![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2020/09/Feature-Image-1360x1020-1.jpg)

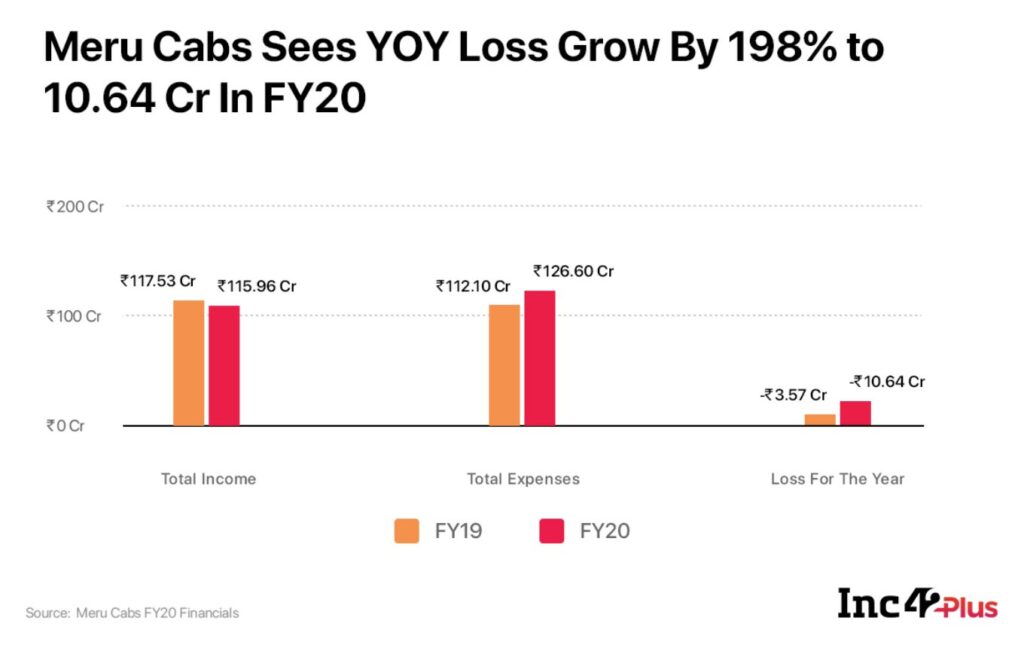

Meru Cabs losses increased from INR 3.57 Cr in FY19 to INR 10.64 Cr in FY20

The company reported a marginal fall in revenue but a 12% increase in expenses in FY20

