SUMMARY

The fund was oversubscribed and achieved final close at INR 1,777 Cr exceeding the initial target of INR 1,500 Cr

With a provision for capital recycling, Trifecta Capital’s third fund will have an investible corpus of up to INR 4,440 Cr

Trifecta Capital has already invested INR 1,500 Cr in over 50 startups, including Zepto, The Good Glamm Group, Kissht, Rebel Foods, and Cashfree Payments, from the third fund

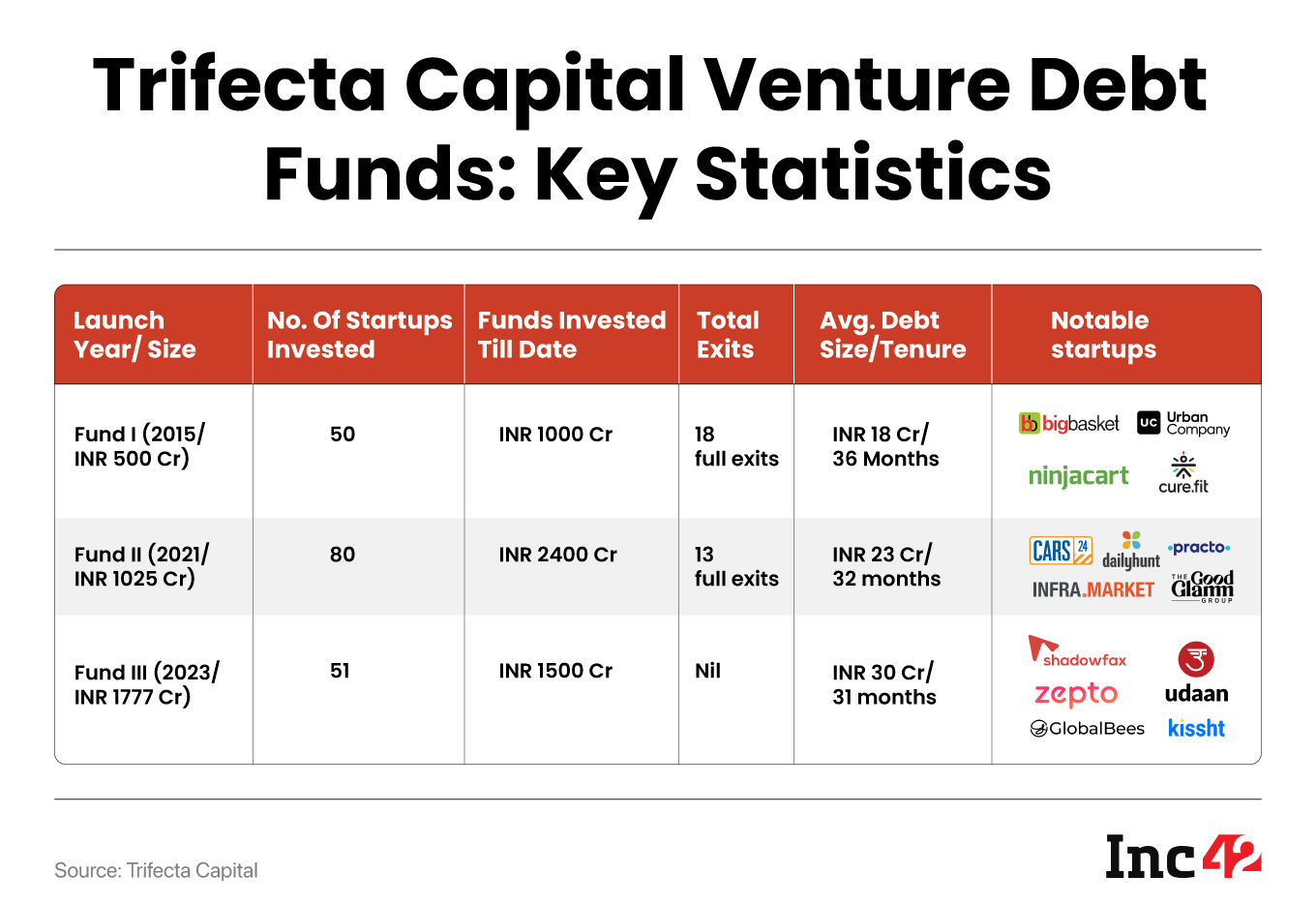

Delhi NCR-based Trifecta Capital has announced the final close of its third venture debt fund, Trifecta Venture Debt Fund III, at INR 1,777 Cr. The fund was oversubscribed, surpassing the initial target of INR 1,500 Cr. The first close of the fund took place in November 2021.

