SUMMARY

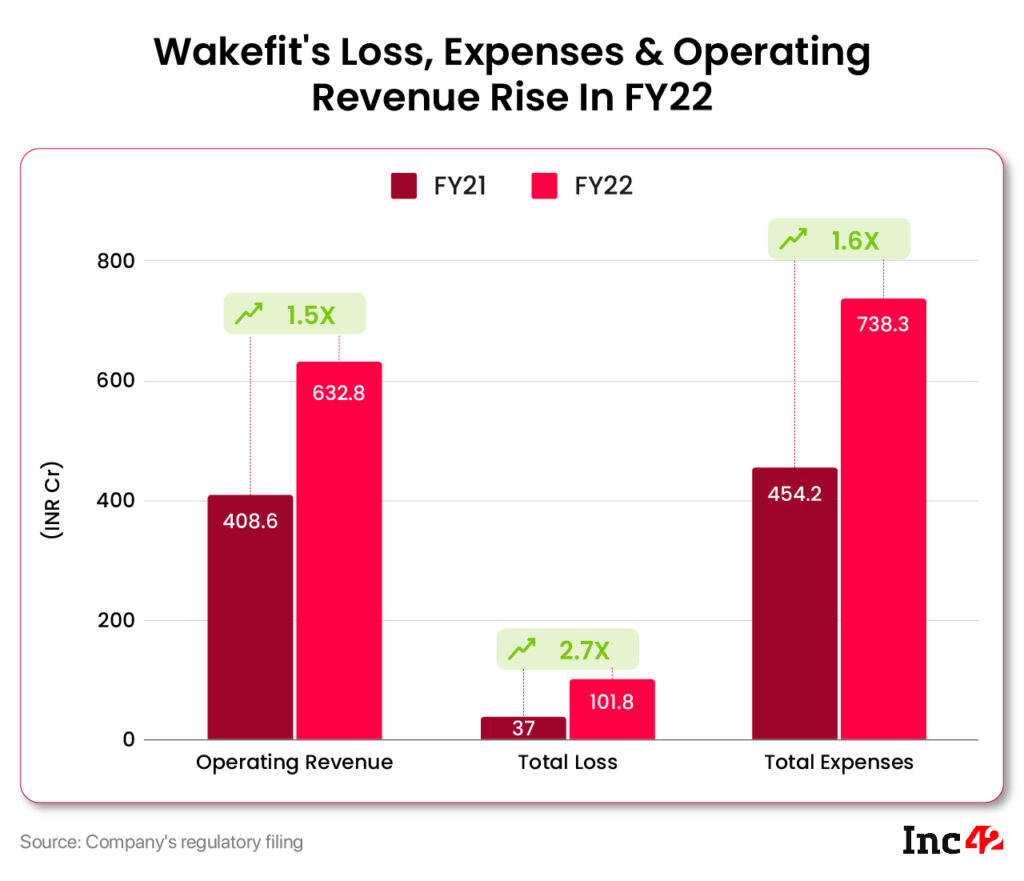

Wakefit’s operating revenue surges to INR 632.8 Cr in FY22, up nearly 55% from INR 408.6 Cr reported in FY21

Total expenses of the Bengaluru-based startup grew 1.6X to INR 738.3 Cr in FY22

Founded in 2016 by Chaitanya Ramalingegowda and Ankit Garg, Wakefit’s product portfolio includes mattresses, pillows as well as home furniture products such as sofa and study tables

Bengaluru-based sleep solutions startup Wakefit saw its total loss surge 2.7X to INR 101.8 Cr in the financial year 2021-22 (FY22) compared to INR 37 Cr in the previous fiscal year FY21.

On the other hand, Wakefit’s operating revenue surged to INR 632.8 Cr in FY22, up nearly 55% from INR 408.6 Cr reported in FY21.

