have not been released for either of the subsidiaries under BYJU’S parent company Think & Learn Private Limited.

However, in terms of the net assets, the startup makes up 6.54% of BYJU’S net assets in FY21. This belies the outsized impact from its losses on the overall financial performance, showing just how much of a drag WhiteHat is on the company.

The fact that BYJU’S is attributing the higher overall losses in FY21 to the changes in revenue recognition in its primary business, means that WhiteHat Jr is actually the most significant loss-making subsidiary within its umbrella. Among the acquired companies, the next highest contributor to loss is US-based Osmo, which contributed just over 5% to the overall loss.

Can Organic Growth Fix WhiteHat?

Besides the high CAC, WhiteHat Jr’s primary focus on international markets means that it needs a separate push from a marketing perspective and its user funnel is also not linked to the larger BYJU’S machinery, the founder and CEO told us.

“We don’t have the kind of funnel (in the US) which we have in India (for BYJU’S). I understand if the market was big for WhiteHat Jr in India, we could use our own funnel, but we don’t see that market to be very big in India.”

Raveendran added that WhiteHat Jr will continue to remain a loss-making business for the next few fiscal years given these challenges. But he is confident that the growth within its core edtech business and other verticals such as Great Learning and Aakash will be able to fuel the cash burn that WhiteHat Jr would require.

“Actually from an impact point of view, if you ask me, it is still very high because WhiteHat has created so many teaching jobs for thousands of women graduates. And the same impact has been seen in students too,” the CEO said.

To solve the customer acquisition challenge, Raveendran said WhiteHat Jr will plug in to BYJU’S international acquisitions US-based Epic, Tinker, Austrian company GeoGebra and others. Tinker is a self-learning platform for coding and the goal is to convert users from these platforms by introducing micro-courses, and then converting them into the full course on WhiteHat Jr.

“This is an organic way of acquiring users rather than spending money on Facebook and Google. We are looking at a similar thing for maths with GeoGebra as an organic top of the funnel. It will be slow but it will be long term and sustainable.”

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.