With a provision for capital recycling, the fund will have an investible corpus of up to INR 4,440 Cr. In an interaction with Inc42, cofounder and managing partner Rahul Khanna said Trifecta Capital now has a dry powder of INR 3,000 Cr.

The firm has already invested INR 1,500 Cr in over 50 startups since its first close in November 2021. Zepto, The Good Glamm Group, Kissht, Rebel Foods, Cashfree Payments, Bira, Infra.Market, Udaan, Arzooo, Globalbees, and Eatfit are among the startups in which capital from the third fund has been invested in.

“With Trifecta Venture Debt Fund III, we have a pipeline of near-term opportunities worth more than INR 800 Cr across a curated cohort of startups. We expect to cross INR 6,000 Cr of cumulative debt capital invested during the current financial year itself,” Khanna said.

The firm claims that its portfolio startups have achieved a median revenue growth rate of 60% annually.

The fund will prioritise follow-on investments in well-capitalised companies and category leaders within the portfolio, fostering long-term relationships while prudently mitigating risks at a portfolio level.

Nilesh Kothari, cofounder and managing partner at Trifecta Capital, said, “Trifecta has been an early mover, and we have played a pivotal role in establishing the entire venture debt asset class. Prior to Trifecta, there was no venture debt fund in the country. We have engaged in extensive education and outreach within the founder and venture capital ecosystem.”