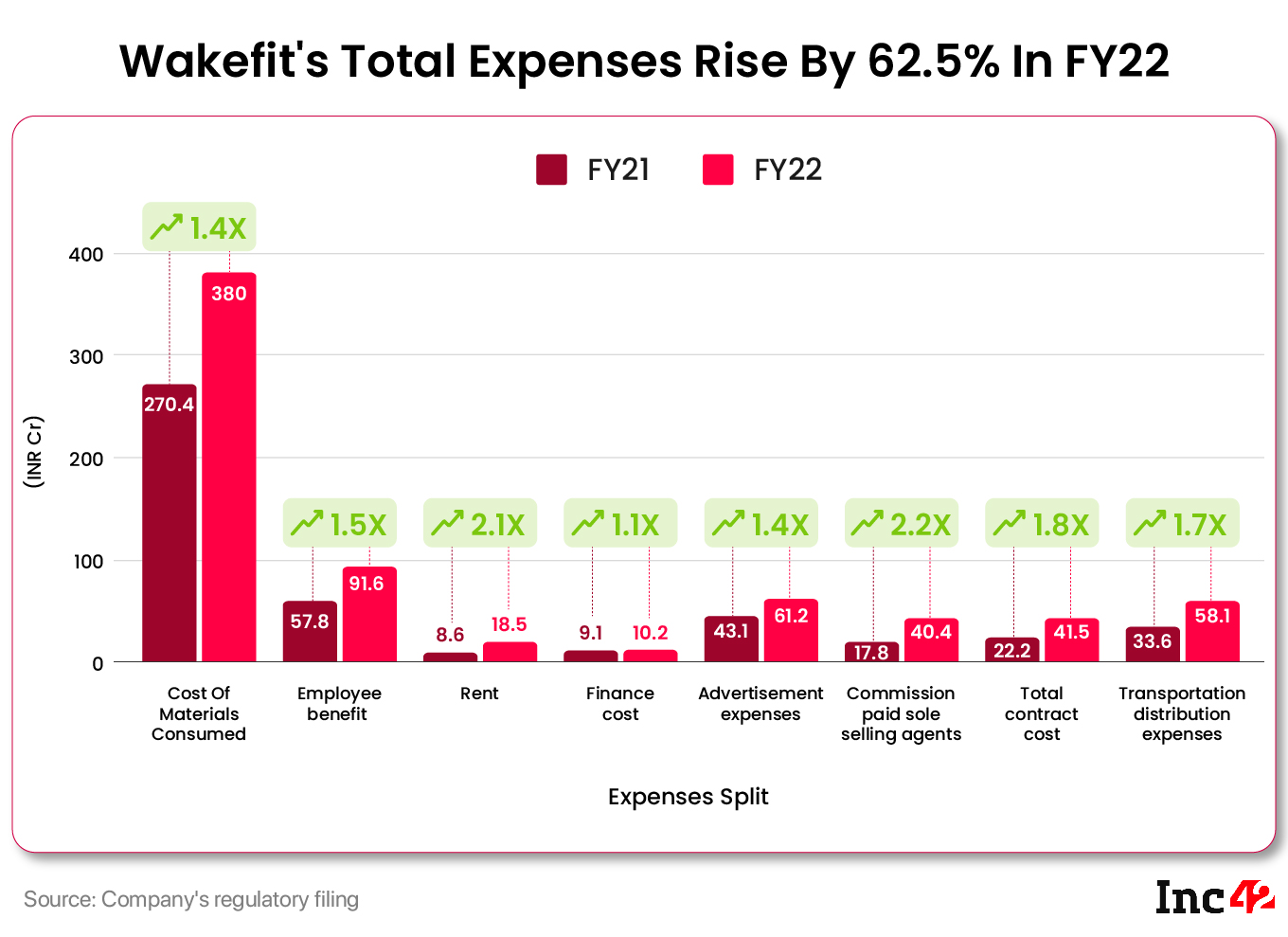

Meanwhile, expenses continued to mount, driven by rising material costs and higher employee expenses. Total expenses of the Bengaluru-based startup in FY22 stood at INR 738.3 Cr, compared to INR 454.2 Cr during the previous fiscal year.

The cost of materials consumed during the period accounted for the biggest chunk of its expenses at INR 380 Cr, rising 1.4X from INR 270.4 Cr in FY21. Employee benefits also increased by more than 58% year-on-year (YoY) to INR 91.6 Cr in the fiscal year ended March 2022.

Marketing expenses also surged nearly 42% YoY to INR 61.2 Cr in FY22.

As losses piled up, Wakefit’s EBITDA margin further deteriorated to -14.36% in FY22 from -7.6% in FY21. In terms of unit economics, the sleep solutions startup spent INR 1.17 to earn a single rupee.

“This year we have also invested in our people with an ESOP (employee stock ownership plan) buyback scheme and the establishment of new departments such as design & engineering, retail operations, and process excellence. In order to take an omnichannel approach and cater to consumer buying patterns in the furniture space, we have set up 10 retail stores across metros and non metros and we plan to expand to 25 stores by this fiscal year. Our marketing and branding efforts have also helped us garner customer love. In our endeavor to become the most loved home solutions company in India, we believe that it is imperative to invest in areas that will bring us long-term benefits. Hence, we have strategically deployed capital that will help us reap multi-year returns,” added Wakefit.

Founded in 2016 by Chaitanya Ramalingegowda and Ankit Garg, Wakefit’s product portfolio includes mattresses, pillows, bed frames, cushions, among others. It also sells home furniture products such as sofa, study tables, bookshelves, shoe racks, dining tables, and others.

The startup has so far raised INR 450 Cr in funding and is backed by marquee investors such as Verlinvest, SIG and Sequoia. Wakefit was last valued at $380 Mn in November last year, after an INR 200 Cr Series C round was led by SIG.

From focusing on selling only mattresses between 2016 and 2018, the startup has now forayed into multiple categories to pad up its revenue base. Growing in scale, Wakefit, earlier this year, set up a giant 6 Lakh sq. ft. furniture manufacturing unit at Hosur.

Ramalingegowda recently told a news portal that 70% of the startup’s sales would likely come from mattresses in 2022, with furniture accounting for the rest. Wakefit also has about 500 SKUs across 15-20 sub-categories.

While Tamil Nadu, Karnataka and Andhra Pradesh contribute about 50-55% of its sales, Maharashtra and Delhi NCR are the other key markets for the company.

The startup largely competes with players such as Duroflex, Sleepycat, Ikea, Pepperfry and HomeLane in the highly competitive market.

The sleeptech industry operates under the aegis of the larger sleep industry. While mattresses are still the bread and butter, the emergence of new players has intensified competition in the sector.

According to Statista, the sale of mattresses generated a revenue of $223.4 Mn in FY22. This number is further projected to surge to $324.6 Mn by FY26, making the sleeptech industry quite lucrative.

(The story has been updated to include Wakefit’s response)