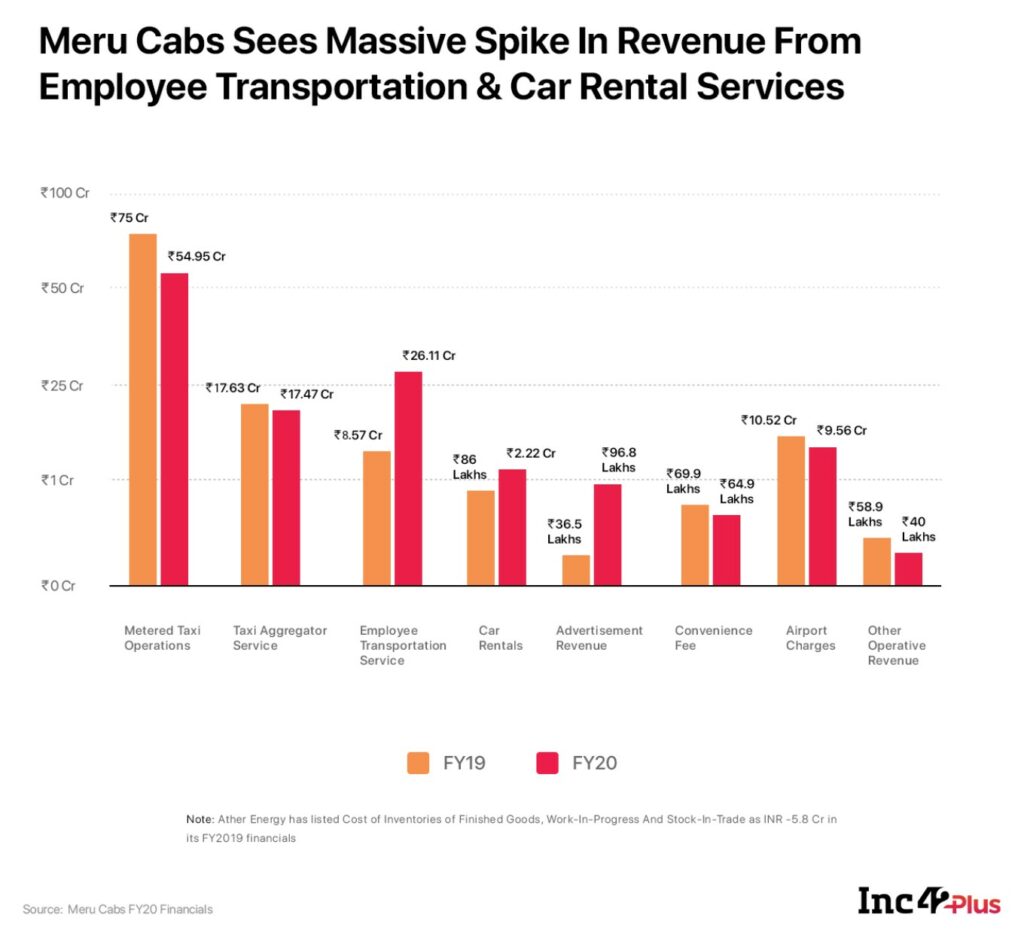

Meru Cabs’ operational revenue from employee transportation and car rental services saw a massive spike, as the company pivots its business model to a B2B-centric one

What The Financials

Inc42 unveils and deciphers all the important financial metrics of Indian startups across industries. Find out revenues, unit economics, profit & loss and all the important financial metrics to judge how the startup will perform in the coming years.

Cab aggregators like Ola and Uber couldn’t escape the harsh realities of the Covid-19 pandemic, as the countrywide lockdown forced both companies to go for mass layoffs and pay cuts for their employees this year. Further, Ola reported a revenue loss of 95% in March-April because of the disruption to the business.

Though the lockdown has been largely lifted in India, work from home policies are still in place for many salaried professionals, which means that ride-hailing companies may have to wait longer to find their feet.

In such a situation, Indian cab aggregator Meru Cabs is in an especially precarious position. The company’s financial performance in the fiscal year 2019-20 (FY20), ending March 31, 2020 — before ride-hailing companies began to feel the impact of Covid-19 on their business — was worrying. Meru Cabs’ filings with the Ministry of Corporate Affairs revealed that the company incurred an INR 10.64 Cr loss in FY20, a 198% year-on-year (YOY) increase.

It is worth noting that five months into FY20, Mahindra & Mahindra had acquired a 55% stake in Meru Cabs for INR 201.5 Cr. With the acquisition, M&M gained the right to appoint a majority of directors on the board of Meru and to control its composition after the first tranche was paid.

In FY20, the increase in losses for Meru Cabs has come about due to a marginal fall in revenue, by 1.35% to INR 115.96 Cr in FY20. At the same time, the company’s expenses increased by 12.9%, from INR 112.1 Cr in FY19 to INR 126.6 Cr in FY20.