Trifecta Capital’s Journey So Far

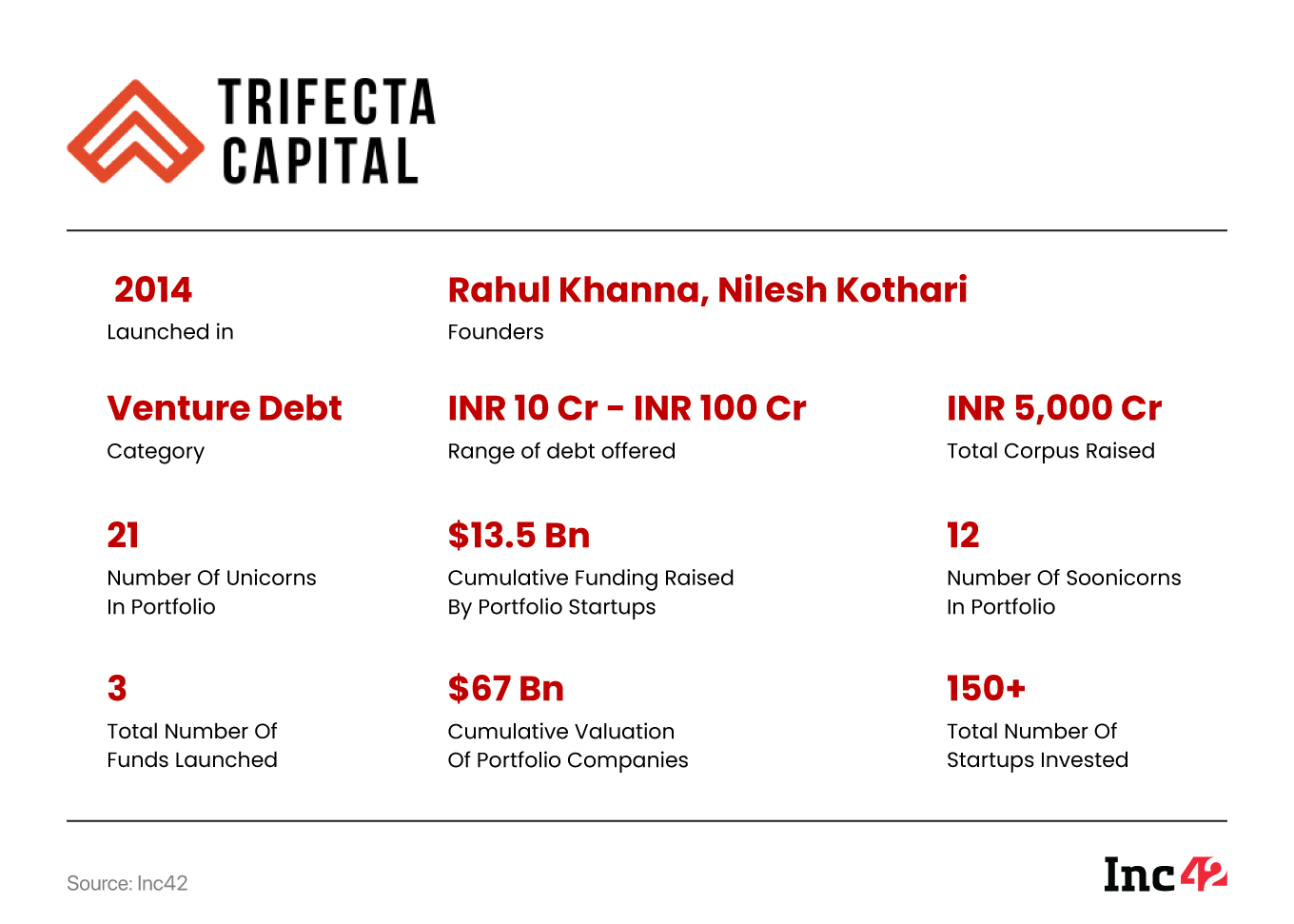

Founded by Khanna and Kothari in 2014, Trifecta Capital offers tailored financing solutions for startups across lifecycles, encompassing venture debt, growth equity, and financial solutions.

The firm provides customised financing to emerging businesses across sectors, including B2B, consumer services, consumer brands, ecommerce, mobility, edtech, agritech, fintech, cleantech, software, and healthcare.

Before extending debt to startups, it looks for several key factors, such as businesses with strong moats, favorable demand-supply dynamics, robust unit economics, high-calibre founders, and more.

Trifecta has also developed a specialised technology and advisory platform with cumulative managed capital exceeding INR 11,000 Cr, to support the treasury and cash management needs of rapidly growing startups

With the third fund’s closure, Trifecta Capital has cumulatively raised nearly INR 5,000 Cr across its three venture debt funds and one growth equity fund, investing in over 150 startups.

It has 21 unicorns and more than 12 soonicorns in its portfolio, including Big Basket, Pharmeasy, Cars24, Vedantu, ShareChat, Dailyhunt, UrbanCompany, CarDekho, Udaan, Ninjacart, NoBroker, Dehaat, Turtlemint, and Livspace.

Launch Of Fourth Venture Debt Fund Soon

In its eighth year, the firm’s first venture debt fund, has returned almost 1.5X of its capital to investors and is expected to wind up the fund in 2024 after distributing additional capital gains.

On the back of this success, the recently closed third fund received support from existing investors as well as new investors, including large global financial institutions, domestic conglomerates, banks, insurance companies, development financial institutions, public sector entities, and reputed family offices.

The number of offshore investors, both individual and institutional, who participated in the third fund more than doubled compared to its second venture debt fund.

“We are grateful to our investors who have supported us in achieving this significant milestone. We will endeavour to deliver best-in-class returns while focusing on the preservation of capital, which is a critical element of this asset class,” Kothari said.

Looking ahead, Trifecta Capital expects to launch its fourth venture debt fund in early 2024 and aims to be the financial partner of choice for leading new economy businesses in India.

Venture Debt Funding: Trend & Future Outlook

Indian venture debt investments grew rapidly at a CAGR of 22% over the three years to 2022, rising to nearly $1 Bn, a report by BCG-Trifecta Capital said earlier this year. It projected venture debt investments in the country to surge to $6 Bn – $7 Bn by 2030.

As per another report by BCG, 63% of market players are willing to replace over 20% of their fundraising with venture debt due to the benefits it offers, including capital efficiency, operational discipline, and improved Return on Equity (RoE).

It must be noted that following the macroeconomic headwinds and the onset of funding winter in 2022, venture debt funding has emerged as an attractive option in the Indian startup ecosystem to raise capital.

As venture capital funding slowed down, startups began seeking alternate financing options, with debt emerging as a potential choice. According to Inc42 data analysis, between 2021 and 2023 so far, 11 debt funds have been announced with a total capital commitment of $1.4 Bn by the likes of Lighthouse Canton, Stride Ventures, Varanium Capital, Anicut Capital, and Altera Capital.

Amid the capital crunch and slowdown following the onset of funding winter, investors, across categories, have increased focus on profitability, unit economics and cash flow, which has resulted in a lot of Indian startups struggling to attract investors, including venture debt firms. However, Khanna said finding quality startups has not been an issue for Trifecta Capital.

“Venture debt and venture capital are companion asset classes, and venture debt has also seen some slowing down. However, by tracking companies right from the Series A stage and offering venture debt at Series B, we have a clearer picture, better relationships with founders, and strong industry references that allow us to shortlist 30-40 companies that we would like to finance each year,” Khanna concluded.