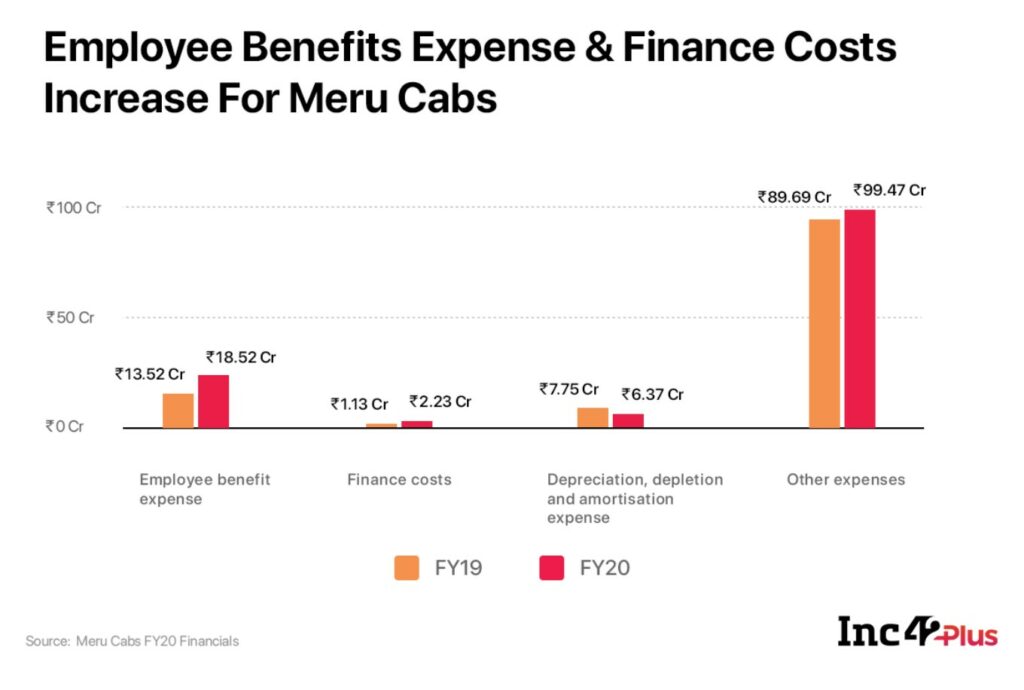

The YOY increase in expenses can be attributed to a 37% increase in employee benefits expense for the 343 employees on the company’s payroll, a 97% increase in finance costs, and an 11% increase in other expenses. The company’s depreciation, depletion and amortisation expense declined by 18% in the said period.

As for Meru Cab’s operational revenue breakdown, the performance was mixed. While the company’s metered taxi operations witnessed a 26.7% decline, from INR 75 Cr in FY19 to INR 54.95 Cr in FY20, it saw a massive spike in revenues from its employee transportation and car rental services. Its income from the employee transportation service increased 204%, from INR 8.57 Cr in FY19 to INR 26.11 Cr in FY20. Meru Cabs’ income from the car rental service also increased by 158%, from INR 86 lakhs in FY19 to INR 2.22 Cr in FY20.

The increase in income from the employee transportation and car rental services could be attributed to the company’s focus on the B2B (business to business) segment, stated on record by Neeraj Gupta, the founder and managing director of Meru Cabs.

Back in 2018, Gupta had conceded that the company’s revenue from the B2C (business to consumer) segment was falling due to Ola and Uber taking the lead in India. He had said that Meru Cabs would focus on ramping up its B2B offerings for corporate players.

“The best viable option for us is to focus on B2B. We are looking at a three-year time frame where the model will shift from a B2C business to a B2B business. Eventually, it will keep on growing much faster than B2C for us,” Gupta had added.

The company was looking to pivot its business to a B2B-centric model, where 70-75% of its revenues would come from its offerings for businesses, such as car rentals, employee transportation and airport contracts.

Two years down the line, that pivot to a B2B-heavy business model is yet to fully come through, since the revenue from employee transportation and car rental services, as well as airport charges, constitutes around 34% of the company’s total operating revenue for FY20. While the figures indicate that the revenue from the B2B segment is growing at a rapid pace, it still hasn’t helped the company make a profit. In fact, as noted above, the losses have only widened, from INR 3.57 Cr in FY19 to INR 10.64 Cr this year.

Nevertheless, the focus on the B2B segment remains. Earlier this month, Gupta reiterated that plan, saying that indulging in a B2C war wasn’t on the company’s radar. “We are not really wanting to get into the B2C segment war. We want to focus on offering cab services wherever we are present and not beyond. We would be focusing on B2B through the mobility platform that we have created,” Gupta told Mint.

Meru Cabs offers the MeruBiz service for businesses, which includes employee commute, airport transfers, car rentals, city rides, outstation business rides and events and conferences, among other services.

As for its financials, Meru Cabs may yet have to wait to mark a profit on its balance sheet, with the Covid-19 pandemic disrupting business for ride-hailing companies.

Although, the company’s managing director Gupta has claimed that it made over 2 lakh deliveries during the lockdown by partnering with ecommerce majors Flipkart and Amazon for the delivery of essentials.

“(In) August we were doing close to 50,000 bookings per month, now this time (September) we will be clocking 65,000-70,000 bookings per month, a growth of 15-20 per cent, with growth in intra-city rides,” he said.

Earlier this month, Inc42 reported that Meru Cabs is eyeing consolidation in the electric vehicles (EV) segment, with a planned investment of $10 Mn in the technology and electric mobility segment by 2020-end. It is also planning to create an infrastructure to operate a fleet of over 300 EVs across India. It plans to increase its fleet size and add 10,000 EVs soon.

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[What The Financials] Meru Cabs Losses Spike 198% Amid Renewed Focus On B2B Mobility-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience